Dogecoin, Bitcoin Cash, and Litecoin Have Awoken From Their Slumber

Who says dinosaur altcoins are extinct? One of these is a joke. Another is underutilized. The third is the most disrespected coin in the market. And that's an opportunity.

On Saturday, Bitcoin Cash ($BCH-USD) rallied 59%. Litecoin ($LTC-USD) was up 11% on the day. And Dogecoin ($DOGE-USD), which I just covered for Seeking Alpha this week, has rallied 67% since Monday. If you’re blown away by the returns from GPU behemoths like NVIDIA NVDA 0.00%↑, wait until you play in the altcoin arena. This is what I said about DOGE on Wednesday (free link alert 🚨):

My view has been that Dogecoin is a meme and nothing more. Turns out that may not be true. For better or worse, Dogecoin has more DAUs than other "OG" proof-of-work coins that I believe offer better functionality and better utility. We can't rule out the possibility that buyers will once again flock to DOGE at some point during 2024.

Flocking indeed. We’ll get into some of the DAU data in a bit. But first, I shared some thoughts about altcoins like Dogecoin during my conversation with James Foord on Thursday:

Please check out the whole convo if you haven’t yet, I watched it back and I think we did a really nice job.

Wouldn’t you know it, just two days after I pontificate about the possibility that spot Bitcoin ETFs might change speculators’ ability to generate the kind of “altcoin season” that we’ve seen during bull cycles in the past, I’m being served a welcomed reminder that these things are going to do what they want no matter what scenario any one analyst’s brain concocts. To be clear, I would love a proper altcoin season as I own a few dozen of them to varying degrees. Let’s start with the basics. What the heck is an altcoin and why do they exist?

What Are Altcoins?

Bitcoin ($BTC-USD) is widely viewed as the godfather cryptocurrency. There are a lot of great things about Bitcoin and I admire the people who have worked on making the network what it is. But there are a lot of ways that Bitcoin isn’t great; transaction throughput, privacy preservation, application building - all of these are major issues that have still yet to be meaningfully changed 15 years later.

My view has generally been that until Bitcoin develops both privacy tools and legitimately usable scaling solutions, these issues are going to be solved by other networks and other coins, or “altcoins.” Bitcoiners can dislike that all they want, but the reality is some of the assets that have been dubbed as “shitcoins” will survive and will serve a purpose. In this article we’re going to focus on activity and valuations in three long standing and well known “altcoins.”

Proof-of-Work Dinosaurs

One of the reasons why I like comparing BCH, LTC, and DOGE so much is because they’re all close siblings that ultimately originate back to BTC through forking. Like BTC, they’re mined through the proof-of-work consensus mechanism and even though they’re all on the older side in the short life of crypto, they’re still among the top 20 in circulating market capitalization:

Dogecoin: $20 billion (ranked 9th)

Bitcoin Cash: $9.2 billion (ranked 17th)

Litecoin: $6.7 billion (ranked 19th)

All three of them are peer-to-peer payments-focused coins that are faster and cheaper to use that Bitcoin. And as we’ll explore through various metrics shortly, they’re arguably cheaper to buy than BTC as well - think value vs network activity not value expressed as simply price per coin.

Network Usage

I’ve made this point many times here on Heretic Speculator previously, but for the benefit of those who have signed up more recently, Bitcoin has a long term security paradox. As time goes on, miners will need user transaction fees to become the primary source of revenue. But if this actually happens, most people won’t be able to use the network on the base layer.

A figure I’ve often utilized in articles is total non-zero wallet addresses:

Bitcoin: 59.2 million

Dogecoin: 6.2 million

Bitcoin Cash: 25 million

Litecoin: 7.9 million

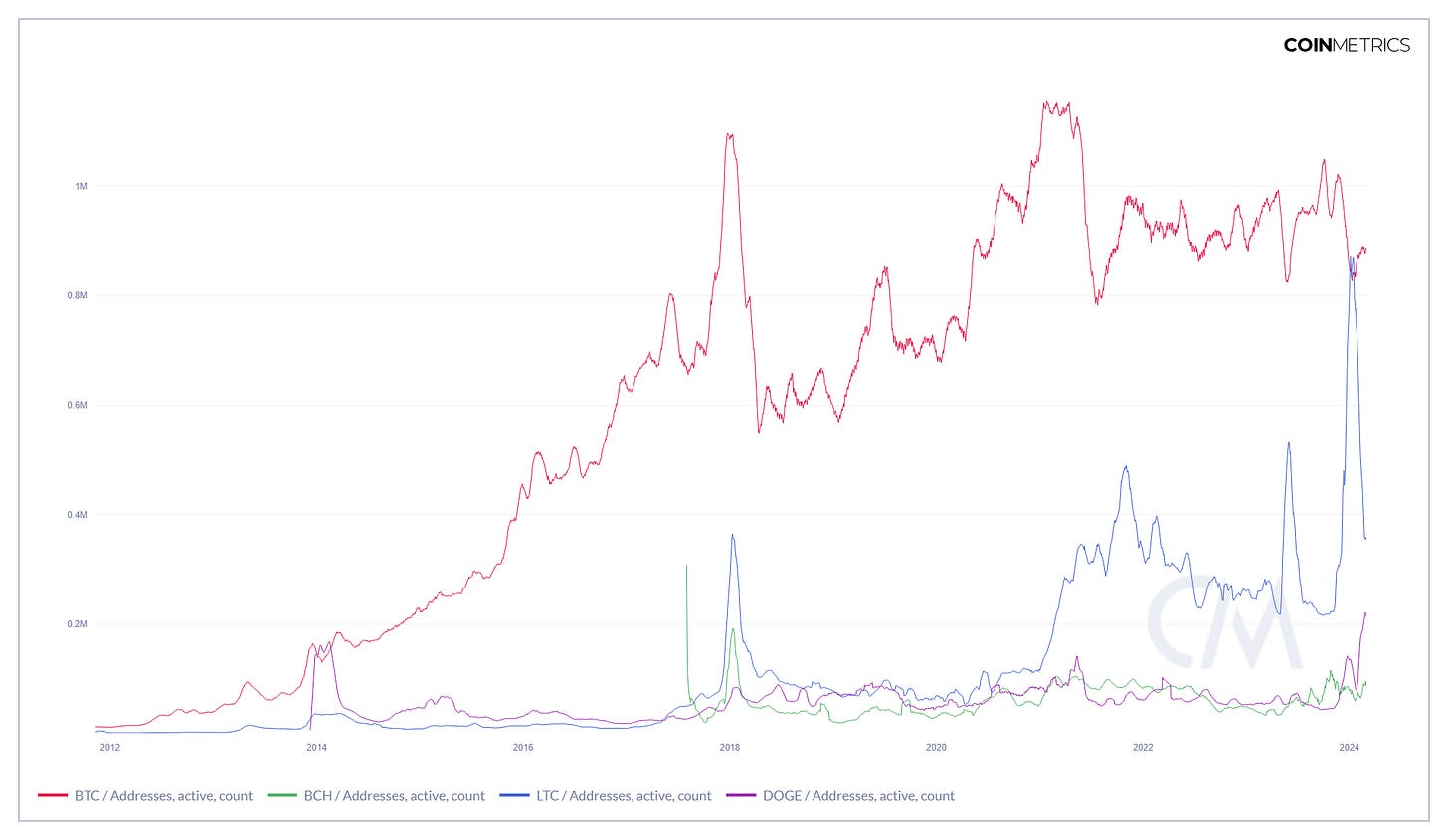

Here, Bitcoin is beastly. But as fees to use the network rise over time, the more important address metrics are DAUs and Active Address Ratio. Of these four, Bitcoin is still the king in DAUs - but that lead in active addresses is not actually as commanding as it was four years ago:

Furthermore, when you adjust for the large advantage Bitcoin has in total wallets and look instead at the percentage of total addresses that actually transact on a daily basis through the active address ratio, Bitcoin is abysmal while coins like LTC actually do very well:

LTC’s 30 day active address ratio occasionally spikes above 10%. It rarely falls below 2% and is generally at least double BTC’s ratio at any given time. And we can see this usage corroborated through third party crypto payment processors like Bitpay. In January, 38% of crypto transactions through Bitpay were with LTC:

Some of this is a consequence of narratives and the push by companies like Grayscale and Blockstream to make Bitcoin “digital gold” rather than “digital money.” This was not a consensus view however. Many notable Bitcoiners, some of whom had been in the community during the early days (like Gavin Andressen, Mike Hearn, and Roger Ver) showed initial support for increasing Bitcoin scalability on the main layer. This proposal turned into a multi-year fight that came to be known as the block size civil war. Bitcoin Cash is the primary manifestation of this war.

Valuation Multiples

Addresses and address ratios only tell half of the usability story. Value transfer over the network also matters and readers here are likely no strangers to the NVT Ratio.

This takes the 30 day average of the market cap of the coins and divides it by the USD-denominated transfer volume. It’s difficult to tell in the chart but LTC is by far the cheapest of the four coins based solely on NVT ratio averages. Which again lends credence to the notion that the coin punches above its weight in real utility.

We get a similar story from the MVRV ratio which divides the coins market value by it’s realized value (price at which all coins were last moved). Here LTC trades at about a 30% discount to both DOGE and BCH and a 60% discount to BTC.

Closing Thoughts

There is no reason any of these things need to trade at the same or even similar multiples. The reality is the crypto market doesn’t always care about fundamentals or utility. This makes crypto similar to the stock market in that regard. This can always change. But I’m steadfastly of the view that LTC needs a repricing upward and if we do actually get an “altcoin season” and this isn’t all a massive fake out, LTC holders should be rewarded well.

Disclaimer: I’m not an investment advisor. Cryptos could all go to zero. I’m long BTC, LTC, and LTC.