Utilizing debt and equity levers in the company that he co-founded back in 1989, Strategy Executive Chairman Michael Saylor has orchestrated one of the most magnificent stock market episodes of our time. In the process, he has helped pump Bitcoin into six-figure territory, achieved a cult-like following for doing so, and also massively enriched himself.

In a sane world, the ‘infinite money glitch’ he has seemingly created will be a case study for corporate management and economics students alike for years to come. In an insane one, his scheme will continue until Strategy owns every last Bitcoin. I’m not betting on the latter and I suspect this game might actually be closer to its end than its beginning.

While remaining cognizant of not wanting to be “the boy who cried wolf,” if you’ll briefly indulge me…

The Money Glitch

I won’t bore those of you have been reading this blog awhile or those of you who are already deeply aware of how Strategy has been acquiring Bitcoin over the last several years. If you’re interested in my prior work on the company through this blog, you can check out my thoughts here. I have more updated comments through my Seeking Alpha work here.

Long story short; the company used to issue convertible debt and dilute common stockholders to buy Bitcoin. It worked really well and because of both the volatility and valuation of MSTR shares, Strategy has been able to continue raising money to buy Bitcoin. The capital raised through convertible debt and common stock shares as part of Strategy’s ‘42/42 plan’ now totals $28.9 billion. More recently, the company has started offering income-based products via preferred share offerings.

Through STRK, STRF, and STRD, fixed income investors currently have 3 different financial products to choose from based on their own individual risk tolerances. STRK and STRF are both cumulative, mandatory dividends. Given Strategy’s Bitcoin-price-reliant collateral ratio, I happen to like both of these with STRF being my personal favorite. STRD does not require quarterly payment or late payment if a dividend is missed. But we reasonably expect Strategy to pay these dividends for STRD if the company ever wants to raise capital again.

Still, for all intents and purposes, STRD is the ‘junk’ tranche of these securities and all three of them require Strategy to either sell Bitcoin or raise additional capital to make payments since Strategy’s actual software business is unprofitable.

This brings us to today.

Approaching Maturity?

Two things happened today regarding Strategy that I think are interesting;

For the first time in twelve weeks, Strategy did not purchase any Bitcoin during the prior seven day period

The company announced a $4.2 billion ATM for its STRD preferred stock - reminder, this is the ‘junk’ tranche

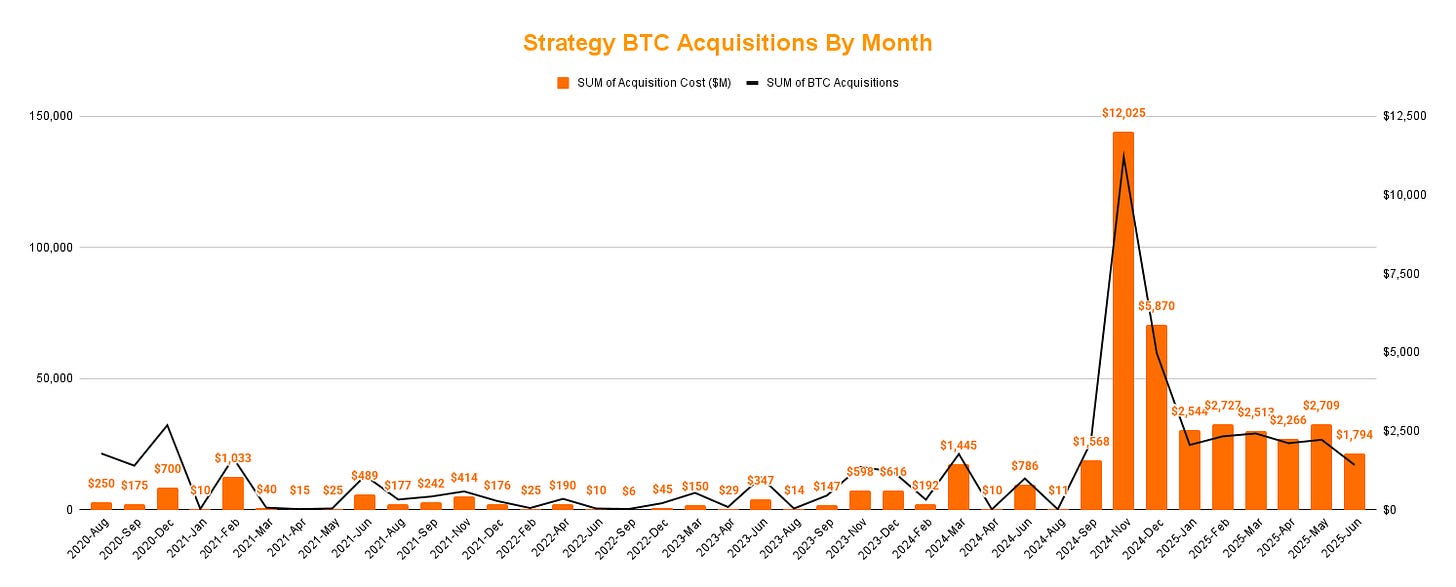

So what can we deduce from the combination of these two facts? I think quite a bit. First, let’s look at the long term trend in Strategy’s BTC acquisitions:

During the month of June, Strategy acquired only 17,075 BTC. It was the company’s lowest BTC-denominated haul since August 2024. Furthermore, it was the smallest dollar-denominated BTC investment since September 2024 at slightly under $1.8 billion. To be sure, this company has been an absolute Bitcoin-gobbling-beast for the better part of a year. But opening July without any buys after what was a comparatively slow June is intriguing.

These are the levers Strategy pulled to raise capital to buy BTC through June:

June 2, 2025 to June 8, 2025: $112.2 million raised from STRK/STRF ATMs

June 9, 2025 to June 15, 2025: $78.4 million raised from STRK/STRF ATMs, $1 billion from the initial STRD offering

June 16, 2025 to June 22, 2025: $26.1 million raised from STRK/STRF ATMs

June 23, 2025 to June 29, 2025: $58.6 million raised from STRK/STRF ATMs, $519.5 million raised from MSTR ATM

The STRD offering was by far the biggest driver of Bitcoin purchased in June. Following that, the common stock ATM was relied upon for most of the rest. That said, investor interest in the STRK/STRF preferred shares remained constant throughout and those shares both trade at premiums to liquidation preference in the secondary market. All told, nearly $1.3 billion of the $1.8 billion raised in the month came via the various preferred share sales.

At present, Strategy has $3.4 billion notional in preferred stock with $316 million in annual liabilities to those shareholders - of which, $198.3 million are mandatory payments. The rest would be paid to STRD shareholders should Strategy decide to pay it. But I suspect it is becoming less likely that STRD shareholders are paid out each quarter and I think the market may already be sniffing it out.

Let’s look at the planned use of proceeds from today’s STRD ATM announcement. I’ve taken some liberties with the highlighter…

Essentially, Strategy is raising fresh capital that could be used to pay previous investors. Compare this to the use of proceeds disclosure from the STRF prospectus:

We intend to use the net proceeds from this offering for general corporate purposes, including the acquisition of bitcoin, and for working capital.

Strategy is telling the world that it plans to raise capital through STRD to make dividend payments to STRF and STRK shareholders. If it looks like a duck and quacks like a duck, it’s probably a Ponzi scheme duck. I’ve been saying for months that I think Strategy will be a ‘forced’ seller of BTC to make these preferred share payments. Forced in a legal sense? No. Forced in an economic sense. That’s more likely.

Kneejerk reaction to be sure, but the market may have given us a nice signal today relative to Strategy’s preferred shares:

After trading in relative correlation for essentially a month, today there was a massive divergence in the performances of STRD and STRF; one that saw STRD down by 1.3% and STRF up over 2.2% on the day of the ATM news. Indication: STRF payments are coming. STRD is a much bigger gamble.

There is a $20.5 billion ATM for STRK - the 2nd ranking preferred share in Strategy’s capital structure. Based on the robust appetite for both STRK and STRF through their respective ATMs going back to April, one would think Strategy would have no problem selling STRK given its low issuance relative to its ATM program. But instead, we get an additional $4.2 billion ATM for STRD - the only fixed income product Strategy doesn’t ever have to actually pay. As well as the only prospectus that mentions paying dividends to different shareholders with the proceeds.

So here’s a key question, if Saylor and crew need to raise capital through STRD to pay STRK and STRF, where does the money come from to pay STRD? Because remember, the underlying business doesn’t actually make money. Perhaps a better question; if your friend borrows money from Peter to pay Paul, are you in a rush to lend money to your friend so he can pay back Peter?

I suspect the performance of this STRD ATM as well as STRD’s secondary market price moves are going to be very telling over the days and weeks.

Tickers Covered: MSTR 0.00%↑ STRD 0.00%↑ STRF 0.00%↑ STRK 0.00%↑

Disclosure: I’m long STRF. I previously held STRD but have taken profit in that trade.

Cash is definitely a scarce resource with no discernible source for MSTR. If/ when sentiment goes negative, the security will trade at truly distressed levels, not just junk.

MSTR is the king of Bitcoin treasury ponzi companies. If we like Bitcoin why buy MSTR at a premium instead of buying spot directly or with ETFs?