I saw an interesting question from Zerohedge on Twitter this evening. Because Elon is being a DB, I’ll copypasta the tweet:

This is unprecedented humiliation for the @federalreserve

Just 2 hours earlier, Powell said US banking system is "sound and resilient", seemingly unaware that yet another of the largest California banks was teetering on the edge. How is this level of incompetence possible

This is in reference to yet another regional bank appearing on the brink of collapse with PacWest PACW 0.00%↑ down roughly 55% after hours. The selloff is in response to the company disclosing it is weighing “strategic options,” with an outright sale on the table. While I haven’t touched on the regional bank crisis much on this blog since March, I’m very aware of the turmoil in the sector.

Just to recap in case you haven’t been following along on your own, in the last two months we’ve seen the end of:

Silvergate Capital

Silicon Valley Bank

Signature Bank

First Republic Bank

Now we have problems at PacWest? This should not be surprising. Recall what I said in What If I Told You This is All a Scam:

Janet Yellen isn’t dumb. She’s just terrible at navigating real questions and it shows. She’s not unaware, she’s in on it. As is Jerome Powell. Call me crazy, but taking actions that have a high likelihood of creating 5 behemoth banks with the understood collateral damage of essentially eliminating smaller competition doesn’t seem like an unforced error. This feels a bit too close to the moves one would make in setting the board to take the king.

Or what I said just a week later in The Confidence Game:

The system is rotten. The Chairman of the Federal Reserve told the world the central bank wasn’t “thinking about thinking about” raising interest rates in June 2020. At that time, he told the financial markets that rates would stay at zero through 2022. Then he raised rates at the fastest pace on record by year over year change percentage beginning the first quarter of 2022. Now all of the banks that bought treasuries on his June 2020 rate guidance are underwater and need bailouts.

So my answer to the Zero Hedge question at the beginning of this post is that it isn’t actually incompetence. It’s orchestrated destruction. The global monetary system is going through an enormous change. Global reserve currency status is not a permanent honor no matter how much the US establishment and its bootlickers pretend everything is under control. The fact of the matter is the rest of the world has a say in all of this and like Magnus Carlsen the BRICS nations have set a little board of their own.

The people really pulling the strings in America know this. It’s obvious. They are not going to be able to weaponize currency against the rest of the world for very much longer but that won’t stop them from trying to keep doing it to the US populace to maintain “order.” To pull this off, they’re setting an entirely different board while playing both games at the same time. And those moves go something like this:

Lock the exits

Set the building on fire

Turn on the hose

The plebeians will be begging for the CBDC water. Which bank is next? Anybody’s guess…

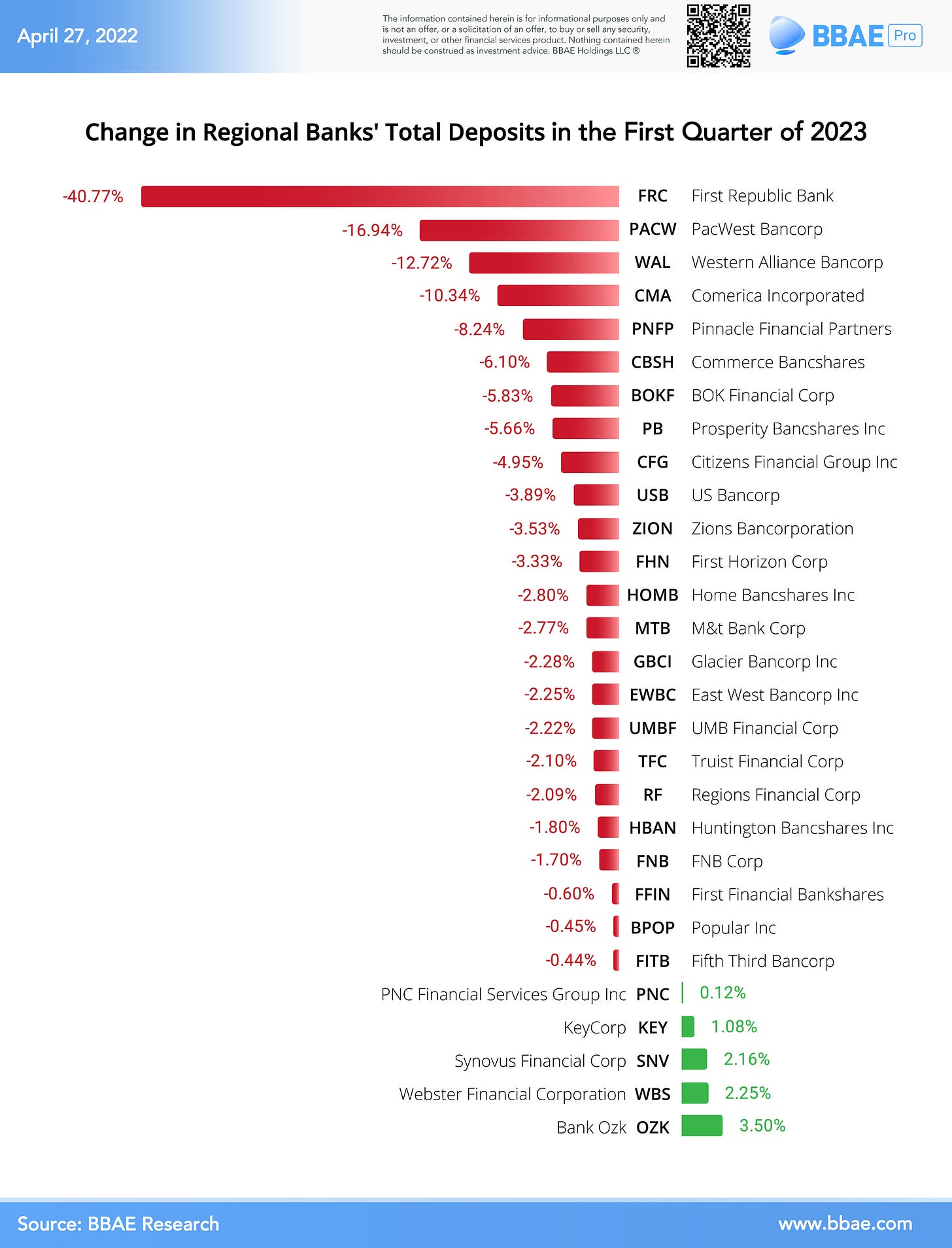

But purely using Q1 deposit flow as a crystal ball, I wouldn’t want to be holding shares of Western Alliance Bancorp WAL 0.00%↑ or Comerica Incorporated CMA 0.00%↑.

Be safe out there, guys. For real.

Disclaimer: I’m not an investment advisor.