Hot Take Time: That Was The Last Rate Hike of 2022

The Federal Reserve raised the funds rate by another 75 basis points yesterday. Naturally, the Nasdaq responded by closing the day 4% higher. Buckle up friends...

I don’t know how much I’ve written about it here or elsewhere, but the running joke with established order Doomers like myself is that when someone in a position of power says the word “tools” in the context of solving some sort of societal threat, it generally means they’re either terrified, unprepared, or lying about their actual abilities; it most cases, it probably means all three. With this in mind, how long do you think it took Jerome Powell to say the word “tools” yesterday after he started speaking?

Any guesses?

Answer: 12 seconds.

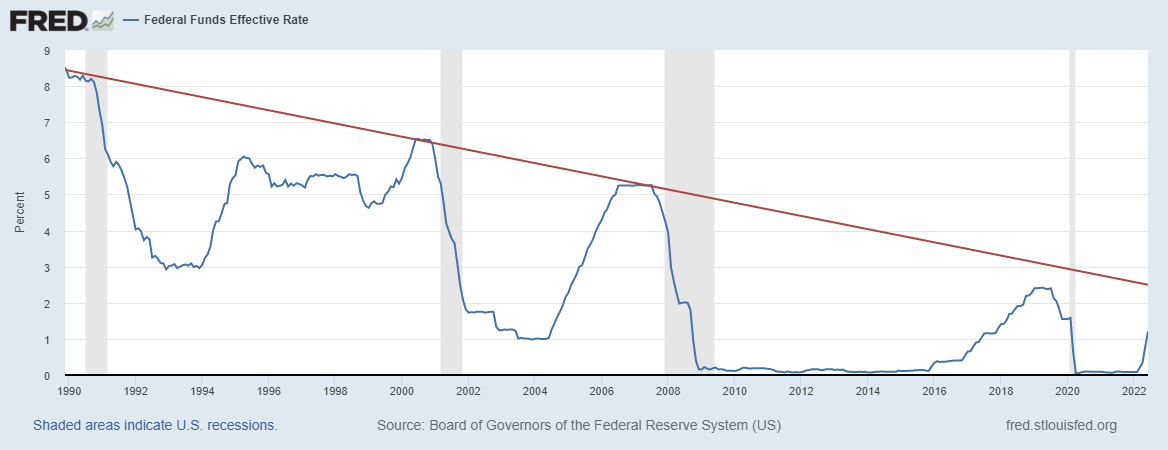

If you want to watch the whole thing, have it at. But it’s not necessary. Because the Fed is done this year. The hiking cycle is over. To be clear, they’re not saying that, I am.

The data hasn’t been updated online yet. Because, you know, I’m sure the Fed is busy at the Hamptons already and just forgot to update the rate data for today. But regardless, that was it. We’re at trend resistance. That was the top of this cycle. That’s the official prediction from ya boi.

All that said… six months from now, it is possible we could see a Fed funds rate of 4%. If that happens, I’ll wear it and admit that I got it wrong. But if that actually happens, it will be because the central bank really doesn’t understand what it’s doing or the hikes are simply part of a larger plan for intentional chaos and government dependency. We just got our second straight negative GDP print this morning at -0.9%.

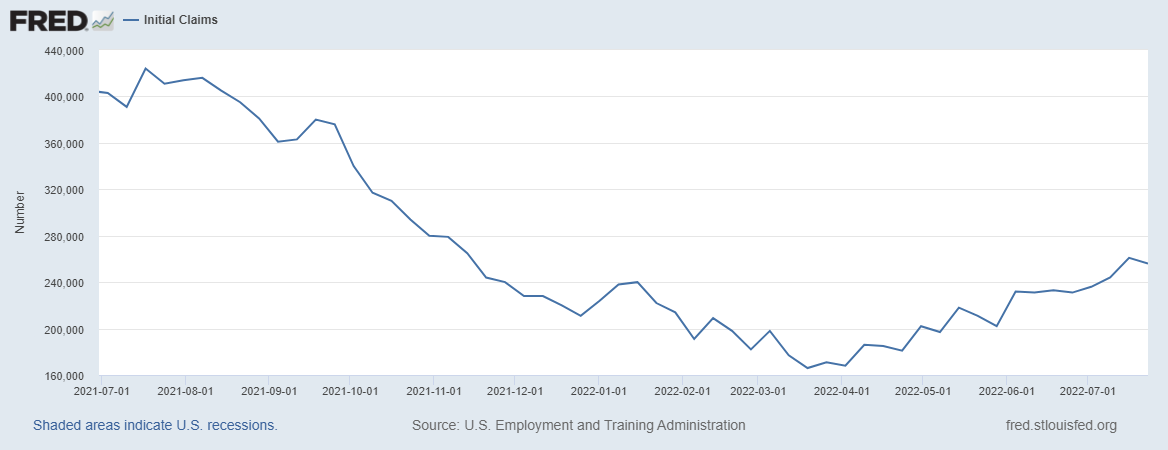

And our three highest weeks of initial jobless claims year to date were printed in the last 3 weeks. Don’t be worried though; we’re not in a recession.

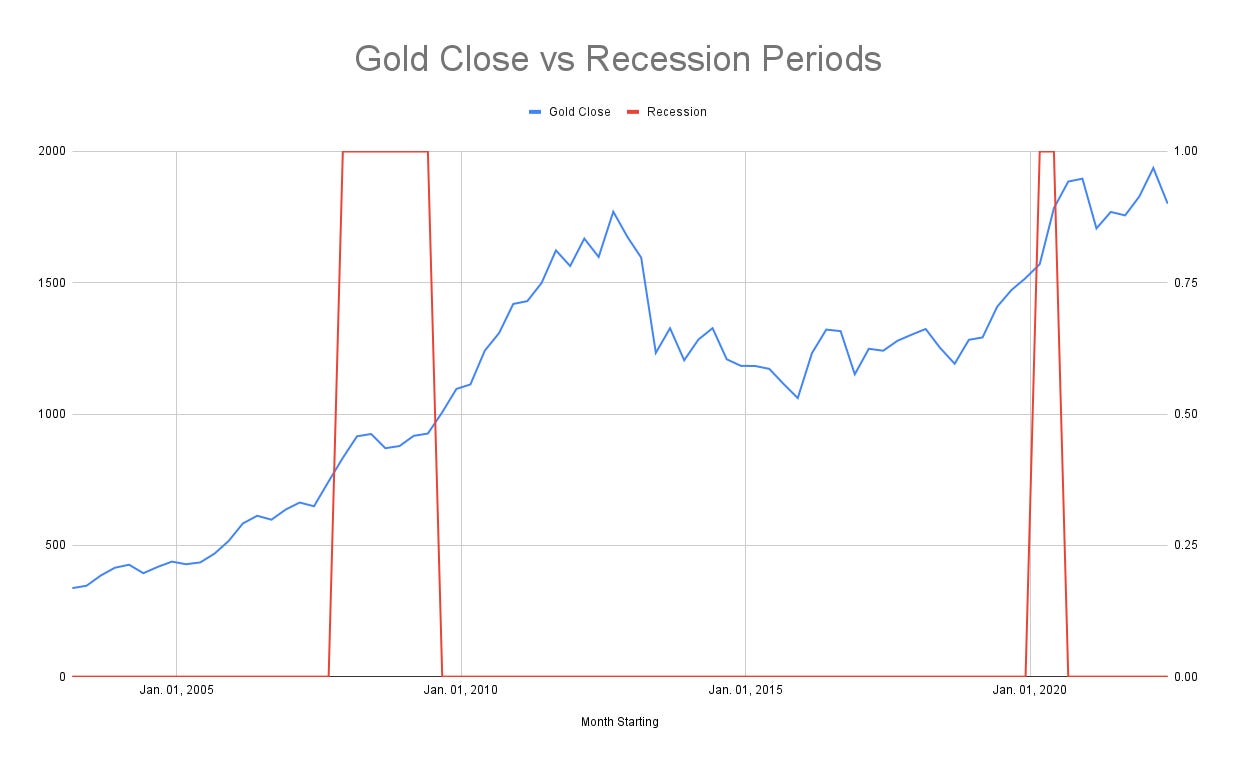

I would love to show you why buying gold right now might make a lot of sense. I’d love to overlay Gold’s price per ounce with recessions and how the price generally reacts to a recession because of the typical policy response to the recession. But I can’t. For some reason, the Fed removed that data from it’s public database in January. I’m sure it’s nothing. Luckily, I have the next best thing…

This is the best I can do without better data. You see, I don’t have the “tools” necessary and I can at least admit it.

Gold prices are from Seeking Alpha. I could only go back to 2003 so we can’t see what happened before and after the dot com bubble. Rumor has it, the price went up.

It’s not the recession that makes Gold go higher. It’s the money printing, the deficit spending, and real interest rates that impact Gold. Real rates and deficit spending would suggest Gold has tailwinds. But, of course, the market is expecting monetary tightening. So there is a lid on Gold. I’m telling you that tightening will not happen. Full stop.

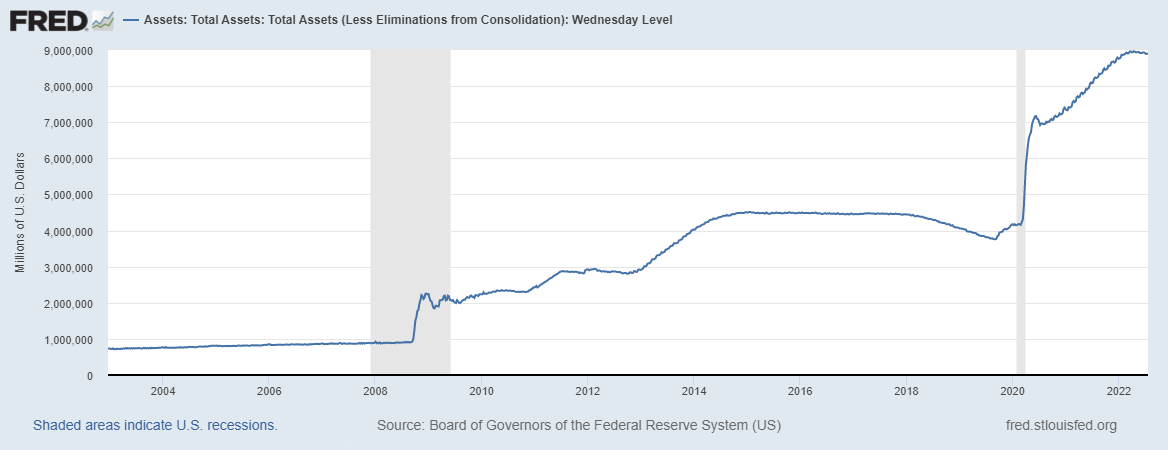

Ben Bernanke said the Fed would reduce its balance sheet after quantitative easing in response to GFC. It could not do it. Janet Yellen said unwinding a 4 and half trillion dollar balance sheet would be like watching paint dry. She lied. Now Jerome Powell is telling you the Fed has the “tools” to tighten monetary policy and fight inflation. Inflation that is absolutely, without any shred of a doubt due, at least in part, to the money printing by the Fed and the US Treasury. Again, we’re being lied to.

And this is the ruse. This is why the administration is trying like hell to pretend that we’re not in a recession. Because if they admit that we’re in a recession, there will be pressure on the Fed to immediately start easing and stop hiking rates; which the Fed says it has to do to fight inflation for the plebeians. And the plebeians are the ones who vote. The fact that all of the overlords behind the curtain who pretend to have super powers are now working even harder to keep the plates spinning is irrelevant. We know how this ends. The policy response will be the same as before. The printer will be back on. And gold and other risk assets will rip. How do I know that? Because we ARE actually in a recession already and the plebeians are going to demand money to fight it since the Fed can’t. And yes, that will exacerbate the problem.

If you want some serious alpha on the Gold trade, the divergence between the miners (GDX) and the metal itself (GLD) over the last year is…

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I am long AEM, NG, and AGI.