9.1% CPI: Was That The Peak?

Consumer price inflation is higher than expectations yet again. The calls for more aggressive hiking are loud. I'm not so sure we'll get it.

You don’t have to run faster than the bear to get away. You just have to run faster than the guy next to you.

That quote is from American novelist Jim Butcher. It’s an amazing line and I think it works perfectly in the world of finance. Not just because the “animal” spirits on Wall Street are bears and bulls, but also because when it’s applied to financial investment, it makes a compelling case about margin and third party risk. I know, I know. I’m beating a dead horse at this point. But hear me out.

When you’re using debt to speculate, that’s when you get wiped out by big drawdowns like the ones we’ve seen in the broad equity markets. Those drawdowns have been particularly bad in some of the streaming names that I like; Roku (ROKU) and Chicken Soup (CSSE) specifically. When you use a cash account, you are afforded the luxury of patience. When you’re only wagering with your own funds, you don’t have to worry about posting more collateral to stay in a trade if you’re getting blown up.

Using a cash account is what can help you survive when the bear is eating your friend. Sure, it hurts to see that. But this is simply part of the lesson taught by the market. Bears don’t get many wins in a system that is designed to benefit bulls. When they get their shot, look out. While I’m certainly not going to call a market bottom today in light of a 9.1% June CPI print, I will try to offer some context. Voices on the street are now calling for a 100 bps hike to the funds rate in July to fight this inflation. Let’s just say I have doubts.

On Debt and Inflation

Look, 9.1% is awful; pure and simple. But it’s hard not to wonder if that wasn’t the peak in the year over year change rate. And if it was, are we close to the Fed pivot yet? Frankly, the Fed has proven over the last year that it simply will not fight high CPI prints by increasing the funds rate into positive real yield territory. I’ve covered this ad nauseum.

While central bank policy is still a significant headwind as long as Jerome keeps jawboning, as I’ve been opining for probably close to a year at this point, how high can the Fed realistically go with rates from here? Who has the most to lose from higher rates? Consumers? I’d wager it’s actually the federal government.

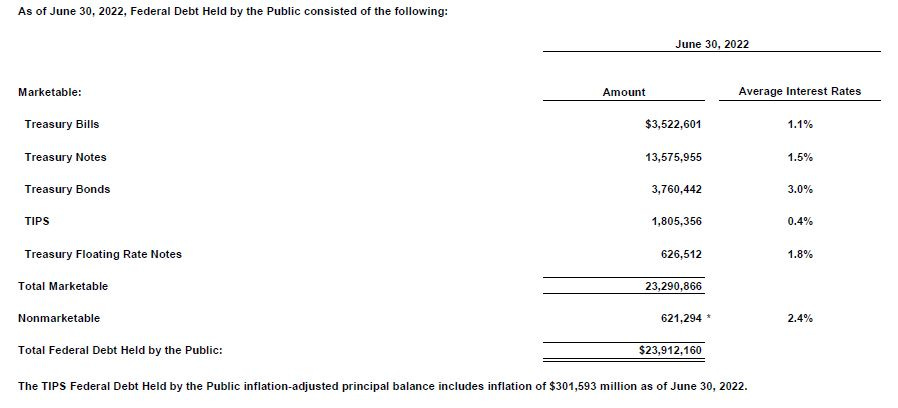

This is the table of federal debt held by the public. Just under $24 trillion. Look at the average interest rates on those obligations. Most of it is well under 2%. Then think about maturity.

While the average maturity on that debt is 6 years, a lot of it is actually going to have to be refinanced much sooner than that at a higher rate - that means more of the federal budget has to go to paying interest on debt rather than on social programs and bombs for Ukraine. And then there’s the possibility that inflation has actually peaked on a year over year rate of change basis already.

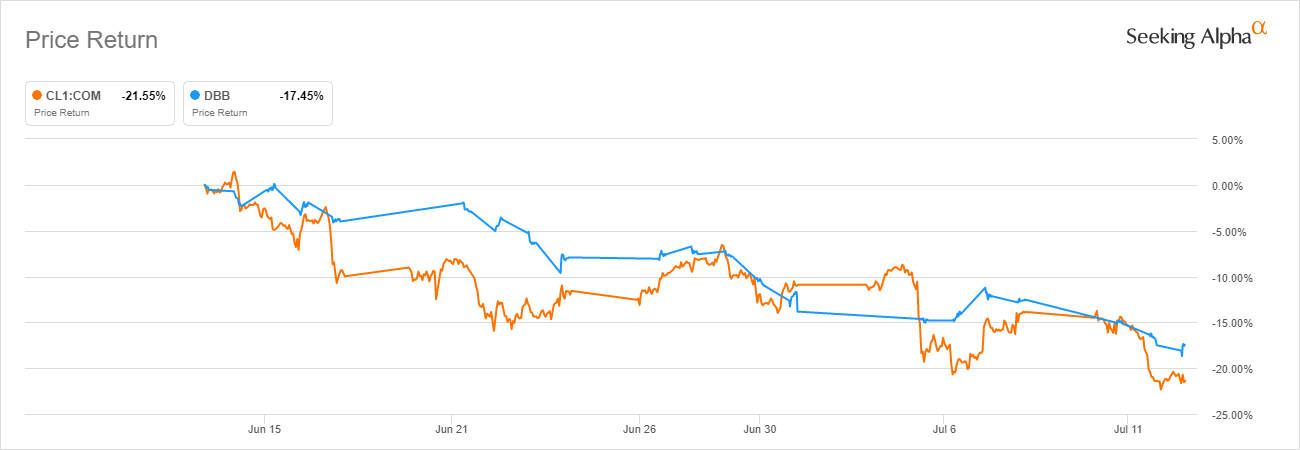

What has been happening to commodity prices over the last few weeks? They’re tanking. Here’s oil (orange) and base metals (blue) over the last month:

Lumber is still like 50% off it’s price from 6 months ago. The point is simple; the Fed has been behind the curve for well over a year. The central bank has actually been so far behind that now it’s raising into a recession. The central bank has two mandates; price stability and full employment. Surely it won’t exacerbate a recession in an effort to pretend it’s still fighting a war on price stability that it already lost… right?

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero.