Marge: What is it your company does again?

Homer: Well, this industry moves so fast, it’s really hard to tell.

One of my all-time favorite lines from The Simpsons is from an episode called “Das Bus.” In it, Homer pretends to be owner/operator of an internet company. In search of ‘faster nudity,’ Comic Book Guy visits Homer and asks for a better connection in the nerdiest way possible. What the viewer gets immediately following is this ever-applicable, underrated gem:

The whole scene is great and really worth watching. Classic late-90’s Simpsons. Bill Gates even gets lampooned for being a mobster. The Simpsons writers were always ahead of the curve…

Anyway.

Why bring this up today, 26 years after the episode has aired?

A silly reason actually.

Because it popped into my mind when I came across Michael Saylor’s three minute Bitcoin Treasury pitch to Microsoft (Bill Gates is everywhere apparently) MSFT 0.00%↑. Listen, if you’re even remotely interested in the stock market or Bitcoin there is a good chance you’ve heard about what Michael Saylor is doing with MicroStrategy MSTR 0.00%↑. I’ve certainly covered it on this blog multiple times. For the unadulterated, Michael Saylor is essentially orchestrating a positive feedback loop with borrowed money to buy Bitcoin.

It goes like this: private investors loan cash to MicroStrategy via convertible notes at low (or no) interest. Saylor then takes that borrowed capital and immediately buys Bitcoin with it at any price. To date, the company has purchased 402,100 BTC. The pace of which has only become more aggressive over the last month:

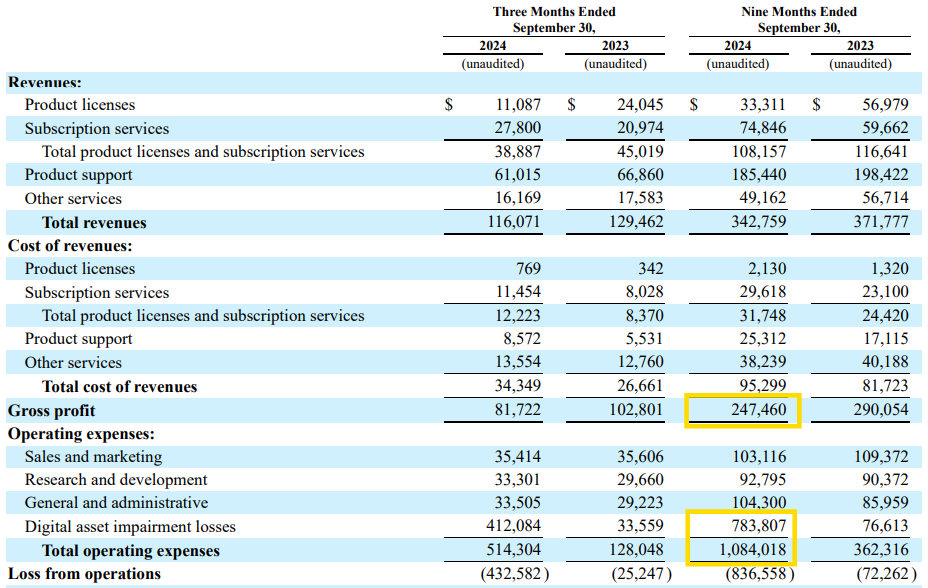

The “levered up” Bitcoin play has been so popular with Bitcoin advocates, that MSTR shares recently traded at nearly three times the value of the Bitcoin that the company holds. At nearly $81 billion, MSTR has a market capitalization that has absolutely no justification based on the mature software business that MicroStrategy operates to pay the bills:

Even when you completely strip out the $784 million in digital asset impairment losses from total opex to properly reflect the underlying business, MicroStrategy has incinerated $52.7 million so far in 2024 just by operating.

Yet, there are traders and even serious analysts out there who have talked themselves into paying a 200% premium for the Bitcoin that has been purchased with MicroStrategy’s convertible debt notes. Since Saylor doesn’t plan to sell the Bitcoin and we’re apparently beyond the point of the underlying business servicing this debt with cash flow, shareholder dilution seems to be essentially a mathematical certainty. Regardless of certain dilution, the market loves it:

The convertible note Bitcoin scheme is working so well for MSTR shareholders, that now other companies are starting to use this treasury strategy as well. Marathon Digital MARA 0.00%↑, a Bitcoin mining company that is supposed to generate revenue from selling Bitcoin, is raising debt to buy Bitcoin. Michael Saylor is actively pitching anyone who will listen to his convertible debt strategy. It was all fun and games when Saylor was the only one pumping Bitcoin with borrowed money, but the Microsoft pitch feels like a ‘jumped the shark’ moment. I mean watch this thing for heaven’s sake:

This was literally a 44-slide pitch deck presented by Saylor himself to Microsoft executives over less than four minutes. It seems desperate, for some reason. And it feels like this presentation time was granted by Microsoft as some sort of courtesy. I swear, they probably thought he’d turn them down when they said he could have 3 minutes. But here we are.

Saylor has found a market edge that is working marvelously for himself and his company. Why does he want others doing it too? He’s clearly going to buy Bitcoin as long has he can get someone to continue lending him capital, but why does he want Microsoft to start doing it too? If it was purely about buying Bitcoin, I don’t know why Saylor would want a deeper-pocketed organization bidding against him. Furthermore, I don’t know why he’d want larger software giants courting presumably the same capital investors that he is for issuing his convertible notes.

It all just seems so weird. And based on how quickly he’s been able to raise capital these last few weeks, it doesn’t seem like he’s met the end of his rope yet.

But perhaps he has?

That’s the only thing that makes sense to me. For how much I feel like I’m seeing claims of “adoption” of this Saylor-style corporate treasury strategy on places like X, it doesn’t appear to actually be manifesting in the data that I’m looking at.

Year to date, public company BTC holdings are up 93.4% - but the majority of that is still from MicroStrategy purchases. In fact, MicroStrategy’s share of public BTC holdings has actually gone up over the last 11 months from 69.5% to 76.4%. Private company BTC holdings are down 14% year to date. Perhaps because those businesses don’t benefit from share price manias when buying BTC. That or perhaps holding crypto on the balance sheet is actually quite risky despite what Saylor says.

To be sure, there’s a big 458% boom in government holdings year to date. Which is a bit deceiving because nearly half of that gain is from 190k in Chinese BTC holdings that are from a 2020 Ponzi scheme seizure. Most of the rest of that government boost is from a 150k BTC net increase to the United States’ known balance - again, captured from past seizures. 61k BTC is UK assets from a 2021 seizure. Add it all up: it’s essentially all from prior seizures that are only now being reported in the holdings data.

Basically, for all of the excitement about adoption and holdings growth from large entities - the organic year to date BTC holdings growth has been primarily from ETFs and Saylor.

Saylor is either selling the greatest ‘infinite money glitch’ we’ve likely ever witnessed, or he’s selling dreams that have little chance of ever being a reality at scale. Perhaps we should look to the past for a glimpse into the future.

What Saylor sells, apart from the software, is membership in his vision of the future. It's a sales pitch that has made him very rich--his 60% stake is worth $370 million--and earned him cultlike devotion from his clients and employees. And it may be what keeps MicroStrategy a step ahead of its rivals. Who, after all, wouldn't want to bear witness to the future? So sincere is Saylor's enthusiasm that it's hard not to believe you're tapping into the next big thing. - Daniel Roth, CNN, 1999

I see no parallels to today… oh wait. Yes I do!

Look at that stock price in 2000! A split-adjusted share price peak of $333 in March down to 48 cents a little over two years later. What happened? Turns out MicroStrategy was reporting losses as profits in an apparent fraud. Even if we presume that everything is on the up and up with the books this time around, we still know how this experiment ends if Bitcoin starts going down in price. Saylor started this strategy in 2020. His stock fell 90% during the last ‘Crypto Winter’ and even traded at discount to the BTC held on the balance sheet.

Surely this time will be different.

His cost basis is now $58,263 for what it’s worth.

Bananas!

Speaking of characters, how about the $6 million banana story from a couple weeks ago? Turns out, the buyer was Tron-founder Justin Sun. And he’s already recouped the $6 million ‘marketing expense’ that was the banana because his 9-figure TRX position has doubled since the auction:

So who has the better version of “Can I Have Some Money Now?” “Pump My Bags,” Sun or Saylor?

Disclaimer/Disclosure: I’m long Bitcoin and other cryptocurrencies. I have no idea when this halving cycle mania will peak. I highly doubt any of us will sell the top, so be careful out there.

Great article Mike, I agree. I didn't know Justin Sun was the buyer of the banana. My first reaction when I saw that art sale was; 'the illustration of the greater fool theory' he hopes to sell the art at a higher price to an even greater fool. Concerning Saylor, theoritically he will dilute his-your ownership of the company, but at slower paced than the valued accrued to the company, from buying btc. also he still has a relatively low cost base of btc, below the 200 week MA (theoritical floor of the price) But I agree with you, he could very well over step the boundaries at one point. It is looking like that. He speaks of btc now as a 'risk free asset' that always goes up. A bit like when you repeat every Sunday that Jesus walked on water, you end up believing he really did walk on water