Don't Play When It Come To My Base

Coinbase's business model is changing before our eyes. And the company isn't battling DEX protocols. It's a far more savvy approach to potential retail volume erosion.

I had a really great question from a reader about Coinbase’s Ethereum scaling network Base. As fate would have it, I was already working on a L2 fee article for my fellow Heretics so I’m going to do my best to fully answer the Base question here.

The immortal words of Masta Ace.

don’t play when it come to my bass

In my work for Seeking Alpha, I’ve made the case that Coinbase COIN 0.00%↑ launching an Ethereum L2 chain (Base) is part of a proactive strategy to combat what I view as significant long term risk to the company’s centralized exchange business. When I initially published that theory, Coinbase was primarily competing with centralized exchanged peers like Binance ($BNB-USD) in addition to all the decentralized exchanges operating on top of the blockchain networks themselves.

In addition to both centralized and decentralized exchanges, there is now a third enemy combatant type to Coinbase’s centralized exchange business that I’ll detail shortly. First, let’s go over the difference between centralized exchanges and decentralized exchanges.

Centralized Exchange

The centralized exchange is the most straightforward way to buy crypto. The user interface is typically simple and buyers generally link a bank account or credit card to start buying and selling coins. Most centralized exchanges practice strict KYC/AML compliance - meaning they’re permissioned platforms that require opening and maintaining an account.

The user is generally at the mercy of the company that owns the platform and there are built in trust assumptions pertaining to security and custody that the user expects for simplicity. The major tradeoff is not ultimately controlling the crypto that is held on the exchange unless they send it to their on-chain address from the exchange, doing so generally comes with a network fee.

While it’s by far the largest US-based exchange, Coinbase is generally a top 5 exchange by total volume as Binance, Upbit, and OKX often beat Coinbase globally. In addition to a UE more similar to a traditional brokerage, trading via centralized exchange can be far cheaper than trading through DEX protocols because users only pay network fees if they “take custody” of the assets they’re buying. For example, one can buy Bitcoin ($BTC-USD) or Ethereum ($ETH-USD) through Coinbase, hold the coins there for 4 years, and then sell them back without ever actually depositing to their on-chain wallet.

Think of on-chain wallets like a physical wallet that you’d buy to hold paper cash. You can generally do everything you want to do with physical cash directly from a bank account. But the tradeoff there is the bank can tell you they don’t actually have your money when you want it. This is what happened with Celsius ($CEL-USD), FTX ($FTT-USD), Voyager ($VGX-USD), and BlockFi in 2022. But with an on-chain wallet, you’re essentially choosing software operating on top of a network rather than an account with a company. Most wallet applications integrate with numerous blockchain networks. It’s a bit like holding paper USD, CAD, and EUR in the same physical wallet in your pocket.

Analog version:

If you can’t hold it, you don’t own it.

Digital version:

Not your keys, not your coins.

For many crypto advocates, self-custody (or holding assets on-chain) is the better approach to owning cryptocurrencies because the user shifts security to themself and to the network where the asset lives rather than any single company. For instance, there turned out to be far less risk in holding a US Dollar stablecoin on Ethereum than holding dollars on FTX in late 2022.

Decentralized Exchange (DEX)

If one is adamantly opposed to centralized custodian risk, the user can instead turn to DEX protocols like Uniswap ($UNI-USD) or SushiSwap ($SUSHI-USD) and trade directly on the blockchain. In contrast to the centralized exchange, DEX protocols like Uniswap are permissionless and don’t exercise KYC/AML compliance.

Rather than creating an account, users “sign-in” to the protocols with their wallet address rather than an email address. Trading this way is theoretically safer for the user because the DEX never actually has custody of the assets being traded. It’s more like a marketplace that connects buyers and sellers in the same way that eBay EBAY 0.00%↑ is a marketplace intermediary rather than a traditional store.

Using a DEX hasn’t been overtly designated as illegal activity (yet) in the United States, but trading with them doesn’t eliminate the obligation to pay the Don his tribute on capital gains. Generally speaking, these blockchains are all absolutely horrendous for personal privacy and it’s incredibly easy to track who is doing what. So the tax avoidance angle from those against DEX trading doesn’t really hold up.

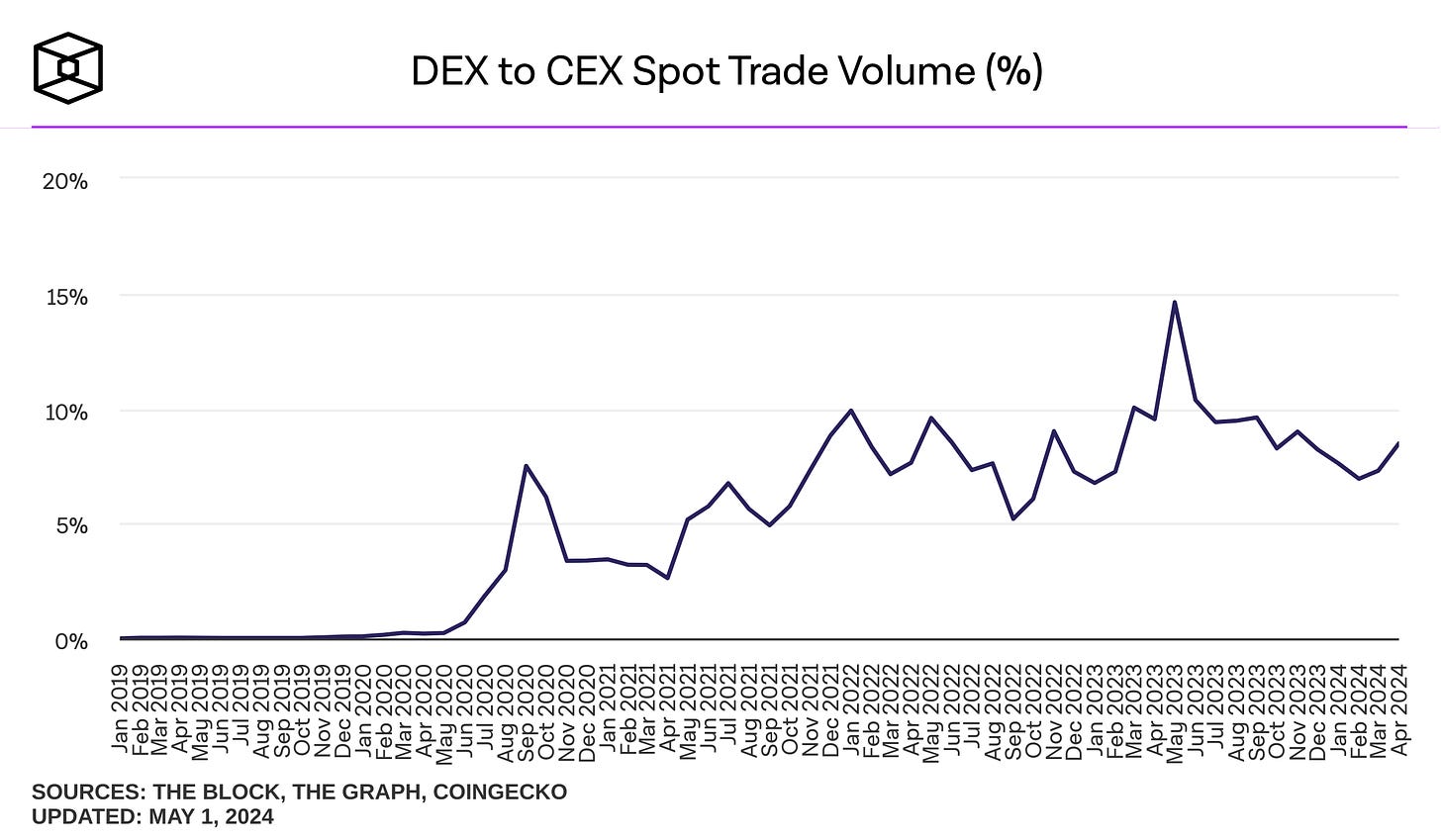

It is fair to acknowledge that DEX share of total crypto trade volume did actually decline year over year in April. However, the long term trend still points to an erosion of centralized exchange volume from the DEX insurgents like Uniswap over time. This all brings us to Coinbase’s business model. Because if DEX protocols steal volume share from centralized exchanges, Coinbase is theoretically a loser in that environment.

Coinbase’s Business Model

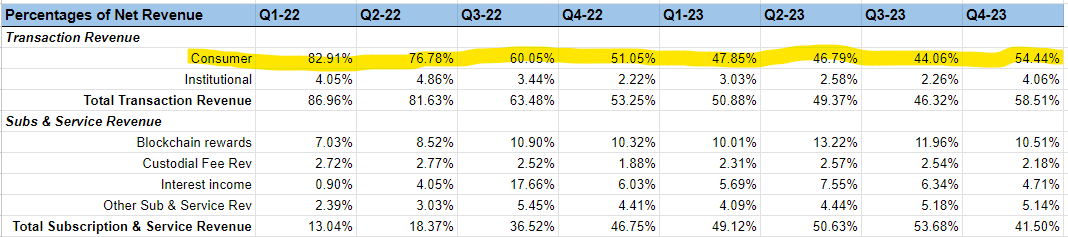

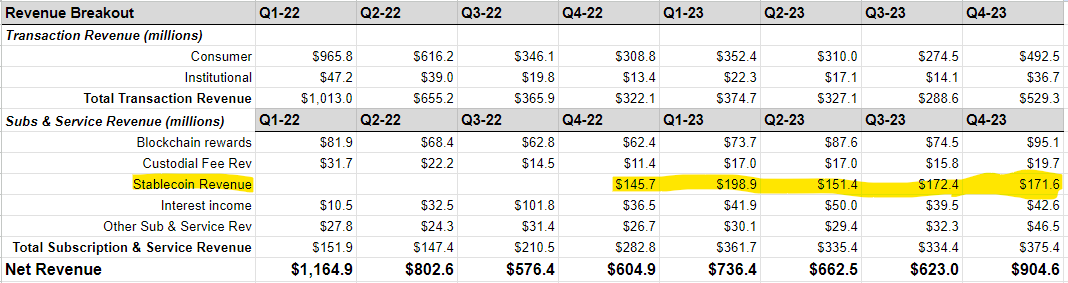

While theoretically more complex to use today, DEX trading is certainly a risk to Coinbase’s long term business as DEX applications will only get better from a UE standpoint over time. During the first half of 2022, roughly 80% of Coinbase’s total revenue came from consumer transaction revenue. Think of this as the “retail” crypto buyer:

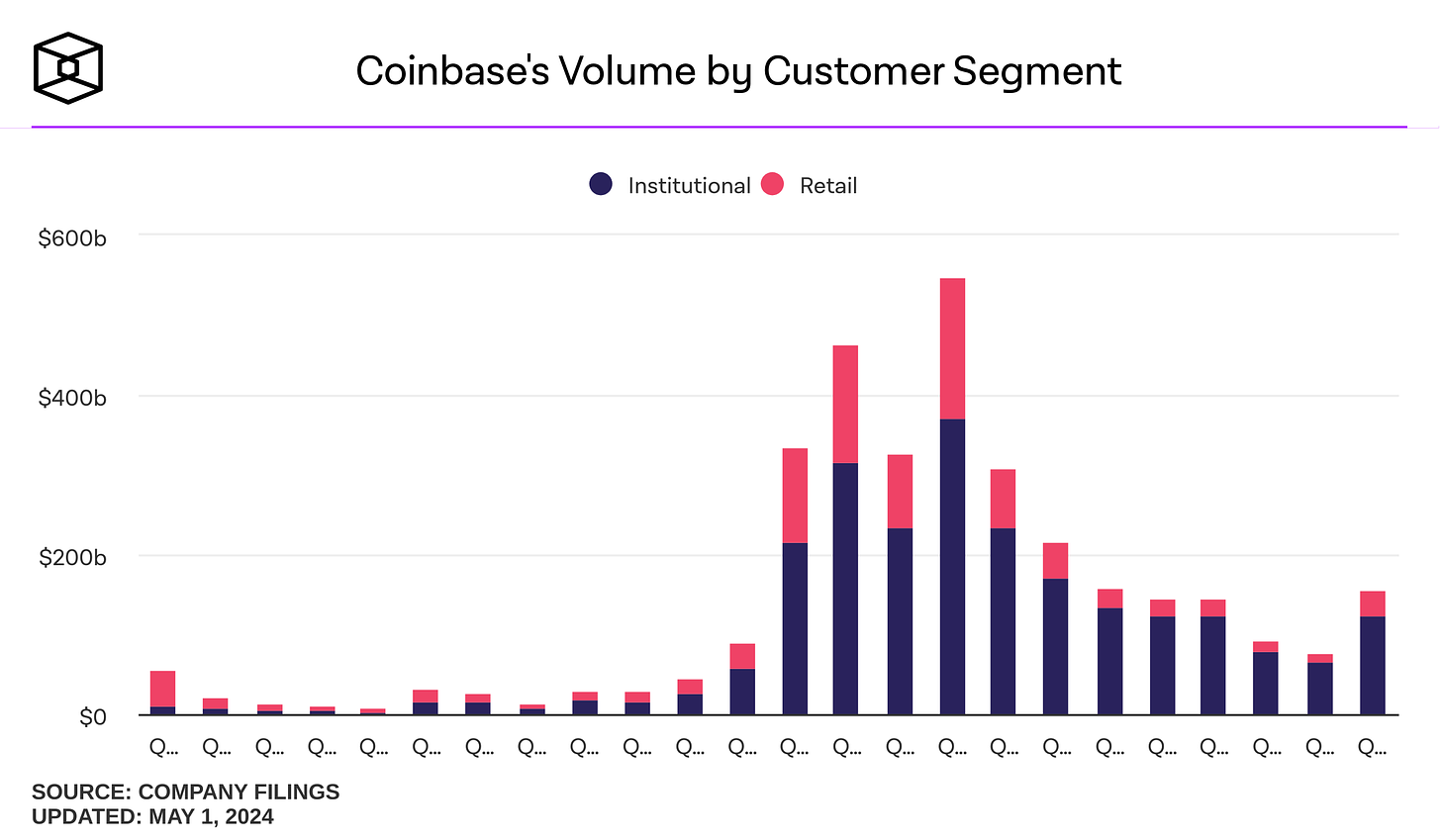

During the second half of 2023, revenue from retail traders was closer to 50%. Interestingly, the overwhelming majority of Coinbase’s transaction volume comes from institutional clients rather than retail clients:

Retail volume has historically been a fraction of institutional revenue. Obviously, this is telling us the margin on the retail volume is significantly better than the margin on the institutional volume. And this brings us to our third enemy combatant to Coinbase’s retail exchange business… ETF managers.

In a recent Seeking Alpha article covering the Fidelity Wise Origin Bitcoin ETF FBTC 0.00%↑, I made the case that spot ETFs make it cheaper, and potentially even less risky, to hold Bitcoin than in a self-custodial wallet:

Consider a speculator who wants to buy $5,000 in BTC. Doing so through an exchange will require an upfront fee and then an additional fee to take custody. If we use $10 as an our base case for average transaction fees and 25 bps as our base case for annual ETF expense, it takes five years to make self-custody more cost-effective than simply buying the ETF:

Why go through the hassle of buying Bitcoin through Coinbase and paying the fees to self-custody the asset when one can just pay 25 bps to let Fidelity do it for them. If I’m a retail buyer who typically uses Coinbase to buy BTC, FBTC is now a clear competitor. And again, Coinbase still makes most of its money from selling coins to retail. Coinbase has essentially two options here:

Raise custody fees on the institutional buyers who are the primary providers of transaction volume, or

Start doing business on-chain

When push comes to shove, I believe the company is going to do both. Speculation aside, it’s clear Coinbase is already starting with number 2.

The L2 Approach

For all intents and purposes, Ethereum is DeFi. With $51 billion in total value locked, Ethereum’s base layer commands more than 59% of the TVL in the DeFi space. When we add in all of the chains that exist primarily to scale Ethereum (circled above), the “Ethereum Ecosystem” is close to 70% of all of DeFi. It’s just a monstrous edge over all of these other Layer 1 blockchain ecosystems and the proliferation of “ETH Killers” in recent years has likely fragmented the insurgents in the same way all of the P2P medium of exchange Bitcoin forks have fragmented any insurgent heir to Bitcoin.

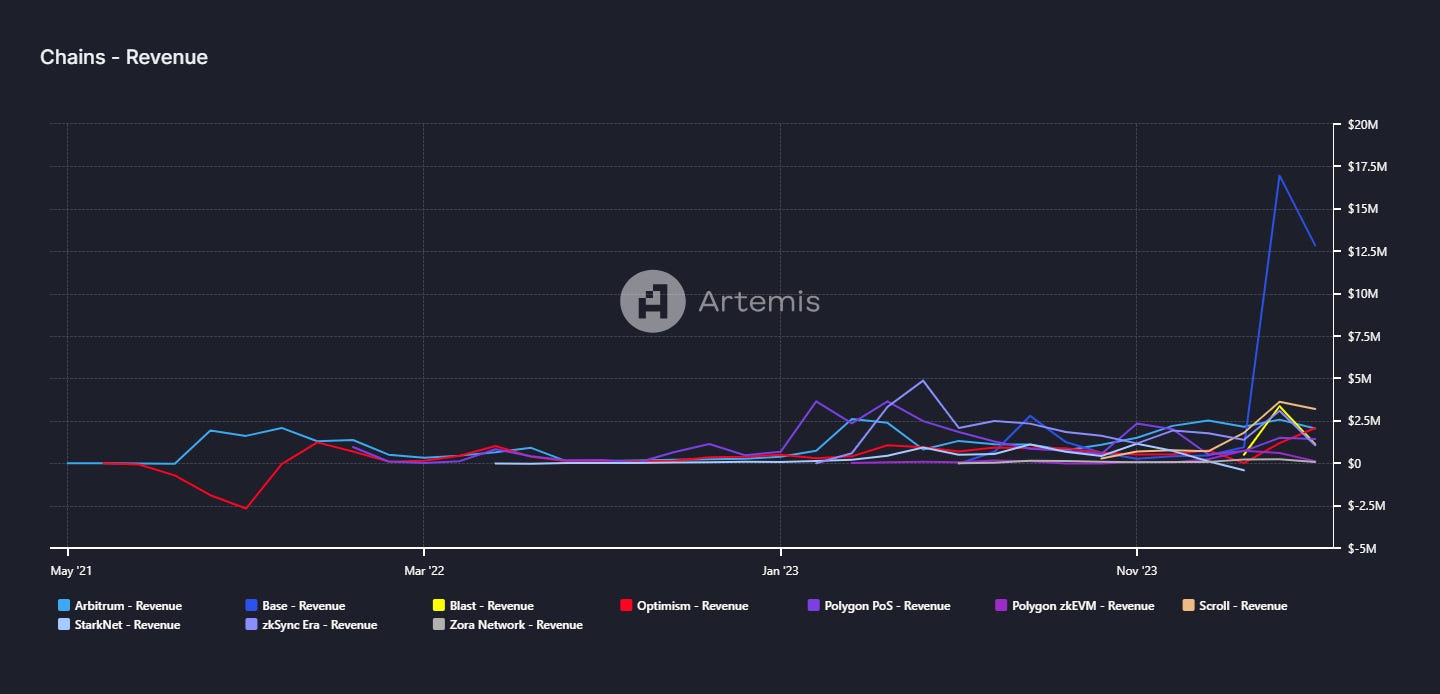

Regardless, usage of Base has absolutely exploded since Ethereum’s Dencun upgrade and the chain generated nearly $30 million in sequencer fees for Coinbase between March and April - more than the next 8 Ethereum L2s combined:

The important thing to know about growing Ethereum through L2 scaling chains like Base is doing so passes off transaction validation to a secondary network. These networks rollup transactions that live off of the Ethereum blockchain and then batch the transactions together in a more compressed format for publishing to the Ethereum network.

L2 networks utilize what is a called a “sequencer” to order the transactions before publishing. For the user, there is a transaction fee that is paid to the sequencer but it is far smaller than it would be if it were on the main chain. The idea for well run L2s is to charge more in sequencer fees than it costs to post the transactions to Ethereum. Ethereum’s Dencun upgrade made this far more economical.

I’ve detailed how Ethereum’s Dencun upgrade has positively impacted L2 scaling chains from a user cost standpoint in a prior post. In the nearly two months since that article, usage of Coinbase’s L2 has absolutely exploded.

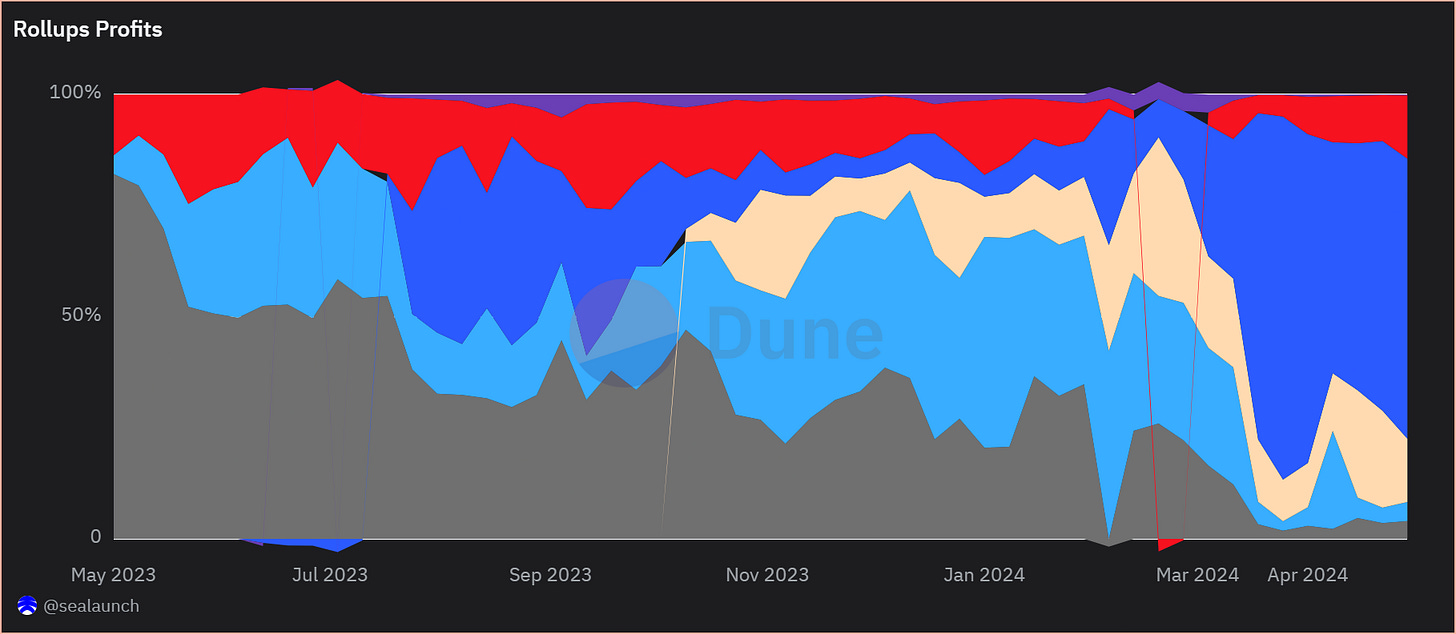

The most interesting part of this usage spike is just how profitable it has been for Coinbase. Coinbase is the only sequencer for the Base blockchain. And even though Coinbase splits base fees with the Optimism Collective, Coinbase still gets the lion’s share of this revenue. Base is apparently so much more profitable than the other scaling solutions, that Base is currently taking more share of rollup profit than L2 peers Arbitrum, Optimism, and zkSync combined:

By itself, this is impressive. But it’s even more impressive when one factors in that Coinbase gets revenue share of Circle’s USDC stablecoin. If you hold USDC with Coinbase, the company will pay you 5% interest and keep a small spread from the t-bills that are backing the USDC collateral. Stablecoin revenue is already a not-so-insignificant source of Coinbase’s total revenue:

Coinbase is in a position where it can incentivize users to buy USDC through the centralized platform, have those users send the USDC to the Base blockchain, and then profit from DEX protocol trading via Base’s sequencer fees. In this way, Coinbase isn’t paying the 5% yield to USDC depositors and is opening sequencer revenue to any altcoin that comes into existence on Base without ever needing to actually list the coins on the centralized exchange. Rather than compete on-chain in the DEX space, Base is simply providing the infrastructure for the DEX space to thrive and getting paid well to do so.

The question for us as individual investors is obvious: how do we play this? After all, we know that Base sequencer revenue can potentially cannibalize Coinbase’s centralized exchange business. Furthermore, COIN stock already trades at more than 16 times trailing twelve months sales. I can’t personally justify longing COIN at these levels.

In my view, the answer to the question is simple; watch how this all progresses. Observe where the revenue growth for Coinbase is over these next two or three quarters and we can then assess if the strategy is playing out the way I’ve laid out above. In the meantime, we watch and wait.

Act like, ya know, the Masta Ace don't play when it come to my bass

Disclaimer: I’m not an investment advisor. I’m long BTC, ETH, UNI and MATIC.

great Mike, thanks