Breaking The Index

The S&P 500 closed Wednesday 0.5% off its all time high. Yet, CNN's "Fear and Greed Index" is reading "fear." How is this possible?

What emotion is driving the market now?

That’s the question CNN’s Fear and Greed Index aims to answer. According to the FAQ that is shared by the publisher, the index attempts to gauge the market’s mood; with fear driving equity prices down and greed driving equities higher. I’ve made the joke in the past that bulls generally have very little pain tolerance, but the current reading of the Fear and Greed Index takes the cake:

With an index read of 41, CNN’s model implies it is “fear” rather than “greed” that is the prevailing sentiment in the market at this point in time. I can confidently say that I’m simply not seeing that. Maybe it’s the S&P 500 that remains just 0.5% away from its highest level in human history:

Or maybe it’s the likes of Tom Lee and Ed Yardeni consistently raising their price targets because… sideways isn’t exciting??

Maybe it’s a combination of price action in the Magnificent Seven Terrific Trio and always higher forever forecasts from the usual suspects, but I’m just not seeing fear in the market. So how could CNN’s index be getting it so wrong? The answer lies in the way it’s constructed. The index itself is simply a single number that is spit out of seven different equally-weighted market indicators:

The Fear & Greed Index is a compilation of seven different indicators that measure some aspect of stock market behavior. They are market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand. The index tracks how much these individual indicators deviate from their averages compared to how much they normally diverge. The index gives each indicator equal weighting in calculating a score from 0 to 100, with 100 representing maximum greediness and 0 signaling maximum fear.

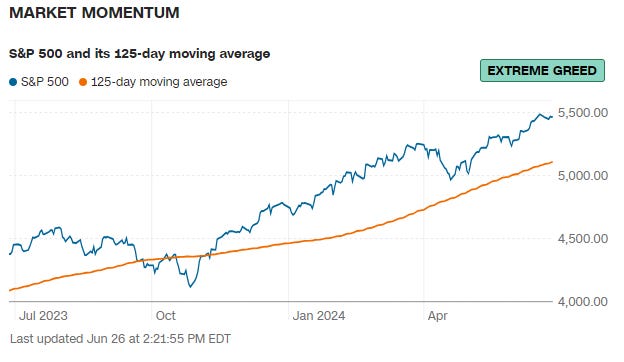

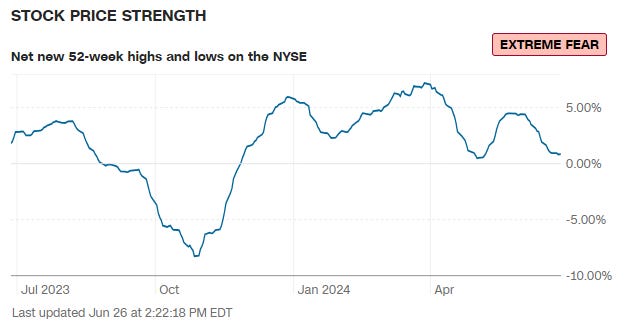

So even as the S&P 500’s extension from it’s 125 day moving average has the market momentum in “extreme greed” territory, it’s the bearish readings in the additional components making up the overall index that are driving CNN’s fearful 41 reading. Stock price strength - or the net new 52 week highs - in the market is showing “extreme fear.”

As is market breadth, which we’ve obviously covered a few times previously:

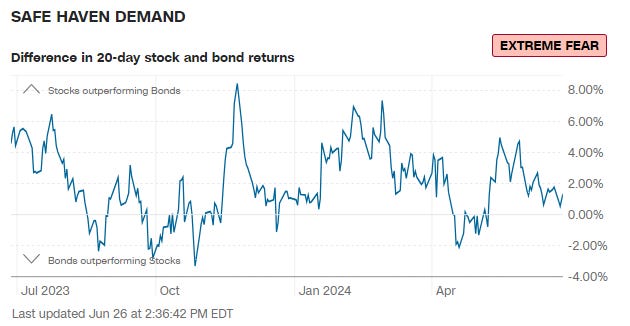

And finally, the safe haven trade is evidently implying “extreme fear” as well:

Charts I did not show:

Put and Call Options - Extreme Greed

Market Volatility - Neutral

Junk Bond Demand - Fear

So there you have it. Seven indicators make up the index. Four of them are either reading “fear” or “extreme fear.” And that’s how we end up with a “fear” reading in the Fear and Greed Index with markets virtually at all time highs. I’ve felt for some time that concerns about breadth and the lack of broad participation in these recent equity market rallies have been justified.

Since the beginning of 2022, the S&P 500 SPY 0.00%↑ is up significantly. The Russell 2000 IWM 0.00%↑ has not participated and is actually down over the last 18 months. The reason poor breadth concerns me personally is due to the high flyers in the tech industry generally needing the smaller companies to thrive because they’re dependent on them for revenue.

Microsoft MSFT 0.00%↑ needs smaller businesses to buy their cloud and productivity services. Meta Platforms META 0.00%↑ needs smaller businesses to buy their advertising inventory. Same story for Google GOOG 0.00%↑. Beyond that, piling into NVIDIA NVDA 0.00%↑ calls because the number keeps going up isn’t going to change that consumers are still very much battling higher prices even if official metrics are engineered in a way to obfuscate the problem.

Old School Mindset

As individual investors, we can point to any idiom we might like to justify the position we have already determined that we want to take:

Time in the market beats timing the market.

This is generally true in principle from where I sit. It’s probably much less true for the 64-year-old who is trying to retire. Corrections are one thing. But if we’re actually headed toward another bear, timing the market just might be the difference between being able to call it a career or not for those closer to net sells rather than net buys. As with most things, there is no one-size fits all solution for everyone. Target maturity funds are nice conceptually. But even bonds got waxed when rates rose.

Here are a few critical questions:

Do fundamentals matter?

If so, what are the proper barometers?

Do valuations matter?

Does a Wilshire 5000 to GDP Ratio that is completely detached from economic reality matter?

Is a 26 P/E the new “cheap?”

Perhaps cyclical stocks will continue beating defensive names forever?

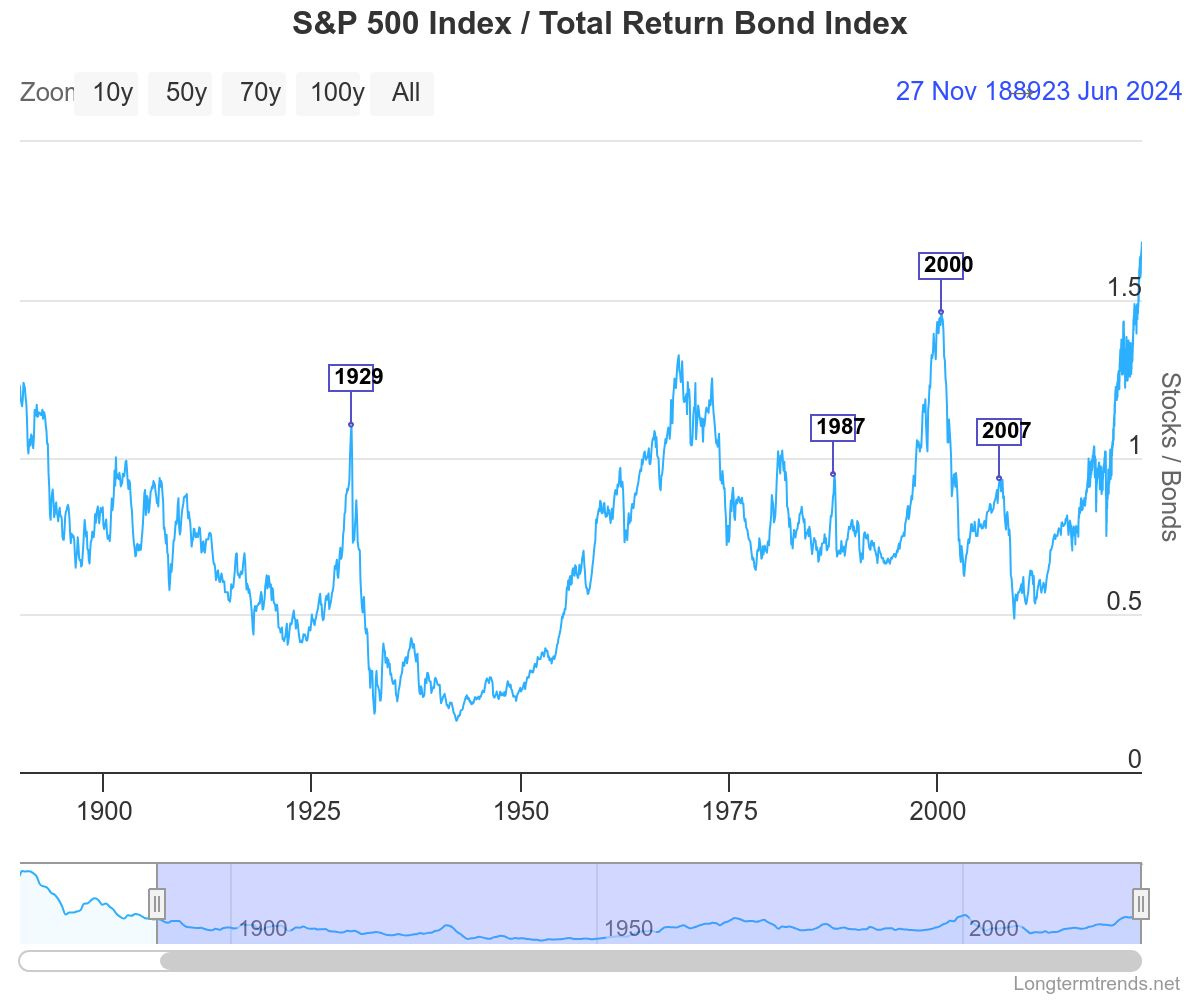

It’s also possible the edge the equities have over bonds could remain at the highest level in over 130 years going forward. And yet…

I’m not sure I buy any of it.

Maybe it’s because I’m a self-admitted heretic, but I just can’t shake the gut feel that things that have a beginning will also have an end.

Paper Or Plastic?

Perhaps the most important question an individual investor might ask the person in the mirror is more simple than any of those questions in the previous section. I suspect this is the one that may matter more…

When do I need the money?

I’ll concede that over the long haul, it’s difficult to argue with the buy and hold strategy. Despite that, it’s important to remember paper wins are not realized gains and it’s mathematically impossible for everyone to get out at the top.

That’s the funny thing about the debt-based, fractional reserve system; there will never be enough real capital to settle every current obligation. If everyone tries to get out of the market at the same time, nobody can get out. It’s a bit like the episode of The Simpsons when Mr. Burns was still functioning despite being diagnosed with every disease in existence:

C. Montgomery Burns wasn’t indestructible in The Simpsons and neither is the US stock market today. Of course, there is currently no imminent “reason” for a decline to manifest. Valuations realistically haven’t mattered for the last three decades or so, why would they suddenly matter now? Noted!

But I’m of the view that poor readings in some of those CNN index inputs are indicative of legitimate problems. We could certainly entertain the notion that S&P at all time highs in spite of poor breadth, minimal new 52 week highs, and growing demand for safety shows just how strong all of the top companies actually are. And yet, I come right back to valuation.

What are you willing to pay for trillion dollar tech companies that have already priced in their growth?

I can’t answer it for you.

Disclaimer: I’m not an investment advisor. I buy cryptos, metal, and boring stocks that pay dividends.

It really is amazing to see us hanging around "fear" as the market has continued to make new highs. It's not typical, and makes me think we are still climbing the "wall of worry" higher in disbelief with many underinvested and underperforming.