Checking In On Consoomers

"Long things you need, short things you want." I don't remember where I saw this quote but I thought it was great.

A lot of states do what is called a “Sales Tax Holiday” at some point during the calendar year. If you’re not familiar with the concept, it’s exactly what it sounds like. For a brief period of time, obedient consoomers consumers are allowed to eat cake and buy things without rendering to Caesar what would otherwise be his. Not following?

The “holiday” is no sales tax on purchases for what is typically a couple of days, often with certain limitations and back-to-school as the primary backdrop.

Not every state has this and each state can have very different rules for their tax holiday. For instance, Iowa’s tax holiday starts tomorrow, goes through August 3rd, applies only to clothing, and stops at $100. South Carolina’s also starts tomorrow. However, that one goes an additional day, applies to clothing, computers, bed/bath products, school supplies, and has no cap. Pretty darn good, right?

How about Ohio though!?

The Buckeye State

Ohio’s tax free holiday is more than a weekend. It’s actually more than a full week. In the Buckeye State, there is no retail sales tax from July 30th through August 8th. It applies to essentially anything but booze and tobacco. Even restaurants will benefit from it this year. And the spending cap is now $500. Which is good, because treating a family of three to lunch at Applebee’s is pretty darn close to a three-figure transaction. This is not normal.

Last year, Ohio’s sales tax holiday was for just two days, applied to only clothes and school supplies, and had very specific lower caps on those categories. $20 for school supplies. $75 for clothes. So what the hell changed? If you ask the state’s governor, one could realistically deduce it’s because the economy sucks and earnings haven’t kept up with real, un-scrubbed inflation numbers:

This expanded sales tax break will help Ohio's families with back-to-school necessities as well as other substantial purchases during a time when so many household budgets are being strained. - Ohio Governor Mike DeWine

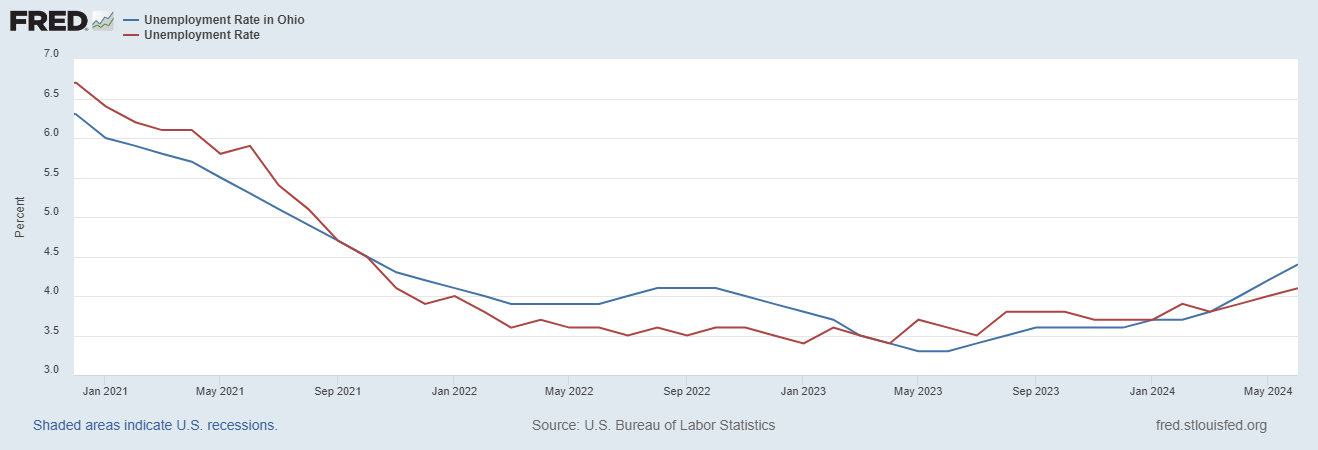

In June 2024, Ohio’s 4.4% unemployment rate was the 9th highest in the country:

And Ohio’s unemployment rate moving back above the national average is a relatively fresh achievement this year as well:

But beyond moving ahead of national metrics, perhaps the bigger concern is the June 4.4% unemployment print puts OH at its highest level since October 2021. And the same is essentially true for the National average as well. US unemployment at 4.1% is the same as it was back in November 2021. Not good either way you look at it.

But bringing it back to Ohio for a moment, check out this absolutely bonkers chart from Econimica via X:

Listen, it’s just Cleveland not the entire state, but wrap your mind around what this chart is telling you. At the beginning of 2020, there were 1.04 million employees in the city of Cleveland. There are now about 5% less employees, yet the Case Shiller housing index in the city is up 50 friggin’ percent! This defies logic in a market that is functioning properly. Which of course, the housing market currently is not.

With high prices and high rates, I’d wager most people who refinanced during 2020 or 2021 may not be able to afford to leave their home even if they wanted to. Thus, anyone who actually does need to buy has to pay what the seller is asking. So yes, it’s prices, it’s rates. It’s supply. It’s the combination of all of it…

This is certainly not unique to Ohio by any stretch. Nationally, the median sale price in June was up 4.4% and the number of homes sold was down 11.4%. Very similar to the Ohio numbers in each category and shown in the chart above. This is also not new.

Now, let’s consider some additional elements of financial markets.

Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion. - Federal Reserve Chairman Ben Bernanke, 2010 via WaPo Op-Ed

While it would be fun to take this quote to task in a full post, we don’t have time for that today. Ben Bernanke told us the game we’re all unwillingly playing back in 2010. Our economy is based on debt and the “wealth effect.” The latter of which is about ‘feelings’ over reality. The thinking goes something like this; when asset valuations are high, it juices consumer spending. Which juices stock prices. Which juices hiring. Which juices the economy. Essentially, if you feel wealthy, you’ll spend money, and we’ll all be wealthy.

But I don’t know, guys. Things don’t seem to totally line up...

The Tea Leaves?

We’re all broke and tired of consuming. - rky5000

I’m not so sure most people actually feel all that wealthy right now. Sure, stonks are still within 5% of the highest levels in human history. Median home prices the same. And yet, credit card delinquencies are headed higher, are above pre-pandemic levels, and are at the highest reading in over a decade:

30+ Day FHA delinquencies are back at GFC levels:

The resell market in the sneaker industry has completely collapsed. It’s so bad, even sneakers that some would consider “grails” are deflating. For instance, here’s the price history for the Air Jordan 4 Bred Colorway - a top 5 Jordan of all-time according to Man of Many:

Bred AJ4 is under the average price and 45% off the 12 month trading range high. And it’s not just sneakers. Collectibles are getting waxed (pun intended):

Things aren’t any better in the sports memorabilia market where auction sales volume is down and price performance in the card market is negative over the last 12 months in every single production era.

NFTs, in many ways the barometer on ‘FU wealth’ in crypto, are essentially dead. And that brings us to the coins themselves…

They’ve all been getting wrecked over the last few days and even Bitcoin has not been immune. And this is despite arguably the best narrative tailwind we’ve ever seen for BTC.

We have a former President and probably the winner in the upcoming election selling Bitcoin-branded sneakers online just days after speaking at the Bitcoin 2024 conference in Nashville. Will retail consumers buy Trump’s Bitcoin sneakers? I don’t know. But a question that is equally important is will retail consumers even buy Bitcoin?

It’s been stunning to watch, but Coinbase’s COIN 0.00%↑ share of volume from retail traders has fallen to under 20% of the company’s total volume. And this is with BTC having made a new all time high this year already. Yet, no mania speculators from the retail side…

Why?

Occam’s Razor perhaps; but it feels to me like consumers are tapped out. I know I’ve said this before. But it really seems like we are there at this point. We have states letting people buy almost anything they want tax-free. We have credit card delinquencies picking up. Home loan delinquencies picking up as well. Alternative asset prices collapsing. It seems like, right now, nobody is buying sneakers, or bitcoin, and so probably not bitcoin sneakers either.

So if consoomers have been squeezed for all the juice they have left in what has been an intentional wealth effect feedback loop, do stonks keeping going up? To be clear, I don’t know the answer. I’m just thinking in print here and asking the question.

Disclaimer: I’m not an investment advisor. I play the ponies.

I think you're on to something, unfortunately...

That fact you put thought to pen means you know the answer... it's just difficult to fathom.