Brave Browser Ecosystem Growth

The Brave Browser is arguably one of the most important ecosystems utilizing a crypto token model. A look at the network growth and why I think BAT is so exciting.

The Brave Browser ecosystem is one of the most interesting projects in crypto. Before we jump into some of the numbers, I hold BAT token and theoretically stand to benefit from increased adoption of the Brave ecosystem. Brave, and by extension Basic Attention Token (BAT-USD), is something I’ve covered numerous times both at Heretic Speculator and for Seeking Alpha. Late last year, I gave BAT my ‘Top Token Idea’ stamp in the BlockChain Reaction crypto research service. So it’s a token that I have a large amount of conviction in.

Quick Background

As I said, I’ve covered Brave/BAT before and you can possibly get more utility nuance from checking out some of these prior posts:

Seeking Alpha: Building A More Free And Fair Internet

Substack: Brave & BAT

Since two of those posts may not be availble to most readers, a very quick explainer; Brave is an internet browser that aims to offer the user a more privacy-respecting alternative to browsers like Chrome GOOG 0.00%↑ or Safari AAPL 0.00%↑. Brave was started by Brendan Eich. Eich is famous for creating javascript and Mozilla. He’s an internet developer heavyweight. His appearance on Scott Melker’s podcast last year is worth a watch:

Brave also uses a token model to reward users for opting into advertising. It is completely up to the user’s discretion how to engage with the advertising model. No ads, no rewards. Ads on, the user gets paid part of the revenue in BAT token. Think of it like the end user having control of their own data and monetizing it if they choose to. This model has actually worked really well for Brave because the company has terrific campaign effectiveness metrics and a young audience:

80% of Brave’s ad rewards audience is 49 years old or younger. Now I should point out that philosophically speaking I’ve made no bones about hating the advertising model in publishing. This model isn’t quite like the traditional advertiser/publisher relationship because there isn’t a direct line between the publisher and the ad buyer - this eliminates the possibility of editorial influence.

In my view, it’s more similar to a programmatic ad platform except the user is getting something out of the deal as well. Advertisers get a young audience with strong CTRs, users get a to either opt in or opt out of data monetization, and the Brave developers gets a piece of the transaction to cover costs and pay employees. It’s a very interesting concept and I’d encourage anyone interested to explore the BAT White Paper for a much deeper dive.

Network Metrics

While growth as admittedly slowed, the daily active users (DAUs) of Brave are now approaching 21 million with 20.8 million DAUs in the month of January.

This is up 3.5% from December. Not pictured above, monthly average users (MAUs) came in at 57.6 million users in January - up 3.8% over December but still behind the June peak of 62.4 million. Nothing goes in a straight line. Broadly, the best growth over the last several months has been in DAUs and we can see that reflected below by the 36% stickiness ratio.

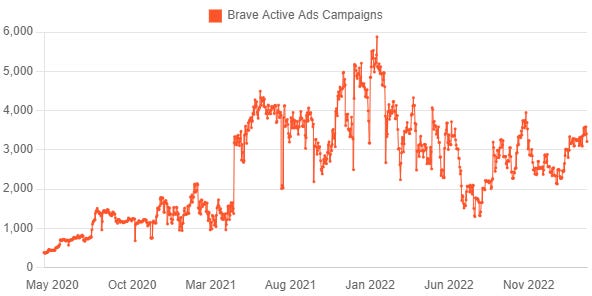

Stickiness shows a more engaged user and this might be why active campaigns have held up fairly well despite the decline from the peak last year:

Active campaigns are still in the 3,500 range on a daily basis and indicative of an ad-platform that hasn’t completely puked advertisers despite the proximity to crypto. Token-wise, BAT addresses on-chain are over 465k:

Notably, BAT that is paid out within the platform is done so through third party custodians - users are given the option between Gemini or Uphold. While this is frustrating for proponents of self-custody, I believe it does limit the downside to BAT if US regulators determine the token is an unregistered security. Payment from Brave already goes through KYC/AML compliant platforms. According to Brave, there are over 10.6 million BAT recipients through those platforms.

BAT As a Speculative Asset

I think the obvious question is why does Brave need a token model at all? Can’t this just be done with dollars? Maybe. But one way the user benefits from the token model is the level of transparency BAT offers since Brave purchases the tokens on-chain for rewards distribution. There is a dedicated page covering those transactions and we can see the most recent purchase was for a little over 1 million BAT tokens earlier this month through Gemini:

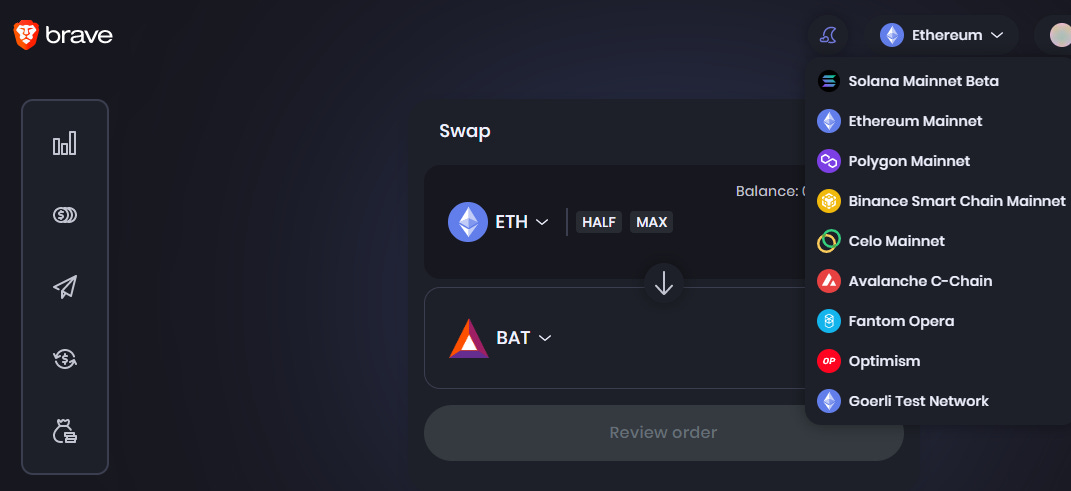

But even on-chain network transparency still doesn’t mean BAT is completely necessary. There is nothing stopping the ad platform from using Ethereum (ETH-USD) or stablecoins. In my view, what helps justify BAT as a true utility token is what Brave is building through the browser-based wallet application.

Not only can users store Ethereum, Solana (SOL-USD) and several other assets natively in-browser, but they can do DEX swaps without ever needing another front-end interface like Uniswap (UNI-USD). This enables Brave to position itself as sort of a one-stop shop for crypto advocates who may want to build a portfolio securely without a third party extension like Metamask or Phantom. From a utility perspective, the Brave DEX could theoretically offer users better rates for holding BAT in-wallet; effectively creating a rewards program.

However, DEX rate discounts are a very base level expectation for BAT within the ecosystem. There are other possibilities for BAT utility as well as a reward-program membership token so to speak. For instance, Brave has an in-browser video chat product called "Brave Talk" that very much could eliminate the need for something like Zoom Video ZM 0.00%↑ depending on how the user engages with group chats. Brave could theoretically offer discounts on Brave Talk or its VPN service for holding BAT.

Main Takeaway

Like all cryptos, BAT is highly speculative and faces regulatory headwinds. But the token has utility in an ecosystem that is growing, has founders that are doxxed, and compliance with AML/KYC regulations in the United States. The ecosystem serves what I view as a growing market for online privacy. I think Brave’s product is quality and the token model makes sense.

Disclaimer: I’m not an investment advisor. I share what I personally do and why I do it.