Macro, Bitcoin ETFs, and an Indecisive Metal Market

Plus my thoughts on a new crypto law from the IRS. Spoiler: it stinks!

What’s up, heretics! With the first week of trading for the year now in the books, here’s a quick glance at some of the headlines that stood out to me this week:

The 9 week rally in the stonk market has officially ended. The S&P 500 SPY 0.00%↑ closed down 1.5% after four sessions. In my view, a necessary pullback and possibly not yet over.

Focusing on one stock: really interesting news out of Peloton PTON 0.00%↑ - the stock rallied 10% in the first week of the year on the news of a partnership with TikTok. I’ve felt PTON is dead in the water, but you never know?

Macro data: initial claims came in under forecast (202k vs 219k), ADP employment beat forecasts (164k vs 130k), and unemployment for December remained at 3.7% - better than the 3.8% expectation.

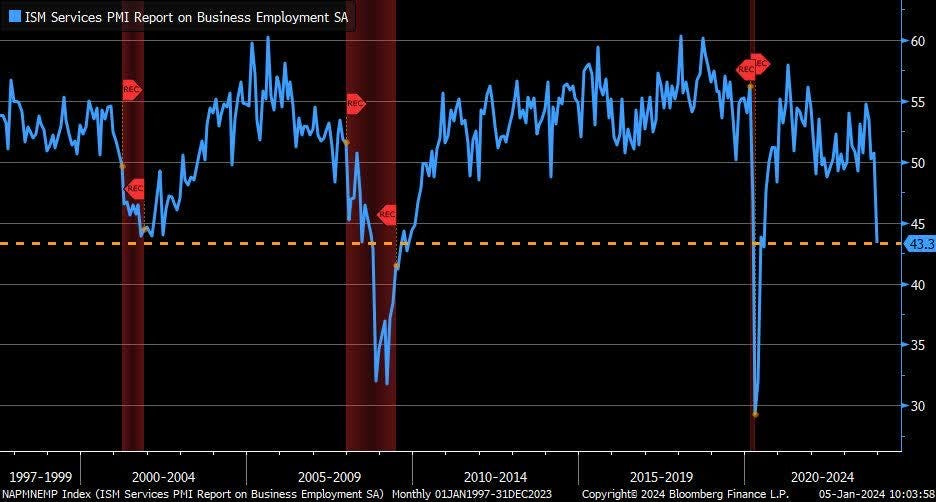

Despite all that, ISM was a big disappointment (50.6% vs 52.2%) and the jobs component completely contradicted the other reports as it fell to 43.3 versus a market expectation of 51.

Every time this figure has fallen this far in the last 25 years we’ve been in a recession already. Don’t worry though, we’re not in a recession until “they” say we are…

Wen, Bitcoin ETF, ser?

The betting markets believe we will have a spot Bitcoin ($BTC-USD) ETF within the next 10 days if the action over at Polymarket is an accurate indication. I tend to agree with this as I think it would be career suicide for Gary Gensler’s SEC to delay this any longer given the punching bag his agency has been for judges in the courts.

On BTC’s potential price reaction to a spot ETF approval in the United States, Seeking Alpha just published my latest Bitcoin article earlier this afternoon. In it, I discuss the issues with high transaction fees from the user’s standpoint and why it pushes people to custodial solutions. I also highlight a recent survey from financial advisors on ETF demand and offer insight on the level of transfer flow that has been settled on-chain in recent months. Here’s an excerpt:

As a decentralized ledger and settlement layer, Bitcoin functions very well. In a typical day, $32.3 billion in dollar denominated value moved around on the network during the month of December. This was up from $16.7 billion in January 2023.

Bonus chart to consider that didn’t make the article:

Maybe crypto goes up for no reason, or maybe price increases with utility? Food for thought.

By the way, for those of you who aren’t members of Seeking Alpha but would like to read my latest piece on the Bitcoin ETF, good news: Seeking Alpha is allowing me to share the full article with anyone, but you have to use this link! I’m happy with how this one came out today and I’d love for all of you to check it out if you’re interested.

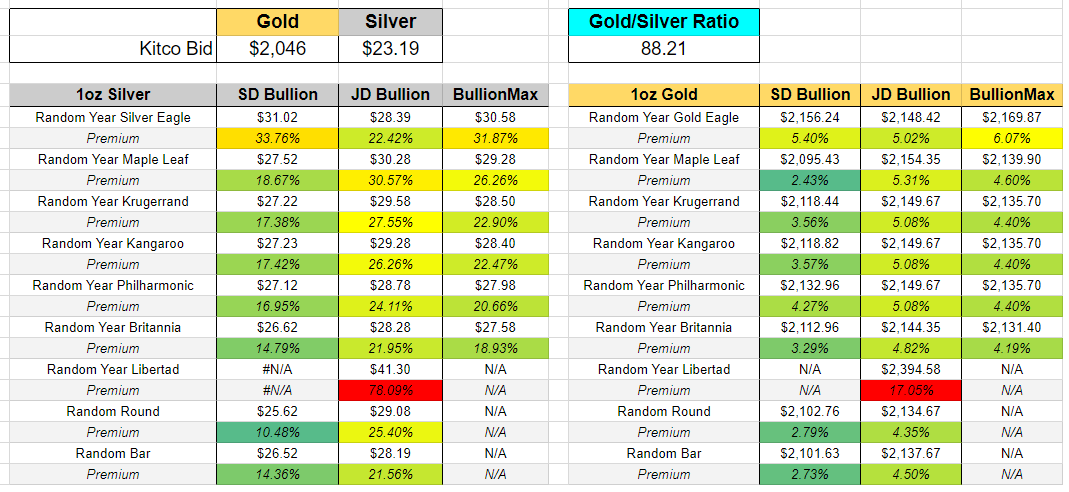

Metals

Shifting gears to the metals, I see a very indecisive market which I think is as telling as it is concerning. Consider that the broader market seemingly believes rate cuts will begin in March and that there will be somewhere between 3-6 cuts this year.

In the past, rate cuts have been good for gold because it means we’re getting an accommodative central bank and more easing. Debasement weakens the dollar against real assets. We’re now closing in on 2 full years of YoY inflation above 3% with a new print coming next week.

For much of the last couple years Gold has largely held up in spite of rate hikes largely due to foreign central banks slapping the bid and sticky consumer price inflation. As far as I’m concerned, rates up or rates down doesn’t matter in the end. We just passed $34 trillion in public debt. Can’t print gold bars… or silver bars!

Silver’s chart remains conflicting. Today we had yet another intraday failure of the trend from April 2023. At some point we’ll get a breakout but I’m not quite sure we’re there yet. But I admittedly go back and forth on this a bit. When in doubt, look to the physical market. Personally, I like to use the paper price to my benefit and I’m getting closer to pulling the trigger on another physical metal buy. Consider though that our premium tracker may still be way too green to be foreshadowing an imminent squeeze driven by retail buyers…

IRS on That BS

New crypto tax reporting obligations took effect on Jan 1. If you receive $10k or more in crypto you now have an obligation to report the transaction (including names, addresses, SS numbers, etc.) to the IRS within 15 days under threat of a felony charge. - Jerry Brito, Executive Director of

The importance of this rule can’t be overstated. It is an attempt to de-anonymize large blockchain transactions. On the surface, this might seem reasonable. It isn’t. Essentially, anyone who trades in large volume, mines crypto, or sells artwork in excess of $10k in a single transaction (or multiple related transactions) must now report personally identifiable data to the IRS within 15 days.

So if you own a Bored Ape or CryptoPunk NFT and sell it at the market floor rate, you are required to notify the IRS within 15 days and provide KYC information for your buyer or you’re committing a felony. It simply isn’t possible to comply with this law. And a non-digital analog for this would be if the IRS required you to notify the agency within 15 days of selling a baseball card for over $10k. Again, this is for the buyer, not yourself. Addresses and social security numbers.

I think there’s an adage for laws that aren’t enforceable…

Privacy is normal. Always has been. Always will be.

Weekend Recommendations

James Altucher had another conversation with Omid Malekan on his show this week. I always really enjoy episodes when James brings on Omid. They’re not afraid to challenge each other. For two guys who I think can be described as crypto bulls, they appear to have very similar frameworks for asset allocations as I do.

In the podcast they mention a Bitcoin ETF, Ethereum (ETH-USD), Render ($RNDR-USD), Solana ($SOL-USD), and Zcash ($ZEC-USD) among other coins. Each of which I either hold now or have held in the past.

Speaking of Zcash, Joel Valenzuela’s latest episode of the Digital Cash Network podcast features new Electric Coin CEO Josh Swihart. This was a really strong podcast and one that I feel had quite a bit of potential alpha for those of you looking for altcoin opportunities. I’ll likely elaborate more on that in a future post for full heretics!

Finally, Alejandro Lopez dropped this banger over at the The Psychology of Wealth earlier this week. It’s really good and well worth your time. I’ll leave you with my favorite part:

Mass isn’t just something you increase with your decisions, but your mindset matters too. You’re more massive when you’re self-conscious about what others think of you, when you’re scared of doing something, or when you get annoyed by a server who got your order wrong. Negative emotions take their toll on us and make our brains fatter. We’re less fit to think clearly if we’re using our cognitive power to process useless negative emotions.

Well put, Alejandro. Have a great weekend everyone!

Disclaimer: I’m not an investment advisor. I’m an internet rando with an affinity for barbarous relics, PunkTulips, and 90’s hip-hop.