Going Long Noodles & Company

The broad market looked like it was starting to find its footing about a week ago. Now it seems new lows could be coming. I've been watching NDLS for a while. Why I've been buying the selloff.

First, in classic Mike fashion, an anecdote. It’ll be quick, I promise. (Narrator: it was not quick). Two weekends ago my wife and I went to a restaurant that we had never tried before for lunch. It was not a new restaurant and it isn’t a national chain so the name isn’t important. But since we had never been there, we weren’t entirely sure of the process.

When we walked in, we had to wait to be seated. There was a big seating area with booths and a bar area that was a little more café-style. Way in the back there was a Mongolian BBQ style grill at the end of the store. Turned out the process was very similar to Mongolian BBQ. You get an empty bowl, you pick your veggies, meats, sauce, and spices - it all gets tossed on the grill and you wait for your food.

After we were seated we watched the person who sat us start bringing food to other tables. She was then able to get back to us and pour our drinks from the bar. Later, she was busing the tables. She was the hostess, plate runner, bartender, and busser. She was hustling HARD. There was another girl doing the same. And the manager was involved as well. Frankly, one of the hardest working managers I’ve ever seen at a restaurant. The whole thing was working because there were three better than solid employees who cared enough to book it who were running the front. Without that effort, it probably wouldn’t have been a very unenjoyable experience for us. This should go without saying, but we left a phenomenal tip.

Anyway, I contrast this experience with what we generally get at my daughter’s favorite spot. At this point, her favorite pizza place (we all refer to it as “Pizza Planet” because of the arcade games) is a shell of what it was pre-lockdowns. The food there is still great, the servers are sort of trying, but they are running bare bones on the essentials all the time. At this point, we go there because it’s family time and my daughter loves it; that’s the value we get. If she didn’t love that place, we wouldn’t go nearly as often because the consumer experience just isn’t that great anymore. That restaurant is also full service.

What made the Mongolian BBQ style restaurant work better, aside from the effort from the staff, was the process. We didn’t have a designated server and the plate running went to customer numbers rather than table numbers. It was actually much closer to fast casual than it was to full service.

What is fast casual?

“Not fast food. Good food quickly.”

Even if you don’t know the term fast-casual, you probably know the kind of spots. Think Chipotle, Panera Bread, or Five Guys. I used to work at a fast casual restaurant back in the day called Noodles and Company (NDLS). Noodles is publicly traded and the stock has taken an absolute beating this year. The company disclosed on its latest earnings call that it missed out on $8 million in Q4 revenue because of store closures amid COVID surges.

I have Noodles and Company on my watch list because I crave Penne Rosa constantly. Or do I crave Penne Rosa constantly because I have Noodles and Company on my watch list?

Anyway, after our lunch at the Mongolian BBQ clone, I couldn’t help but think to myself, “I could have had a very similar meal at Noodles for a fraction of the price and the service level would have probably been similar.”

Losing $8 million in a quarter is not ideal for a company that generally does between $100-125 million in revenue each quarter. $8 million is a big miss and the market took NDLS longs to the woodshed for such abysmal planning. Still, I’m not ready to write Noodles off yet. I started averaging into a speculative long position after the massive revenue miss. One reason I did that is these big selloffs after temporary catalysts are usually decent buy opportunities. I may be a little too close to this name emotionally because I worked just about every position at one of their Chicago suburb locations in my teens, but I think there’s a decent potential macro setup for Noodles that the market might not be considering.

If you’ll indulge me, we’ll make some assumptions based on the labor situation, the inflation situation, consumer game theory, and why Noodles specifically should benefit if those assumptions turn out to be accurate.

The Macro Setup

I talked about this in the 1st Founder report back in December but labor is changing in a big way going forward. While it’s true that we’ve started to see people coming back to work as their stimmy-driven savings begin to run out, leisure and hospitality is one area where workers haven’t been in a rush to return. Probably because the jobs are grueling, largely thankless, and the hours are terrible. I’d wager very few people actually want to sign up for that because they enjoy it.

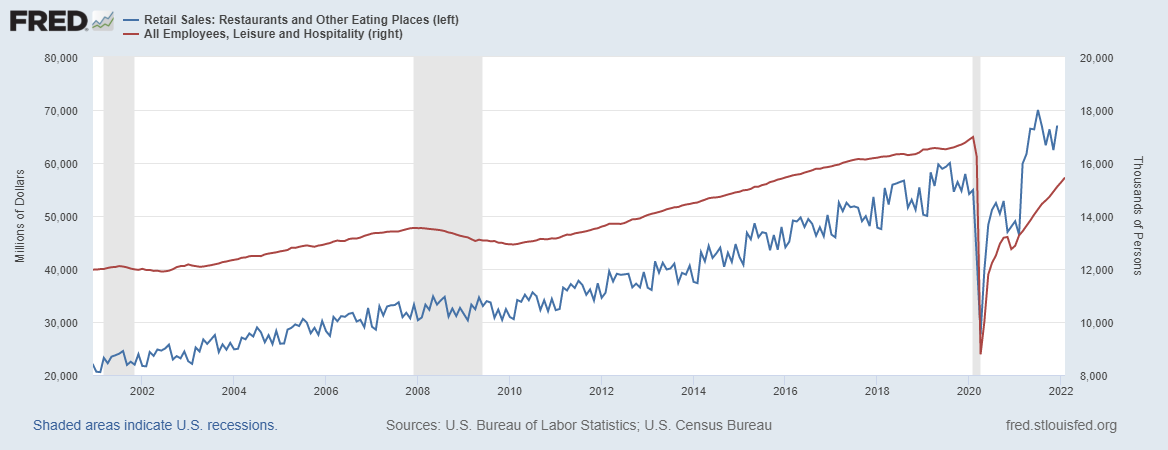

In the chart above, we can see how restaurants have had a phenomenal resurgence in sales, yet the labor sector for leisure and hospitality is still about a million and a half workers away from where it was before the virus. How many of the 1.5 million worker shortage in leisure and hospitality is specifically food services? About 80% of it.

Source: BLS, worker figures in 000s

If it isn’t necessarily productivity from a robust labor force that is driving that retail sales figure in the food sector, what it is? Higher consumer prices!

Noodles and Company specifically mentioned issues with retention and wage inflation as significant expense drivers in Q4 of last year:

Increased labor costs represent a major challenge for the chain. During the fourth quarter, Noodles paid an extra $1.1 million in one-time labor expenses for hiring, retention and COVID-related charges. Wage inflation during the quarter was about 9%.

So far, I’m probably making a pretty good case to avoid the restaurant industry like the plague if you’re an investor looking for a margin growth story. But let’s put on our consumer hats for a moment and see if what is happening broadly might push the filthy masses toward fast casual chains to a larger degree. And if so, why Noodles?

What I haven’t been able to get out of my head from the lunch my wife and I had at the Mongolian BBQ clone was the process. I had no expectations of good service because I knew a) we didn’t have a designated server and b) even if we did, these people are likely stretched pretty thin already given the labor setup. With my minimal expectations for service, I was pleasantly surprised by how much I ended up enjoying everything when I expected nothing. What helped set up that psychological over-performance was the fast casual-like process.

My biggest issue though, as I’m sure many Americans are now also dealing with, was the price. I got very good fast casual service for a full service price. How do I combat that as a consumer? Well, I need something closer to a fast casual price for fast casual service. More importantly, as an investor, how can I get exposure to fast casual stores that might not be as hindered by the inflationary pressure on labor and cost of goods?

Noodles and Company is an interesting fast casual option from a pricing perspective because most of the dishes don’t require a protein as a default. You can order Chicken or Beef as an add-on, but a bowl of pasta doesn’t require it. While protein prices in America continue higher, the cost of wheat flour and eggs cost about the same as they did 14 years ago.

Wheat flour and eggs are what you need to make pasta. While I’m not trying to claim that Noodles and company isn’t experiencing increased inventory costs, I’m just saying Noodles may not be as exposed on the expense side as companies like Potbelly’s or Chipotle as they generally sells items that utilize higher priced proteins.

Now it’s important to note, protein prices were higher than what has been historically typical even in Q4 last year. Even though those prices were at or near all time highs already, those costs should already be reflected in gross margins for the publicly traded competitors. What we don’t know for certain is how those prices will look over the next twelve months and how much pricing power any of these chains really have.

The bet I’m making is that pasta will stay relatively cheap compared to historical norms better than beef or chicken. And while Noodles and Company doesn’t sell protein as a default, it does offer protein as an add-on with any dish so there is still protein pricing exposure. The question is to what degree is that now and to what degree will it continue? I willingly admit I don’t know. All I know is when cash is tight, people try to cut costs. And if they want to get out of the house for a meal, a fast casual noodle joint is a pretty cheap escape.

Valuation metrics

Purely from a valuation standpoint, Noodles still isn’t necessarily cheap even after being down 35% year to date and down 52% over the last 6 months. Noodles currently trades at a seriously elevated price to earnings ratio over 78 - considerably more expensive than peers. Looking at price to sales, the story is actually much better. While not as cheap as Potbelly, Noodles is much cheaper than Chipotle (CMG).

But if we put aside traditional valuation metrics for a moment and consider what the fundamental thesis is behind this post, stripped down we’re betting simply on consumer prices and inventory costs long term. Margin. What is the profit margin story?

Even after an abysmal earnings miss in Q4, the company had its second best quarter by gross profit margin since 2015.

The Company Wants to Expand

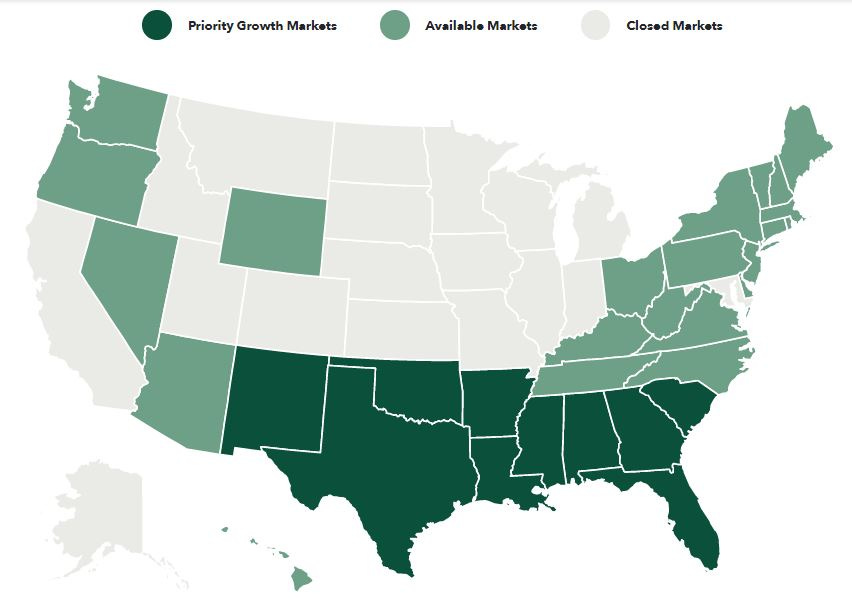

When you look at franchising options for Noodles and Company, there’s a pretty helpful map widget that shows which states are open, which are closed, and which are priority targets. Within each state, you can see the specific priority markets.

Source: Noodles and Company

These priorities overlay very well with where people are actually going from a domestic migration standpoint.

Source: Consumer Affairs

The growth opportunity in Texas is significant because Noodles and Company is just getting started there. This was company CEO Dave Boennighausen on the last earnings call:

As we closed earlier this quarter, in January, we closed a transaction with an established 150 plus unit, multi-concept franchisee to be our exclusive partner for California. This transaction included the sale of 15 existing company-owned restaurants, as well as the early development agreement that provides for the opening of 40 new locations over the next several years. This agreement, the recent strong opening of our newest franchisee in South Carolina, and the previously announced franchised deals expanded to West Texas and Southern New Mexico validates the Noodles & Company opportunity and we’re pleased with the current quality and trajectory of our conversations with additional prospective franchisees.

It’s all an “if.” But we’re playing the long game on this bet. Just like Jeffrey Jones.

Insider Buy

Jeffrey Jones, who is a Director for Noodles, just purchased 29,000 shares at an average cost basis of $6.90 per. As I write this, the stock is trading at $5.78 intraday. A buy down here is a 16% discount to a $200k investment made by a company insider less than a week ago. Jones had a little under 56k shares before that transaction. 29k is a pretty big add.

In Closing

If consumers want to enjoy the fruits of eating out on a budget, fast casual is a good option. Long term, I don’t think fast casual chains will struggle with product pricing increases due to labor costs because fast casuals don’t have to staff the front of their stores as robustly as full service restaurants do. While other fast casual chains like Chipotle might have a larger market footprint and significantly better brand recognition than Noodles, investors probably aren’t buying them cheap today at a 16 price to book multiple. That’s the bet. That’s the why. Now, I’m going to stare at this picture of Penne Rosa.

Courtesy: Kristi Sauer via flickr

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice. I’m not featured on trustworthy financial news sources like CNBC or Bloomberg and I don’t wear a necktie when I make my trades. I am long NDLS. I remember the recipe for Penne Rosa and don’t need Noodles and Company to make it myself. That said, I’d love a Toledo, OH location.