Checking Sentiment

I think we're going to get fireworks in the markets tomorrow. For kicks, let's see what people who are much smarter than me think...

Tomorrow is the day. Jerome will likely decide the direction of many markets. The three markets that I care the most about are as follows; broad equities, cryptos, and commodities - specifically metals. I talked about some of my specific positions over the weekend in The Wedge of Jerome.

Here’s what that wedge now looks like with just a few session hours remaining until we get to the theoretical trend convergence point.

A comedian, this market surely is. After strictly trading within this wedge for two and a half weeks, the S&P closed below the wedge yesterday and then closed above the wedge today. This means the wedge is either invalidated entirely (which I doubt) or yesterday was a fake-out. Today could also very much be a fake-out, but I don’t think so. I’m personally positioned for a big move higher in risk assets following Powell’s comments. Here are my main three reasons:

The Federal Reserve can’t meaningfully battle inflation by raising rates without crashing just about everything

If the central bank can’t realistically fight an honest war against inflation, dollars are a terrible place to be UNLESS there is a shortage of dollars and robust global demand

Global demand for dollars may have peaked as major economic players are positioning for life after the petrodollar

How it all shakes out from here is far from a guarantee but we can try to make a guess about how things will go based off what people who independently do this for a living are offering up. I don’t care what Goldman Sachs says I should do because Goldman Sachs serves Goldman Sachs. Even though I booted the bird, Twitter is still a really good place to get intel and when you have direct links to profiles (as I do), you get to see a handful of tweets before you’re given the middle finger and told you need to log in. The people running Twitter are douchebags. Regardless, here is what macro strategist and contrarian investor David Hunter is saying:

Here is what professional trader and accused “perma-bear” Sven Henrich is pointing out:

The implication in Sven’s chart being that the Nasdaq has hit support and could be preparing to bounce higher. Here’s what macro investor and Real Vision founder Raoul Paul sees:

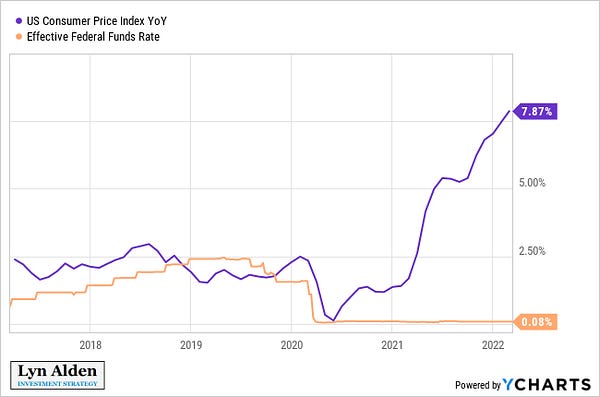

Here is what investment strategist Lyn Alden is pointing out:

She’s making a very similar point that I’ve been making for months regarding the Fed’s urgency regarding interest rates. Here’s hedge fund manager Thomas Thornton:

And just to prove I’m not cherry-picking, here are two more very sharp analysts who appear to be taking the other side. Steph Pomboy:

And macro strategist Darius Dale seems to agree with Bitcoin analyst Dylan LeClair that problems in the credit market are going to create more issues:

It’s all very interesting and I can’t wait to see what happens. I’ll get my popcorn ready. In the meantime, if you missed it earlier because it was hidden behind the paywall, the Founder Tier is on hiatus. What was previously supposed to be a deep dive research piece add-on is now available to anyone who has a paid membership. I think this is a really solid position to take, especially if I’m wrong and broad equities have more room to go down. My pick in this report is pretty defensive.

Get access to it!

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice. I’m not featured on trustworthy financial news sources like CNBC or Bloomberg and I don’t wear a necktie when I make my trades.