Masa, Me, Web3, and Dash is a Security?

If you enjoy listening to my voice as much as I do, you’re going to love this post!

My latest guest on the BlockChain Reaction podcast is Calanthia Mei. She's the co-founder of Masa - formerly Masa Finance. Masa is a digital identity protocol that is built on the Celo (CELO-USD) blockchain. The company recently announced inclusion in the Binance (BNB-USD) accelerator program and is aiming to be a global leader in Web3 identity infrastructure.

Check Out The Episode Here or through Spotify below:

I thought this was a really interesting episode and we touched on everything from the privacy concerns about digital IDs to the global macro setup for fiat currencies more broadly speaking.

What we covered

What is Masa?

Calanthia's TradFi bank and fintech background

Building a new world on chain with identity infrastructure

What are Soulbound tokens?

How Masa allows developers to build Web3 native communities

Web3 is likely more attractive to a global audience rather than a Western audience

Future generations will be "on-chain native"

How does a crypto builder define "decentralized?"

Applicable ways Web3 identity is useful

Protecting privacy in Web3

On choosing the Celo blockchain but also being a cross-chain protocol

What being in the Binance Accelerator program enables

The differences between jurisdictions in attracting crypto businesses

Phones as a fintech utility

How does Masa simplify Web3 for the non-crypto native

Is EVM the blockchain winner or do ecosystems like Solana (SOL-USD) and Cosmos (ATOM-USD) have a chance long term?

A possible Masa token in the future

Learning from the airdrops of other market participants

Remember, you can get the full episodes and access to the archives by joining my BlockChain Reaction research service.

The views and opinions expressed in this podcast are those of myself and my guest. None of this is investment advice or a solicitation for you to buy any financial instrument. I am not a licensed investment advisor. This content is for information purposes only. This episode was recorded on April 18th, 2023.

Additional Audio

I also joined James Foord for the second episode of his new podcast The Pragmatic Investor earlier this week. You check that out here. Or below:

In that pod, we talk crypto broadly, Bitcoin (BTC-USD), and the macro outlook. You can check out Jame’s Substack here. You can also find his financial analysis via his Seeking Alpha profile: The Digital Trend.

Sick of me yet?

If for some reason you want more Faybomb audio in your life, you can also check out Seeking Alpha’s Wall Street Breakfast podcast. Every Thursday I share a segment called “Crypto Thursday" with host Julie Morgan.

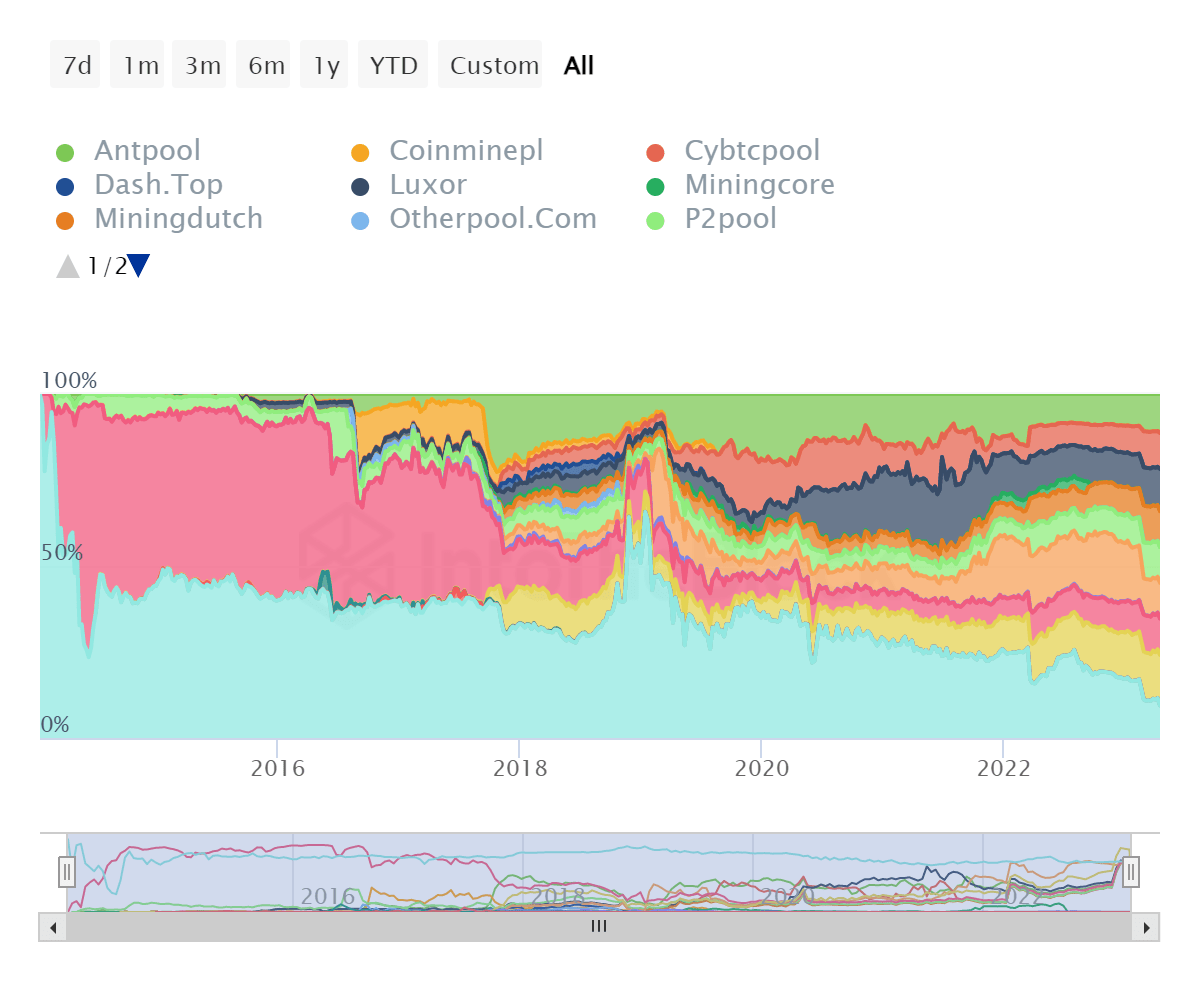

On Today’s installment, I talked about the Gary Gensler’s testimony before the House Financial Services Committee and commented on the agency’s Bittrex lawsuit where it claimed Dash (DASH-USD), among other coins, is an unregistered security. I went much deeper on this with BlockChain Reaction subscribers yesterday but my thinking can best be summed up with one chart:

DASH’s mining pool is more decentralized than Bitcoin’s, there was never an ICO for DASH, and it’s a proof-of-work chain. While I’m the loudest when I disagree, I don’t always disagree with the SEC’s securities designations. But it’s very difficult for me to comprehend how DASH could be considered one. Of all of the specific unregistered securities claims the SEC has made under Gary Gensler, this one is probably the most dubious in my own opinion.

This goes without saying, but it would really be great if we could get some clarity on which goalposts the SEC is using for these designations. Under this administration, I’m not holding my breath.

Disclaimer: I’m not an investment advisor. Don’t do anything I do. I research, write, and host podcasts in my pajamas.