It's All The Same Trade

Gold, Bitcoin, STONKS, Oil... none of these assets are holding up in a market desperate for dollars.

Days like today in the market can be tough to watch. Without going all cliché adage, you don’t necessarily want to sell on a day when the market is down 3%. You want to sell the day before the day when the market is down 3%. If it were only that easy, right? As I write this, the Nasdaq is down about 4%. Bitcoin is down about 10%. And it isn’t just speculative tech-like instruments. Commodities are getting punished as well.

Gold is down almost 2% and oil is down nearly 7%. There is nowhere to go but cash. Ironically, at a time when inflation is at a 40 year high, the dollar is the only thing not killing investors right now. Perhaps there is something to the milkshake theory after all. It seems that everything is the same trade for the time being. You’re either long dollars or you’re short dollars. If you’re short dollars, it doesn’t matter how you’re expressing that trade, you’re getting waxed. I know I am!

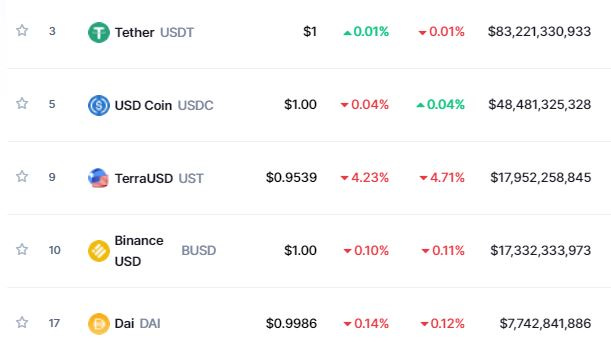

Still, perspective is key. The demand for dollars is real and we’re seeing it manifest everywhere. Just look at Terra USD. Stablecoins aren’t all created equally. Here are the top 5 stable coins by market cap:

Which of these is not like the other? I don’t talk about stablecoins on here all that much but they’re supposed to be pegged to US Dollars on a 1 to 1 basis. That means they should all have a price of $1.00 on the nose or be really close to it. What the hell is going on with TerraUSD? I’m not an expert in the mechanics of UST or any stablecoin for that matter. But as more holders of UST try to liquidate for dollars rather than “Terra dollars,” pressure on the peg is a possibility and I think that’s what we’ve seen play out today.

Something of interest though pertaining to Terra; the protocol’s founder Do Kwon has been using treasury funds to buy Bitcoin for weeks. The fact that Do Kwon’s stablecoin project clearly requires peg defense at the moment would seem to indicate to me that Bitcoin is going to face continued selling pressure until that peg is restored; if it ever is. To defend the peg, Terra needs dollars. To get dollars, Terra needs to sell Bitcoin.

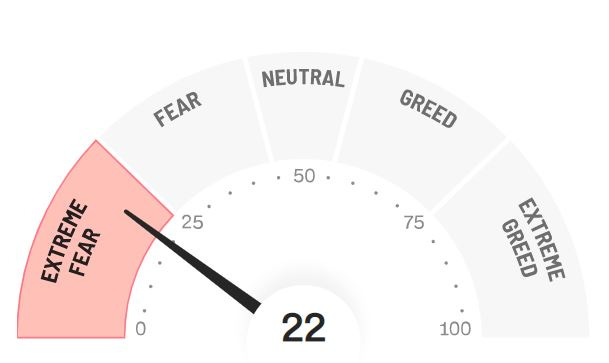

It could certainly be wishful thinking, but I think Bitcoin is actually closer to the end of this selloff than the beginning. I wouldn’t rule out a deeper capitulation event under $30k, but it’s basically been a straight line down now from $48k to $30.5 - six straight weeks of selling and this week’s candle is by far the worst. This feels like a final purge of weak hands to me.

Then again, it’s all the same trade. Bitcoin, gold, STONKS, commodities… everyone wants out of risk and into dollars. When a market gets that bearish, that’s when you see things like what we’re seeing in TerraUSD - people would rather take 95 cents on the dollar just to get into something “safe.” When sentiment gets this bad, a bear market rally isn’t too far away.

The only question is how much longer before the central bank pivots?

Taper the taper!!!