Fun Fact: Bonds Are Collapsing

Memory lane strolling is fun. Now back to your regularly scheduled programming...

Smoke ‘em if ya go ‘em! I really meant what I said in the cigar post earlier this afternoon. Tomorrow is not guaranteed and today is certainly not pretty. We live in interesting times, my friends. If you have nice whiskey, wine, or cigars what are you waiting for? The 6 million barrel milestone only comes once and there are no rules that say you can only drink the good stuff when times are wonderful. Remember a few weeks ago when I sad the TLT was at its lowest level in 8 years?

Well now its at its lowest level in ELEVEN years. This is incomprehensible. Reminder; the TLT is a derivative of longer duration US debt. Mainly the US 20 year+. TLT was at $180 per share during the COVID March crash when capital flew to bonds as equities crashed. Now, everything is falling together but it has been worse in US debt. The 20 year yield has gone from 3% to 4.5% in less than 3 months.

What we’ve been witnessing is the collapse of the 60/40 portfolio. And the alternative assets don’t seem care. Precious metals aren’t working, crypto isn’t working, collectibles aren’t working. Even oil is well off highs. This is all while the currency slowly dies in purchasing power. Basically, there is nowhere to go right now.

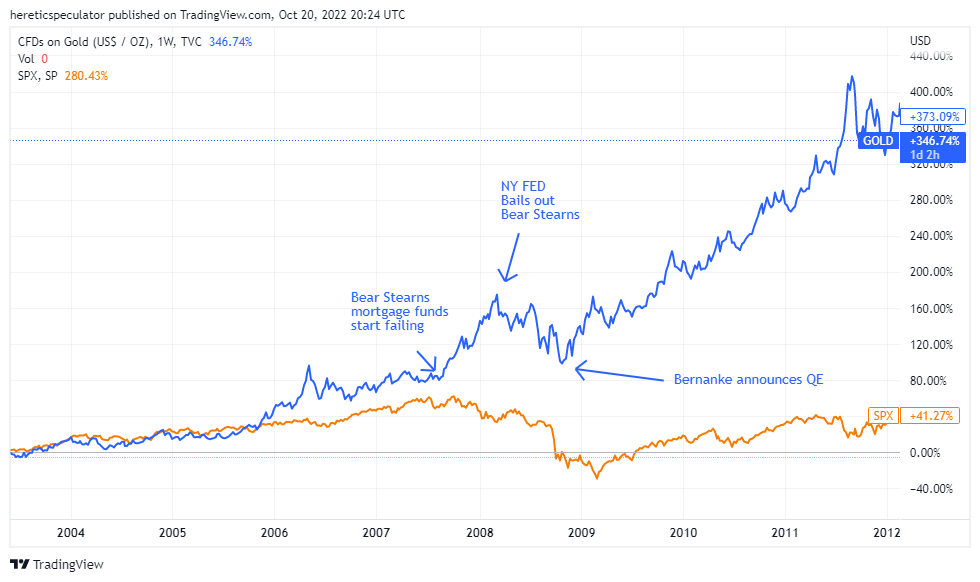

Look, I’ve been saying the Fed will inevitably pivot because there won’t be any buyers for US debt if the central bank doesn’t pivot. But one thing that I don’t think I’ve done a good enough job articulating is that when stuff gets ugly, the volatility impacts everything indiscriminately at first. So it really isn’t all that surprising that Gold isn’t doing well in this environment when priced in dollars. But check out what history tells us:

The blue line is Gold. The Orange line is the S&P 500. Bear Stearns’ sub prime funds started failing in the summer of 2007. This is right around the time the S&P peaked. While Gold did start rallying following Bear’s fund issues, Gold actually sold the news that the New York FED would be bailing out Bear later that year. Gold sold off about 25% following that bailout. It wasn’t until Bernanke announced QE in November of 2008 that Gold bottomed before going absolutely gangbusters over the next 3 years - all while the S&P didn’t take out the pre-GFC high until 2013.

The point is, Gold will do what Gold did a decade ago if we get another QE pivot; even if the Fed calls it something different. But for now, I think cash makes a lot of sense. Be selective with your stocks. Companies that pay a sustainable dividend and/or produce necessities. I’m still holding the TLT trade because I don’t think yields can go much higher without blowing up the whole world. With a setup like this I look at it through this lens; buy when the world seems to be ending. Because if you’re right you win and if you’re wrong it won’t really matter.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice.