He Who Holds The Paper Derivative

The powers that be are losing control. That doesn't mean the ride won't be bumpy.

We have much to talk about today. Before I get to the real meat, I will simply point out how nice it is to see the crypto markets still rallying even after these big moves over the last several weeks. Even Litecoin ($LTC-USD) has decided to get off the mat a little bit. All it took was me complaining yesterday. Fun.

Weeks and months when we see gains like this, it’s easy to get caught up in the excitement of returns, profits and all of those wonderful financial things. Don’t get me wrong, I think it’s great that people can make money in this market. But I also think it’s important to remember one of the big reasons why people like myself are so excited about the future of this technology. At best, the traditional financial sector has generally failed to innovate for decades. At worst, we’re living in a sneaky-dystopian, permissioned system where cash is losing relevance, privacy is disappearing, and financial gatekeepers ruling over everything has been normalized.

Crypto assets and blockchain networks have the potential to dramatically disrupt how this system works and the legacy players don’t like that. Not only do these players not like crypto, but for many of the same reasons, they don’t like precious metals either. Wealth out of the traditional system is wealth that isn’t paying a management fee. It’s wealth that doesn’t need entities like Visa V 0.00%↑ to facilitate transactions. This is a problem if you’re JPMorgan Chase JPM 0.00%↑ CEO Jamie Dimon.

I occasionally share songs from Jonathan Mann and this one is pretty great. I’d really invite you to watch the entire thing and read the backgrounds. With respect to his numerous takedowns of SEC Chairman “Goldman” Gensler, this might be his best work this year:

Jamie Dimon’s company is GUILTY OF EVERY SINGLE THING he just accused the people in the crypto market of being! Yes, there are crooks in crypto. But to pretend that the entirety of this $1.6 trillion market is all nefarious activity, is pretty friggin’ rich coming from Jamie friggin’ Dimon. The guy who runs the company that banked Jeffrey friggin’ Epstein.

There have been $39 billion in violation penalties from Jamie’s company since 2000. Nearly 10 times the recent settlement payment between Binance and the DOJ.

And Elizabeth Warren. My God. What an unbelievable liar. For someone who has made a name for herself pretending to be the champion of the little guy following GFC and Occupy Wall Street, what a disappointing development it must be seeing her true colors if you’re a pro-crypto Massachusetts resident.

These are the moments that create people like me. What do I mean by that? I’m referencing people who are so incomprehensibly frustrated with the direction this country has been going for the last two decades. I’m 36. My professional/adult life essentially started during the financial crisis. I’ve seen no accountability for what happened back then. And I’ve seen bailout after bailout after bailout of the companies that help make these politicians rich through campaign donations, speaking fees, private sector jobs post-political careers, and/or contractor kickbacks to family member-owned businesses.

And this brings us to gold and silver. What happened in the metal markets this week is not at all surprising. Those of us who have been in the precious metals space for longer than a couple years have seen this many times before. Things look wonderful, the metal is breaking out…. and monkey hammer.

Let me pose a question; why did Gold crash back below $2,000 today? Is it because the dollar is getting a bounce? Maybe. But then stonks and crypto would have probably been beaten up this week too and the opposite happened. Even oil is reversing from the intraweek low as of writing. Could it be Gold is simply sniffing out that rate cuts in March are a sell? Maybe. Could it be the banks hammering the metal prices as they have done for years?

Sidebar: I’m sorry. I shouldn’t say “the banks.” Not all banks employ market manipulators and it’s not fair to act as though everyone in financial services behave the way some at JPMorgan Chase have historically behaved.

Sure, there could be market manipulation at play here in the metals markets. We’ve seen it before. But that’s only for tinfoil hat-wearing “conspiracy theorists” and Heretic Speculator is above that…

Narrator: It was not above that.

Nihilism aside, Gold can dip back below $2,000 and take out stops underneath the breakout. That’s fine. It will ultimately be a speedbump in the journey that is non-fiat assets accounting for all of the digital printing since the end of the Bretton Woods monetary system.

Yes, M2 has declined in the last year. That may be a problem if you have a high amount of dollar-denominated debt.

You can’t taper a Ponzi

The entire thesis behind Brent Johnson’s “Dollar Milkshake Theory” is that there are too many dollar-denominated liabilities and not enough dollars to extinguish those liabilities. Thus, demand for ‘real’ dollars will push the currency higher against other fiat currencies. This is true. You know what else has an enormous amount of paper derivatives without enough real units to satisfy obligations? Hmmm…

In Q3-23, world central banks bought over 337 tonnes of gold. It was the third largest quarter for purchases in at least the last 13 years. And this comes after the world central banks bought 1,082 tonnes last year. I wonder why the central bankers want a barbarous relic?

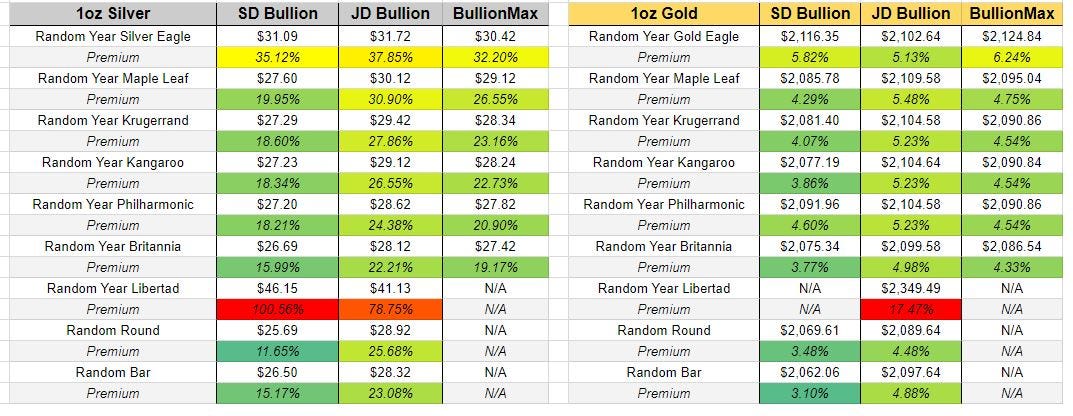

BTW: paid members can now find access to the live automated version of this metal premium data sheet shown below on the Premium Subscriber Resources page:

I hope you guys have a wonderful weekend!

Disclaimer: I’m not an investment advisor. I’m long Gold, Silver, Bitcoin, Litecoin and other magic internet monies.