Disclaimer: I’m not a professional. None of this is investment advice. For God’s sake do your own research.

I’ve had an investment thesis for about two years that I’m now second guessing. That’s a good thing, by the way. You should always be willing to challenge your own thinking when it comes to stocks and market theories. Best case, you know that your theory holds up. Worst case, you lose conviction in the idea and make the necessary changes. Regularly testing your own ideas against an opposing viewpoint to reassess positioning is a good thing to do.

Even before COVID-19 and the economic measures taken to crush the curve, the US economy was due for a recession. I’ve covered it here on Medium a few times. Long story short, if you thought the US had the strongest economy ever before the pandemic, it didn’t. Corporate earnings before tax peaked in 2014.

You read that right.

Not only that, but growth trajectories in corporate debt and corporate profit completely diverged right around the same time. And no, it wasn’t profit that kept moving up. The economic activity was debt-based and wildly unhealthy from a financial standpoint. But I’m getting off topic.

Anyway… my thesis. I’m getting there. The point is, we were already much closer to a recession than most people realize (if not already in one). Because of this, portfolio-wise I have been positioned for a recession for a while. One of my favorite long ideas is MolsonCoors (TAP). Why?

Beer, wine and liquor sales are a slam dunk. ALWAYS. The chart below is annual retail sales of beer, wine, and liquor in millions of dollars.

Alcohol sales have averaged a 4% CAGR for two decades. Sales even increased during the financial crisis. So even when the world is burning, you can bank on booze. More recently, we saw liquor sales spike as the country faced stay at home orders. Short of a peak in aggregate alcohol consumption, booze is still a safe bet in my mind.

Until recently, large alcohol companies with brand recognition and scale were solid bets in my eyes. When I originally made this bet, I liked MolsonCoors specifically because it lagged the other big beer makers like Anheuser-Busch, Boston Beer, and Constellation Brands. Value metrics I like to look at also favored MolsonCoors compared to peers when I opened the trade.

Now, I’m second guessing everything.

And it’s not just because I’m holding a $34 stock with a $50+ cost basis. I’m contrarian by nature. Being down doesn’t bother me if I think the market is getting it wrong short term. Problem here is the market just might not be getting it wrong. The company suspended it’s dividend and is back down to financial crisis share price levels.

There’s no denying traditional American beer brands have been bleeding share for some time. With craft beer taking off in the last 10 years and hard seltzers stealing away share from everything, the American light swill brews have been on borrowed time. My thesis in MolsonCoors was largely predicated on a looming recession putting smaller craft breweries out of business. With job losses and households tightening up spending in a recession, beer enthusiasts would be forced to transition away from $18 sixers and expensive visits to taprooms in exchange for the cheap promise of a buzz offered by the Champagne of Beers. I now believe these smaller localized micro-brewers could be in a fairly favorable position.

Something that Tenino, WA Mayor Wayne Fournier touched on during my last podcast is a move towards more localized economies. The motivation for that is pretty straightforward; COVID-19 has shown us that reliance on a handful of distribution centers for large-scale consumption can present big problems when supply chains get disrupted. If we learn from this pandemic, we could be at the beginning of a larger movement toward economic localization.

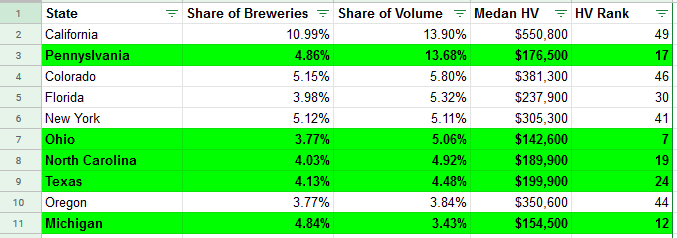

Economic localization figures to be a good thing for businesses that already have more localized models. Independent craft breweries fit in that category. Since there is already a large craft brewing economy, which states are supplying demand? In an attempt to figure that out, I took state by state data from BrewersAssociation.org and compared which states had a higher percentage of barrel volume than percentage of total breweries. Depending on how one chooses to look at it, states where barrel volume percentage exceeds craft brewery percentage may have the most to lose in localization if they’re also high cost of living areas.

The top 10 states account for about 51% of total US breweries. Those same states also account for 65.5% of US barrel volume. In the case of PA, Yuengling is almost certainly the outlier ramping up the state’s share of volume. Otherwise, you can see moderate levels of over performance in many states with higher brewery share. Michigan being the only real laggard. Beyond which states are serving demand, we can take a stab at which states have a more solid base of interest. Todd Alstrom is the founder of BeerAdvocate.com, he shared the top 10 states by activity from his registered users over the last month on twitter.

It’s admittedly a small sample size, but it can at least give us some insight as to where the diehards currently reside. It probably shouldn’t go unnoticed that Colorado is a top-3 state by volume yet didn’t crack the top 10 locations for registered users on Beer Advocate last month. I see you, MA.

I alluded to it earlier; if we want to really go crazy we can look at housing affordability by state and see if anything stands out. This data from experian shows median home values. If we accept that lower home valuations equate to better living affordability, 5 of the top 10 states by volume are in the top half of affordability. Maybe that shouldn’t come as a surprise.

Why does any of that matter? If we combine the economic localization theory with the potential the country has for a remote workforce movement, we get to a place where low-cost of living states where craft beer punches above it’s weight are in a great position moving forward. If we do indeed get a remote workforce movement that makes it possible for California’s craft beer fanatics to migrate to lower cost of living states and keep their jobs, places like Ohio, Michigan, North Carolina, and Pennsylvania could see craft connoisseur inflow.

It’s a lot of ifs. I get it. And we won’t know how this all plays out for years, maybe decades. But at minimum it’s making me rethink the way I’m investing in alcohol.

It might be time to dump this bag and retry that Mr. Beer kit here in the Buckeye State.

Another Disclaimer: as of publishing I am still long TAP.

This paywalled article is free for everyone for a limited time! If you know somebody who you think would enjoy reading it, you are absolutely free to share with them. There’s a lot of good stuff behind the paywall! Take the deal.