Lessons in Liquidity

Thanks to Rally Rd and Otis, we now have the intersection of avatar NFTs and fractional share investment apps. Let's explore the extra absurd valuation of Otis' CryptoPunk.

This week, CryptoPunk #543 began trading on Otis and it has been a rocket ship ride to say the least. No, I don’t own any shares but I’m an Otis investor and very interested in the NFT space overall. Not a shock if you've visited this site at all this year. Naturally, seeing a platform that I use for buying fractional shares of rare sports memorabilia now offering NFT assets provides some next level investment entertainment.

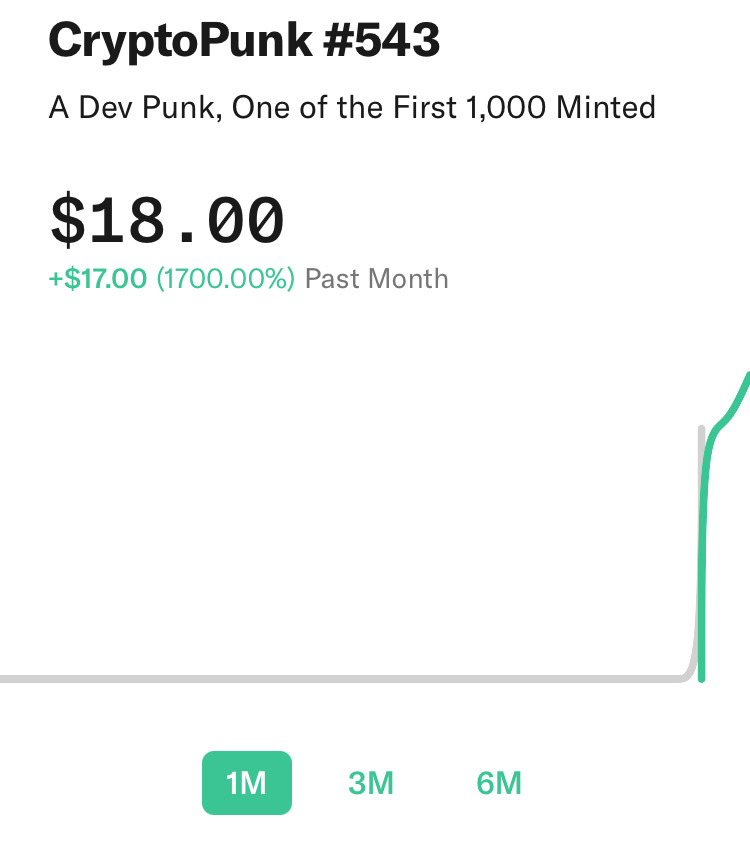

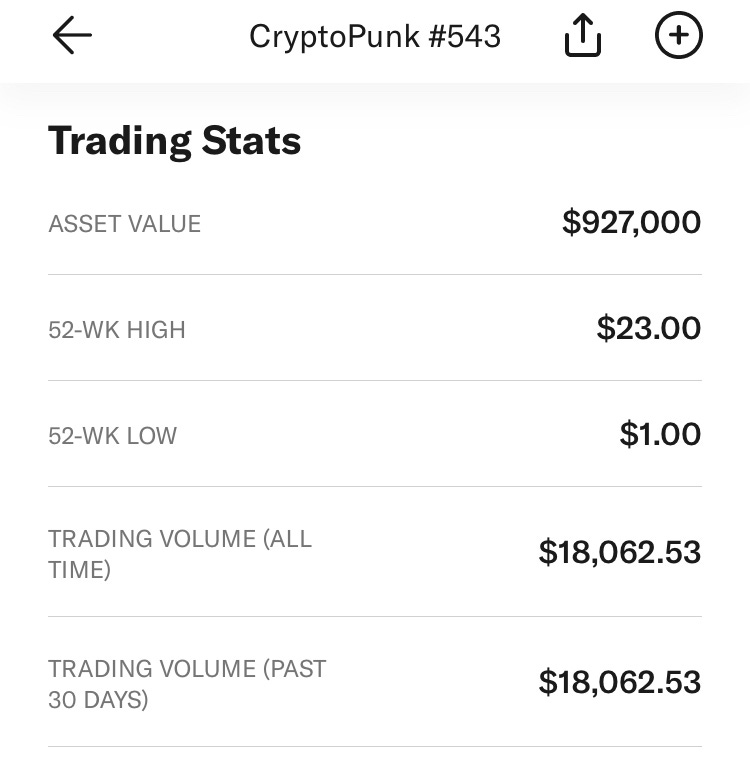

After selling out the asset at $1 per share just a few weeks ago (implying a $51,500 valuation), shares of Punk 543 are currently commanding an $18 price tag. This would give it an implied valuation of $927,000. Let’s add some context to see if this makes sense. For one thing, Otis actually provides what is called an “Otis Estimate.”

They claim this is a data-backed estimate of what the asset could sell for on the open market. That Otis Estimate is currently $7.03 per share. Giving it an implied asset valuation of $361,944. Hence, Punk 543 is trading at a considerable premium to estimated value. How do the value estimate and share price valuation stack up with what full asset purchases of CryptoPunks from OpenSea are going for?

Both the Otis estimate and the current average price are well ahead of the 90 day average. No big deal. What about recent sales? As of yesterday (9/2/21), the average punk price was 120.133 ETH. Or a little over $477,000. That’s higher than the Otis Estimate, but 46% below what Otis market participants are paying for Punk 543.

How can this happen?

Liquidity. Pure and simple. These fractional asset apps still don’t have the market operability that you get in the crypto or equities markets. Look at how little capital has been required to move the Punk 543 market on Otis.

So far, only $18,062.53 worth of CryptoPunk #543 shares have traded between accounts. This means just 1.9% of the total current value of the asset has actually been traded this week. Otis' Newborn Grimes NFT Collection also started trading this week. 6.0% of that asset value has traded hands. Mike Tyson's punch out started trading this week as well. 6.9% of that asset has traded hands. Each of those assets have performed remarkably well since trading launched this week. But those returns have been dwarfed by the far less liquid CryptoPunk #543. To be fair, the daily sale volume of CryptoPunks on OpenSea has been steadily declining since the August 27th spike. But that decline in sale volume the last week has mostly contributed to average price declines rather than increases.

Fractional premium

I should also note that market participants will often value a fractional asset higher than what a full asset comp would likely fetch at a competing market. This is because it is normal for a premium to be associated with buying a smaller amount of something. Think the opposite of buying in bulk at a place like Costco. That being said, how does the premium that Otis users are paying for Punk 543 compare with other assets on the platform? Let’s look at a few sports cards as a proxy.

The chart above is the price history of a PSA 10 1987 Fleer Michael Jordan #59. Otis' 1987 Fleer PSA 10 Michael Jordan #59 is currently valued at $23,600 compared to the most recent sale of $19,118 through the open market. That's a 23.4% premium for fractionalization. The 2003 SP Authentic SP Limited LeBron PSA 10 trades for $229k on Otis. This compares rather well with a previous full asset sale of $221k on the open market. That's just a 3.6% premium. More context? In it's trading history, 81% of the LeBron card asset value has traded hands in Otis. See. Liquidity matters. It helps find the real price.

Final thoughts

Look I'm not a short seller and I don't advocate shorting anything. I certainly wouldn't be shorting speculative assets during an everything bubble. But I can't help but wonder what would be happening in CryptoPunk 543 if Otis allowed shorting. If nothing else, we can learn from the lesson that liquidity teachs us. Low volume generates larger price fluctuation. It's an opportunity if you can get in at an IPO stage before a mania takes off.

Otis is dropping Chromie Squiggle #524 on Tuesday. Valuation? $25,300. Want a comp? The highest offer for Chromie Squiggle #525 on OpenSea is a little over 9 ETH. Currently valued at $35,700. This is what Chromie Squiggle 524 looks like.

Standard disclaimer: I am not an investment advisor. Please do your own research. I do not own any CryptoPunks or Chromie Squiggles. I just share what I do and why I do it. I would not invest in Chromie Squiggles with free money.