Investing in Culture

I've referred to alternative assets as "The Culture Trade." Why so many people seem to be plowing into rare video games, sneakers, and sports cards.

I’ve covered the alternative asset space sporadically on this website for some time now. I think investing in alternative assets is almost an essential part of a balanced portfolio at this point. Alternative assets have traditionally been investments usually made by collectors and those with larger accumulations of wealth.

As I detailed in Investment Regulations Need Reform, the fact that non-accredited investors don’t have access to some of the same alternative investments that accredited investors have is disadvantageous for non-accredited individuals who actually have their stuff together. This is partially why democratized investment platforms like Rally Rd, Otis, Collectable, VinoVest, Vint, and Masterworks have started to find success. While the assets they’re listing are not all the exact same type of financial instruments, many of these platforms securitize whole assets and sell fractionalized shares so that the non-accredited investor has access.

I talked about my own personal allocation to the space in a post called The New 60/40 in late 2020. It’s for paid members only, but it is very worth the read if any of this is starting to peak your interest.

And if you enjoy that one, more recently I shared my Top 5 individual alternative asset investments. Four of them are trading on a daily basis on the platforms that have them under custody.

Whether the alternative investor buys sneakers, video games, wine, or Pokémon cards, the one thing that is constant is the buyers of these assets are getting what they believe is investment grade exposure to culture. I own the alternative assets that I own because I believe they have cultural significance. If not broadly for society, in the niche communities they represent, at minimum.

Fundamentally Speaking…

Before going too much further, I got into my rationale for The New 60/40 in a post called 60/40 is Dead. That post is worth a read and much of what I said back then still holds up. In some cases, the extremes are even worse now. The key takeaways though were as follows:

Bonds have a negative real yield

Stocks are overvalued

The dollar is collapsing

So what do you do to protect yourself? I came to the conclusion that after a core portfolio with dividend paying stocks that provide some sort of necessity, precious metals, and crypto/tokens, the next way to diversify is in the alternative space.

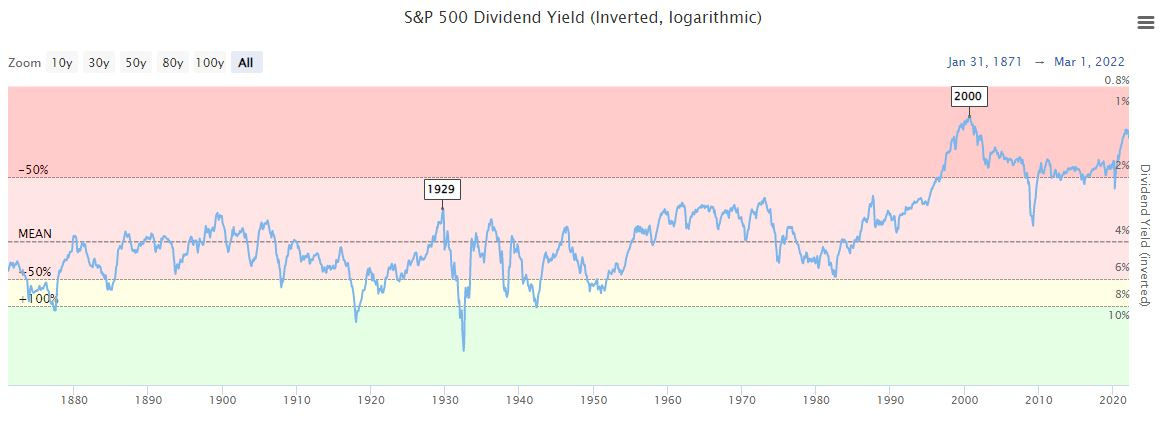

The traditional fundamental investor reading this might be thinking, “alternative assets don’t provide cash flow which means you’re just betting on ‘number go up.’” For the most part that is true. ‘Number go up’ is a horrible reason to invest in something. Sadly though, people really aren’t left with many other options. Bonds are guaranteed to destroy purchasing power if held to maturity and equities are almost entirely a ‘number go up’ bet as well since dividend payments really don’t exist anymore anyway. This is the yield inverted to show the S&P dividend yield has been historically atrocious for over 20 years.

Source: LongTermTrends.net

The S&P pays no dividend. Buying shares of fractionalized game worn Jordan sneakers is buying exposure to a famous, culturally significant sports brand that provides the investor zero cash payment. I could say the exact same thing about Under Armor stock. Fun fact: the notorious FAANG stocks are made up of Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google (GOOG). These are among the largest corporations in existence and only one of them pays a dividend. It’s Apple. And the dividend is 0.57%. Hey, thanks, Tim Apple.

With stocks not paying a yield and bonds offering no yield adjusted for inflation, everything has essentially become a digital collectible. Everyone has been pushed out on the risk curve. There is no real intrinsic difference at this point between shares of common stock in unprofitable companies, baseball cards, and the vast majority of NFTs currently on the market. It’s all just chasing culture and membership in communities. Someone else may pay more for it later so buy it. Stripped down, it really is all the same fundamental trade. The one edge equities have in this area is nobody is buying fake stock certificates. If you buy shares of AirBNB from Robinhood, you know they’re real.

The Knockoff Problem

In an earlier post, I shared a screengrab where I showed not one but three Webzee NFT scams. Scams and fakes have been a big area of concern for many of the NFT naysayers. While I’ll admit the ease with which a bad actor can copy and paste a jpeg file makes the barrier to entry in fake NFTs really low for con artists, the scam factor in the NFT space isn’t as big of a concern to me as it might be for some. I take this view because I don’t believe forgeries make NFTs any different than numerous other alternative assets. There is a physical analog for this, of course.

Some of the most sought after alternative assets for fashion fans are sneakers, handbags, and watches. Each of these consumer products turned culture investments have problems with forgeries. There are sites dedicated to selling fake Jordan sneakers, fake Rolex watches, and fake Gucci handbags. DHGate is basically Amazon for knockoff everything. At this point I’d like to transparently advise; I DO NOT recommend buying fake merch from these kinds of sites. Ethical dilemma of knowingly funding counterfeit operations aside, you might not get any product.

I share these examples to illustrate the point. Fakes are everywhere and it isn’t limited to just the newer alternative investments. If anything, the emergence of the cultural asset ripoff might be proof the genuine articles are worth owning. Obviously the trailer above is for the documentary Sour Grapes. That story focused on one conman who was found out to be making and selling fake wine after infiltrating a massive group of marks and fooling auction houses. It isn’t just the NFT degenerates, even the very wealthy get scammed in the alternative investment space. Often they find out they have fake vintage wine, fake Cuban cigars, and fake Picasso art.

So while I’ll concede that it is incredibly easy to make fake NFTs, I don’t think the potential to be scammed is a big enough reason to stay away from the space entirely as long you understand how to only follow trusted links and sources.

Diversification is Key

Like any investment class, you should never get over-exposed to any one asset. A balanced portfolio has allocation to different asset classes and different assets in those asset classes. How one chooses to weigh those allocations is entirely up to their own discretion. But I think my weighting in The New 60/40 is a good one. Join the paid team and get the full picture.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice. I’m not featured on trustworthy financial news sources like CNBC or Bloomberg and I don’t wear a necktie when I make my trades.