A Falling Knife Worth Catching?

One of my top holdings took a bit of a haircut last week. There are headwinds, but I believe the worst was just priced in.

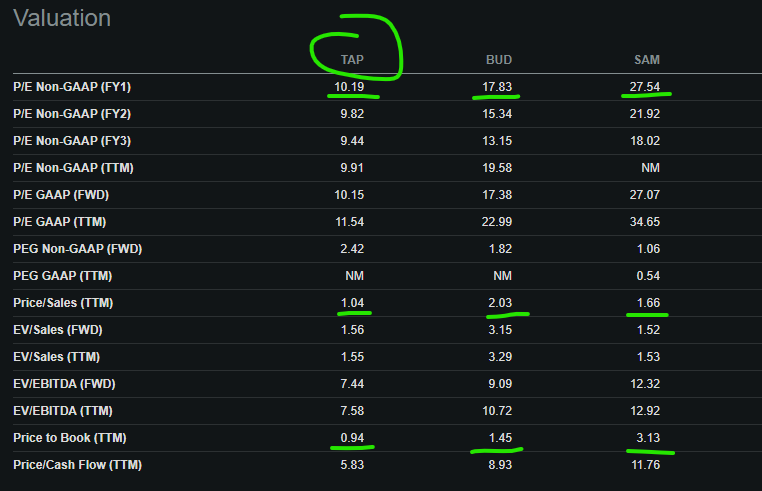

What if I told you I liked a stock that trades at a forward price to earnings multiple of 10, pays a 3% dividend yield, is in a virtually recession-proof industry, and just nuked 10% after crushing earnings? Would you be interested? Well interested or not, that’s what we have on the menu today for my fellow heretics. If you’re a contrarian investor with a value-mindset, this one is probably right up your alley.

Of course, many of you who have been here for longer than a year likely already know my affinity for Molson Coors TAP 0.00%↑ stock. Do I love all of the products? Not really. But TAP plays very well in a long term macro thesis that I’ve had for some time. Namely, high inflation leads to consumer down-trading. For beer drinkers like myself, as it gets increasingly more difficult to justify $16 six-pack craft offerings from local and regional brewers, things like Blue Moon and Sam Adams Boston Lager at $11 per sixer look a lot better by comparison.

Obviously I’m aware Sam Adams Boston Lager is Boston Beer Company SAM 0.00%↑ brand, not a Molson Coors brand. But one stock trades at 10 times earnings and below book value. The other trades at about three times each of those multiples.

Quick Earnings Takeaways

Molson Coors’ Q1-24 earnings release crushed expectations. A few highlights:

EPS of $0.95 beat by 20 cents

$2.6b in Revenue beat by $91.6 million

Bought back 1.8 million shares for $110 million

Net revenue grew by 10.1%

8% reduction in net debt

There is no question that Molson Coors has been a big beneficiary of share growth in the United States market due to Anheuser-Busch InBev BUD 0.00%↑ self-destructing last year. While BUD still has powerful brands and owns Modelo, the company’s Bud Light brand has been losing shelf space to Molson Coors’ brands like Coors Light over the last year or so. Even against what CEO Gavin Hattersley acknowledged are going to be tough growth comps in Q2, Hattersley indicated on last week’s conference call that the company’s share gains in the US are the new normal rather than a flash in the pan response to temporary consumer outrage:

We believe that we've created a new foundation on which to grow. Our shares held for more than a year now. And our first quarter share gains are consistent with the gains that we experienced in the second half of 2023. Our core brands in the US now hold around 15.6% volume share of the industry. That's up over 2 share points from the beginning of 2023.

The question is why such a negative response to what seemed to be a terrific quarter for the company?

I see two factors driving this drawdown - one of which seems overt. The other possibly less so. First, the obvious; guidance for the rest of the year was not great. Hattersley on early indications from April performance:

The first two weeks were not good. Obviously, there were some dislocations there like -- and timing issues like Easter, which moved into Q1. But it's been pretty noisy. The third week actually was a little better, actually quite a lot better than the first two weeks of April. So a lot of volatility at the moment, a lot of holiday mismatches and that drove us to be just a little bit more cautious about the outlook for the industry.

And as I've said in the past, the industry will largely land on how summer goes because it's obviously a really big selling part of the year. And so we'll have a much better idea of where the industry is going to land for the full year as we start to head into summer.

Interestingly, the company indicated this April softness is industry-wide rather than isolated to Molson Coors. Recall that a large part of my Molson Coors thesis is consumers trading down. Turns out, the trading down isn’t necessarily manifesting in choosing different beers as much as it is manifesting in unit economic decisions:

And then from a consumer behavior point of view, we're not seeing trade down to between price segments. We are seeing -- I think I made this point last time around Brian. We are seeing some consumer behavior changing at the two extremes of our pack sizes. So more focused on singles and small packs and on the other end of that spectrum, more focus on large pack consumption with a little bit of a squeeze taking place on that sort of mid-tier pack size of 12 packs and 24 packs.

Bold my emphasis. Basically, beer drinkers are sticking with their brands but they’re either buying less or they’re offsetting inflation pressures by buying in bulk and buying more at once. Which brings us to issue number two impacting the stock, Hattersley on inflation from last week’s call:

I do think that inflation is proving to be a little more, sticky than folks expected, and interest rates are higher and staying for longer. So I do see cautious behavior from consumers.

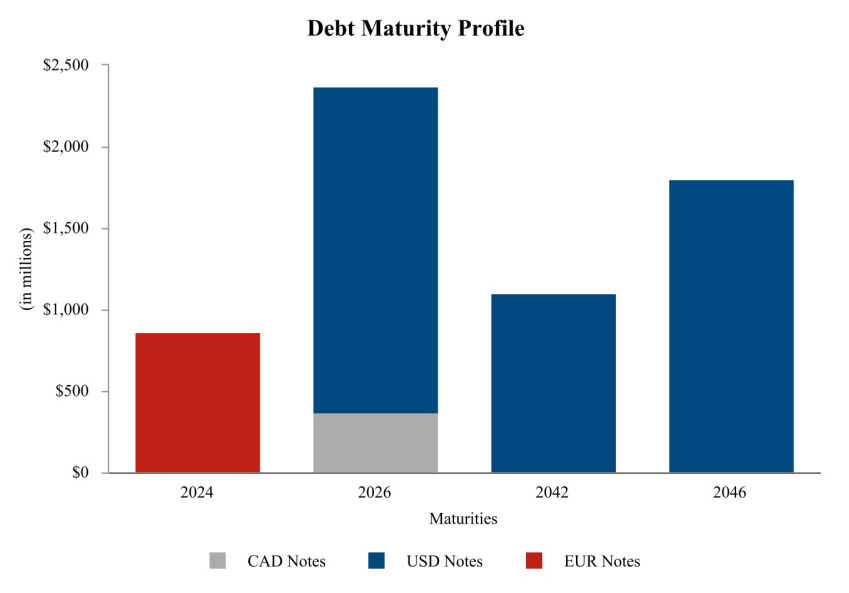

Bold again my emphasis. Higher for longer interest rates may have an impact on Molson Coors very soon as the company has $863 million in EUR notes due in July.

Those notes are at 1.25% - stupid cheap - and will need to be refinanced at a much higher rate since the company has less than $500 million in cash and equivalents. The ECB has interest rates at 4.5% at the moment and it’s generally assumed that refinancing the EUR notes will be at a premium to that.

For what it’s worth, leadership must not be as concerned about this refinancing as the company has already spent $260 million of a 5-year $2 billion share repurchase plan over the last two quarters. The market apparently isn’t seeing it the same way. That $260 million netted 4.3 million shares - thus, a cost basis of about $60.50 per share - a 6% premium to today’s share price. Not great capital management to be totally honest. Especially when that capital could be used to pay down debt that is about to get quite a bit more expensive to service.

Following the EUR note refinancing this summer, the company is generally in the clear with debt obligations through 2025. Things get interesting by 2026 as there is another $2.4 billion due at rates between 3% and 3.4%. I suspect what we’ve witnessed over the last week in TAP’s stock price is a complete re-rating ahead of July refinancing. My hope is the worst is over and the stock is now attractively priced at just 94% of book value:

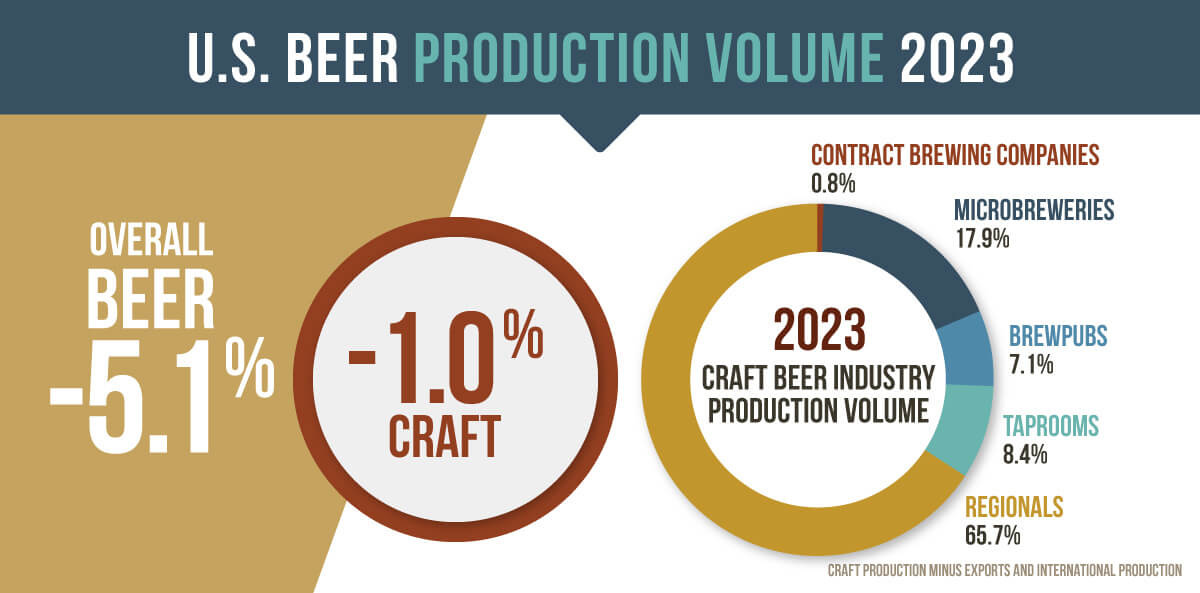

There are admittedly other considerations though. For instance, a large part of my Molson Coors thesis is the impending meltdown of the craft beer industry. So far, we’re not seeing that happen in the data yet:

In 2023, craft’s 1% pullback was actually better than than overall beer category. Furthermore, we’ve yet to see the deterioration of the segment manifest in the total brewer numbers:

Growth in aggregate brewer numbers has certainly slowed in recent years but we are not yet seeing those numbers actually go down, as I suspect they will. That said, my anecdotal notes show serious distress in the craft brewer scene. My private investment in Columbus-based 1487 Brewery went bust and the business recently closed. Elsewhere, South Bend Brew Works has halted investor repayments for a full year and things certainly don’t look great there long term.

Again, I don’t think I’m wrong on craft. Just early. Hattersley commented on the craft industry as well on the last call as the company is revamping the Blue Moon line - Molson Coor’s largest craft offering:

From a Blue Moon point of view, yes, Blue Moon Belgian White is the number one in craft. And it's and Blue Moon Light is actually the number one in light craft beer and as we all know, the Craft segment has had fairly significant challenges over the last couple of years. And because we're the biggest brand in that space, we're not immune to that.

Taking all of this together, there are clear concerns not just for the industry, but for Molson Coors specifically. That said, I have a hard time believing TAP has much downside remaining. A 10% nerfing after a solid quarter seems excessive to me even with the July refinancing impending and shaky Q2 guidance. Of course, I’m just a speculator and I’m a TAP long who may be trying to rationalize away a poor fundamental setup. But this is how I’m seeing it and interpreting things. Do with it whatever you wish.

Disclaimer: I’m not an investment advisor. I play the ponies. TAP is one of my larger equity holdings and I’ve bought more shares post-earnings meltdown.