Gas, Blobs, and Network Abstraction

Ethereum's Dencun upgrade looks like a silver bullet for ecosystem user growth. We'll explore some potential indirect implications.

In a period of constant financial innovation, the youngest people assumed power (and part of the reason young people got rich was that the 1980’s was a period of constant change). - Michael Lewis, Liar’s Poker (1989)

On Wednesday, Ethereum ($ETH-USD) is undergoing arguably the biggest upgrade to the network’s mainnet since “The Merge” from proof-of-work to proof-of-stake. If the impact of the “Dencun” upgrade proves to live up to expectations, it has the potential to radically change how the network ecosystem progresses for both the developer and the end user. In this article, we’ll go over what the upgrade will do and we’ll explore what I think some of the indirect ramifications from this could be.

What The Upgrade Is/Does

Simply put, Dencun will enable blobs and proto-danksharding.

I swear… these names and words…

Okay so in normal people speak; Dencun will allow for more data on the network and it will do so in a way that will essentially open up transaction throughput for the entire ecosystem. This will also result in lower fees for scaling chains. “Normal people speak” is probably relative…

Here’s another try: every blockchain has a limit to how many transactions per second (TPS) the network can handle. Ethereum’s TPS is not great (14.4 TPS yesterday). To help scale the blockchain, secondary layer chains, or L2s, build additional ledgers on top of Ethereum and pool transactions off the main network that are then recorded together on the primary layer. This system currently allows more than 8 times the TPS throughput over what Ethereum could do by itself:

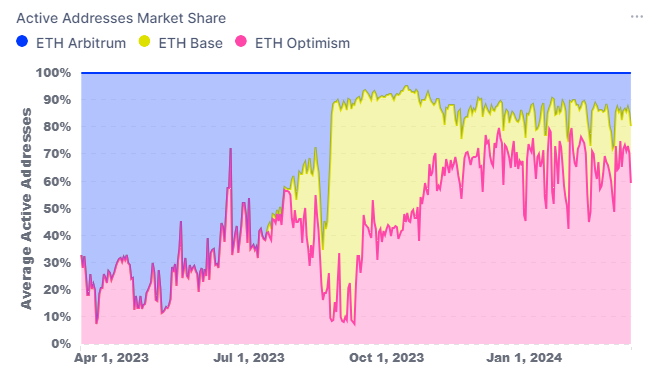

Each L2 is slightly different. The most popular one by active user base is Optimism ($OP-USD):

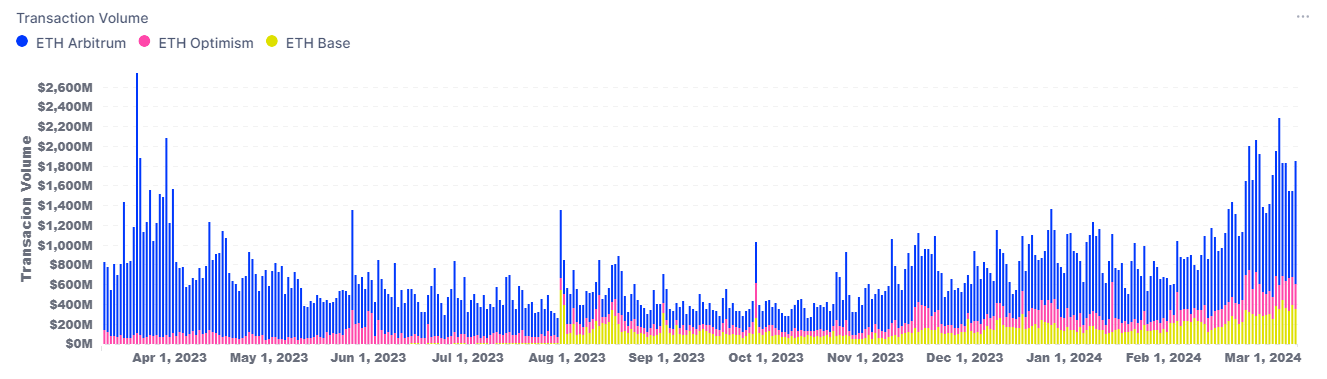

Optimism’s share of active addresses between Optimism, Base COIN 0.00%↑, and Arbitrum ($ARB-USD) is generally 60-70%. However, the transaction volume edge goes to Arbitrum:

This would seem to indicate Arbitrum is the preferred chain for high volume users while Optimism is the chain for the most unique users. To get L2s where they ultimately need to be, the L2-based developer must be able to abstract away that an application user is engaging with a blockchain altogether. Think Reddit Avatars or Trump trading cards on Polygon ($MATIC-USD)

For instance, if I were purchasing a digital movie or song through a blockchain-based streaming application, I should be able to conduct my business without ever knowing I’m using a blockchain ledger or digital currency asset. As I understand it, this scenario is closer to a reality at scale with Dencun. And this is not a small deal because usability is still one of the biggest issues with public blockchain technology in my personal opinion.

Ask 100 small business owners if they would like to lower their payment processing fees and you’ll probably get a unanimous “yes.” As a Substack publisher, I can assure you I’d much rather cut Stripe out of our relationship. Theoretically, poor crypto UE and convenience are the only things really holding back people like myself from saying something like this:

Hey, shoot over some ZEC, DASH, or LTC to my Coindrop and email me the transaction hash so I can get your premium subscription squared away manually.

Of course, I’m not saying that. You should never do that. We should always stay captured by these rent seeking payment processors who play god with people and small businesses.

Digging More On Dencun’s Impact

Gas fee abstraction is actually a great thing for long term adoption, in my opinion. While faster and cheaper than Ethereum, even L2s currently leave quite a bit to be desired from a user experience standpoint. However, the ability to abstract away this poor UE because gas fees get so much lower might actually be a bit of a double edged sword in the shorter term.

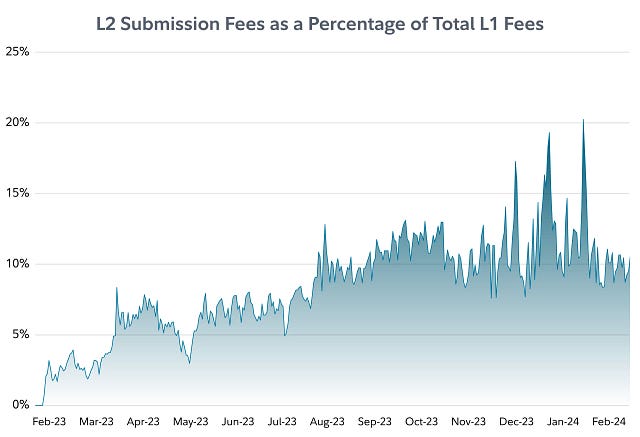

According to a research report from Fidelity, developers expect L2 fees to be reduced by as much as 90%. This will actually bring down the fees on Ethereum somewhat significantly because L2 fees typically account for 10% of all fees on Ethereum’s main chain. This is one of the final takeaways from Fidelity’s analyst, bold below is my emphasis:

Although this upgrade may lower fee revenue and burn from L2s in the medium term, EIP-4844 provides the level of scaling necessary to support millions of users on L2 platforms. Ultimately, this makes it a more fitting distributed database for other blockchains. Given that these improvements are likely to bring substantially more users into the Ethereum ecosystem, the Deneb-Cancun implementation seems synonymous with sacrificing short-term revenues in hopes of expanding Ethereum’s total addressable market.

That sounds like an admission that this may actually hurt Ethereum’s earnings at least in the immediate future. Lower margins solved by scaling I suppose. Something else to consider is this could actually ding the profitability of the L2s as well.

Since Ethereum’s network growth has come through these secondary blockchains that exist primarily for the purpose of scaling Ethereum, it’s important that L2s can actual be profitably run. For this scaling service, these second layer chains should be benefitting from capturing part of the fee market for Ethereum security. Essentially, users pay a small fee to engage with L2s and those secondary layers pay the fee to batch the transactions on Ethereum’s mainnet.

If the scaling chain can charge enough from its users through the pooled fees method and then pay less than what was taken in to batch on Ethereum, the secondary layer operators keep the fee spread. If the fees on these scaling layers disappear at the user level, the question becomes how is that network activity monetized? History would indicate the user becomes the product.

And here’s the big one for me personally; what about Polygon’s PoS chain? Though it’s considered more of a “sidechain” than a true L2, Polygon’s original chain is the only one of these scaling chains mentioned in this article that utilizes its own native token for gas payment (transaction fees). The concern here is then twofold;

How does MATIC retain value as a utility token if the coin itself isn’t utilized to the same degree assuming Dencun reduces fees on Polygon? Or…

If Polygon’s PoS chain is somehow an outlier here because it isn’t a true L2, how then does that chain compete in an environment where it’s primary competitors are enjoying fee reductions of as much as 90%?

I’m leaning this isn’t necessarily good for Polygon specifically. But we’ll have to see how things go in the weeks ahead. Not everyone is going to be a loser here though, and I have some ideas that I hope to explore soon.

Disclaimer: I’m not an investment advisor. Cryptocorns could all go to zero. I’m personally long ETH and MATIC.

this, interesting article. my main take away is that defi, is not decentralized , but people don't care that want fast and cheap transactions and they have completely forgotten about censorship resistance and decentralization