Crazy Like a Fox

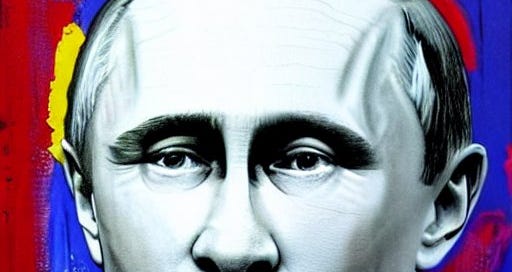

Despite cries to ban Russia from SWIFT, Biden's hesitation to do so is very telling. Let's explore why Putin might be crazy like a fox.

I started writing about finance back in 2017 or so. While I’m now getting paid for sharing my thoughts (THANK YOU), I’m still really just an amateur in this field. I didn’t go to school for this. I’ve never worked for an institution. I don’t have any licenses. I think this has actually been very beneficial when molding my personal finance and my personal investment thinking. I’m not in “the system” in the way that an insurance salesman would be. It’s actually a luxury that has allowed me to maintain an outsider’s view. In the past, I’ve been very critical of things that I see on networks like CNBC that I think lead people to make bad decisions.

I share all of this because much of what I have written about and personally positioned for over the last few years is a world where the US dollar is no longer the world reserve currency. Like I said yesterday morning, I am not a geopolitical analyst. I don’t know for sure what Putin is planning. But I’ve seen sentiment online that I can best describe as bewilderment from some in reaction to Biden not doing more to sanction Russia yesterday.

If you found yourself Googling “SWIFT system” yesterday like the rest of America, you are who I’ve been writing for these last few years. SWIFT is what has allowed America to be a bully whenever it wants economically. SWIFT is a global payment system. That payment system utilizes the US dollar for cross border settlement - getting kicked out of SWIFT makes your economic life similar to that of a Canadian trucker supporter’s. But for a whole country it’s actually worse. Since the rest of the world is operating on SWIFT, if you’re not, it’s very difficult to do business with you.

That’s why we’re now seeing headlines like this one:

Bitcoin, and other cryptocurrencies can be used as an escape valve from the US dollar system. Now there are some who will say, “duh, wake up, this is why crypto will be banned in America.” My response to that would be there is a big difference between making something criminal and eliminating its use entirely. It’s illegal to murder people. Yet murders are still happening.

The US government could declare it illegal to transact in cryptocurrency. People will still do it. Why? Because the currencies aren’t run by central banks. They are decentralized. This is a feature, not a flaw. To shut down the Bitcoin network, the US government would have to find every single miner on the network and shut them down. Even if the government wanted to do that, it physically can’t. And if you think people who want financial privacy are all criminals, Bitcoin has also enabled this:

Both sides can use Bitcoin to their advantage. It’s a borderless, permission-less currency. You may be thinking, “I get it, Mike. This isn’t new. What are you really getting at?”

Thanks for asking.

As I pointed out last week in The Fed Can’t Hike, something broke after the Financial Crisis. The staggering amount of dollars printed out of thin air to save the US economy did not go unnoticed by foreign powers. You can find numerous examples of smaller, less militarily powerful countries getting punished for trying to circumvent the US dollar system. In 2009, Libyan ruler Muammar Gaddafi tried to create a gold-backed currency for oil transactions throughout Africa. Two years later, he was dead. But Libya was far from the only country taking steps to get out of dollars at that time.

Two more powerful countries that the US is at odds with politically, namely Russia and China, have been taking steps for years to abandon the dollar system. China’s treasury reserves peaked about a decade ago.

With such large position in US treasuries (over $1 trillion), China has had to play it much slower with the unwind as to not oversupply the market for US debt. Russia has been selling off US treasuries to a larger degree though. This chart doesn’t even do the selloff justice because it only shows the two year trend:

Russia’s US treasury holdings are now just $2.4 billion. Down from $131.8 billion in 2014. A decline of 98%. What has Russia been doing with those liquidations? Buying gold. A lot of it, actually. This is Russia’s Gold holdings measured in tonnes.

China has nearly quadrupled gold holdings since 2008. And there has been speculation for years that China has been buying much more Gold than the country has been officially reporting.

Then there’s also the whole Yuan-denominated oil contract that is redeemable in Gold. China buys crude from different trade partners and is evidently tired of needing dollars to do it.

The US monopoly on money is dying. The world powers can see it. They aren’t dumb. They’ve been positioning for something else for years. It is unlikely, in my estimation, that the US government will be able to continue its financial stranglehold on the rest of the world. For it to be able to maintain financial control over just its own citizens, a central bank digital currency (CBDC) will likely have to be adopted. And a monetary shift of that magnitude will likely require some sort of crisis. Destruction of the currency by inflation and global de-dollarization would likely create that crisis. As I’ve pointed out before CBDCs will eliminate all financial privacy.

Now, some of you may be thinking, “I’m not a criminal so I don’t have anything to worry about.” Wrong. None of us have blown up a commercial airliner with a bomb hidden in our footwear, but we’ve all been taking our shoes off to get on a plane for 20 years. When draconian measures are adopted to stop the bad guys, everyone gets treated like a bad guy. Let me give you some possible uses for a blockchain-based programmable currency controlled by a central power:

expiration dates to drive usage (use the currency or lose it)

metered allowance (too many cheeseburgers in a week, your restaurant privileges are frozen)

support the wrong business or charity (funds are frozen, you’re now a terrorist)

aren’t up on your shots (funds are frozen so you can’t “spread lice and typhus")

Now, these are just off the top of my head. I’m sure there are other examples. You can use your imagination.

What Putin is doing is waging war in a variety of different ways. Obviously, there is the airstrike, boots on the ground conflict that is overtly taking place. But there’s more to it. Removing Russia from SWIFT would be bad for some countries in the EU but not others. Putin could very much be intentionally testing loyalties in the EU. And then there’s the US. I might be off base here, but I think kicking Russia out of the SWIFT system is almost as bad for the global dollar standard as it is for Russia. The US doesn’t want a country as big as Russia proving it doesn’t actually need SWIFT.

We can either believe Putin is simply a crazy man with a bloodlust or, possibly, he could be crazy like a fox. It’s possible he’s a chess player who has been positioning pieces on the board for this moment. In my opinion, it is very telling that despite the cries to remove Russia from SWIFT, Biden wouldn’t do it. Perhaps the US establishment understands it has more to lose by kicking world powers out of SWIFT than many may realize.

If you’re enjoying the Stack, please like, share, and comment! And, of course, you can always support by going paid. I’ve been hiding this promo code in articles all month. It expires in 3 days…

Mike, thanks for NOT being s formally trained economist. I always learn plenty studying faybombs. I have to read today’s offering again and maybe another time after that.

I had a moment of clarity myself in 2020, realizing CNBC was not my friend, and I didn't need to be one of their sheep.