Yesterday, I dropped my latest on MicroStrategy MSTR 0.00%↑ for Seeking Alpha. The theme of the article was very similar to what I wrote about MSTR here on Heretic Speculator a couple weeks ago in “Fund Flows and Crowd Behavior:”

As always, one should enter the comments section in articles that cover polarizing stocks at their own risk. In a totally acceptable chat with a different reader, I made the case that everyone in MSTR is essentially a “trader” rather than an “investor” because the stock moves entirely on Bitcoin’s valuation and doesn’t pay shareholders dividends out of cashflow from business operations. A pretty fair and reasonable point of view, in my opinion.

Not so!

“CryptoKing” (🤣) weighed in and chose violence. I’ve never really had the impulse to say “don’t you know who I am” in any discourse before, but that changed after reading this gem (bold my emphasis):

I'm not sure if you should touch anything BTC related if you are talking about cashflow and dividends. You don't have the proper understanding of a young and evolving asset class like this. You should've resisted the urge to hit 'submit' when writing this Seeking Alpha article because you're clearly not equipped to advise others what to do with regards to Microstrategy.

Oh really, motherf***er?

I’m Moe Greene!

In all seriousness, lets take these haymakers one at a time.

I’m not advising anyone what to do. I share what I do and why I do it. You want an advisor? Go buy one.

Seeking Alpha asked me if I wanted to provide the platform with an update on MSTR. Why? Because I’m f***ing Moe Greene.

This “young and evolving” asset class is almost entirely driven by yield and cash flow.

Lido Finance ($LDO-USD) is the biggest protocol in all of DeFi because it allows users to put their staked ETH back to work for additional yield. AAVE ($AAVE-USD) is the second biggest protocol in DeFi because it’s a lending and borrowing application - so, yields again. MakerDAO ($MKR-USD) is a top five protocol. Why? Again, it’s yields; this time from the treasury notes backing the DAI stablecoin. Uniswap ($UNI-USD) is the largest DEX because it has the most liquidity. What benefit could liquidity providers possibly get out of providing said liquidity? Fees from swaps! AKA share of protocol cashflow…

As far as I can tell, every single smart contract blockchain has a reward rate for transaction validation. Why? Yield is an incentive to participate!

But, Mike, bItCOiN iS dIFfeReNt.

No, it is not.

Bitcoin ($BTC-USD) may just be a different form of proof-of-stake. Where rather than staking coins directly on chain, miners have to spend a fortune to stake machines and hope that…

I standby what I said. Crypto and blockchain may be new and exciting, but the participants in this space are not immune from economic law. There’s a reason why the then-largest public Bitcoin miner Core Scientific CORZ 0.00%↑ went bankrupt in 2022.

The point I’m making is not that I do actually have an understanding of this space (that should be obvious), it’s that these are the kinds of idiots who fly to this market like moths to a zapper. This dude who chirped me is probably going to get wrecked and I doubt he’s going to see it coming. Why? Because he thinks he’s investing when he’s really playing the slots.

The lesson? Hubris. Keep it in check. And be careful who you’re letting guide your thinking.

Now, I’m going to avoid the massage tables so I don’t end up with a bullet in my eyeball.

Let’s check in on some of the Bitcorn fundamentals…

ETF Flows

I’ve definitely been happy with this big pullback in the broad crypto market from a pricing standpoint. We’ve badly needed this for sustainability’s sake. Part of what is likely driving these pullbacks is that we had two consecutive days of spot ETF outflow on Monday and Tuesday:

The Grayscale Bitcoin ETF GBTC 0.00%↑ continues to absolutely hemorrhage AUM due to it’s wildly uncompetitive 1.5% annual fee - the rest of the market is at about 0.25%. These last two days the other funds couldn’t pick up the slack from the GBTC bleed out. Despite the back to back days of spot BTC ETF outflow, we’re still soundly positive in the total net flow department with well over 216k BTC entering the traditional financial system since spot ETF approvals in January.

I can not wrap my mind around how short-sighted I feel Grayscale is being right now. Combined, the iShares Bitcoin ETF IBIT 0.00%↑ and the Fidelity Wise Origin Bitcoin ETF FBTC 0.00%↑ are now larger than GBTC from an AUM standpoint. At this rate, it’s a just a matter of time before IBIT is larger by itself.

On-Chain Data

One of the on-chain metrics that I think makes the most sense to pay attention to right now is the Hodler balance. As IntoTheBlock calculates it, this is the amount of BTC supply that hasn’t moved in the last year. It matters because these holders are considered the “smart money” in the market. They start selling when the mania begins and start buying back when the top has blown off:

In January, this balance was 13.8 million BTC. It is currently just a little under 13.4 million. This would indicate that the “hodler” selling hasn’t really started yet. This has historically been indicative of more upside in BTC.

This is not a metric that I recall sharing with you guys before but I’ve been watching it over the last couple months. Miners volume share is the percentage of transactions that include miner addresses. I don’t think this is a good trend because, ideally, miner volume share would be going down. It’s been going up for two straight years.

My interpretation of this is the chain clearly isn’t being used for it’s intended purpose. This is a problem long term because of the declining block reward subsidy. We’re about a month away from the halving.

The expectation is that higher BTC prices will make up the difference for miners - remember, cashflow and incentives matter. Yes, even in Bitcoin. Since the overwhelming majority of miner revenue still comes from new coin issuance rather than from fees from transactions, the incentive structure to secure the ledger (the whole point of all this) needs a dramatic change long term or the miners are going to inevitably turn off machines.

And this is one of the major differences between “digital gold” and real gold. The gold that has already been dug out of the ground doesn’t need more mining to retain value above ground. For BTC, transaction validation from a distributed network of computers must continue or this all falls apart. You take away the incentive structure for miners and the ledger security is jeopardized. This is why transaction fees are such an important component of Bitcoin’s future and anyone who dismisses that as “FUD” probably hasn’t really thought it through. The alternative is the supply cap has to lift and no Bitcoiner wants that or the entire thesis dies.

But alas, transaction fees have made up just 4.9% of miner revenue so far in March. This is down from 9% in January and 17% between November and December. Point is, we’re headed the wrong direction. Ideally, we’d see transaction fee revenue move higher and the miner volume share move back down. Until then, this is all a “number go up,” anti-fiat trade. Which, admittedly, may work out very well. But that would be bad for most people if it is indeed what is driving these BTC price returns because it would mean their dollars are collapsing even faster.

Valuation Multiples

I’ve shared the MVRV Z-score in the past. This shows the market value to realized value ratio. It basically gives us a multiple for how high Bitcoin is being valued versus what the average price is that market participants have paid for all of the BTC in circulation.

For example, if the average purchase price of BTC is $30k and BTC is trading at $90k, the MVRV Z-Score would be 3. Historically the top is in when you hit 7. Right now it’s at 2.3. This is more of a speculation multiple rather than a true “value” multiple. For that, I’ve shared the NVT ratio, or Network Value to Transactions ratio which measures the market cap of BTC against the value that is being transacted over the network:

It’s probably not a surprise here that Bitcoins 30 Day average NVT ratio is in the stratosphere at 136. It’s more overvalued than it was at any point during the 2021 run. It’s more overvalued than peers like Bitcoin Cash ($BCH-USD) and Litecoin ($LTC-USD). LTC is really the only proof-of-work payment coin that can even sniff “cheap” at this point.

But again, this is clearly indicative of a network that isn’t being used for it’s original intention. The longer this goes on, the less NVT may ultimately matter. For a better signal of a possible price top, we can look to some of the more artistic indicators…

Cycle Indicators

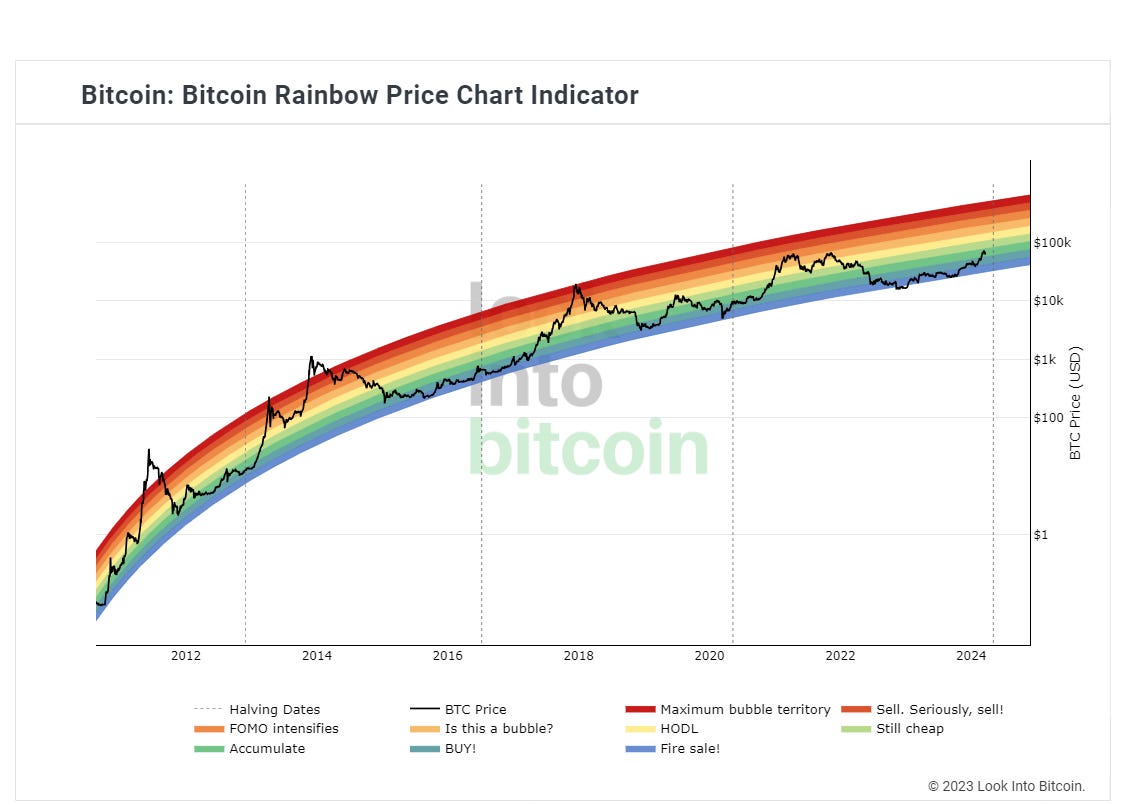

The Rainbow price chart:

Plenty of room to run. We’re not even in “is this a bubble” territory yet. Cycle Master is less optimistic:

Here we’re actually getting to the “aggressively valued” band. Then there’s the Mayer Multiple:

Which shows we are much closer to the red sell band than the green buy band.

Here’s the obligatory reminder that none of this stuff means BTC is going to $250k, $150k, or even $90k. This cycle is playing out very differently from the last one. Because of the supply/demand dynamic following the halving, the price of BTC has always produced a new all time high following the event. This time, we got the new all time high before the halving. Last cycle Bitcoin benefited from stimmy checks and stay at home orders. We don’t have that tailwind this time. We really don’t know. It’s all a guessing game.

Regardless, it’ll be fascinating to see how this all plays out the rest of the year.

Disclaimer: I’m not an investment advisor. I’m not actually this thin-skinned and I get nonsense like this lobbed at me on SA all the time. I’m long FBTC, BTC-USD and MKR-USD. Dragging “CryptoKing” is business not personal ;)