Follow the "Leader"

There's an old adage in the investment community that if you follow the smart money, you'll do better than most. Who is the smart money in 2022?

You ever wonder why fund managers can’t beat the S&P 500? Cause they’re sheep. And sheep get slaughtered.

Gordon Gekko

Would it surprise you to know that even though I am absolutely fascinated by finance, I’ve only seen Wall Street with Charlie Sheen and Michael Douglas one time? I own the movie. Literally a DVD in my possession, and I’ve watched it one time. I’m not even really sure why, to be totally honest. I liked it. I obviously remember the quote from above. I just think that when I have a couple hours to myself to watch a movie that I want to watch, when I go finance, I go either The Big Short or Margin Call. Not sure what that says about me, but it’s the truth. I actually kinda hate The Wolf of Wall Street. The best thing that movie offered the world are the gifs…

I’m more interested in calamity

While Wall Street (to the best of my memory) makes more of a point about trading insider information and gamer shenanigans in finance, The Big Short and Margin Call are just a bit more impactful. The Big Short shows some of the real world consequences of the awful financial decision making and how it hurt people who didn’t know what they were doing. Margin Call is just amazing. It’s a must watch finance movie, IMHO. Both movies are very much “market crash” movies where the other two mentioned are more focused on finance criminality in my view.

Financial calamity is just more interesting to me. Which is why the bond market has been wild to watch. This is the monthly chart of the US 2 year:

Diabolical. Here’s the 10:

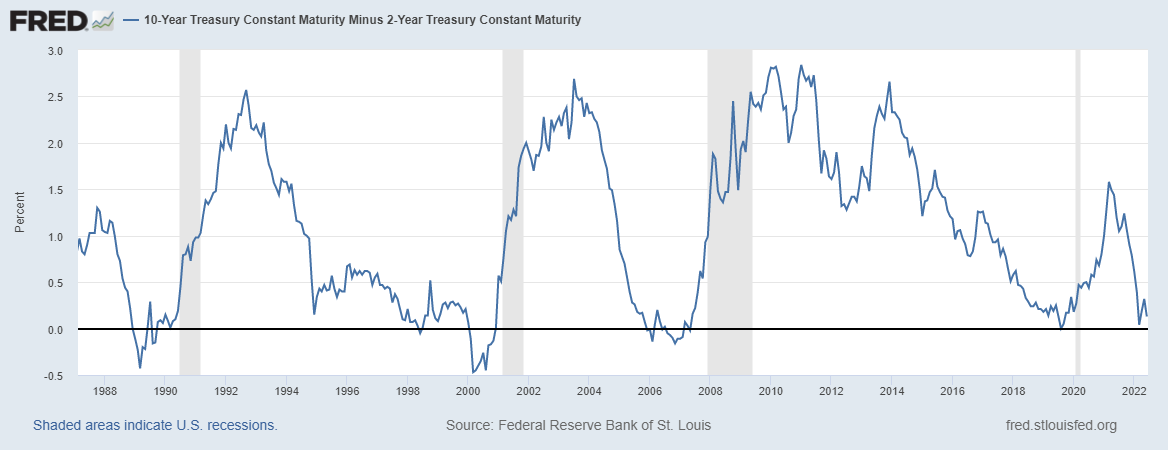

The credit market is what has put so much pressure on all other risk assets. Remember, these green candles are inverse. The yield rising means the treasuries are actually collapsing. Nobody wants to buy this debt if the central bank isn’t doing it too. Since the Fed claims it will tighten asset purchases, there isn’t a reason to front run the Fed’s bond buying unless you believe the Fed will pivot on tightening and rates (I obviously do). Here’s the yield curve, traditionally 10s minus 2s:

Historically an indicator of a recession, we are very close to another inverted yield curve. And yet, we’re told a recession is unlikely or it’ll be tame. We’re getting this from central bank, the investment firms, and the carnival barkers.

They’re either totally lying their asses off or they’re just not paying attention to any of the data. I dismiss the latter entirely. It’s not possible. They know what is happening. They just can’t say it out loud. Mortgage rates are the highest they’ve been in over a decade. Inflation is completely out of control. For all of the insistence we’ve been fed by the central bank that they have have “the tools” and “the resolve” to do what is necessary, the truth is they have had neither to this point. Could that change? Who knows.

Just last month we were told to expect a 50 bps rate hike in June and then the Fed, once again, did something different from what they forecasted. Now they’re saying they can keep raising rates while the country is teetering closer and closer to a recession. Nonsense. If they could fight inflation, they’d have done it already. The Fed has exactly two tools: buying US debt and controlling the rate of credit. Are we really to believe that less than 5 months from an election there won’t be pressure from the administration to do something?

Sheep get slaughtered

Most people don’t have endless hours to do their own homework. So who do they follow? Who is the smart money? Is it fund managers? Gordon Gekko would say no. How about this lady? If so, the dip buying has actually slowed quite a bit:

Pink is S&P, yellow bars are sells, green bars are buys. Despite recent Microsoft and Apple buys, the Pelosi Fund actually doesn’t look to be timing things all that well right now. My two cents; the Fed is and has been the market for years. Until there is a pivot in tightening, there will be stress in risk markets. That doesn’t mean there won’t be very tradeable bear market rallies, there will be and they will be awesome. But the pivot is crucial. Until there is a pivot, it’s probably best to have cash and gold.

Fed in Flames

Finally, if you have 10 grand to burn like Leo and want an incredible 1 of 1 art piece, check this beauty out:

It’s an oil painting of the Los Angeles Federal Reserve Bank building on fire with an angry mob doing angry mob things. Here is a description from the auction link:

This artwork is part of an ongoing series of paintings of Too Big To Fail banks on fire that started in 2011 and continues to this day. The painting is the only one I’ve ever finished depicting a Federal Reserve bank in flames. Within 3 hours of setting up at the corner of Grand and Olympic the sheriff was taking photos.

Wow.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero.