All I can say since that market update last week is wowzers. From a broad direction standpoint, I pretty much had the call right; stocks down. But the trades that I put on were absolutely massacred yesterday. Turns out a broad market decline isn’t conducive to a reversal in pot stocks. Especially when congress is completely committed to allowing US-based business owners to be victims of honeypot raids:

Despite significant bipartisan support within Congress and increasing popularity among constituents, cannabis reform to allow basic banking services for state legal cannabis companies has once again failed to advance. As a result, the 425,000 employees working in the legal cannabis industry will continue to face undue risk of robberies and economic harm.

I mean MSOS, Jiminy Christmas:

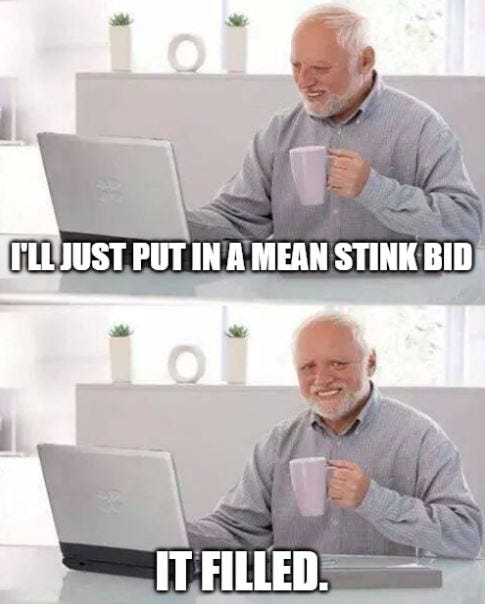

Yesterday MSOS was down 18% in a single session… crazy. I actually had a ‘stink bid’ for $7.50 that I put in last week when the ETF was trading at about $9. That stink bid filled yesterday.

This is complete insanity. These multi-state operator stocks have been sold off roughly 90% now. They are either going out of business and they’re all zeroes (certainly possible), or the ‘news’ of SAFE banking not passing this year has now been sold roughly 3 times and the worst should be behind us. I really don’t know. But my God. It’s been a bad year for crypto, but US pot as an industry is actually down worse - no joke.

I’ve been told crypto is thin air and I should be investing in real companies. Well, here we have the US pot industry… real domestic companies, providing real goods and services, in a growth industry, and it’s completely un-investable. Why? I guess we’ll have to ask congress. This is why so many millennials and zoomers are nihilists.

Metal Miners Diverge

Meanwhile, we have metal miners completely ignoring the price moves in the underlying products that they mine. Look at this divergence in SILJ:

For six months SILJ and Silver have performed roughly in tandem. Now, Silver is going up and SILJ is going down. Six month price performance:

Silver: +9.7%

SILJ: -5.8%

One of these is a fake move and the other is the real move. I don’t think I’d be selling silver today. So take that for what it’s worth.

Disclosure: I am not a financial adviser. I am not a law expert. I share what I do and why I do it for informational purposes. This blog simply reflects my personal opinions. I have exposure to equities, precious metals, cryptocurrencies, and various other alternative assets. I am staunch supporter of third-party risk minimization when applicable. Meaning, do it yourself and hold it yourself. If you don’t know how, learn. If you can’t manage your wealth yourself, talk to a professional wealth manager. Of course, please remember nobody cares about your money as much as you do.

![[FOTOS] El hombre del meme está en Chile: Hide the Pain Harold fue visto en Plaza Italia ... [FOTOS] El hombre del meme está en Chile: Hide the Pain Harold fue visto en Plaza Italia ...](https://substackcdn.com/image/fetch/$s_!--TB!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F71ea13fb-74a9-418e-a7dc-78d0da505360_1200x800.jpeg)