Farcaster, Fragmentation, and The Reality of "Decentralized" Social Media

No matter which blockchain-based social media solution one favors, the reality that can be observed from Web3 isn't all that different from Web2 at this point in time.

Disclaimer: This post has been adapted from an article that was previously written exclusively for my BlockChain Reaction investor group subscribers through Seeking Alpha in late 2022. Much of this post may look familiar to those of you followed from BlockChain Reaction to Heretic Speculator. However, in this post I’m taking a far more aggregate view of the landscape that I hope you’ll find valuable. Finally, I have a position in the token for the Decentralized Social ($DESO-USD) blockchain network though I haven’t used any of the applications build on top of that network in quite some time. From here on out, I’ll be using Twitter and X interchangeably.

Social Walled Gardens

One of the biggest stories in the zeitgeist over the last couple years has no doubt been Elon Musk’s purchase of the platform formerly known as Twitter. For several years preceding the acquisition, many Twitter users (including myself) and Musk took issue with that platform's content moderation policies. Whether those critiques are valid or not isn't necessarily important for this article.

There was a market demand for something else as evidenced by the proliferation of Twitter-alterative platforms like Parler, Gettr, Minds, Gab, Mastodon, Threads, Bluesky, and Flote (RIP). None of these have really taken off in the way the users and developers probably have hoped and I think there are a couple different problems that have led to their inability to take meaningful share from X.

The Centralization Problem

Social media platforms are immensely powerful aggregators of information. When those aggregators wield that power in ways that might be deemed problematic by the user base, there isn't always another platform where agitated users can migrate that provides a similar level of enjoyment or connectivity. For instance, there are at least a dozen alternatives to Twitter and none of them have anything close to the scale of reach that Twitter offers.

Most of them also lack meaningful improvements to user experience or usability. Consider Mastodon, which was widely viewed as the escape destination following the blue check temper tantrum when Elon Musk appeared to be ending the monopoly on acceptable views on Twitter. The UE on Mastodon is abysmal and not even remotely intuitive for normal people.

Even the competing platforms that were essentially carbon copies of Twitter’s UI (cough Gettr cough) have failed to garner large scale migration because the user can’t rely on their followers joining in the move. For instance, if we follow each other on X and then I start doing most of my microblog posting over on Notes, you’re not going to see it if you aren’t also on Notes.

Even though the barrier to entry for a new social media platform from the user's perspective is often negligible nominally, it is usually seen as a low upside proposition because moving to a new platform requires starting over from zero followers and without any of the existing content from the previous platform.

For users with an established following and years of posting history on a platform like Twitter, focusing attention instead on a little-known alternative is generally a non-starter. But this sort of user-capture is only possible because the platforms own the content and the audience. This is what is called a "walled garden." X is digging in on this approach and it’s easy to see what that approach will ultimately lead to. Namely, further fragmentation.

Competing Walled Gardens

Substack, which started as a simple newsletter service, is also a walled garden. I think it’s a better version of one and I’ll get into the reasons why, but it’s still somewhat closed off to the outside world in a couple different ways. Consider Notes for instance:

I think Notes has become a terrific tool for writers and readers since it was launched. There is no question that discoverability is getting a lot better than it was when it started even though I think it still has a long way to go (PLEASE get cashtag operability,

). But a noticeable drawback is the reality that readership growth for each individual publication has been somewhat reliant on internal growth. Here’s why this is a problem…There can be no doubt that we have a limit to how much upside individual Substack publications can have if external traffic doesn’t improve. I’m currently subscribed to nearly 40 publications. Many of them post 3 to 4 times per week. What do you imagine is the likelihood that I can read all of this material and still be productive?

Spoiler: it’s a zero percent chance.

In a normal week I’m lucky if I can read 20% of it. And I would wager many readers on this platform similarly have more subscriptions than available bandwidth. The point is, without growing aggregate readership, Substack publications have limited potential for internal growth. Importantly, this is not the same thing as external growth - which is essentially limitless. Email-based newsletters can still thrive even if readers don’t engage with Substack’s other platform tools like Notes or chat.

This is why I made the decision to dump my Wordpress domain about a year ago and go forward with Substack only. Of all of the walled gardens that I’ve found, Substack is the best for aligned incentives. As a creator, X can still monetize my content whether I grow an audience or not. Substack only benefits from me when my publication is successful because the company takes a cut from subscription revenue. I like this approach better. I also like that if Substack decides to FAFO with content moderation policies, I can easily take my list elsewhere. And this is the important concept to grasp going forward.

I could argue Substack is “Web2” mixed with some elements of “Web3.” But that might not actually be correct. What the hell is “Web3” anyway?

The “Web3” Approach Still Sucks

Remember Web3? I’ve written about it many times but it has been a while. Depending on which source you use to define it, Web3 can be viewed as the “decentralization” of the internet through the use of blockchain networks for things like data storage, domains, payments, and ownership. I actually want this future. But I don’t think you’d get much argument from the builders in Web3 that they are very much in ‘fake it til ya make it’ mode.

A decentralized future like the one just described would be very problematic for the current gatekeepers. As I see it, the problem with all of the blockchain-based attempts at building social networks is they’re all still walled gardens at the end of the day. They’re just walling in a different way.

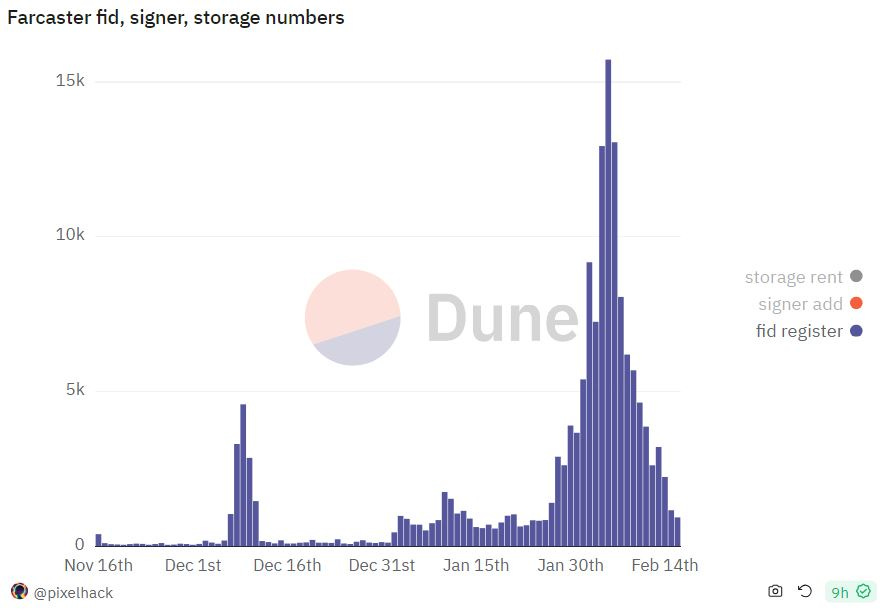

Sure, you can access these networks through a variety of different front-end applications from desktop or mobile devices. But you still need to be on the same chain to engage. Bitcoin has Nostr. Polygon has Lens Protocol. Ethereum has Farcaster. The later of which has been all the rage for “crypto Twitter” over the last week or two. But as I understand it, a Buttrfly user (Lens Protocol) can’t engage with a Warpcast user (Farcaster) for the same reason that a Diamond user (DeSo) can’t engage with a Damus user (Nostr); they’re not on the same network.

Here’s a prediction, Farcaster will suffer the same fate as all of these other Web3 social networks because it's the exact same problem as the Web2 Twitter alternatives - it’s still network fragmentation, just built on a blockchain rather than on AWS.

For social media specifically, we’ve seen how users on the various platforms are able to grow large followings through an engagement model that generally incentivizes cheap thrills more than thought-provoking material. There are several platforms that are trying to combat that. Some are “Web2” based (Substack) and some are “Web3” based (Paragraph/Mirror). Some take more of the “busker” route and prioritize tipping, while others aim to financialize engagement. Those two things may look the same but there’s a subtle difference.

All this said, some of these networks may reach some level of success. Bitcoiners may be able to keep Nostr kicking long term. I have no idea. I’ve still never used it. But if my hunch is correct, Farcaster is doomed already.

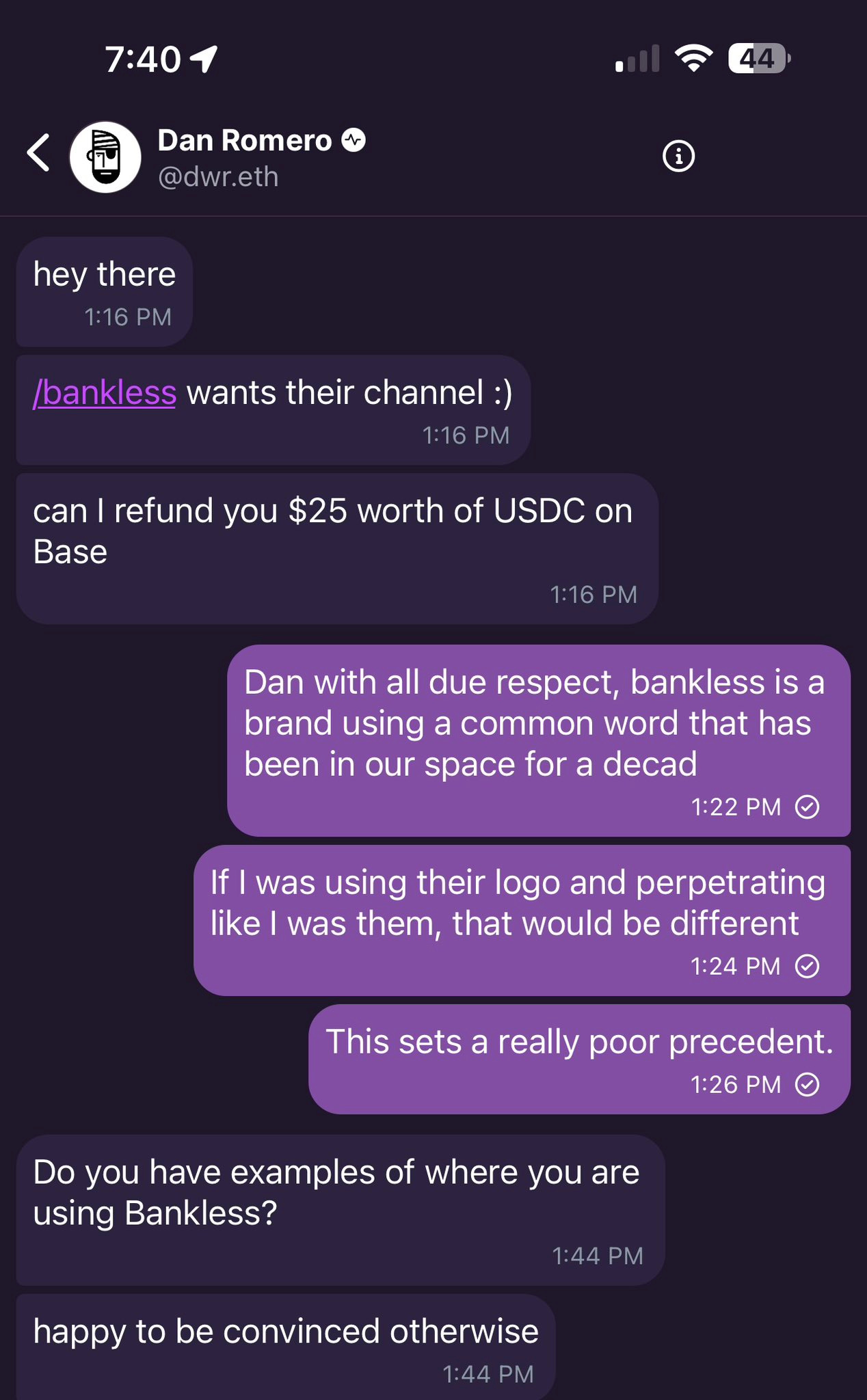

Let me explain what is happening in this thread above. A Farcaster user that registered the name “Bankless” had it taken away by one of Farcaster’s developers because the guys over at Bankless think they own the word and decided they wanted it. Hence, this decentralized “Web3” network is unequivocally not decentralized. We could certainly debate whether or not domain squatting is a good thing. What I don’t think is a good thing is people who claim to want decentralization opting for centralized control measures the moment something becomes mildly inconvenient.

Thus, who does Farcaster now appeal to? Advocates of decentralization? Eh, I’m not sure that works. Time will tell.

Decentralized Social

Decentralized Social, or DeSo, isn’t ultimately all that different from some of these other networks. Like Nostr, it has various clients (applications) that can engage with the blockchain. Developers of the applications can set their own rules in those clients. Development of the network itself is centralized in that only a handful of people are actually committing code:

However, it’s important to note that my quibble with true decentralization aside, DeSo does get the incentive structure correct in my opinion. Users of this network have to pay to post - it’s micropayments, but the users are paying for the product rather than being the product.

“Diamond” is probably the most notable social media front end that is built on DeSo but if another developer built an application on the DeSo blockchain, users of Diamond could log into the new application with their same wallet seeds and maintain the same following and content they have on Diamond. This is no different from how a Metamask user can enter their wallet seed phrase in a different Ethereum wallet application and still access all of their ERC-20 tokens and NFTs provided the accessibility has been built into the application.

From the user's vantage, this is probably an attractive long term proposition because it means the user owns their content and owns their social presence provided they stay on the DeSo network. From the developer's vantage it's an attractive proposition because it means it is the user, not the platform, that funds the posting of that content through micro-transactions. The development teams that build DeSo-based dApps can be more nimble and less worried about content moderation because the pay-to-post model is theoretically self-policing.

Even though each transaction is a small fraction of a penny, positive reinforcement at the user level is done monetarily with tips rather than with "likes." Bot content wouldn't figure to be rewarded and would carry a cost to post. It puts the content moderation policy into more of a free market discovery mechanism. This won't be for everyone and there will probably be a lot of growing pains first if it's successful, but its a very interesting concept.

The people who run platforms like Facebook META 0.00%↑ or YouTube GOOG 0.00%↑are unlikely to have any interest in building their operations on a decentralized blockchain. DeSo is a complete departure from how social media applications are currently built and managed. Rather than advertising and data monetization models, builders on DeSo would see returns on effort through the network effect of the blockchain and the resulting appreciation of the DESO token, which has a fixed supply.

DeSo vs Other Web3 Efforts

There are currently just 10.8 million DESO tokens in existence. I say currently because the DeSo foundation has pondered a token split in the future. Split or no split, what I do like about DeSo's current token situation is the coin has 82% of supply in circulation and a fairly decentralized holding distribution with no one founder getting more than 5% of the supply.

One of the questions that I had when I first came across DeSo was structural. Why did the Deso Foundation feel the need to build an entirely new blockchain as opposed to just building a social media app as a proof of concept on a low-transaction cost, high-throughput chain that already exists? The answer lies in the difference between storage-light and storage-heavy internet applications. DeFi is storage-light and can be done easily with just about any smart contract chain. Social media is storage-heavy and requires a blockchain that is optimized for a very specific kind of activity.

According to DeSo, the cost to store 1 Gigabyte on-chain varies by network with Ethereum being the most expensive for this particular application example. A huge issue that developers run into when building new social media platforms from scratch is the infrastructure cost. It takes a tremendous amount of data storage to maintain Twitter and Facebook. The idea that this storage cost is instead paid by the user is very interesting and potentially opens up the possibilities for the network to appeal to a wider set of developers who maybe didn't have access to the investment capital required to start a social media app previously.

If we look at Farcaster as an example, the protocol data is synced off-chain. So for all of the noise about the decentralization offered by Web3, I would challenge readers to really think about how a blockchain-based social media network that syncs off-chain is all that different from Web2. Of course, I could be missing something here, and if I am by all means sound off in the comments.

Final Takeaways

Ultimately, it is incredibly difficult to change consumer habits, especially in social media. I think that many people understand why the current structure of many of the top social media platforms may have serious problems going forward, but to this point there just haven't been enough people who are willing to try new things.

When you throw something like blockchain on top of that and tell the users they have to pay microtransactions to post, most people are probably unlikely to welcome that. Even if they're overtly explained the benefits of content/audience ownership, no advertising, more clear content moderation policies, and no shadow banning; there are many who still won't be willing to make that tradeoff.

That said, we're already seeing X start charging users a monetary fee for service upgrades through the company's Premium offering. Paying to use social media has been viewed as taboo. But the more paying to post is normalized by X, the more viable micro-payment alternatives like DeSo may become in the future.

For me, DESO is worth a small speculative bet in a diversified digital asset portfolio. This idea is probably only for a buyer who understands allocation sizing and risk tolerance. Full disclosure, it’s easy for me to write about DESO after the coin recently hit $40 because I started buying it when it was under $8.

I’m of the belief that content production and consumption on the internet are going through an evolution. I don’t know if blockchains are the way to go. But I do know that I personally prefer decentralization when it can be achieved. And I’m not sure content distribution can get more decentralized than something as simple as a nimble network of email addresses. Make sure you’re regularly exporting those lists, fellow Substackers. I love it here. But I loved Twitter and YouTube once upon a time too.