A Bank Failure, Analog Rails, And The Next Narrative

The old system requires trust to function properly. Failure after failure hasn’t done much to change that. In the new system with faster settlement, trust can be replaced with verification.

The first interstate regional bank in the United States was the Bank of New England. Formed in 1985 after Boston-based Bank of New England Corporation and Connecticut-based CBT Corporation merged, the company was the 18th largest bank in the country at one point in time. However, the time near the top was short lived as Bank of New England ended up going bankrupt shortly after.

Turns out an aggressive M&A strategy over-leveraged the business. But that’s possibly an overly simplistic take on what ultimately killed the bank. Bank of New England aggressively tried to grow during a major economic boom in the region. Growth in the tech sector during the 1980’s was dubbed the “Massachusetts Miracle.” Massachusetts had struggled with high unemployment following the decline of manufacturing in the region in the decades prior to the 80’s.

During the boom, Massachusetts Route 128 was viewed by some as the region’s “Silicon Valley.” At the time, major corporations like Raytheon RTN 0.00%↑, Analog Devices ADI 0.00%↑, Thermo Fisher TMO 0.00%↑, PTC PTC 0.00%↑, and Autodesk ADSK 0.00%↑ were either headquartered or had major locations in the area. Companies that were ultimately bought by larger corporations like Dell DELL 0.00%↑ and Honeywell HON 0.00%↑ were also there during the Massachusetts Miracle.

Of course, not every company is a success and when there are aggressive booms there can also be brutal busts. During the 80’s, corporate lending market share growth was finding its way to Wall Street. Banks became increasingly more reliant on real estate borrowing for yield. In 1988, 42% of New England’s large bank loan portfolios was real estate - larger than the national average of 37%.

The problems the Northeastern banks are suffering do not necessarily mean that homeowners are facing a decline in housing values. Most of the problems have been limited to overbuilding of offices around Route 128 outside of Boston and in the Stamford, Conn., area. - Sarah Bartlett, via New York Times, November 1988

Eventually the market turned, loans stopped being serviced, and the company’s CEO Walter Connolly was replaced with Lawrence Fish. It wasn’t enough.

The New England economy refused to cooperate with Fish's plans. The jobless rate continued to climb throughout 1990, pushing more and more borrowers into financial trouble. Even blue-chip clients stopped paying their loans late in the year. Instead of shrinking, nonperforming loans grew by $500 million in the final quarter of the year. When news came out Friday that the company had lost $450 million in the quarter, the struggle for survival was over. - Charles Stein, via Washington Post, January 1991

Bank of New England was taken over by the FDIC to prevent a bank run. Cost to taxpayers? $2.3 billion. Most of the customer assets that previously lived with the bank currently live on with Bank of America BAC 0.00%↑. A win for depositors. Not so much for Bank of New England equity holders. Which brings us to the point of this story…

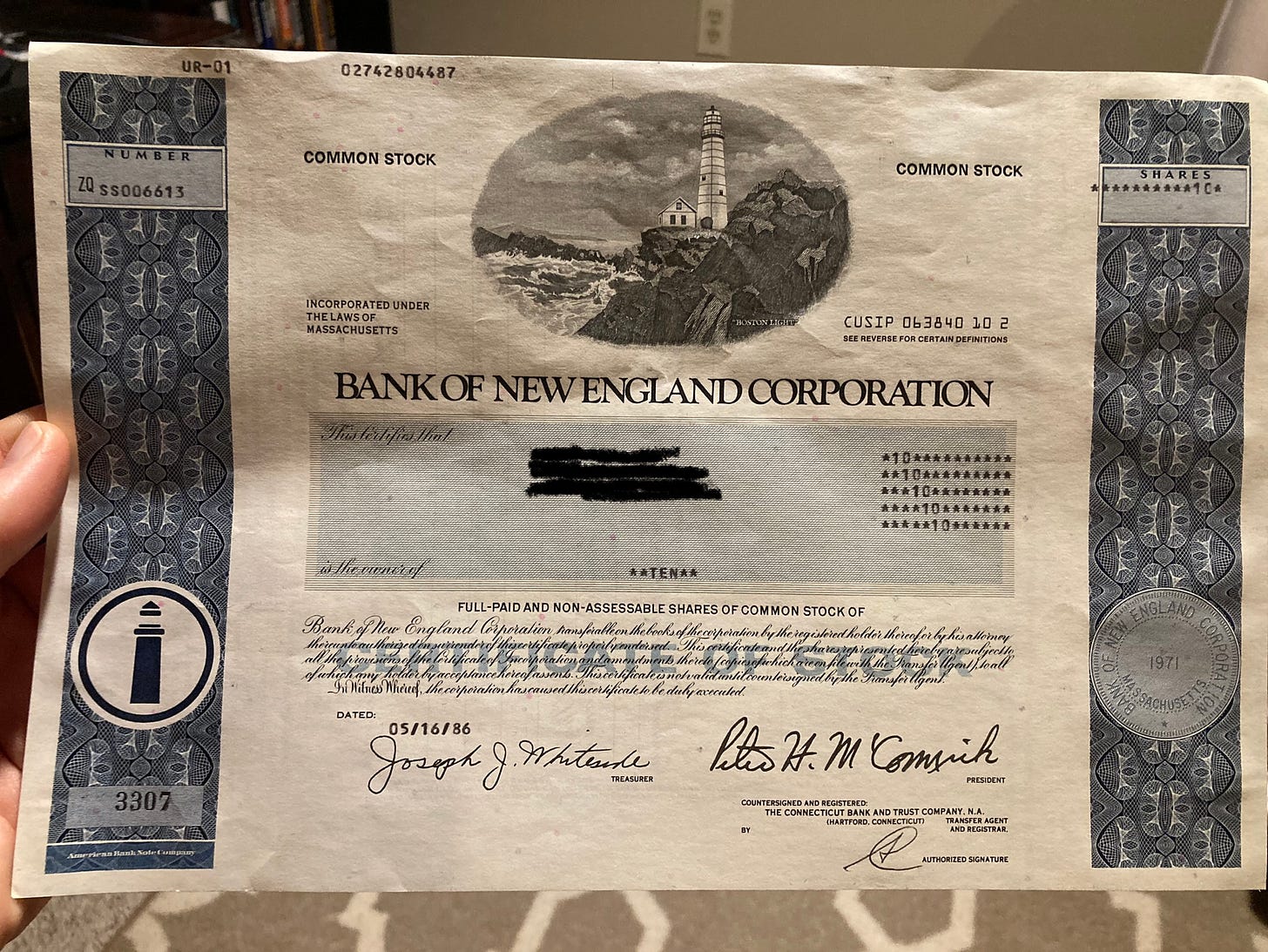

This is a paper stock certificate that was purchased by my grandfather in 1986. I have no idea what he paid for these 10 shares of Bank of New England because I can’t find a historical price chart for this company. The equity is obviously worthless but the paper stock certificate now serves as sort of a collectible or family artifact for me.

It’s also a really interesting example of how far we’ve come from analog paper stock certificates to online brokerages. To be sure, you can still purchase paper stock certificates and there may actually be some justification to do so. But the brokerages don’t make it easy on you to go paper. All incentives are for the opposite. The internet obviously made it so much easier to buy and sell stocks. So easy that it would be utterly ridiculous to most to suggest one should want or even need to buy common stock equity through paper certificate.

The same can be said for transferring money or other assets. And yet, with the exception of physical cash which should never be given up, it’s still viewed as normal to use checks that route funds to and from bank accounts. There are even instances where it’s apparently necessary to do this.

I Had To Use a Check Last Week

I literally haven’t written a check in years. But I needed one last week. Turns out, even mobile-only banks (cough Ally Financial ALLY 0.00%↑ cough) that have had no problems processing electronic funds transfers from a separate bank every single month for the last three years, somehow only accept paper checks for certain types of transactions.

Okay fine. I’ll play your game just this once, Ally.

After spending no less than 60 minutes hunting my drawers and folders, I had to face the reality that I didn’t actually have physical checks to write. Options? I could order checks for my local bank branch through a third party for a fee to send just this one check. I could do the same through my primary cash management account which required equally annoying hoops to jump through that involved printers and scanners and then wait a week. Or I could just face the music, buy a cashier’s check, and mail it to it’s final destination.

I did the latter. After 60 minutes of physically searching my house, using two “AI chats” to explore alternative opportunities, transferring capital from one bank to another, driving to my local branch, then driving to the post office and purchasing an envelop/stamp with tracking, I’m happy to report the transaction was confirmed yesterday.

For me, this entire process has been utterly ridiculous when we consider that the technology already exists to not have to do it this way. It took personal time, money, gas, and about 4 days from the start of the process to finalize this transaction. And this was to pay one of the more “innovative” banks.

This transaction could have been settled in literally a few minutes (or less) through any number of public blockchain networks using stablecoins. Reminder, stablecoins are digital assets that are remarkably similar in structure to Eurodollars and they’re transferable in large quantities. Not only that, but the collateral backing the stablecoins is literally the same collateral that backs my cash account deposits with my bank. It’s all t-bills.

The chart above shows total stablecoin transfer volume of $445 billion in December. January is going to eclipse that figure easily. And these numbers are being achieved with just $134 billion in total stablecoin liquidity. This means on average every stablecoin was used 3.32 times in December. If we take this as a comp for M2 velocity, stablecoins are almost three times as useful as M2 money stock.

Honestly, this isn’t really all that surprising. It’s easy to use public blockchains and much less so to use the traditional banking system. People obviously like speed and convenience. If they didn’t, Venmo and CashApp wouldn’t have so many users. And nobody needs to know the plumbing of how those applications and systems work. They just need to work. At a certain point, people may end up using stablecoins without even realizing it.

Ethereum ($ETH-USD) is the top dog at $69 billion in stablecoin market cap, but there are 6 additional blockchain networks that have at least $1 billion in total stablecoin liquidity as of posting:

Tron ($TRX-USD): $50.8 billion

Binance Smart Chain ($BNB-USD): $4.6 billion

Arbitrum ($ARB-USD): $2.1 billion

Solana ($SOL-USD): $1.9 billion

Polygon ($MATIC-USD): $1.3 billion

Avalanche ($AVAX-USD): $1.1 billion

These are funds that can be used for lending, borrowing, and paying invoices. And these transactions can be done on most of these blockchains for under a buck. Here are the average transaction fees for these networks currently:

Ethereum: $3.80

Tron: $0.35

Arbitrum: $0.19

Solana: <$0.01

Polygon: $0.33

Avalanche: $0.19

Show me any small business owner that wouldn’t jump at the opportunity to pay just 19 cents for a non-cash transaction (let alone less than a penny) and I’ll show you someone who bumped their head. I know I’d love nothing more than to not have to use Stripe to process your subscriptions!

The idea that stablecoins could, and in certain cases probably should, become a more meaningful part of the global economy isn’t some pie in the sky lunatic pontification, it’s an idea so cRaZY Visa V 0.00%↑ is already doing it over the Solana blockchain and PayPal PYPL 0.00%↑ just launched their own stablecoin product ($PYUSD-USD) last year.

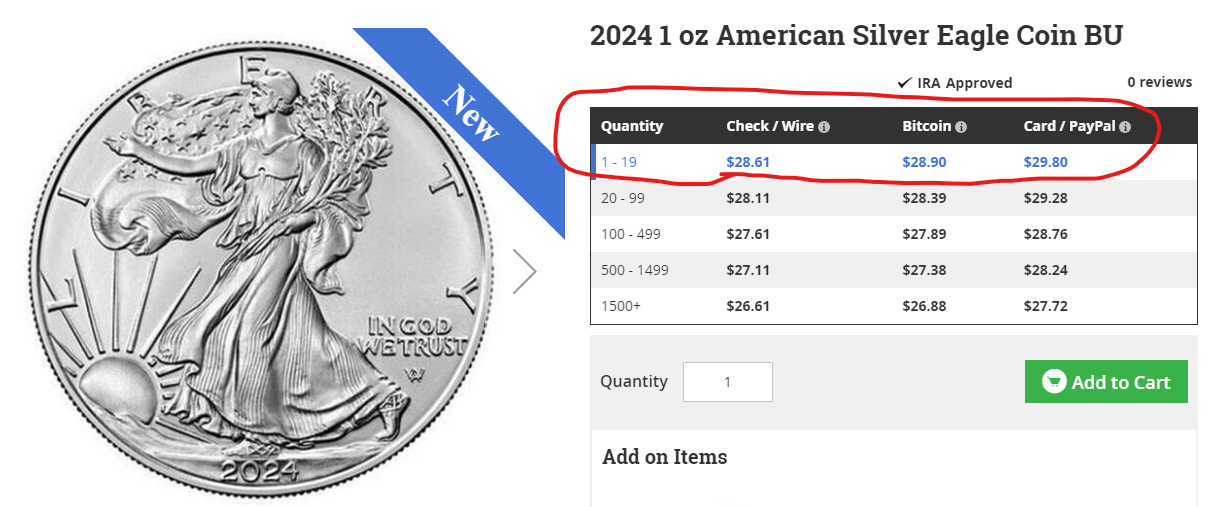

Sooner or later, the banks will follow. Kicking and screaming perhaps. But I suspect they have no choice. And the tipping point could be coming quicker than some might think. I know locally I’m already seeing instances of businesses doing what the bullion dealers have done for years…

…charging more for certain payment processing methods. The irony isn’t lost on me that it’s cheaper to use a check to buy bullion than something like Bitcoin ($BTC-USD). But in a way, we’re coming full circle on purpose.

The Next Narrative

Each crypto bull cycle there’s generally a narrative of some sort that helps push prices higher. These narratives are often recycled but now that “the ‘tutes” are here, the narrative that I expect to play a significant role over the next few years is “tokenization.”

What does that mean? The most straight forward way to explain it is probably blockchain-based versions of records that have typically lived in more “analog” environments. A couple easy examples could be proof of home ownership or auto titles. But I don’t think that’s where we’re going in the next 3 to 5 years. I do wonder about equities though. Crazy? Maybe. But once upon a time stock certificates were printed on paper. Not so much today.

“We're a believer in digitization of products. ETFs was a big revolution for the mutual fund industry and its really taking over the mutual fund industry. We do believe that if we can create more tokenization of assets and securities, that's what bitcoin is, it could revolutionize again finance.”

Who said that?

Larry Fink. The CEO of BlackRock BLK 0.00%↑. Yes, the same BlackRock that essentially decided SEC Chairman Gary Gensler is wrong on spot Bitcoin ETFs and helped push those products through in tandem with Grayscale’s court victory.

The logical question one may ask is, “cool story, bro, how do I even express this if I agree?” Per usual, I don’t tell anyone what to do or think, I just share how I think. For me, it’s actually far more simple than it may seem. Blockchain networks that secure stablecoins and other digital assets utilize native tokens for fees. Thus, if the networks reach any sort of critical mass, there will be an organic demand for those tokens as the network usage grows.

Want to bet on Visa’s USDC ($USDC-USD) pilot program being successful? Buying SOL might make sense. Arbitrum or Optimism your desired networks? Probably ETH then. Perhaps you believe Larry Fink wants to put tokenized versions of equities on Avalanche? AVAX it is. How do you pick between the group? The beauty is you don’t really have to. You can simply go with the Coffee Can Investing approach, buy a bunch of them, and then go on living your life not worrying about it.

These networks may seem scary or intimidating but they really don’t need to be. If you can trust yourself to send an email to the correct person, you can use a public blockchain. Yes, even the privacy-preserving ones are easy. If you want to try this stuff out without any monetary risk whatsoever, download a crypto wallet, hop over to zecfaucet and claim a little bit at no charge just to see how it works.

This stuff isn’t going away.

Bitcoin has been declared dead by a notable publication or financial figure 475 times according to 99Bitcoins. And yet, you can now buy not one, but eleven different spot Bitcoin ETFs. These ETFs essentially serve as a wrapped version of Bitcoin that lives within the traditional financial system. For all its faults, and there are several, Bitcoin has been adopted by TradFi. I highly doubt this stops here. In fact, the CEO of one of the TradFi behemoths is telling you it doesn’t stop here.

It’ll be a narrative until it isn’t. Settlement is begging to be disrupted. I’m not going to fade it. Even in an increasingly digital world, natural law still matters; adapt or die.

Disclaimer: I’m not an investment advisor. I personally hold BTC, ETH, SOL, AVAX, ZEC, and MATIC. There will be booms. There will be busts. Don’t ever wager anything you can’t afford to lose on these highly speculative instruments.