7.7% CPI: Buy Everything

We have inflation figures for October. My general thoughts on the print and how I think we should approach the news with our investment dollars.

Okay before jumping into the charts today, I want to be clear; I am not suggesting investors indiscriminately buy everything - I’m just mocking the immediate response by the market. It’s hilarious. Here’s what’s happening; CPI came in slightly beneath expectations for October. The market response has been enormous. Why? The belief that the Fed could view this CPI print as an indication rate hikes have worked and inflation has peaked. Maybe? But that’s the narrative the market is running with.

I personally think Fed hikes are probably done regardless of what CPI says but I felt that way two hikes ago, so what do I know? It could easily be argued that rate hikes are more about saving face than fighting inflation. The reality is rates can’t continue higher unless the central bank really is determined to crash the entire economy. Reason? US debt spending can’t be refinanced 5% or the federal budget will quickly become more about interest payments than social programs and bombs in Ukraine. I don’t think why the central bank claims hikes will slow down matters as much as the reality that hikes may slow down (or stop entirely).

What matters?

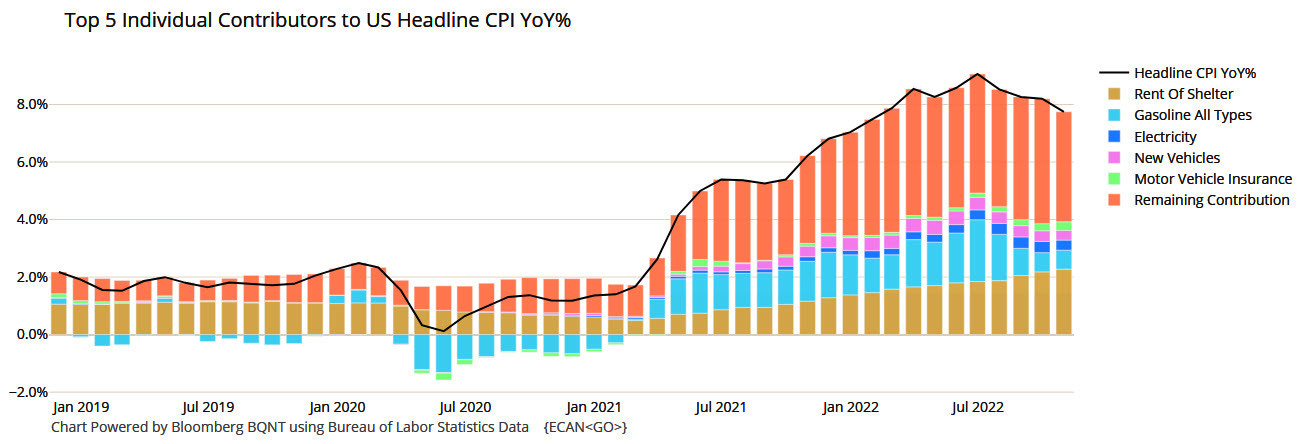

Here is a nice chart of the CPI trend over the last several years:

October is now the fourth consecutive month of declining year over year headline CPI. There are still problems though when we look at the top 5 contributors of the headline number:

CPI (as the BLS measures it) is really only coming down because gas prices have been trending lower for several months. Look at shelter! It’s still going the wrong way and I highly doubt that trend will reverse and here’s why:

Home sales have already started falling but year over year price changes haven’t. Those didn’t peak until May 2022. Since CPI figures are lagging indicators, there is likely still room to rise in year over year shelter increases as a CPI component. The other problem is gas was the second contributing factor and oil correction looks like it may have bottomed:

The point is, I’m not sure CPI has actually peaked. We may see some of the other components come down due to declining retail sales, people getting laid off, and services getting cut, but the message certainly seems to be price increases in “real things” isn’t over. The dollar is getting absolutely obliterated in response to the CPI print:

Judging by that 37 RSI, there is still plenty of room to go lower in the DXY. The markets are saying risk on. We must listen. Here’s what I did yesterday afternoon and this morning:

For starters, I took off some of the trades that weren’t working; 1 day too soon as it turns out. iHeartMedia (IHRT) came off because it wasn’t working and First Majestic (AG) was finally closed because it hit the top of my range and looked to be rolling over. Both stocks are ripping this morning. Fine whatever. Here’s what I’m paying attention to regarding stocks:

As long as the S&P holds 3,900, I think stock bias is long. Today’s 4% surge so far is immense and we’ll get a sense for how sustainable it is this afternoon. It’s okay if we see the typical lunch time fade. That might actually be a buying opportunity. What we want to see is a rally into the close - presumably one that starts between 2:30 and 3p and that closes near the high. As long as the S&P closes above 3,900 I think it’s game on and we could see the S&P move up another 200 points. I still like my Paramount knife catch:

I think this goes to $18 minimum. I still have my Netflix trade on as well. And don’t hate me… I added a couple shares of Roku today. Some of these Nasdaq names have been left for dead. They’re going to rip if this rally lasts a couple weeks. On the metal front, pms look amazing. Here’s Gold:

A pretty textbook breakout above the 50 day moving average and long term trend resistance. I think Gold has another $35-50 easy before it shows signs of stopping. As such, I took a position in GDX this morning:

Another awesome breakout chart. I think there’s another $1.50 to run in this one before we see a slow down. I took a 1/4 position in GDX today. What I mean by that is my position scaling. For instance, if I want to ultimately have a $1,000 position in GDX, my first buy was for just $250 worth of stock. This allows me to carefully get in while being cognizant of back-tests. Call it “chase insurance.” For instance, I want my next buy to be somewhere in the $27.25-27.50 area. Ultimately, my last buy should be after GDX has taken out $29.50 on a closing candle.

That way, I’ll have more confidence the trend has shifted and can be sustained. Anyway, hope that helps. My plan is to hold the metal miners much longer than the media stocks. The media stocks probably need broad equities to rally while the miners should do fine as long as the metals have bottomed - and it looks like they have.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice.