Leverage, Leverage, Leverage

Once again, too much leverage has blown up the cryptocurrency market. History tells us there is more to come.

It’s the same story again and again. Where do we even begin? I know…

Amid renewed tariff concerns in the market on Friday, Strategy’s founder and Executive Chairman Michael Saylor made this stunning proclamation to his congregation:

No tariffs on Bitcoin. The implication here, I think, being that Bitcoin is globally decentralized and not at risk of tariffs in the same way that physical metal or manufactured goods would be. Thus, the coin could be viewed as potentially superior to metals like Gold or Silver.

There’s just one problem… an estimated 90% of ASIC machines used to mine Bitcoin are produced by Bitmain, MicroBT, and Canaan - all of which are Chinese companies that ship their rigs to the US. Given about a third of Bitcoin’s global compute is hashing in the United States, 100% tariffs on Chinese goods would actually be a very bad thing for Bitcoin. You can't double the price of fast-depreciating hardware and expect domestic miners to be profitable. Especially when BTC is going down in price rather than up.

And even though Maximalist Saint Saylor doesn’t seem to see it, the rest of the market received the possibility of a 100% tariff on Chinese goods quite poorly:

After sliding from $122k down to $117k through most of the day yesterday, Trump’s 100% Chinese tariff bomb absolutely nuked BTC (and every other crypto) down by nearly 20% in short order. Some alts were down by as much as 70%. And I'm not just talking about meme coins, even respectable projects like Aave were briefly down more than 50%.

I’ve seen a lot of crypto market meltdowns in my time following this industry, I’ve never seen it get that bad that fast. It was incredible and almost entirely driven by an utter wipe-out in leverage:

$5.4 billion BTC longs were liquidated yesterday. $4.5 billion ETH longs were liquidated and $2 billion SOL longs were liquidated. Total market both long and short? $19.4 billion crypto capital liquidated on October 10th 2025. This is an absolutely preposterous amount of leverage given the inherent volatility of Digital Assets. And to put this level of liquidation in perspective; yesterday was more than ten times bigger than the damage from the FTX collapse back in 2022.

So yeah, I suspect we’re going to have ongoing problems.

But first…

Zcash Is Back, BABY!

To be sure, there were already signs the crypto market was getting close to a point of exhaustion and one had to look no further than the absolute monster rally that we’ve seen in ZEC over the last couple weeks. ZEC is up about 500% in less than 14 days and has ripped off its biggest rally in 5 years:

Don’t get me wrong, I’m elated with this move. But it does make one ask, “why now?” Did the world suddenly start caring more about financial privacy in late September 2025?

Or could it be that several influential crypto investors have all started talking about it at the same time? My guess is this is more of a narrative trade revival than anything else. Yet, there is actually some credence to the idea that Zcash is organically catching on. For instance, the amount of coins in the shielded ZEC pool just passed 4 million for the first time. Given 16.2 million ZEC in circulation, that puts Zcash at roughly 25% of supply in the shielded pool. A terrific sign.

Still, I’d be careful chasing ZEC at this point and I personally closed out my Grayscale Zcash Trust shares on Friday. For other privacy ideas down the cap rankings, DASH, ARRR, and even RAIL are still well below highs from the last cycle if one views this as a legitimate movement.

But again, privacy coins pumping has usually been a sign that we're much closer to the end than the beginning of a major broad crypto rally. Perhaps this time is different. I'm not so convinced.

It's The Leverage, Stupid

I want to circle back and reiterate a point. Even though all of these coins are well off yesterday's lows, a $19 billion liquidation event was almost certainly quite damaging to some major players in this field. I'm convinced someone big blew up yesterday and we won't find out who for some time.

For assets that are designed to enable self-custody, this industry is filled with counter party risk. We saw in 2022’s crypto winter that it turned out to be FTX founder Sam Bankman-Fried - the man dubbed the JP Morgan of crypto - who was overseeing a bankrupt operation all along while presenting strength through bailing out peers like Voyager.

The original catalyst that ultimately led to FTX was Terra Luna’s collapse a few months earlier. That event wiped out Three Arrows Capital (3AC) and 3AC had borrowed money from essentially everyone in the industry, including Voyager. With no ability to pay back those loans, counter party risk eviscerated the industry.

Interestingly, one of the big trades that 3AC was implementing with borrowed money was the Grayscale Bitcoin Trust (GBTC) arbitrage trade. Recall, once upon a time, GBTC was really the only game in town if one wanted Bitcoin exposure in a traditional brokerage account. Unlike an ETF that offers a redemption method, GBTC was initially launched as a closed end fund without the possibility of redemption.

This brings us to ‘NAV rates’ or net asset value rates. Early in it's existence, GBTC traded at a significant premium to its NAV on the secondary OTC market. Essentially, a Bitcoin holder could privately place BTC in GBTC at NAV, wait out a lockup period, and sell the shares at a premium to NAV after the lockup ended. By doing so, an arbitrage spread would be captured as pure profit.

Example: if the Bitcoin underlying each GBTC share had a net asset value of $10 but the shares were actually trading at $15 in the market, that $5 premium could be captured by privately placing $10 of BTC in exchange for newly issued GBTC shares and then selling the shares for $15 on the market. It's essentially a free $5 as long as the premium holds up during the lockup period.

3AC went heavy into this arbitrage trade. It borrowed a substantial amount of money to attempt the arb. Unfortunately for them, not only did GBTC’s NAV premium vanish before share lockup expired, but the NAV rate actually went deeply negative. So negative, that 3AC was completely trapped in the trade. Because again, this was before GBTC converted to an ETF in 2024. There was no redemption mechanism for arb traders on the opposite side of the NAV rate.

So to summarize; 3AC leveraged up in a big way and essentially blew itself up because of poor risk management and an unfavorable market. 3AC’s demise had an enormous impact because the firm owed so many other entities money. Entities like Voyager and FTX also went bust. But the larger point is it took months to figure out where all the bodies were in this massacre.

The point is, you can't tell me the market can obliterate $19 billion in a single day and everyone made it out alive. Someone was just taken out back and shot yesterday and we may not know who for a while.

My honest advice; keep as little exposure to a centralized exchange or third party custodian as possible.

An Arb of Another Sort

I don't want to continue to harp on the same critique of Strategy's Bitcoin flywheel over and over again, but I think there is a very real possibility that Strategy transforms from a Bitcoin tailwind to a Bitcoin headwind, potentially even this year.

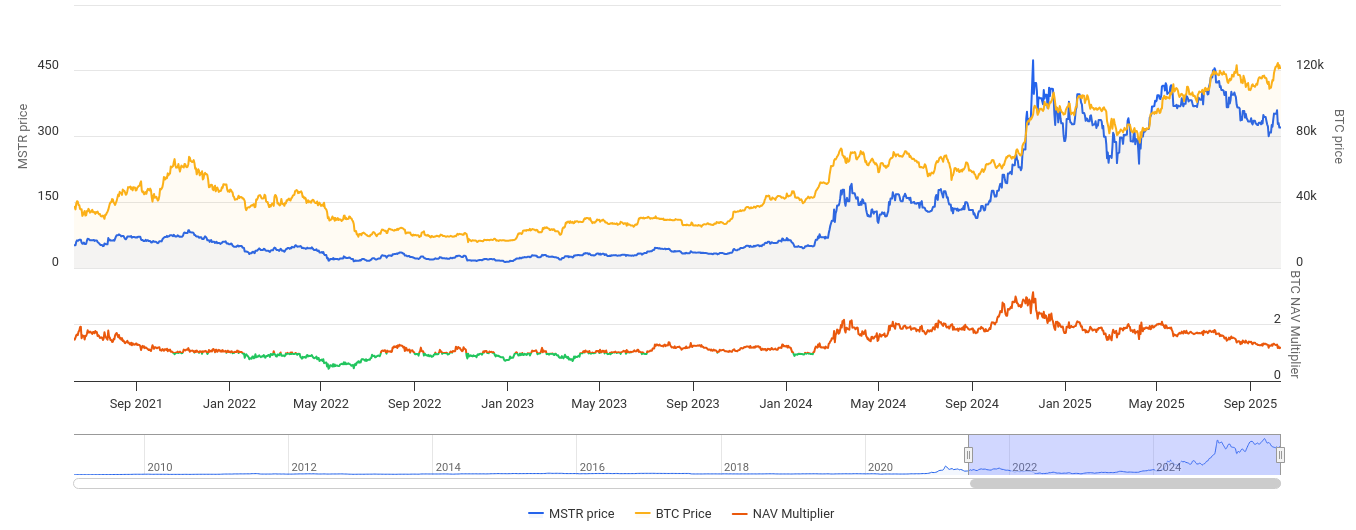

To be sure, Strategy isn't utilizing convertible notes to buy Bitcoin any longer. But I’d argue there is a far bigger problem for the company than it's low-rate debt; it's Strategy's flat-lining mNAV coupled with preferred share dividend obligations that spell trouble down the line. MSTR closed Friday at an mNAV of 1.18.

The mNAV rate was 1.5 as recently as August. The closer the stock gets to an mNAV multiple of just 1, the less leeway Strategy will have to purchase BTC. Why? Because when mNAV is 2, there is plenty of justification for issuing common stock shares to buy more BTC. However, when the common stock shares trade at an mNAV rate under 1, the arb setup changes dramatically. A company that previously had an incentive to issue stock to buy BTC may actually have an incentive to sell BTC to buyback common stock shares and capture its own equity arb.

In some ways this is similar to the GBTC arb all over again. The biggest difference is, unlike GBTC as a closed end fund, Saylor actually can sell the company's Bitcoin to capture the arb in his common shares. Does Saylor want to sell BTC? He has said that he won’t. But he may not have much of a choice if his common stock keeps losing ground to his BTC. I know what some of you might be thinking; “cool, Mike. What can we actually do with this?”

Maybe something, actually.

Is Strategy going to be margin called in 2025?

No.

Is Strategy going to go bankrupt in 2025?

No.

Is Strategy going to be forced to liquidate BTC in 2025?

No.

Is Strategy going to voluntarily sell any BTC in 2025?

Yeah, that could actually happen. And right now Polymarket is pricing Strategy’s potential for even a modest BTC sale this year essentially the same as it is the company’s bankruptcy. That seems like a mispricing to me. And if you’re looking for a way to capitalize on that mispricing, $120 bet at 6 cents pays out $2,000 if Saylor sells even 1 BTC before the end of the year.

What could create the sold BTC scenario? Simple. mNAV cratering under 1 could put that wheel in motion. The company has a $600 million annualized dividend obligation each year with another payment remaining in December. It cannot pay this dividend from software business earnings because the business is unprofitable. Strategy is now very close to seeing mNAV fall below 1 again and at the rate that mNAV is compressing, MSTR could be trading at a discount to the company’s BTC as soon as this month.

In that scenario, I think the appetite for common stock dilution will be non-existent. While the thought of Strategy selling BTC this year might have seemed totally absurd to many in the market a week ago, all it takes for things to dramatically change is a catalyst. And we arguably just had our Terra Luna event yesterday.

Now we wait.

Seeking Alpha Freebies

Tickers Mentioned: MSTR 0.00%↑ GBTC 0.00%↑ $ZCSH BTBT 0.00%↑ ETHU 0.00%↑ CAN 0.00%↑

Disclaimer: I’m not an investment advisor. I share my own opinions on markets for readers to use in their own research efforts.