Investment Regulations Need Reform

"Protection" is the given reason for blocking investor freedom. That token you have there is nice. It'd be a shame if something happened to it.

Earlier this month, the United States Securities and Exchange Commision (SEC) denied two more Bitcoin spot ETFs. This time, Global X and NYDIG had their proposals for Bitcoin ETFs shot down. This now puts NYDIG and Global X in a category with Fidelity, VanEck, and the Winklevoss twins. The “Winklevi” were actually rejected twice. In an interview with Yahoo earlier this month, SEC Chair Gary Gensler said this on a potential Bitcoin spot ETF approval:

it's every bit as important to have investor protection for crypto exchanges, for the lending platforms where people are transacting-- buying and selling crypto tokens-- and have appropriate disclosure about the tokens themselves and protect the public from fraud and manipulation

Gary Gensler, SEC Chair

Gensler wants jurisdiction over the entire cryptocurrency industry, it seems. Investor protection is a very interesting concept. What does it even really mean? Was there investor protection for the retail traders who bought GameStop (GME) stock at $480? Was investor protection the reason Robinhood traders were only allowed to sell GME positions when Melvin Capital was getting gamma squeezed by competing hedge funds in January 2021?

While mafia-style “protection” seems to be the real reason a spot BTC ETF has yet to be accepted by the SEC, protecting investors as a concept might not be as straightforward as it seems.

Accredited Investors

If there is one investment regulation that probably needs rethinking its the accredited investor rules. Under the guise of protecting people, only accredited investors are allowed access to certain markets. This is how an “accredited investor” is defined by the SEC, via Investopedia:

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.

Basically, you either have to be in the investment business or already wealthy to make certain investments. The private equity offered by EquityZen is a good example of an investment platform that is closed off to most people even though it probably shouldn’t be. This is for the “protection” of the little guy, of course. The problem is having a lot of money does not necessarily make you a sophisticated investor.

If I was going to try to value the IP of a video game company that I was considering investing in, I’d probably ask my teenage nephew for some insight rather than the dentist down the street. But the dentist is the one who the SEC says is actually allowed to profit from such insight. This is silly because it potentially keeps the smartest money out of the market. Smart money finds value and invests with an edge. If only dumb money has access to a very unconventional idea, that unconventional idea may fail. Not because it is a bad idea necessarily, but because it might not have access to capital that it otherwise would have if it could have been discovered by a collection of smaller, smarter investors.

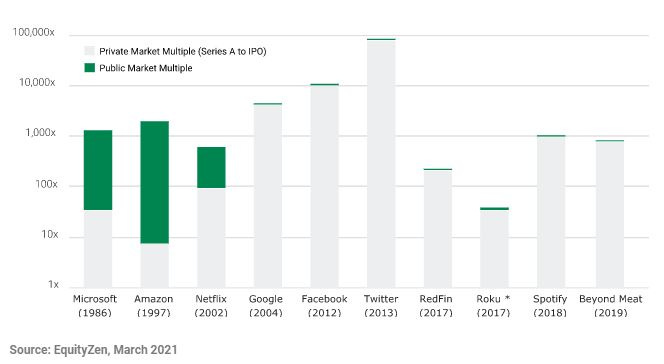

This “accredited investor” notion is frustrating in a lot of ways because private equity is also such a massive return generator compared to public markets. The bar chart above shows how so many of the popular tech names that we see in public markets had the overwhelming majority of the return come from the Series A round through the IPO rather than after IPO.

This means the accredited investors who had access to the private equity are the ones who get massively profitable exits by selling to the non-accredited public market. The deck is so wildly stacked against the average person that it’s almost baffling that this is still allowed. And remember, the SEC thinks it is protecting investors by doing this when it could absolutely be argued that the agency is doing the opposite.

I would love to buy some very specific names in the private equity world through EquityZen. Unfortunately, I can’t because I’m not worth $1 million and I don’t make $200k annually. But where there’s a will there is a way if you want private equity and aren’t an accredited investor. There are a handful of companies that offer either equity or promissory notes in the small business investment space. Some of those include:

Republic

Mainvest

NetCapital

These kinds of options are cool but they’re really just offering a workaround to a problem when the best course of action would be to fix the problem at its genesis.

Digital Assets Were Different

In a lot of ways, this is why digital assets have been so interesting for the “unsophisticated investor.” NFTs can be a struggle for traditional investors to grasp. But in many cases, those who lack finance credentials or a sizeable bankroll, have understood the opportunity. For those who have been willing to dive in and put in the work to learn the space, returns have been astronomical. Cryptocurrency and NFTs have been an investment equalizer.

Expensive research reports and business school educations haven’t been required. For the first time, that I can think of, the Neanderthal-non-accredited speculators have the edge over Wall Street. The degenerates waiting for mom to drop off the tendies beat the credentialed class to the investment. Now Tesla has Bitcoin on the corporate balance sheet. Visa owns a CryptoPunk. Taco Bell sells NFT art. Nike and Adidas have metaverse strategies.

What is next?

This is still just the beginning of the digital assets story though. The gangsters who sell insurance at gunpoint don’t seem content with the current setup. They’re going to take a larger cut of all of this, no doubt. But I personally believe we’re past the point of outright elimination. Biden’s Executive Order was actually less sledgehammer-ish than I expected. Others seemed pleasantly surprised as well.

With that Executive Order, the real crypto lobbying likely begins. Different agencies will lobby for oversight. Different companies will lobby for rules that benefit themselves over insurgents. And the rest of us are left with the difficult task of handicapping how it’s going to all play out while we make bets that reflect our own personal thought process.

And to be clear, staying out is also a bet. Everyone is making a bet whether they realize it or not. Fortunately, you don’t need a degree to have a plan. Now run along, pleb. Go try your luck with some scratch offs when you buy your cigarettes later. And make sure you leave the private equity in actual businesses for sophisticated investors.