It's Never What It Seems

Perhaps an all too common tale in our day and age; just how much can we trust the data?

We are approaching some really interesting levels in some of the most popular cryptocurrencies and crypto-proxies in the equity markets. This post isn’t meant to be a comprehensive opinion on the broad market or the potential macro headwinds that I think could have an impact in the short to medium term. But I wanted to give you guys a updated view of one of the crypto assets that I’ve been trying to pay more attention to.

Many of you who have followed me for a while may recall that I generally think it makes sense to have some dry powder at all times.

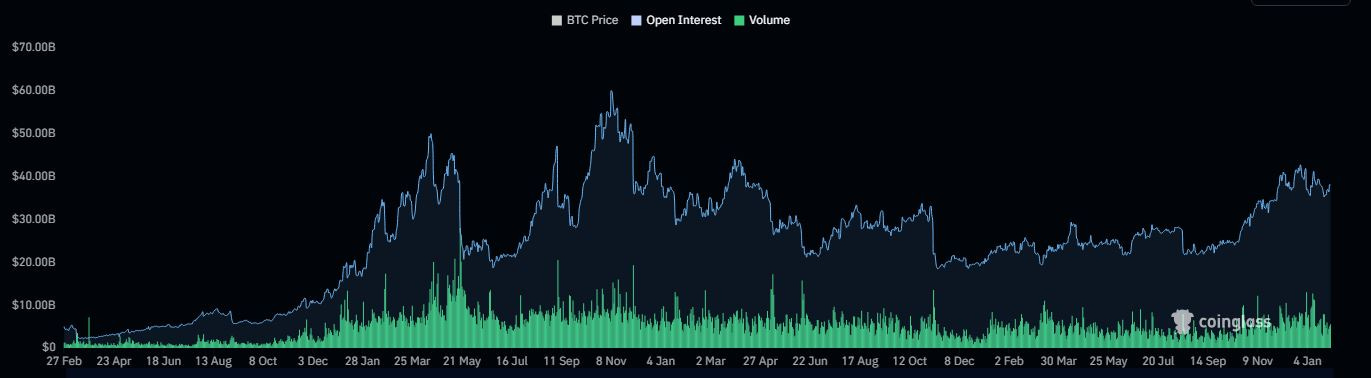

This market is notorious for having large cascading sell events that typically take place when futures gamblers get offsides to an extreme degree. Heading into the end of last year, open interest (OI) on futures contracts hit a peak of $42.75 billion. We’ve seen that figure pull back to about $38 billion today. But with ETF approvals now having set in, I’m starting to think we may see some of this OI get washed out before we can have another leg higher in the major blue chip cryptos.

Total market futures OI is still ahead of the pre-Terra Luna collapse of $35 billion in the spring of 2022. Which is interesting and impressive to be honest. The trends in most of these assets look somewhat similar and are inline with the broad trend that can be observed the chart above. However, there are some outliers.

Solana

One of the clear standouts in OI continues to be Solana ($SOL-USD). I have to admit I’m absolutely floored by the resiliency we’re seeing from this blockchain. Even though NFT activity on Solana has cooled down considerably, the network itself still offers a relatively robust market for fees:

The price of SOL on a circulating P/F ratio is still near 52 week lows even though the coin price is only 20% off it’s 52 week high. Recall what I said in A Bank Failure, Analog Rails, And The Next Narrative earlier this month:

This means on average every stablecoin was used 3.32 times in December. If we take this as a comp for M2 velocity, stablecoins are almost three times as useful as M2 money stock.

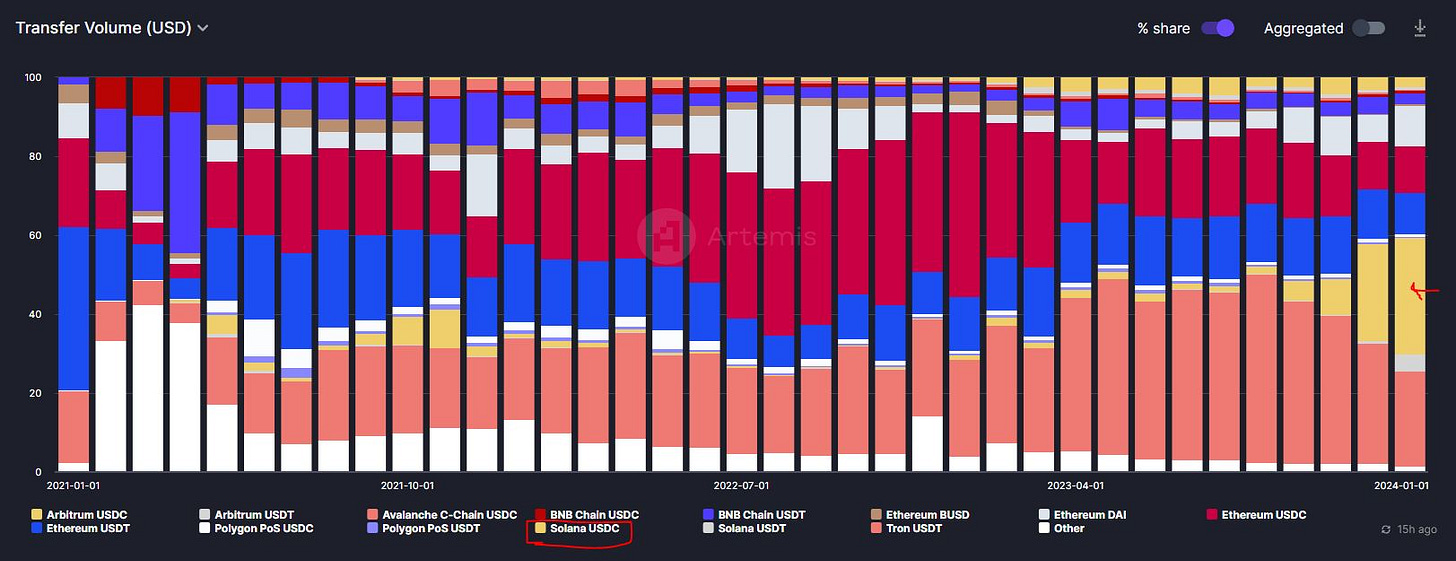

This is important: the data cited in that post comes from IntoTheBlock - which does not count Solana stablecoin volume. If we include that volume from a different source (in this case Artemis), Solana essentially is the stablecoin market in January 2024:

With just a few hours left in the month, 29.43% of the $1.5 trillion in stablecoin volume on major crypto chains is USDC on Solana. This is absolutely staggering when we consider that there is only $1.2 billion in USDC supply on Solana. I’ve mentioned these transfer volumes in a previous post and speculated that it had to be Visa V 0.00%↑ utilizing its crypto pilot program. But even in that case, $400 billion in transfer volume on $1.2 billion coin supply is an astronomically high velocity of money.

Turns out, it’s probably bad data! Because of course it is…

Defi Llama simply doesn’t reflect this level of volume on Solana. In fact, DeFi Llama has volume actually peaking in December not accelerating in January. At this point, I did what any self-respecting 37 year old man would do when he’s not sure what is happening… I went to Twitter and typed in “Solana USDC.”

I believe the widely circulated Solana Stablecoin Volumes, particularly USDC, are completely FALSE if not MANIPULATED through Spoofing. And I got the receipts to show for it, please read on:

It’s a phenomenal thread, you should read the whole thing if you’re even remotely interested in this stuff. Long story short, one of Solana’s DEXes is posting unfilled order data on chain and it’s incorrectly being counted by Artemis as real volume. All of this is coming from basically two wallet addresses. Which means it’s a very high likelihood that this is intentional market spoofing.

(friggin’ crypto, man)

Just for kicks, here’s the daily chart of SOL:

This coin was rallying all last year but the real moonshot arguably came in the second half of December when the transfer volume data on Artemis was looking increasingly bullish for Solana.

So here’s my final takeaway; I haven’t sold any of the remaining SOL that have. I sort of see my current SOL position as introductory at this point since I did sell my trading exposure back in early November. I wouldn’t be surprised if this thing trades back under $70 in the coming months. That would still be a large premium to where I sold my tactical long but a 30% discount from current pricing. Taking everything together, I see high OI and a market that may be bullish on fraudulent data.

Sure, we have Bitcoin ETFs, but this scene is still the Wild West. Be careful out there.

Disclaimer: I’m not an investment advisor. I share what I do and why I do it. I have a small position in SOL from the long side.