Post-China Ban, STEPN Appears to Be Struggling

After largely falling from the social media zeitgeist for two months, STEPN was once again trending on social media yesterday. I decided to revisit the Ponzi-like play to earn crypto project.

Yesterday I was perusing Twitter and I noticed something interesting on the side panel; STEPN was trending. So I decided to see if I could figure out why. Turns out the community was doing a token giveaway that apparently led to a spike in social traffic and, as we'll see in the charts below, a brief spike in new user inflow.

Some of you probably know that I’ve covered STEPN twice for Seeking Alpha publicly and I wrote about it privately once on Substack. STEPN is the “move to earn” fitness app that rewards users for getting outside and exercising. I actually love the concept. In practice there is a bit of a catch. In order to use the app for its intended purpose, the app users have to buy a sneaker NFT that they use during the exercise.

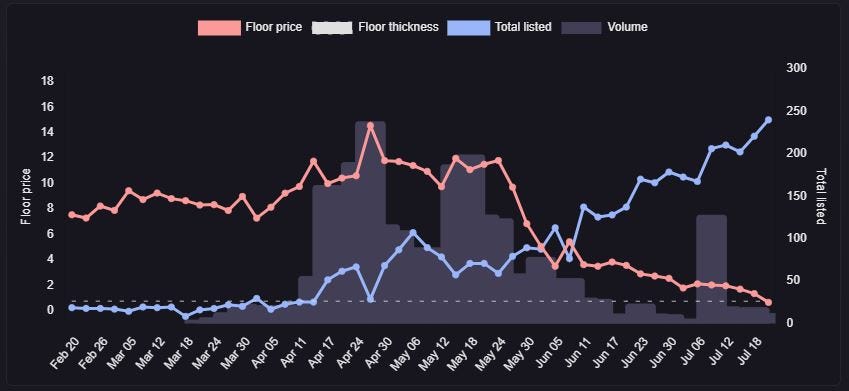

Back in May, everything STEPN was going gangbusters. The sneaker NFTs were fetching thousands of dollars. The governance token (GMT-USD) was $4 in late April. The payout token (GST-USD) hit $9 on Solana at the same time. The floor price on the sneaker NFTs hit 17 SOL on April 28th - the equivalent of $1,700 at that time. Since then, GMT has plummeted to under $1, GST collapsed over 99%, and the sneaker NFTs hit a floor price of 0.63 SOL just this morning - the equivalent of $25 at current Solana pricing. And as I’ve mentioned previously, listings have increased while volume has dried up - thus, the floor prices have collapsed very much in line with GST.

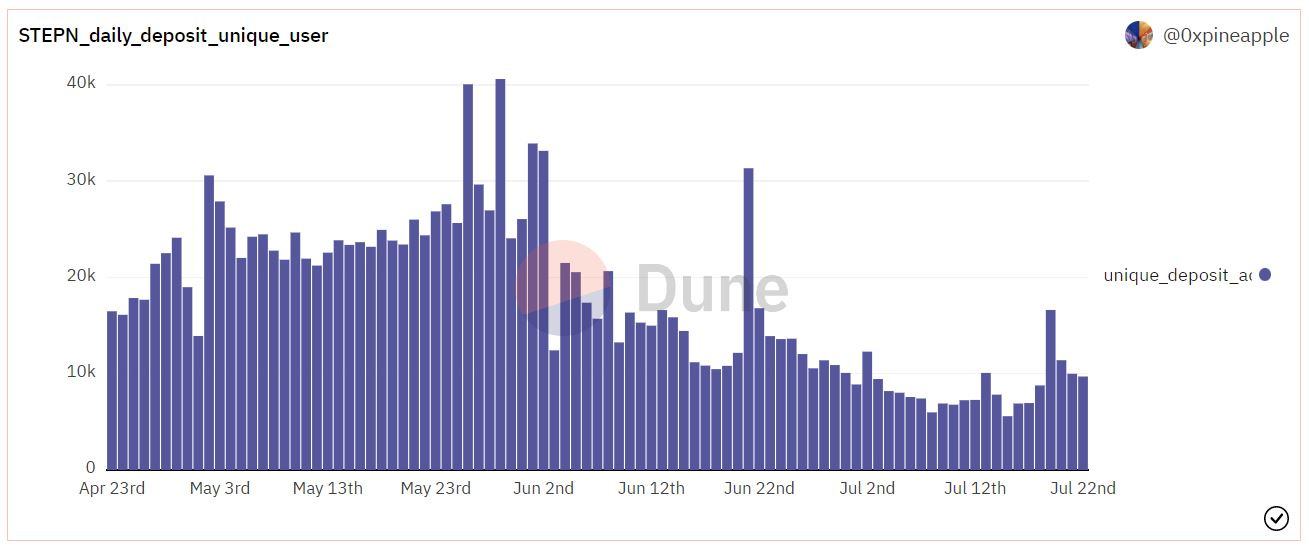

Community interest in high profile projects like STEPN is good because it means eventually smart, driven people start building their own data dashboards on platforms like Dune Analytics. There’s a Dune user called 0xPineapple that has built a really nice dashboard covering STEPN’s currency flow and user adoption. Sorry, the rest of this post is going to be chart heavy. Here’s a chart showing daily unique users actively doing deposits:

You can see while it’s nowhere close to where it was during the May mania, the platform still has about 10k unique users depositing funds on a daily basis over the last month or so. This next one is important though, this is the daily new user deposits:

It has really slowed down. Another way to look at this is through accumulated users:

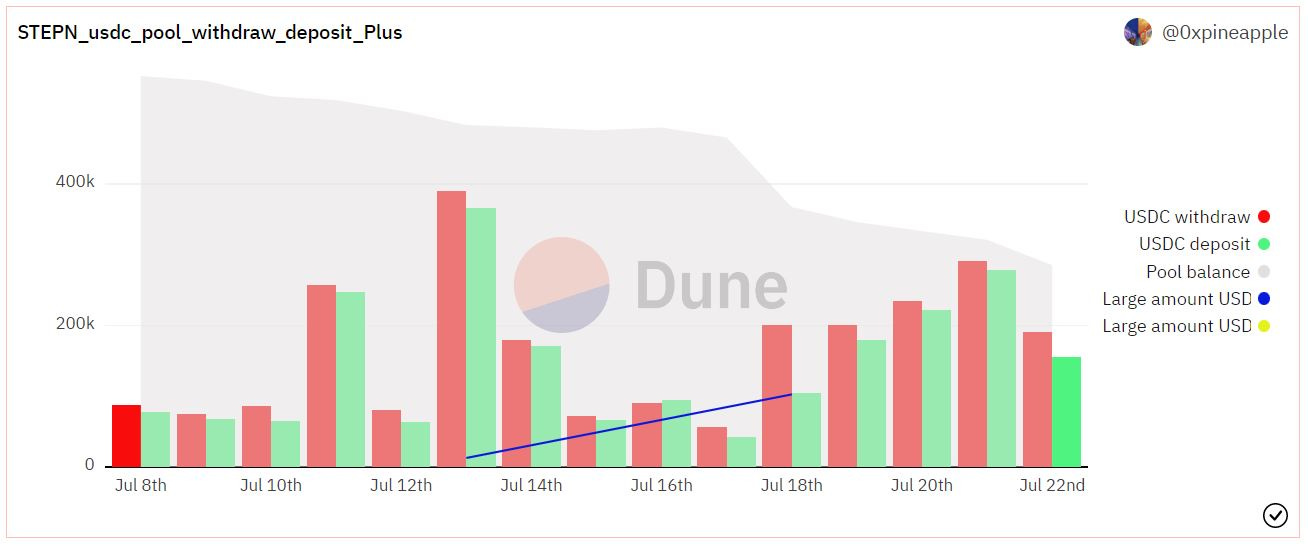

Here we can see just how wild the growth was in May. It really looks like it has peaked at this point. And just to kind of hammer home the issue that STEPN is likely now facing; here’s an unbelievable chart that shows the USDC asset flow with the USDC pool balance:

The red bars are withdrawals. The green bars are deposits. The gray line in the back is the pool balance. The liquidity pool is shrinking. I could show more charts that indicate SOL and BSC outflow but I think you get the point. Interestingly, despite the apparent outflow problem, the governance token is actually holding up fairly well compared to the NFTs and the payout token. GMT still commands roughly $0.95 per coin and it’s actually up roughly 50% from where it bottomed in mid-June.

Hypothetically, if you want to throw some scratch off ticket money at this project, I’d probably express that wager through the GMT governance token. But even that should probably be limited to a swing trade and nothing more. The circulating supply of GMT is only 10% - there is a massive amount of dilution still coming. The NFTs are at the mercy of the payout token and GST has an unlimited supply. But to be clear, I have serious concerns about the viability of this project.

While it would be easy to point to the fact that China banned the app at the end of May as an important catalyst in both the drop in growth and the outflow issues, STEPN was also trending in the United States in May and June as well. Interest domestically has also fallen drastically according to Google Trends.

As a crypto proponent and a casual jogger, I was very excited about the possibility of STEPN when I learned of its existence. It took me all of an hour after getting into the platform to determine it wasn’t a good fit for me as a consumer. That might be an indication into exactly the kind of user this platform was appealing to in May. It was classic money for nothing, “number go up” speculation. Maybe the folks at STEPN can revive this thing and make it work down the line for a global consumer base. Personally, I’d rather put the scratch off ticket money elsewhere.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero.