There are two parts of this post. The first part is an un-updated reproduction of a piece called “Insanity of The Apes” that was originally published for my old Seeking Alpha Investor Group BlockChain Reaction back in April 2022. The second part of the post is an updated look at the ‘ape ecosystem’ valuation to determine if there is now a potential opportunity.

Part 1: Insanity Of The Apes

Maybe the most misunderstood phenomenon in the crypto world is Bored Ape Yacht Club, or BAYC for short. The collection of BAYC "jpegs" is among the most successful NFT projects from both a token price and a cultural relevance perspective. The BAYC NFT project is the first project in what has been dubbed the “ape ecosystem.”

That ecosystem now consists of two spinoff NFT projects and a cryptocurrency called Apecoin (APE-USD). In this article, we’ll explore the goal of the original BAYC project and the ape ecosystem. From there we can attempt to find a more traditional analog with the purpose of identifying if the ape ecosystem is undervalued, fairly valued, or overvalued.

Yuga Labs

Yuga Labs is the company behind the ape ecosystem. There is a clear philosophical motivation behind what Yuga claims to be building with the ape ecosystem. The first words you'll find scrolling down the homepage are these:

Shaping Web3 through storytelling, experiences, and community.

The company's stated aim is to build a decentralized ownership model for its NFT projects. This model would allow individual owners to monetize the project tokens however they see fit. The BAYC project is a collection of 10,000 unique pieces of generative art that live on the Ethereum (ETH-USD) blockchain.

Practically speaking, the ape pictures really are just jpegs on the blockchain today. Those jpegs can be copied and pasted an infinite amount of times. But the key difference between the apes on Ethereum and many other jpeg projects is the IP rights. When we view the apes threw that lens, we begin to see why the mania has taken off the way it has.

Commercial Use

For those of you who read my Allied Esports article from early April, I picked on that company's EPICBEAST NFT project. In that article I speculated that part of the reason EPICBEAST failed to sell out was because the project didn't grant commercial use for token holders. Artistically speaking, I have no idea if Yuga's apes are better than Allied's beasts. In my view, the quality of the cartoon pictures isn't a distinction that is currently as critical as the ownership rights that are attached to the cartoon pictures. Allied doesn't give token holders commercial license. Yuga Labs does. Section iii of the terms and conditions for BAYC NFTs says this:

Commercial Use. Subject to your continued compliance with these Terms, Yuga Labs LLC grants you an unlimited, worldwide license to use, copy, and display the purchased Art for the purpose of creating derivative works based upon the Art (“Commercial Use”). Examples of such Commercial Use would e.g. be the use of the Art to produce and sell merchandise products (T-Shirts etc.) displaying copies of the Art.

Through this lens, Bored Ape Yacht Club is not simply an NFT project. BAYC is a brand. Part of that brand includes the NFT project. Whatever the value of that brand becomes is what investors in the tokens have to figure out. Are the apes just pictures? Yes and no. I believe the owners of those tokens view themselves more as franchisees than as collectors. Some of the apes may be well monetized while others aren't. But unlike traditional franchises in the restaurant business, for instance, the BAYC IP isn't a borrowed brand with baked in royalty obligations. It's owned outright by the NFT holders.

Apes are more like comic book heroes

I previously drew the comparison to restaurant franchisees. From a valuation perspective, I don't think we can compare the ape ecosystem to traditional franchised brands like McDonalds MCD 0.00%↑ or Subway. The apes are more of a franchise model for content generation. Because of that, I think a better comparison for the sake of valuation is actually comic book super heroes.

Like those old comic book characters, the cultural existence of the apes started as two-dimensional pictures. Those comic book characters are now licensed properties that we see in merchandise and in movies. Like the comic characters, it is content and merchandise that is ultimately how the NFT holders will monetize the ape IP.

How do we value it?

Disney DIS 0.00%↑ famously purchased the Marvel franchise for $4 billion. Marvel was publicly traded as MVL before the Disney sale. According to this old SA article, MVL had $676 million in 2008 revenue. Based off that figure, Disney paid almost 6x revenue for Marvel when the company purchased it. I think that figure understates the total economic value of the Marvel brand though because it doesn't count the companies that rely on the IP to make money on top of Marvel's wholesale pricing.

At the time of the Marvel purchase, the company had already found huge big screen success through Iron Man and to a lesser extend The Incredible Hulk in 2008. Combined, those two films grossed $850 million in worldwide revenue. According to Comichron, there was $436.3 million in total comic book sales in 2008 and nearly half of it was Marvel's. This gives Marvel as a brand roughly $1.3 billion in true economic value in 2008 before even factoring in the margin from retailers on action figure/merchandise sales.

So depending on whether we price the $4 billion buy based on 6x Marvel's revenue or 3x the true economic value of the brands, the exercise hopefully drives home the point. Marvel as a branded content/merchandise concept already had over a $1 billion in economic activity when it was valued at $4 billion. The ape ecosystem doesn't currently sniff that level of retail activity. And yet, the market says it's worth vastly more than Marvel was in 2008.

The ape ecosystem is wildly overvalued

Despite all of the hype, there is very little real economic activity so far actually happening in the ape ecosystem. There are numerous BAYC stores selling ape-based clothing and general merchandise. But buyers can buy the clothes with dollars as opposed to Apecoin. There is a BAYC Redbubble store that has 99 followers and items priced in dollars. Yuga Labs had a merchandise store and was only accepting Apecoin. That store dealt with issues and is currently closed.

There is an ape-based musical act called Bored Brothers that recently dropped a music NFT called "Drip" on the Sound.xyz platform. That track sold out in just a few minutes and raised roughly $89k in sales. But those 300 NFT sales of the track "Drip" were all done in ETH as opposed to Apecoin. There is a BAYC video game in the works called "Otherside." The BAYC YouTube channel with the game's trailer has less than 7 thousand subscribers. There is a BAYC-branded restaurant in California called "Bored & Hungry" that will only accept ETH or APE for transactions. But before you get too excited about that, Bored & Hungry is a pop-up store that is open for just 90 days. The only activity pertaining to the apes, is the trading of the apes.

Despite the minimal real economic activity, the apes and the other NFT projects in the ape ecosystem are apparently worth three times what Disney paid for Marvel. And almost none of the actual economic activity in the ape ecosystem actually requires having the Apecoin currency.

There is just no conceivable justification for a valuation like this. Even if you take out the Apecoin market cap of $5.1 billion, the ape ecosystem has a $7 billion valuation with just a video game in development, a song with less than six figures in sales, and a pop-up shop restaurant that isn't accepting dollars. And we're to believe this is worth more than Marvel after two movies and several decades as a comic publisher? Nonsense. One final point, only 28% of Apecoin's total supply is circulating. The fully diluted value of APE is currently $18 billion. Again, nonsense.

Summary

I love the idea of the apes from a philosophical standpoint. Decentralized ownership is something that is very interesting to me. I still can't recommend deploying capital in this ecosystem given the very small level of real economic activity that has come from the ape IP to this point. I freely admit I'm rooting for the ape holders and the ecosystem builders. I just can't justify getting exposed to any of it at this kind of nosebleed valuation with a recession likely imminent. These are assets to keep an eye on, however. If not for the ape IP itself for the simple proof of concept should it ultimately succeed. Just wait for the epic correction before you "ape" into the ape ecosystem.

Analyst's Disclosure: I/we have a beneficial long position in the shares of ETH-USD either through stock ownership, options, or other derivatives.

Part 2: Opportunity In The Apes?

I can’t help but laugh at Scott Melker’s BAYC post from earlier this month when the crypto market was falling apart with everything else. It’s not because I don’t like Scott or anything. I actually like some of his content. But it’s funny to me because Scott gave his price target for a Bored Ape at the top of the market and still didn’t want it when his price came. That’s how hated these things are right now.

The question today is perhaps more simple; are NFTS truly dead? Former (& probably future) President Trump would likely say ‘no’ after dropping another NFT project yesterday. The video announcement of the digital cards collection views like a paid program that you’d accidently see at 2 AM after waking up on the sofa covered in Cheeto crumbs. Nevertheless, dude is printing…

Meanwhile, the SEC issued a Wells Notice to NFT marketplace OpenSea just today for allegedly selling securities on the platform. Certainly not a coincidence.

But anyway, back to the apes…

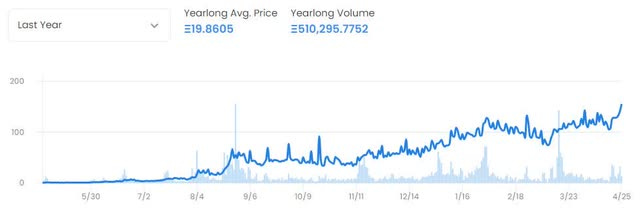

To say the price of these monkey pics has collapsed since I originally published the first part of this post would be an understatement:

The floor price on Bored Apes is currently just 13.1 ETH. The all time high was 128 ETH and there were 144 sales at that price. The peak was April 30th, 2022. Here’s what’s wild… the price of ETH at that time was $2,700. Today, the price of ETH is well within striking distance of that price. Unadjusted, a 13.1 ETH price today represents an 89.7% decline from the high. Adjusted for the dollar price of ETH, the floor price of Apes has collapsed by 90.5%. And keep in mind, this is floor price. Some of these things traded for MUCH more.

Real Vision founder Raoul Pal paid $400k for his and detailed why in a since-deleted Substack post. He changed his profile pic on Twitter/X to a CryptoPunk NFT (or derivative work, IDFK) last year. The point is, nobody likes the apes right now. But I’d argue NFTs are actually closer to acceptance than they were back then.

The most successful NFT project from a true economic value standpoint is probably ‘Pudgy Penguins.’ That’s a brand that started as an NFT project just like the rest of them and now has a real-life merch store on Amazon AMZN 0.00%↑. So even as some projects are experiencing success, one of the most well-known brands is now ‘tacky.’ This guy literally said “it’s actually kinda embarrassing” that he still likes Bored Apes. Ape IP owner/creator Yuga Labs went through layoffs last year. Yet, the company still says its “Otherside” gaming idea is still in development. Who knows?

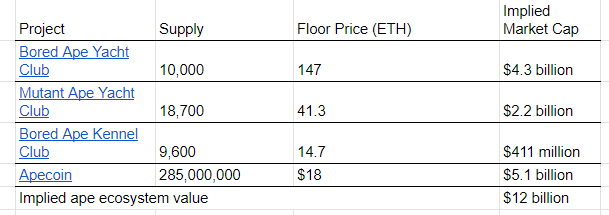

From a valuation standpoint, the entire Ape Ecosystem has struggled over the last two years, an that is putting it mildly:

Above is an update of the valuation table that I shared in Part 1. Not shown is a handful of additional Ape-related NFT projects like Otherdeed and various Otherside-related projects. But we can realistically round up to $900 million for the entire ecosystem. Thus, the Ape ecosystem has collapsed a total of 92.5% from the highs back in May 2022.

Apecoin, the price of which itself has collapsed by 98% from its all time high of $27.75, now has a larger valuation than the actual NFT collection. This is in part because the coin has endured more than a doubling of the token supply in just 24 months:

And just about anyone still holding it is completely underwater at these levels:

So here’s where I’m ultimately going with this post today… we have a brand that has gone from being so “trendy" that it was talked about on the Jimmy Kimmel show, to supporters now being “embarrassed” they still like it. Everything in the ‘ecosystem’ is down by 90% minimum and the currency associated with said ecosystem is down 98% even though most of the aggressive supply inflation through 2025 has already happened.

To be clear, this is not an investment idea. Its not even a trade idea. It’s an if you’re bored (eh eh) and want to throw a few shillings at a long shot bet for the coffee can idea. It’s a pull on the slot machine. At least that is how I view it. I’m not saying Bored Apes will ever reclaim the price they commanded two summers ago. I don’t think Apecoin will ever sniff it’s all time high near $28. But I do think the IP has some value. And I suspect $0.65 for ApeCoin is a small price to pay for any rally that may come if/when the liquidity spigot is turned back on.

I took a small long in APE. It’s a silly idea and thus has a silly small amount allocated to it. If it goes to zero, it’s not going to hurt me at all. But if APE somehow shoots up to $5, it’ll be a nice little trade. Almost like hitting it in the slots.

Disclosure: I took a small position in ApeCoin at $0.65 this week. There is no intrinsic value to this currency whatsoever. It’s essentially a bet on a memecoin that is currently out of favor getting a second life as a retro brand at some point in the future. It’s s long-shot bet and should be viewed as such. It could fall another 98% and still be overvalued. Don’t do what I do.