Jerome Powell Says Stablecoins Are A Form of Money

Is it possible the fiat-backed stablecoins will wind up being de-facto central bank digital currencies after all?

Julie Morgan is the host of Wall Street Breakfast - Seeking Alpha’s daily podcast covering news in the financial markets. Earlier today, she reached out for my thoughts on all the latest happenings in crypto. The following is what I submitted for her Thursday morning episode.

On Wednesday, Bitcoin surpassed 30 thousand dollars per coin for the first time since late April. Crypto’s top coin is currently up 14% on the week. There have been several points of emphasis that are likely driving this new interest from bulls. On June 15th, asset management giant BlackRock BLK 0.00%↑ applied for a spot Bitcoin ETF. If approved, it would be the first spot Bitcoin ETF in the United States.

The SEC has somewhat notoriously denied every single spot Bitcoin ETF application to date; of which, there have been well over a dozen. Van Eck, WisdomTree, Global X, and Grayscale have all had spot applications denied in recent years. BlackRock has a nearly perfect record in bringing ETFs to market with just 1 application denial and several hundred approvals.

In the days since BlackRock’s application, other fund managers have followed BlackRock’s lead as WisdomTree and Invesco have also applied for spot Bitcoin ETFs. In an article for Seeking Alpha late last week, I wondered if BlackRock’s application would be a good thing for the Grayscale Bitcoin Trust (GBTC) - and that thesis hasn’t disappointed.

Since June 15th, the GBTC NAV discount has moved in shareholders’ favor from 42% to just 35% - there’s a long way to go yet. While some of the altcoins have caught a bid as well in recent days, there is no denying Bitcoin is eating the rest of the cryptocurrency market. Bitcoin dominance has reached 50% for the first time in 2 years.

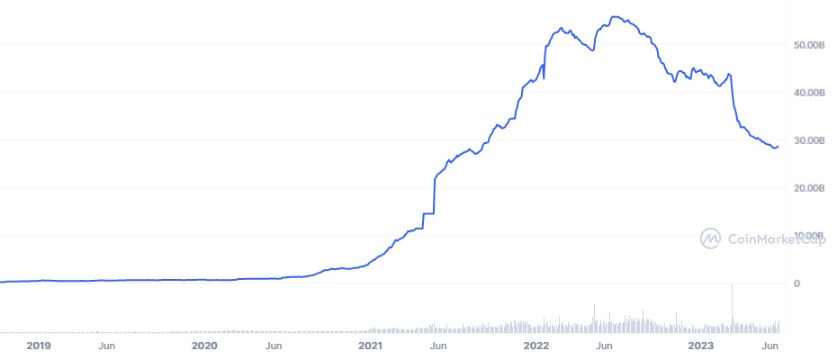

Of course, one of the biggest areas where value flows in the crypto market is stablecoins. Stables come in many different forms, but the fiat-backed variety has been puking capital - the total market cap of fiat-backed stablecoins is now $72 billion. This is down about 30% from a year ago.

Fiat-backed stablecoins are theoretically a good thing for US treasuries as the collateral that backs those coins is typically held in US debt. Perhaps it’s not a surprise then that Federal Reserve Chairman Jerome Powell told Congress on Wednesday that stablecoins are a form of money and that there were no plans for a Central Bank Digital Currency from the Fed.

We do see payment stablecoins as a form of money. In all advanced economies, the ultimate source of credibility in money is the central bank. And we believe it would be appropriate to have quite a robust federal role in what happens in stablecoins going forward. Leaving us with a weak role and allowing a lot of private money creation at the state level would be a mistake. - Jerome Powell, Today

The following was originally published in BlockChain Reaction in response to the OFAC Tornado Cash sanctions last August. The data and charts are now ten months old. Following this excerpt, I’ll offer some additional insight with fresh data and my interpretations.

USDC is now a de-facto CBDC

The biggest potential issue that I see for crypto going forward is in the centrally operated crypto-based dollar derivatives like Circle's USDC stablecoin. As a result of the Tornado Cash sanctions, Circle was able to freeze USDC that has been used in the protocol:

Ethereum blockchain explorer data shows that Centre has stopped the movement of at least 75,000 USDC by blacklisting Tornado Cash wallets on the sanctions list. Among these addresses is Tornado Cash’s USDC pool, meaning those with USDC deposited on Tornado Cash may be unable to withdraw their funds.

The fact that just $75k in USDC was frozen isn't what matters. In terms of the total scope of DeFi, that's actually a miniscule number. What matters is that Circle can do this at all. There are possibly serious implications here for DeFi because of how much crypto-capital is tied up in USDC.

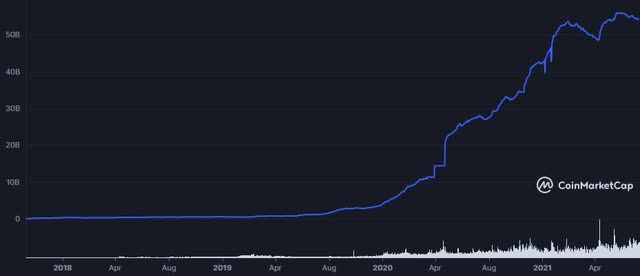

USDC has absolutely exploded in "market cap" from just $1.1 billion in August 2020 to over $54 billion today. It's the 4th largest crypto token by market cap after Bitcoin, Ethereum, and Tether (USDT-USD). And USDC has integration on Solana, Avalanche, Algorand, Polygon, Stellar, and Ethereum, among others. It's a massive component of the entire crypto ecosystem. But here's the problem; if Circle can just turn these funds off at its own discretion and is willing to do so at the beck and call of the US Treasury, there is theoretically a lot of capital that is tied up in this stablecoin that could possibly move back to native assets.

Decentralization is such a large part of the crypto ethos. The ability to freeze funds is the antithesis of that.

Stables: Crypto’s Trojan Horse or Killer App?

Many in crypto, including myself, have referred to stablecoins as the “killer app” of public blockchain. Over blockchain networks like Solana (SOL) or Algorand (ALGO), a user can send dollars to another person across borders in mere seconds and for a fraction of a penny.

But all stables aren’t created equal and the fiat-collateralized stables that command overwhelming majority share of the market are not the solution that decentralization purists might be hoping for. I think this testimony from Powell today is incredibly telling:

We would not support accounts at the Federal Reserve by individuals. If we were to support, at some point in the future, a CBDC, it would be one that would be intermediated through the banking system and not directly at the Fed.

On one hand, it sounds like Powell is saying there won’t be a CBDC. On the other, he might actually be foreshadowing that fiat-backed stablecoins will ultimately become the CBDCs. The fiat-backed stables have been collateralized with treasuries and issued by KYC/AML compliant intermediaries. They don’t currently have the level of programmability that would be possible from full-fledged CBDCs, but they are freezable.

By themselves, stablecoins are not necessarily a bad concept. I can certainly understand the desire to use them as a trading vehicle or for payments in a familiar unit of account. There are some interesting crypto-backed stablecoin projects in the market as well. One that I’m particularly intrigued by is cUSD - which is a crypto-collateralized stable issued by the Mento protocol on the Celo (CELO) blockchain.

Like DAI, cUSD has an overcollateralized backing that is made up of a basket of crypto assets. Obviously USDC, Circle’s fiat-backed stable, makes up 12% of this collateral. That’s not ideal. But I think the basket approach is probably the right one. Other decentralized stablecoins utilize different collateralization models. For instance, the DJED stablecoin on the Cardano (ADA) blockchain is a single-asset backed coin. It’s entirely backed by ADA. This is riskier and thus requires a larger collateralization ratio.

Of course, all of this could simply wind up a giant failed experiment after the dollar collapses and we end up on a Bitcoin standard that utilizes ultra fast and cheap secondary layers for peer to peer payments in sats as a unit of account. I’m only half kidding. What I’m watching going forward is how the regulators try to delegitimize the decentralized stablecoins. Calling stables money today was a very interesting development and I’ll just leave it at that.

If the plan is to sort of commandeer the fiat-backed stables like USDC, the powers that be better do something to stop the bleeding. The market cap of that coin has been cut in half from $56 billion last summer to $28 billion a couple days ago. I can’t imagine Janet and Jerome want Circle selling US debt to fill redemptions.

Disclaimer: I’m not an investment advisor. I’m long BTC, GBTC, ALGO, and CELO.