Living On The Edge

After a 4.8% selloff from all time highs over the last week and half, is the pain over? I don't think so. Sorry. But that doesn't mean there isn't a bull market somewhere!

Please keep in my mind that I prefer fundamentals over technicals generally speaking for long term investing. However, for shorter term moves I think TA can be a very useful tool. But I am aware some of you don’t care about technical analysis at all. Apologies in advance; this is going to be a fairly chart-heavy post today. If you’re not into that, this one might be a skip. But I think it would be wise to consider what I have for you today anyway.

There's somethin' wrong with the world today

The light bulb's gettin’ dim

There's meltdown’ in the sky

Just to be clear, I’m not calling for a market meltdown. Okay? I don’t want that. Nobody wants that. But I looked at some charts today and Aerosmith popped in my head. What can I say? The brain goes where it goes.

These are those charts…

First, the Volatility S&P 500 Index $VIX:

Look, I’m not a big time VIX watcher. The index is supposed to measure volatility. I question how useful this really is. Volatility can be both to the upside and to the downside. What what we’ve generally seen in recent years is the VIX goes up when stocks go down. Regardless, we have a VIX index that is now threatening a weekly close above trend with one session remaining. Could be nothing, but I doubt it.

We have a US 10 year bond that is hanging on to “support.” Not quite by a thread yet, but it’s getting very close.

And based on this action in the 10 year, it sure seems like the market is telling the central bank that it’s time to start cutting. We can certainly debate the merits of the metrics that the Fed is using to justify decision making, but the reality is they’re going to use the data they want regardless of whether that data is cooked or not (it is, btw):

There is very little expectation for a rate cut next week. However, looking out to September we observe certainty that rates will be lower two months from now. Probability of rates 25 bps lower than here in September is 89.6%. More than 10% probability for 50 bps lower. No chance of a hike.

Does 50 basis points solve all of the problems in housing affordability and tapped out consumers? I would think not but I suppose its possible for investors to talk themselves into rainbows, unicorns, soft landings, and no landings. That’s probably not wise though.

We’ve heard a bit about the “rotation trade” in recent weeks. I’m admittedly one who has brought this concept up as well. The belief is that we’re at the beginning of capital flight from big tech names in the Magnificent 7 MAGS 0.00%↑ to smaller cap/value. Thus, the Russell 2000 IWM 0.00%↑ has been playing catch up nicely.

The small caps are still behind both the S&P 500 SPY 0.00%↑ and MAGS year to date:

IWM (+9.9%)

SPX (+13.2%)

MAGS (+30%)

But over the last couple weeks we can see a clear divergence between MAGS and the Russell that started on June 10th. Here’s my question: what if the sustained rotation trade isn’t actually big caps to small caps? Is it possible we see more of a rotation out of stocks and into bonds? I suspect yes.

This ratio above is the SPX divided by the total return bond index. When it’s high, stocks are outperforming bonds. When it’s low, bonds are outperforming stocks. We are currently at 166. This ratio hit 172 on July 9th - one day before the “rotation trade” started. Even still, we’re currently higher than dot com and the peak preceding the crash of 1929. At a minimum, I suspect we’ll see the SPX test the 100 day MA, circled below:

But by the end of the year, I actually think we’ll have given the 100 up already. It just isn’t going to all happen at once. Now, I’d be remiss if I didn’t mention that I actually hate bonds. It’s a bias. I’m sorry. We all have them. But I can at least admit that I understand their place in the financial world. And I do have plenty of exposure to bonds at this point. Cash deposits are backed by bonds. There is nothing wrong with longing the 2yr in my view. I just personally wouldn’t go much further out than that.

We have to remember, these guys get to grade their own homework. They can manufacture a “real yield” by monkeying with the numbers. It doesn’t mean the dollars you get back from those bonds will still protect your purchasing power for goods and services in the real world.

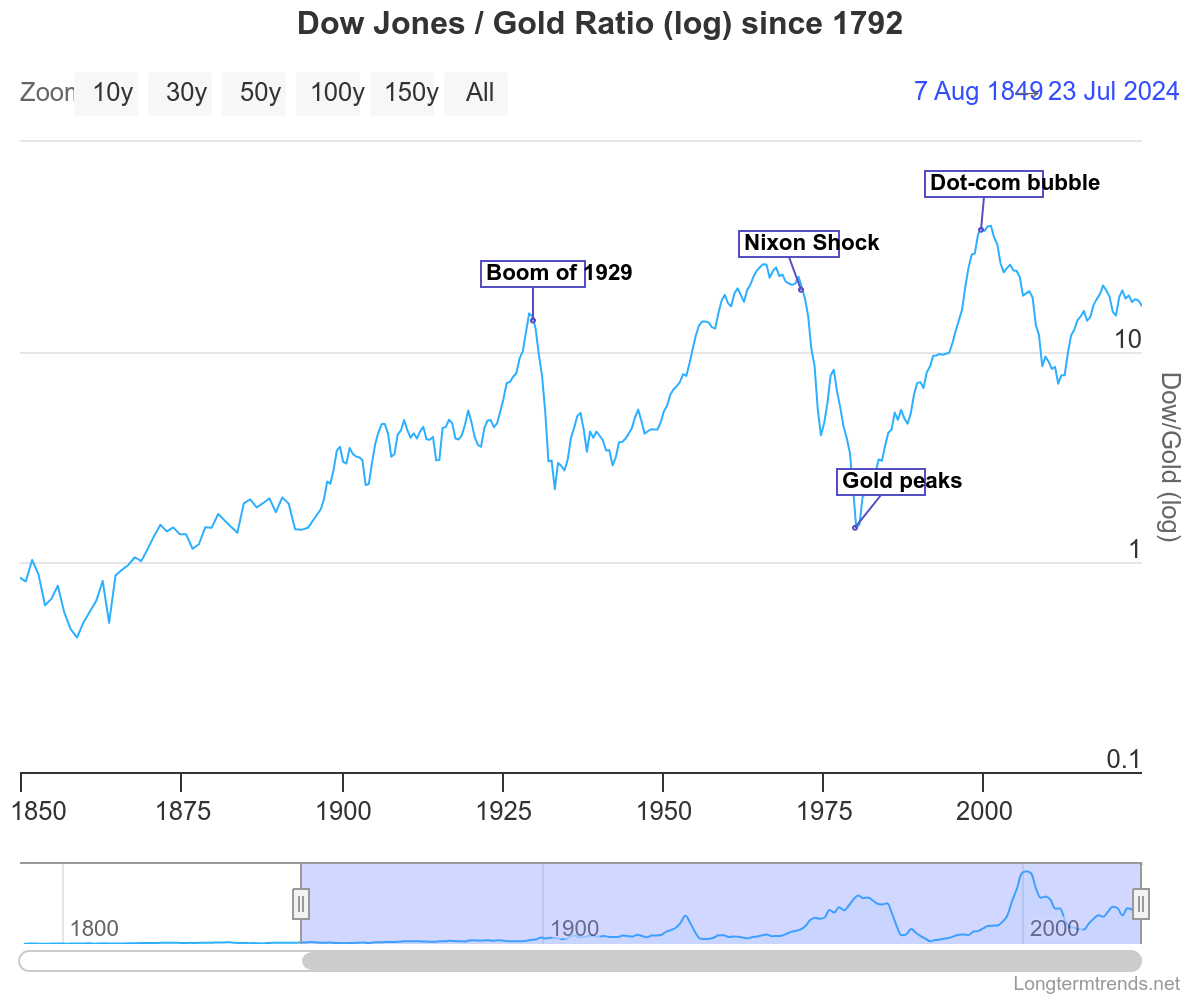

In my view, metal is a much better play at this point in time because I think it’s superior collateral to notes from a Ponzi debtor. Furthermore, Gold is arguably undervalued against stocks. We could easily see a Dow/Gold ratio back into the single digits. That can happen one of two ways: the Dow Jones goes down or Gold goes up. Maybe both. In either scenario, you’re better off in the metal than in equities.

Last week, I said Gold could give up $100/oz. This week it happened. Silver has been wrecked even harder:

Mr. Slammy stopped by yesterday. Each of these metals can admittedly head lower and in the case of Silver, I suspect sub-$27 is possible if not likely. But I very much see this as a buyable dip.

Silver has spent essentially the entire months of June and July above $29/oz and yet we now find it closer to $26 than $29 in the final week of July? I call BS. In my opinion, these are steal buys. We have absolutely not given up support in XAG. If anything, we’re just back-testing it. And I base my bullish metal view on both technicals but also on macro.

This is how I see it:

The rally in US stocks is either over or very close to over

Russell 2000 outperformance will be temporary

We’re going to get capital flight from “risk” to “safety”

Many investors will move to bonds, thus reducing yields

I think bonds are riskier than many believe, particularly the longer duration bonds

And I think there are family offices, individual investors, and nation states (BRICS) that view metal as better “safety” than US debt

So that’s the thinking. Long Gold, long Silver, long real assets, and we can play around with things like Bitcoin to satisfy our yearning for financial degeneracy.

Sound off in the comments if you see it differently. And more importantly, have a great weekend! Don’t blow your life savings betting on Biden to resign.

Disclaimer: I’m not an investment advisor. I play the ponies and try not to drink too many Modelos before noon on Summer Fridays.