Altcoin Deep Dive: Polygon, June 2024

Are the best days behind this 2021 high flier? We'll dive into the chain's usage, network activity metrics, and valuation multiples to consider.

One of the altcoins that I’ve been bullish for several years is the native token of Polygon’s flagship Proof of Stake network, MATIC. One of the most frustrating aspects of MATIC is the very thing that gives the token value in the first place; it’s the gas token of Polygon’s primary blockchain network. Not to be confused with Polygon’s zkEVM chain - which doesn’t require MATIC to pay for transactions - Polygon’s PoS chain requires MATIC for every swap.

This is different from most of the other Ethereum scaling chains that have risen in popularity through the years. Optimism, Arbitrum, and Base all utilize ETH for transaction fees. Because of this, those chains are often viewed as “true L2” chains while some have argued Polygon’s reliance on a chain-native token for payments makes it more of an L1 or sidechain to Ethereum.

Functionally, Polygon’s bridging is very similar to that of any of the aforementioned L2s. A user can bridge ETH over to Polygon using numerous protocols. Of course, ETH isn’t used for transaction fees. So if a user deposits ETH to Polygon’s PoS chain from Ethereum, it’s essentially stuck unless that same wallet has MATIC as well to pay to move it. This can make Polygon somewhat difficult to use without a centralized exchange as a supplement for MATIC deposits.

Consider the process for an Ethereum user who wants to buy a $50 NFT on Polygon. Unless that user has MATIC in their Ethereum wallet already, they’re going to have to pay both a swap fee to change ETH to MATIC and then a bridge fee to move the MATIC to Polygon. During times of high traffic, these fees can add up. Given that one of the major selling points of the L2s and side chains is to reduce cost to the user, engaging with Polygon initially can be cumbersome compared to true L2s that utilize ETH for fees.

Chain Usage

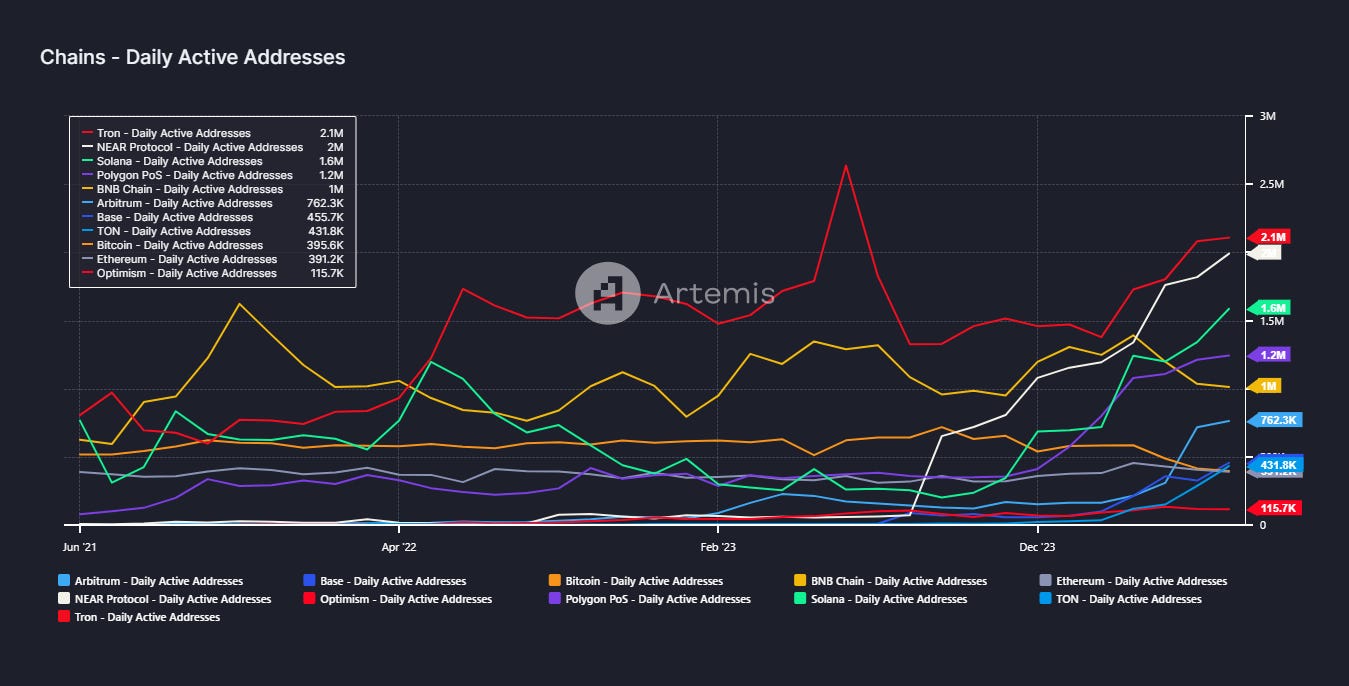

Despite all of that, Polygon remains one of the most used public blockchain networks in the entire landscape. Consider the Daily Active User trend for Polygon PoS compared to some of the other top networks in the blockchain space:

To be sure, there are other L1 blockchains that have higher monthly DAUs like Solana or Tron. But within the EVM “ETH Scaler” ecosystem, Polygon’s PoS chain has the largest DAU figure by a fairly wide margin and has some of the best growth year over year as well (shown in parenthesis):

Base: 501k (silly high number)

Arbitrum: 746k (+346%)

Polygon PoS: 1.2m (+239%)

Optimism: 115k (+28.6%)

Ethereum: 392k (+19.5%)

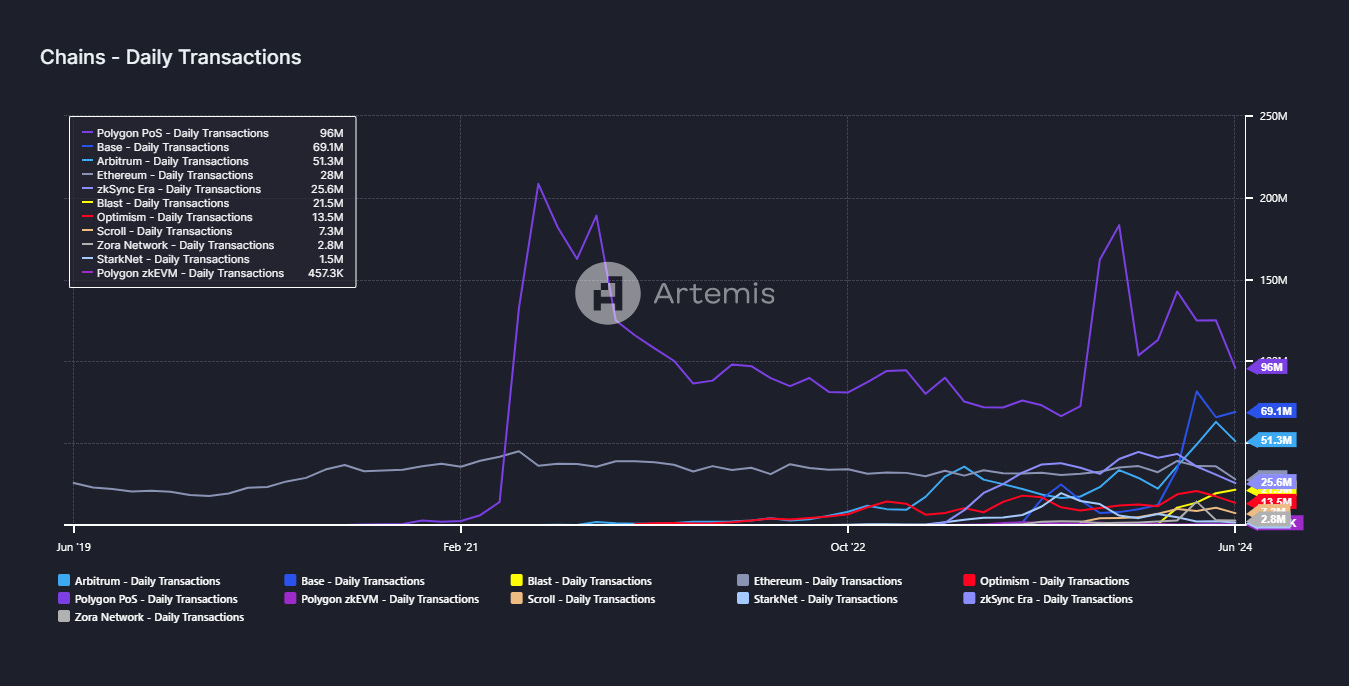

This larger user base on Polygon has propelled the chain to the top spot in the Ethereum ecosystem based on daily transactions:

As a low-cost chain, Polygon’s transaction story has generally been positive since the chain was launched back in 2021. But there is no question in my mind that the proliferation of scaling chains - among them Polygon’s zkEVM network - has led to a fragmentation of the Ethereum ecosystem and Polygon’s PoS chain growth has likely been stunted due to the increasing options that traders and developers have in utilizing other networks.

Network Activity

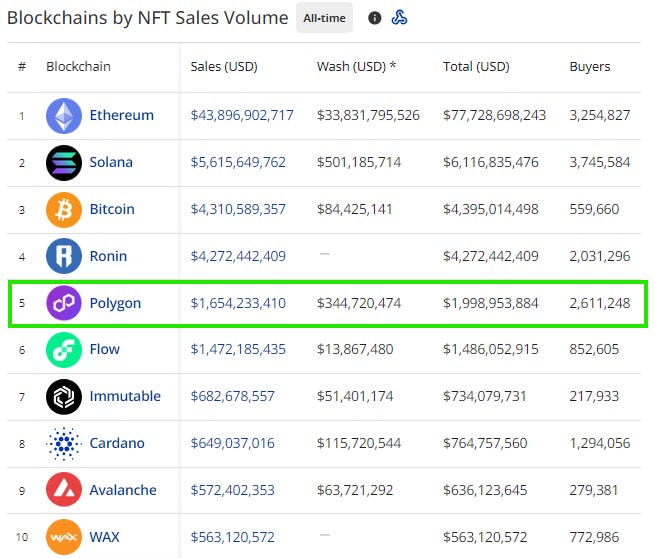

What has always endeared me to Polygon is that many of the protocols that I’ve experimented with have been built on top of the network. The network ranks 5th all time in NFT sales volume and third and NFT buyers:

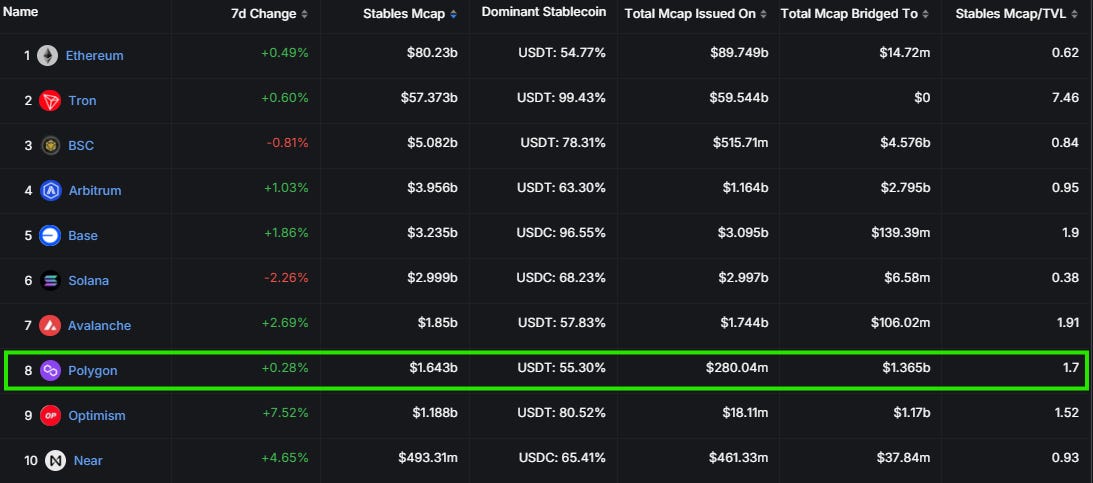

Chains like Ronin and Immutable X are specifically designed for gaming/NFT solutions, so it’s interesting to see Polygon still among the top 5 all time in the NFT category. The chain is actually third in sales behind just Ethereum and Bitcoin over the last 30 days. In the “DeFi” space, Polygon still holds a top 10 position in the market, but it has been noticeably slipping in this market segment:

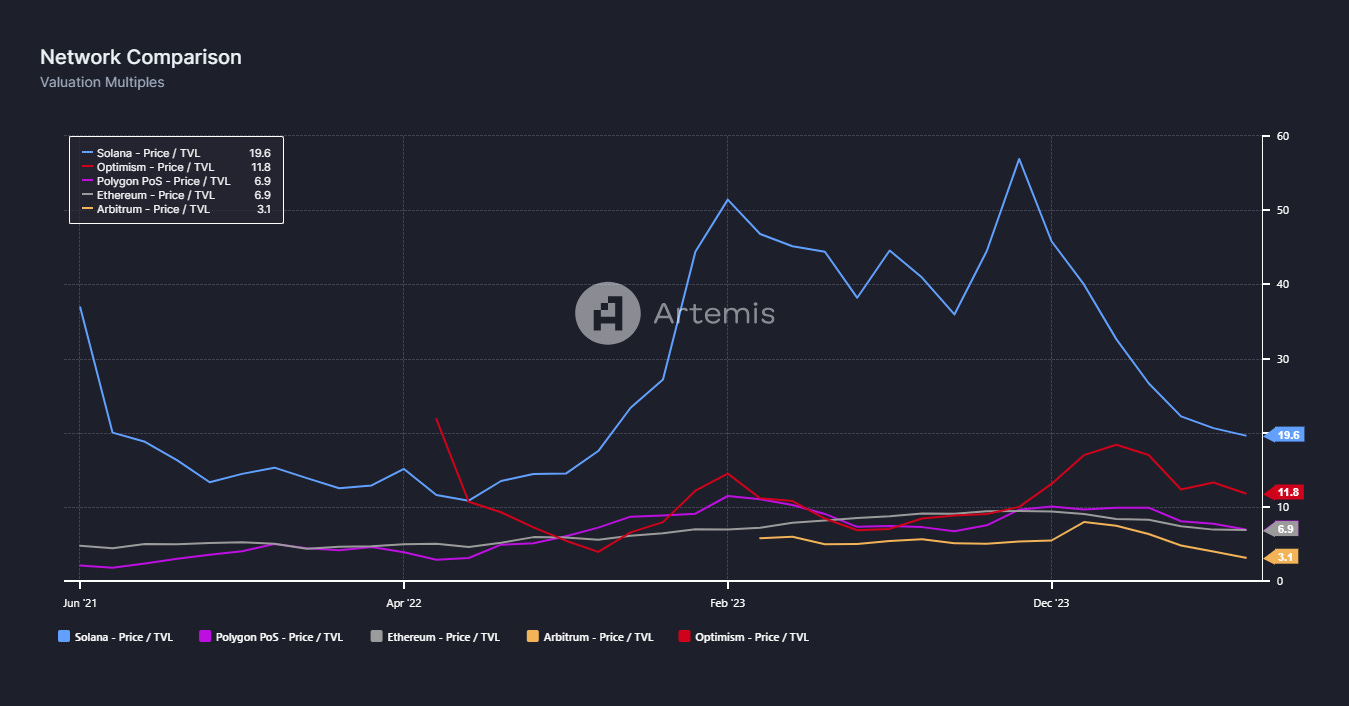

Polygon’s TVL story may not be great. But the chain itself still has 559 protocols utilizing the network - this still fourth in the DeFi space. At one point, Polygon had nearly $10 billion in Total Value Locked. That figure is now just $852 million. The longer term trend in this category is admittedly rough. But I suspect a large part of this multi-year TVL slide is a result of MATIC’s overvaluation during the the previous bull cycle:

Polygon’s MATIC token was one of the high fliers during the 2020/2021 bull run due to the network’s leading position as an ETH scaler and because the chain has a footprint in nearly every aspect of the crypto market. There’s an NFT angle, a DeFi angle, and even a stablecoin angle. As this coin has rerated lower, so too has the network’s TVL declined with it.

Polygon does still command $1.6 billion in stablecoin market footprint, good for 8th among all public blockchains as measured by DeFi Llama. Like the TVL story, Polygon’s stable market is well off the peak of $3.1 billion from 2021 though it has been rising over the last 6 months. Once again, the network has been competing with ETH-based scaling chains for liquidity. Polygon’s primary utility is that it’s an all-encompassing consumer chain that touches most facets of crypto.

The ultimate question is can Polygon withstand the more cumbersome UE of MATIC as gas rather than ETH? This is not a UE problem that is shared by Optimism or Base. That said, this is not a new problem for Polygon and usage is still increasing to a larger degree than most peers based on raw DAUs. The user angle is one worth watching. It’s an uphill climb, but it’s not an insurmountable one if gas payment is abstracted away at the application level and there are already examples of this happening.

Fees and Valuation

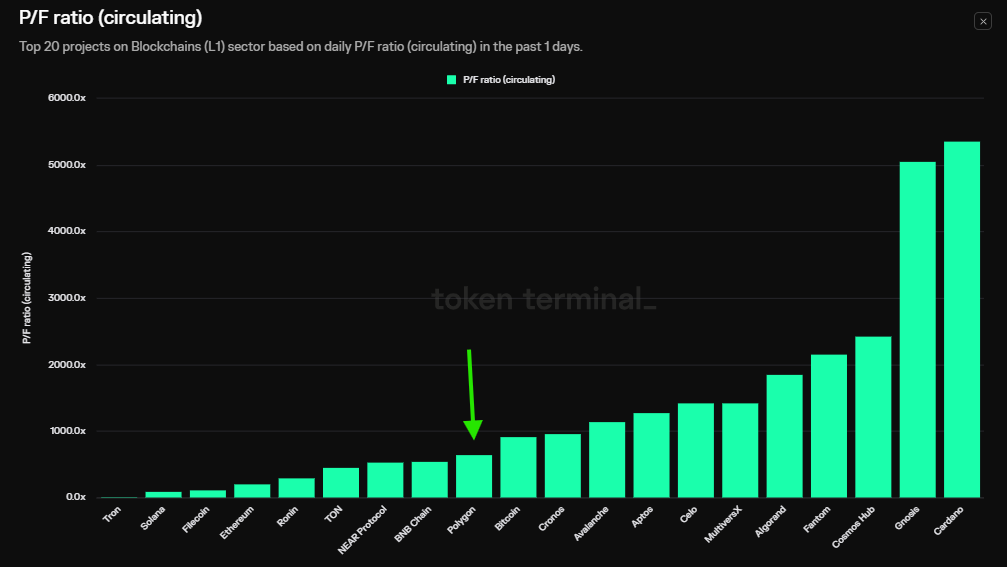

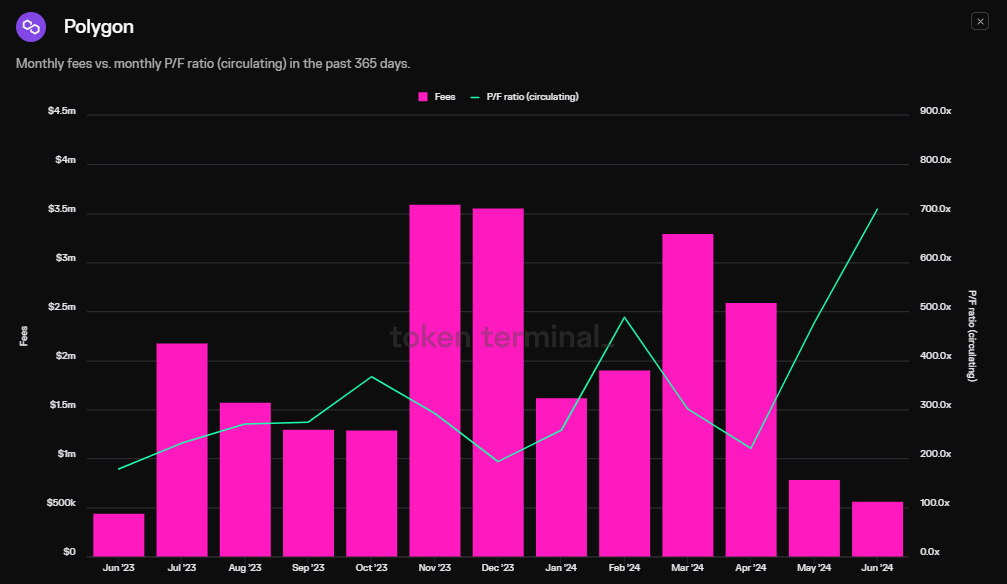

For investors, valuation is worth consideration as well. As a smart contract chain, price to fees is an important metric to consider. At 650x circulating fees, Polygon’s MATIC token is not what I’d call a cheap asset though it is dramatically less expensive than networks like Avalanche, Aptos, or Cardano based on this metric.

As of today, Polygon’s PoS chain has generated just $566k in fees for the month. While this is already ahead of last June, the price to fee multiple has more than tripled from the 178x P/F ratio that it traded at during June 2023. This is till cheaper than many cost-efficient chains but well behind a chain like Solana - which averages more DAUs, more transactions, and has larger TVL figures.

However, price to fees isn’t the only valuation metric to consider. Based on market cap to TVL numbers, Polygon’s price is more inline with a network like Ethereum and trades at about the third of the price of Solana.

Price Action

We can’t get out of this without at least mentioning the price action in the token itself.

At $0.57 per coin, MATIC has almost entirely retraced its gains since the Q4-23 lows. In the chart above, we can see the purple channel that the coin was nicely trading in for much of October through March. However, since last tagging the top of that channel in mid-March the coin has sold off by a monstrous 60% in about 3 months. It’s certainly not a good looking chart.

Main Takeaways

I’m personally still long MATIC and I added to my holdings yesterday. I think Polygon’s usage story is still a strong one. We could certainly see plenty of further downside if we get a larger crypto selloff - something that I do think could theoretically happen. But I’m actually of the view that most of the damage in top tier altcoins has likely happened. Shorter term, I think the more likely scenario is MATIC retests some of those key MAs in the $0.70-0.75 range.

For more long term-minded holders, Polygon’s PoS chain is still the flagship chain of the network. Polygon’s zkEVM chain has been very disappointing in my view. The zkEVM chain has a small fraction of the protocols and TVL that the PoS network has. Despite those UE tradeoffs with the MATIC token, the PoS chain is still the clear favorite of the two for developers and users. I think there’s a signal there and MATIC still deserves a spot in diversified portfolio of digital assets given the chain’s strength with those users and developers.

Of course, fees are the key. And Polygon’s fees are still very low. If we see more protocols that utilize the network abstract those fees away at the application layer, MATIC will still have an organic bid for fees even if the consumers who are engaging with those applications aren’t aware that the MATIC gas fee is baked into their total cost to transact.

Disclaimer: I’m not an investment advisor. I’m long MATIC.