Mortgage Rates, Home Ownership, and Getting Ahead

30 year mortgage rates are on the rise. Home prices are too. What could possibly go wrong?

Last weekend, my wife and I were casually chatting while watching TV. We were talking about some of our old jobs and how decisions that were made many years ago have led to where we are now. During the conversation there was a moment when we revisited how rough our financial situation was about ten years ago.

There was one specific moment that I remember fairly well. We were both in our mid-20’s and had just left my car at a shop for expensive repairs. The estimate was four figures and I had no choice but to pay it. After that invoice, I was going to be within $100 of maxing out my credit card. Her card, though not maxed, also carried a bit of a balance. Neither of us had savings. We basically had enough cash to pay the rent. I remember the ride back to my apartment well. While we weren’t panicking, we were in a bad spot and we knew it. We each had a negative net worth. Not fun at all.

In reliving that story together, the question was asked: “how did we get out of that?” Thankfully, she and I are usually on the same page and even when we were just two broke millennials who happened to be dating, we knew we were the ones for each other pretty early on. What helped us reverse that debt situation was moving in together and becoming more efficient with our living expenses. Two rent payments down to one was a huge factor in getting us some freed up cash flow.

That was just the first step though. Roughly 21 months after our first date, we were married. Instead of registering for a bunch of household items that we felt we didn’t need, we did something that was (and probably still is) considered taboo; we asked for money instead of gifts. Through a third party website designed to crowdfund honeymoons, our guests crowdfunded our savings account. The stacks in that account were basically our emergency money. We didn't touch it.

After a relocation and two years in a more expensive apartment, about three years into our marriage we used that emergency money from our wedding as a down payment on a house. That was when we started to actually grow our wealth and build toward a retirement. After buying a house that we could easily afford based on traditional price to income ratios, we lowered our monthly housing costs again. Fixed housing expenses were pretty critical in getting us whole and in getting us ahead.

Like everyone else, our livelihood is getting more expensive because of consumer price inflation. Still, we are very, very lucky. We don’t have any student debt. Our home value (on paper) has increased substantially since we purchased it. And we’ve made smart investments both monetarily and with our time. It’s been a long time since our net worth was negative.

This isn’t meant to be perceived as bragging. The larger point of the story is there were two critical decisions that changed the game for us and they both ultimately involved our housing expense. We turned two monthly rents into one. Then we turned dozens of material gifts into a down payment on a house and reduced our housing expense again.

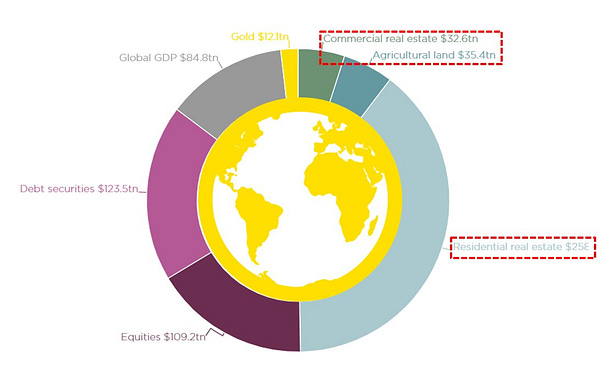

There has historically been a relationship between interest rates and home prices that tells a very interesting story. The lower interest rates go, the cheaper it is to buy a home. The cheaper it is to buy a home, the more demand there is to buy a home. The more demand there is to buy a home, the higher the price to buy a home if new supply can't keep up with demand. You can see in the chart below that as rates to borrow get lower, the average home sale price increases.

The higher the price of homes, the more people are potentially priced out of home ownership. We can see this data manifest itself through income to price ratios. For the chart below, I've taken the median household income and divided it by Zillow's Home Value Index to get a price/income ratio. The lower the ratio, the more affordable housing potentially is on a very macro level.

Now you might notice the data is missing for 2022 up to this point. That isn't because we don't have 2022 home price data. It's because we don't have Median HHI data after 2020. I actually had to build an estimate for 2021 just to keep the data set going. That estimate utilizes income per capita and how that figure has generally compared to HHI over the last few decades. Without getting any more into the weeds, I think the estimate will work. Notice how that ratio is back above 4.0 for the first time since 2007. Yikes! I'm not saying housing is in a bubble by any means. The market isn't nearly as exposed to adjustable rate mortgages as it was during the housing collapse 15 years ago. To me, this ratio increasing is more a problem of cheap credit and increasing commodity prices. The more expensive it becomes to build a new home, the more attractive it is to buy an existing home. And again, we get the higher prices loop.

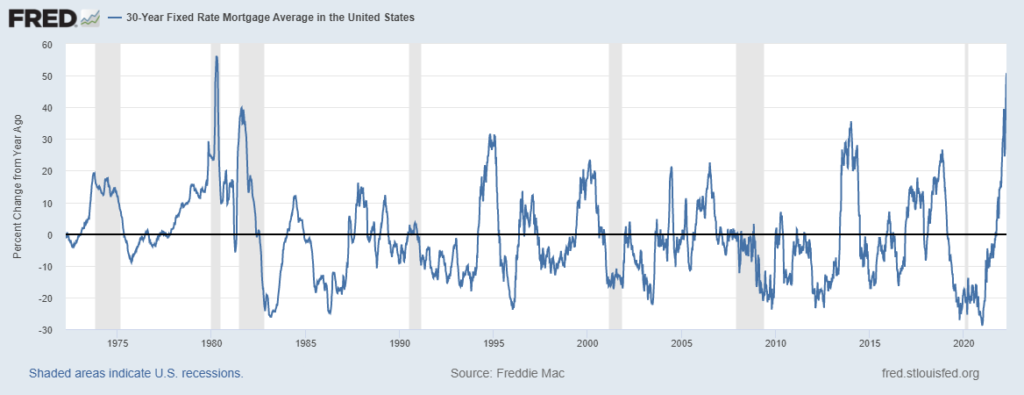

The more people priced out of home ownership, the harder it is to have a functioning housing market. Yesterday, we were blessed with fresh data on mortgage rates. The average 30 year mortgage rate is approaching 5%. Now I know what those of you who have been around the block before are probably thinking. A 5% interest rate is still very low in historical context. It's the rate of change that we haven't seen since the early 1980's.

When you factor in that home prices have still been increasing even as rates have risen, we can easily start to wonder if this is the demographic issue of our time. Boomers are retiring. They should be selling assets. They should be downsizing and locking in home equity gains when they sell. How high can mortgage rates keep going? I don't know. But at some point cost of credit increases are going to have to weigh on home prices. Otherwise there won't be anybody left to buy except maybe Blackrock. And then we'd all really own nothing and be happy. Whether we like it or not.

At the beginning of this post, I shared an anecdotal story about how we were able to really start building for a retirement. Shelter expense management is a massive part of it. Home ownership. It's important. A couple days ago, I mentioned Alfonso Peccatiello. I leave you with his last tweet...