Bullion Run: Gold, Silver, and The Quest For Collateral

Plus, some very interesting signals from the 2024 central bank Gold survey.

If it looks like a run on bullion and smells like a run on bullion, it's probably a run on bullion. Given Sprott would issue shares and buy more Silver bullion in the event of a NAV rate premium through PSLV - exacerbating the pain felt in a broader bullion run - I suspect this massive move to short PSLV is a desperate effort to keep a lid on the price of Silver. - Ya boi

Seeking Alpha just covered my latest on the Sprott Physical Silver Trust PHYS 0.00%↑ yesterday. I really recommend reading the entire piece (it’s one of my shorter articles) and can provide a freebie link so that all of you have the chance to review it whether you subscribe to Seeking Alpha or not. Important takeaways for those who really don’t have any time to spare:

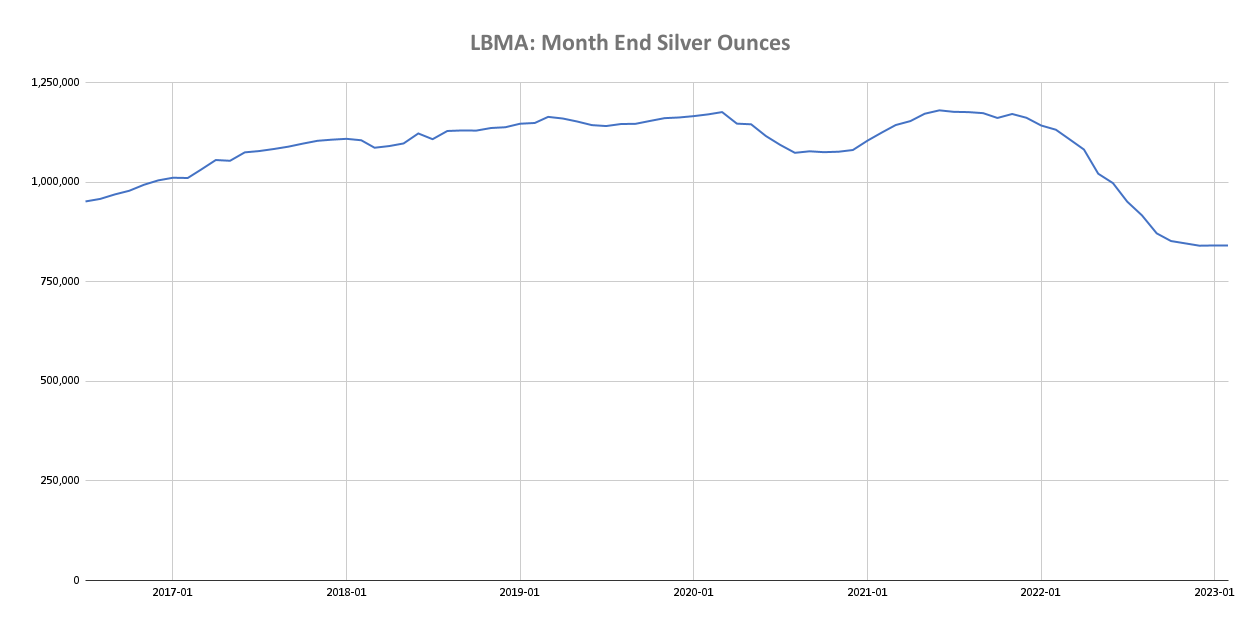

The LBMA is experiencing what looks like a run on metal. There are more people on X and elsewhere talking about the Gold moving around. But the Silver draw-down has actually been far more intense.

Due to the ability to redeem the physical metal through PSLV shares, it appears that somebody (or multiple somebodies) presumably with a very large short on Silver is desperately trying to prevent the Sprott Silver fund managers from buying more bullion by also shorting PSLV shares.

It’s not working:

The chart above shows that this rally is likely just getting started. XAG has already taken out both the monthly closing high from Silver Squeeze 1.0 and the $29.82 price high from Silver Squeeze 1.0. The metal has back-tested both of these levels and is proceeding higher. Gold is going to go where it’s going to go. I suspect that could be as high as $3,500 - $4,000 and provide some historical bull run charts in recent coverage of the Sprott Physical Gold Trust PHYS 0.00%↑ for Seeking Alpha (freebie link). A Gold price of $3.5k-$4k per ounce is still a tremendous upside, but I really think the fun is just getting started in Silver.

Some people think those who mention the Gold/Silver ratio are charlatans. IDGAF.

The multi-decade trend in the Gold/Silver ratio has been higher. This is preposterous, in my opinion. Silver is too important as an industrial component (which might explain the apparent price suppression) to justify a pricing against Gold to this degree. My base case is we see the Gold/Silver ratio fall below 70. If it were to retest its 2011 low of 32, XAG costs $93.75/oz at $3,000/oz Gold. At $3,500 Gold a 32 Gold/Silver ratio puts XAG at $109. At that point, I might sell some PSLV shares.

LBMA Drain & Central Bank Signals

The London Bullion Market Association, or LBMA, is the global OTC market for precious metals. While they’re often mentioned together, the LBMA is not the COMEX. If you want physical metal, you’re likely going through the LBMA. If you you’re trading cash-settled futures, you’re likely using the COMEX. This is the important part; typically when the LBMA settles bullion trades, the metal is allocated to the buyer but remains in London vaults. But things have changed recently and bullion is now leaving the vaults as buyers ‘take delivery’ of the metal.

There is awareness about this pertaining to Gold, but it is Silver that has actually seen the more extreme bullion draw-down over the last few years:

At 722k Silver ounces at the LBMA, Silver bullion supply is down nearly 40% from the 2021 high and nearly 13% in just the last two months. This is not typical.

He who holds the Gold makes the rules.

What does that quote above actually mean?

Simple: decisions and outcomes are determined by those who control the resources. Thus, whoever actually controls the bullion sets the terms of an arrangement. This is where things get interesting in the precious metals markets.

COMEX Gold is generally held in custody by major banks like JP Morgan and HSBC. ETF Gold supply is held at these very same banks. And for quite literally years, the prevailing theory within the precious metals investing community has been that the bullion bars held by these custodians are being double or even triple counted.

USDebtClock estimates the paper to silver ratio is over 377 to 1. Meaning, for every bullion bar of Silver there are 377 paper derivatives built on top of it. Essentially, people who believe they hold Silver through an intermediary likely have a claim on the very same bar that another market participant believes they too also own. Which means both obligations can’t possibly be satisfied without new metal coming into the vaults - which would be difficult to do with mine supply in an annual deficit for 6 years running…

Thus, if there is a large enough drain on the bullion supply, this paper metal scheme can quickly collapse. The WallStreetBets apes tried to orchestrate this very scenario back in 2021. They just picked the wrong strategy. Cash settling is certainly possible, but that likely comes at a significant price premium if someone standing for delivery decides to take the cash instead.

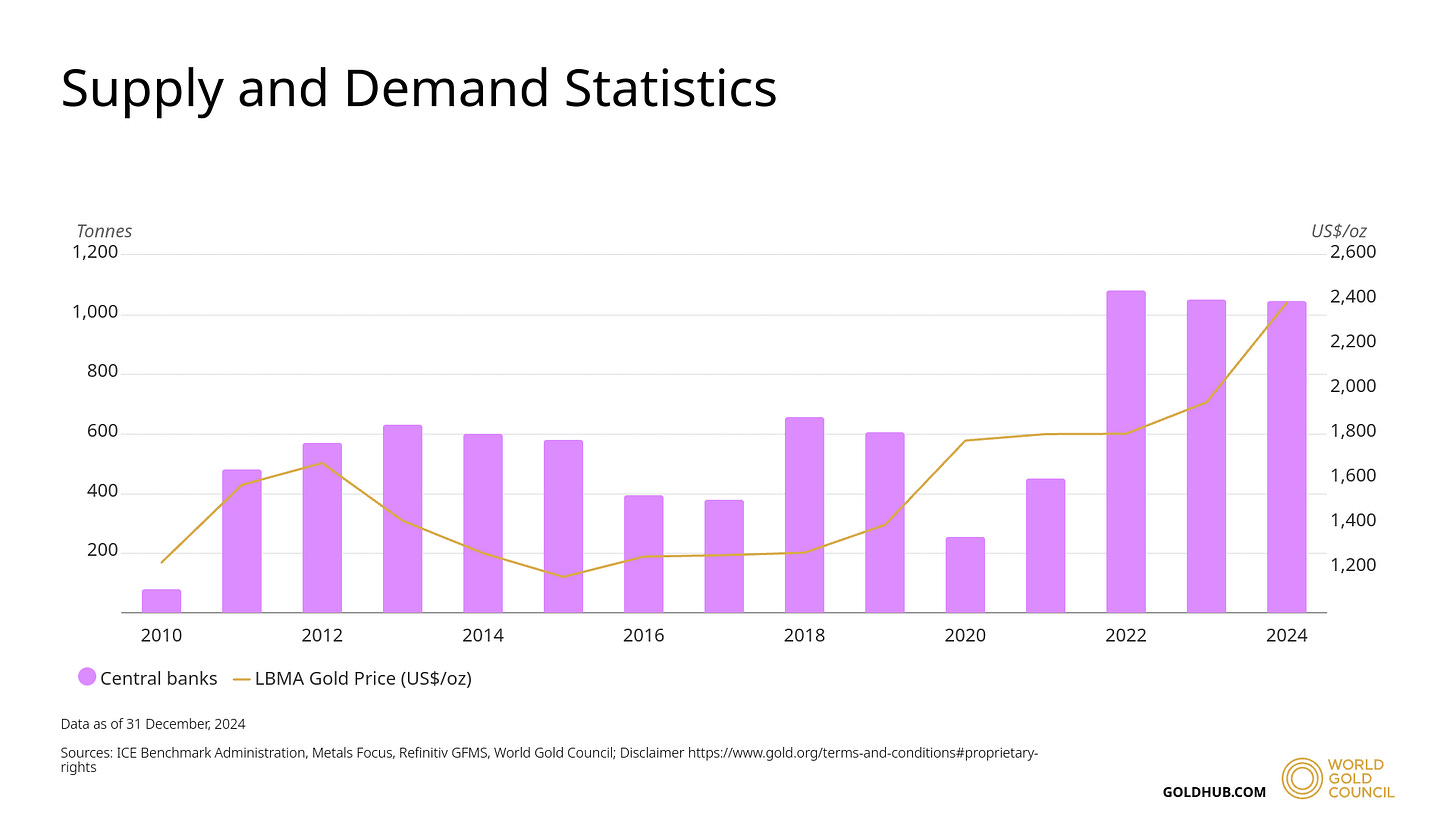

Of course, we’ve heard all of this before. So what is different this time? In my view, global central banks are clearly signalling that they don’t trust dollars and/or their own fiat:

It’s not that central banks have been loading up on Gold going back the last three year. We’ve been following that on this blog for a while.

It’s why they’re doing it….

There were 18 ‘advanced economy’ central banks that responded to the World Gold Council surveys. I find the year to year change in these answers quite telling. When asked how relevant each of these factors are in the decision to hold Gold, 83% of advanced economy central banks cited long-term store-of-value and/or inflation hedge. This is an enormous change from the 2023 survey when just 27% of advanced economy central banks cited that as a factor in holding. You can see the other answers for yourself, but liquidity and default risk also had what I’d call ‘significant’ increases in just one year.

I don’t prefer the SPDR Gold Shares ETF GLD 0.00%↑ over PHYS, but here’s my recent coverage of that fund as well if you’re interested.

Disclaimer: I’m not an investment advisor. I’m not a geopolitical analyst. I like boring stocks, Bitcoin, and precious metals. I speculate in coins and save in Gold & Silver. Everything could go to zero. Nothing is guaranteed and nobody owes you a damn thing.