Today the S&P 500 SPY 0.00%↑ made a new all time high. Yes, 24 months since the intraday peak of 4,818, we have a new high number. Rejoice! We have achieved sublime perfection. “Goldilocks!” The Federal Reserve hiked to a restrictive funds rate, stomped out inflation, and did it all without sacrificing jobs. Soft landing achieved! Magnificent. Jerome Powell isn’t just a hero, he’s a champion of the people. A king among mere men. A god of printers while we mortals drink from the hose of precious illiquidity.

Okay, I’ll stop.

The reality is far more nuanced. While I certainly have made it no mystery that I’m considerably more bearish on the broader economy than the market seems to be, even I’ll say I’m impressed by the resilience of this rally. However, there are a few things that I’ll quickly point out:

Jobs data is probably misleading at best. Almost every single monthly report last year was accompanied by a downward revision in the headline number from the previous month.

The data would suggest that rather than laying people off, many companies are just cutting hours. In this way, they’re reducing payroll while not losing the employee outright as it is indeed hard to find quality replacements.

While the broad market is still chugging along, breadth is once again not great. The Russell 2000 IWM 0.00%↑ is actually down 5% this year.

Furthermore, oil looks very weak and the market is now pricing in seven rate cuts this year. The Fed meets eight times. It’s likely not a stretch to say the good news is probably priced in at this point.

Of course, I could simply be seeing what I want to see because I’m sort of a bear in bull’s clothing. Sure, I’ll buy stocks even though I think the economy has problems. I just don’t think there are a whole lot of good deals to be had at the moment.

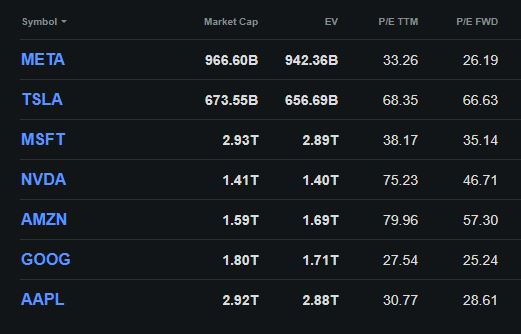

The “Magnificent 7” of Tesla TSLA 0.00%↑, Nvidia NVDA 0.00%↑ , Apple AAPL 0.00%↑ , Microsoft MSFT 0.00%↑ , Meta Platforms META 0.00%↑, Amazon AMZN 0.00%↑ , and Google GOOG 0.00%↑ continue to be stupid overvalued. I mean seriously look at that table and tell me which one looks cheap? Should we buy Amazon at a 57 forward price to earnings multiple? No? The index then?

Alas, none of this new. The market can stay irrational longer than a bear can stay solvent. Understood. But if you’re telling me that I need to buy stocks with a 25 P/E ratio on the index and a Buffett Indicator Stock to GDP ratio of 173, I’m sorry, I’ll just “buy mah bitcorns” instead. Here’s a question, and I’ve been legitimately wondering this for several weeks. Feel free to answer in the comments if you have any thoughts, I’m legitimately curious:

If the market is rallying on rate cuts while Gold is still above $2k per ounce and oil is 23% off its 52 week high, why do the gold stocks look dead in the water?

Second question: why is the 10 year yield back above its 200 day moving average for the third consecutive day?

And you believe that rates are indeed done and inflation is beat, why isn’t the iShares 20+ Year Bond ETF TLT 0.00%↑ going gangbusters? I would assume with rates coming down and inflation “defeated,” investors would be locking in the 20 year yield rather than chasing Nvidia at 24x forward sales. And we’re seeing the opposite. My thinking is that everything is way ahead of itself and the smart money probably knows it.

This chart is absolutely wild to me. That’s 11 out of 12 weeks with gains in the S&P. Nearly an entire quarter, up almost in a straight line! One can’t help but wonder than if this is indeed the start of the “melt up” that David Hunter has been saying is 3 to 6 months out for the last two years. That might explain this insanity:

What’s a couple hundred billion in market cap gains in 13 sessions among friends? This is probably not a shock, but I think this is ridiculous and I’m putting my money where my mouth is again. No, not in HSEP - but in my standard IRA. I’ve been aggressively shorting this rally over the last week or so through the AXS 1.25 Bear NVIDIA ETF NVDS 0.00%↑. There is a massive bearish divergence on the weekly chart. There’s a couple smaller ones on the monthly chart. And the daily RSI is already very overbought at 80.

These maniacs may push this hog over $600 per share next week, but that’s where the bloodbath starts in my opinion. And I want some of that bacon. There’s your official heretic speculation. NVDA hits $600 and then it’s slaughter city from there.

I hope you guys have a wonderful weekend! Sorry I was so MIA this week. My daughter had school for exactly 1 day. And the weekend is here. Good for her…

Disclaimer: I may not be a financial advisor, and this may not be financial advice. But I don’t see a worried face in the mirror. This is what I do, friends. I’m a simple man who plays the ponies.