Bit Digital: An Updated Look At The Fundamentals

If you're buying the AI hype, you may want to take a look at one of the data center companies buying NVIDIA's silicon shovels.

Bitcoin mining stocks are notoriously incredibly volatile and the last three months have been no different. One of the fastest horses on the BTC mining track is arguably Bit Digital BTBT 0.00%↑. After nearly tripling between mid-November through the end of 2023, BTBT shares have collapsed 54% since the start of the year.

This is the second time in the last 12 months that this sort of round trip roller coaster has happened. My position on Bitcoin miners for some time has been that they’re great short term trading instruments and terrible long term investments as currently constructed. There are about two dozen of these companies that trade in the public markets and I think I’ve now covered nearly all of them.

As such, BTBT is a company that I have some familiarity with. I’ve written about it a half dozen times for Seeking Alpha over the last two years and it has generally been one of my top 3 to 5 BTC mining positions at any given time. More than simply Bitcoin mining, which has considerable headwinds without a permanent change to Bitcoin transaction fee market dynamics, Bit Digital also runs an Ethereum-staking business and recently started generating revenue from generative AI solutions.

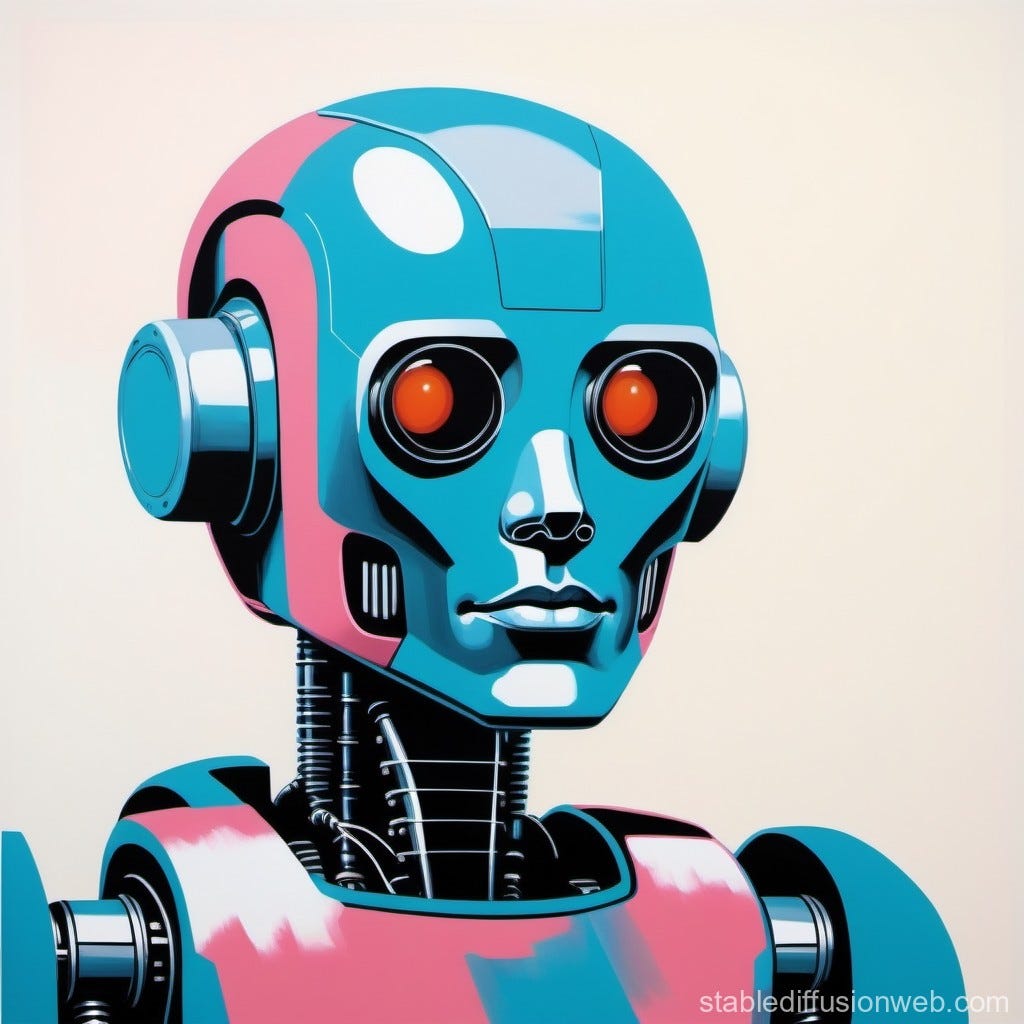

In my opinion, if you believe all of the NVIDIA NVDA 0.00%↑ hype, then companies like Bit Digital should be on your radar as well since this is one of the companies buying the H100s that NVIDIA is slinging. Bit Digital is finding itself in the increasingly crowded Bitcoin miner-turned-HPC data center realm. Just buying chips is one part of all of this. From there, AI/machine learning solutions need physical infrastructure and that’s where data centers like Bit Digital come in.

If this is all completely Greek to you, I would recommend trying out an image generating service like Stable Diffusion - it’s an incredible tool and shows how powerful AI can actually be. Here’s an example of what it can do. I entered the prompt:

a painting of an artificial intelligence powered robot in the style of Andy Warhol

Less than a minute later, I had this:

An art enthusiast may take issue with the “Warhol-ness” of this output but it’s a lot better than I could do with Gimp or Photoshop and it took a heck of a lot less time to generate.

For Bit Digital, generative AI is interesting. Frankly, I have a lot of questions about how these types of things will ultimately be monetized, but what can I say; when you’re in a gold rush you can charge a lot for shovels. We’ll see if it sticks. So far, Bit Digital has disclosed $1 million in revenue from its first AI contract near the end of January. This is where projections get interesting and when combining AI revenue forecasts with what we can reasonably expect Bit Digital to earn from BTC mining for the remainder of the year, I’d actually argue BTBT may be cheap at Monday’s closing price based purely on what I think are achievable full year revenue expectations.

Projecting 2024 Revenue

Back in October, Bit Digital announced the launch of its new AI data center business. In conjunction with the announcement, which could be worth up to $257 million in revenue, Bit Digital disclosed purchase orders for over 1,000 Nvidia HGX H100 GPUs. As is sometimes the case with these “worth up to” contract announcements, the reality is likely much less lucrative. More recently, it appears as though Bit Digital is expecting $50 million in annualized revenue from this AI contract:

The total contract value with the customer for an aggregate of 2,048 GPUs is now worth more than $50 million of annualized revenue to Bit Digital.

That’s certainly nothing to sneeze at but it surely comes with a hefty price tag. H100 GPUs can range from $30k to as high as $40k a pop. That puts the purchase price of 2,048 Nvidia GPUs at $61 million if we’re taking the low end estimate and assuming favorable pricing for bulk purchases. Given the length of the disclosed contract is three years, $50 million annualized comes out to $150 million in total revenue. I don’t think we know yet what that energy cost will look like but it’s a good bet that actually running the machines will eat into that return on capital quite a bit.

Honestly, if the cash burn to run the machines is anything like Bitcoin mining, Bit Digital’s AI strategy may be a whole lot of effort for a modest payoff. The good thing is, use of language models doesn’t figure to diminish over time as is the case with Bitcoin supply emissions. The only thing more parabolic than the NVDA price chart is Bitcoin’s global hash rate:

This is a brutal chart for miners who haven’t grown hash over the last two years because it means their share of the network reward has been eviscerated. Making the economics of mining more challenging is the fast approaching block reward halving in April. On average, Bit Digital mined 126 BTC per month for all of 2023. If network hash and transaction fees all stay the same, that number will be much closer to 60 in May following the halving.

Thus, predicting the impact on revenue for Q3 and Q4 of this year for Bit Digital requires the ability to forecast Bitcoin’s price and I don’t think anyone can reasonably claim to do that with great certainty. For some time, the Stock-to-Flow model was viewed as the crystal ball but 2023 really threw a wrench in that theory as $50k was never reached and the model indicated BTC should have been there the entire year.

That said, since $50k was nearly hit last month following spot ETF approvals, I think we can safely use that figure as a base case for 2024 when building a revenue table for BTBT’s post-halving production. At the end of 2023, Bit Digital guided for 6.0 EH/s by the end of 2024 though it hasn’t provided a timetable for that growth as far as I can tell. But if we assume the company will deliver on that goal, it will have essentially made up for the production decline from the halving as EH/s capacity was just 2.5 at the end of January.

If we operate under the assumptions that production will remain where it is for the remainder of Q1-24, Bit Digital’s EH/s will begin to scale in Q3 and hit 6 in Q4-24, and the company’s AI contract won’t flake, this is what full year revenue might look like with $50k BTC:

Q1 mine production: 2.5 EH/s generates 444 BTC for $22.2 million

Q2 mine production: 2.5 EH/s generates 222 BTC for $11.1 million

Q3 mine production: 4.5 EH/s generates 400 BTC = $20 million

Q4 mine production: 6.0 EH/s generates 533 BTC = $26.6 million

Full year AI compute: $50 million

Total 2024 revenue: $129.9 million

Obviously, this is really a back of the envelope calculation that takes some liberties with assumptions. But it also doesn’t use a forecasted Bitcoin price at a large premium to what we just saw a couple weeks ago when BTC hit $49k. It also happens to be more than what the consensus estimate is for Bit Digital’s 2024 revenue of $96 million:

Given the current $232 million market cap for BTBT, this 2024 full year revenue estimate would put the company’s valuation at just 1.8x forward sales - which is actually well below the 2.9x Information Technology sector median for that valuation metric. Of course, this does not necessarily equate to positive earnings. I suspect growing EH/s and building out AI compute is going to require quite a bit of cash and Bitcoin miners have a history of growing through share dilution.

In my view, it’s an important year for BTBT and I suspect there will be some deeply negative earnings quarters as hash/compute capacity scales this year. As some of you know, I’m a sucker for charts and BTBT has an interesting one.

I’ve drawn some trend lines from the cycle bottom at the end of 2022. BTBT is currently in the space between those two lines as of posting. I wouldn’t totally rule out a dip below $2.20 but I don’t think we want to spend too much time below there. In any case, I’m planning to hold this one in HSEP through the halving. Ideally, I can get my cost basis down to the mid-$2’s but it will take some good trading to get that done.

Disclaimer: I’m not an investment advisor. I’m long BTBT in both HSEP and in my IRA. I’m also short NVDA through NVDS shares. There is an enormous amount of risk in BTBT. It’s not a company that has a rich history of profitability. Dilution is a regular occurrence and short interest is high.