Is Stuff Finally Breaking?

The technicals in the S&P don't look terrific. The credit market is melting down. I'll share what I'm looking at and what I'm doing.

Occasionally I come across tweets that I think are interesting. Often because they’re shared with me by friends. Sometimes though I’ll seek out certain feeds to see what the person thinks about certain moves in stocks or coins. Raoul Pal is someone who I check on every once in a while. Another analyst that might be worth your while if you’re really data minded and care about the credit market is Alfonso Peccatiello. This is what he tweeted yesterday while I was losing my mind over Elon Musk:

I can only speculate what Alf is referring to here but regarding supply/demand I believe this is a reference to dollars. Alfonso appears to be implying the Fed is going to stimulate real market demand for dollars by allowing deeper carnage in the equity and credit markets. Since the Fed has shown zero gravitas with its own actions on rates, the central bank might be comfortable with letting everyone else just figure it out for them. Again, this is all my take on what Alf is saying here and I could be misinterpreting it. You can check out his Substack The Macro Compass if you want to see more of his stuff.

As I’ve said for months now, I don’t think the Fed can actually do anything regarding rates. So far, it’s playing out almost exactly as I have anticipated. For instance, my thought was the 25 bps hike would be a sell the rumor buy the news event and many finance pros didn’t see it the same - turned out, ya boi was right. I like reading Alf because he’s incredibly smart. I like that he has a different perspective than I do because it keeps me out of my own echo chamber. Now, it’s starting to look like Alf’s position is winning. Consider some of these charts. First, here are the S&P futures heading into Wednesday’s session:

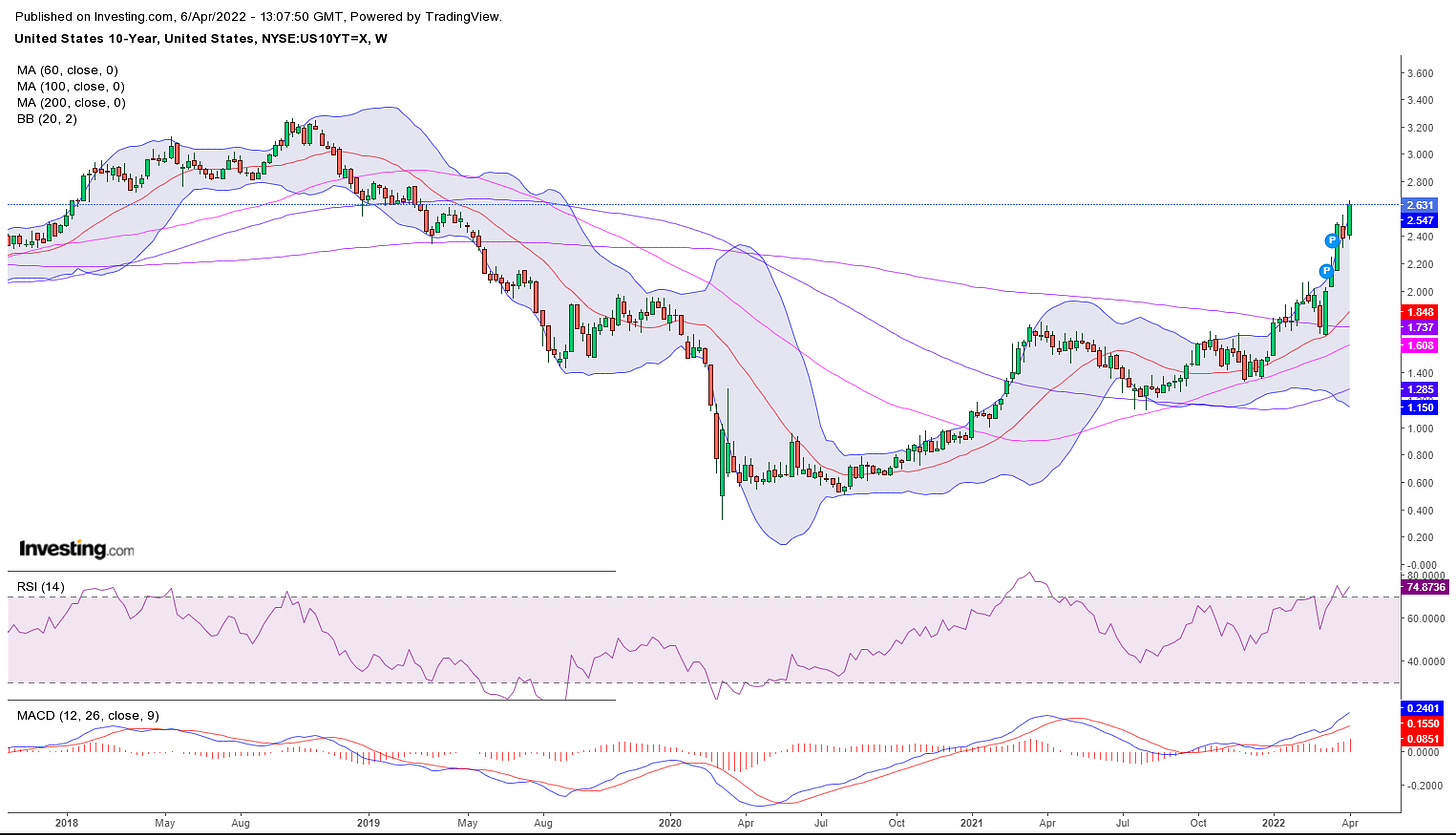

MACD is rolling over. RSI is weakening. And the futures price of the index has fallen below the 200 day moving average. I expect the S&P is going to revisit 4450 today. I think a sustained break of 4445 is probably a bad sign for STONKS going forward. Here’s the yield on the 10 year bond:

This is what I believe Alf is referring to when he says demand. Yields rising means the value of the bond is actually falling. This chart is showing a bond market that is collapsing. Fed asset purchases, though incomprehensibly not fully stopped yet, appear to be slowing down:

And the 30 year mortgage rate is ripping.

I wouldn’t be surprised if tomorrow’s fresh number shows an average rate higher than the November 2018 peak of 4.94. So how am I approaching this today? My eyes are on that S&P level and on the 10 year. If we see a big move down today, I’m probably closing my last Trade Idea. If Bill Dudley’s op-ed in Bloomberg this morning is any indication, there is more mainstream pressure on the Fed to actually let asset values go down.

It’s hard to know how much the U.S. Federal Reserve will need to do to get inflation under control. But one thing is certain: To be effective, it’ll have to inflict more losses on stock and bond investors than it has so far.

The question we have to ask ourselves is this: do the powers that be benefit from falling asset valuations. If not, why would they allow it to happen? These are not rhetorical questions. We should really be thinking critically about what is going on beneath the surface.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero. I have no job and I live in my wife’s basement. I’m the last person on the face of the earth who you should listen to for financial advice or life advice. I’m not featured on trustworthy financial news sources like CNBC or Bloomberg and I don’t wear a necktie when I make my trades.

Can I still YOLO $VIX shitcalls?