New Conspiracy Theory Alert!

Turns out if you point out the Magnetar Capital guys using CoreWeave to send NVDA shares skyward, you're a conspiracy theorist. We know what that means...

I’m not asking you to believe a Twitter Rando. I’m not asking you to get your investment advise from YouTube. I’m asking you to just look. The links are down in the description. Just bother to look.

I don’t know who Nobody Special is or what his real name is, but I don’t think you can argue his conviction. After his three-part YouTube deep dive on CoreWeave, the defense of NVIDIA NVDA 0.00%↑ from the corporate financial media has begun and it’s really less of a defense of NVIDIA and more of a smear offense against people like Nobody Special, Kashyap Sriram, and Samantha LaDuc. Nobody Special’s latest:

Look, NVDA shareholders have had an absolutely magnificent run over the last year. The stock has rallied nearly 400% from an October 2022 low of $108 per share up to about $500 in late August. Driven largely by the hype around artificial intelligence and the need for GPUs in data centers that offer cloud computing services, NVDA shareholders have clearly been well rewarded as the company has beat earnings for three consecutive quarters. But there are reasons bulls may want to exercise caution from here beyond just the CoreWeave “conspiracy theory.”

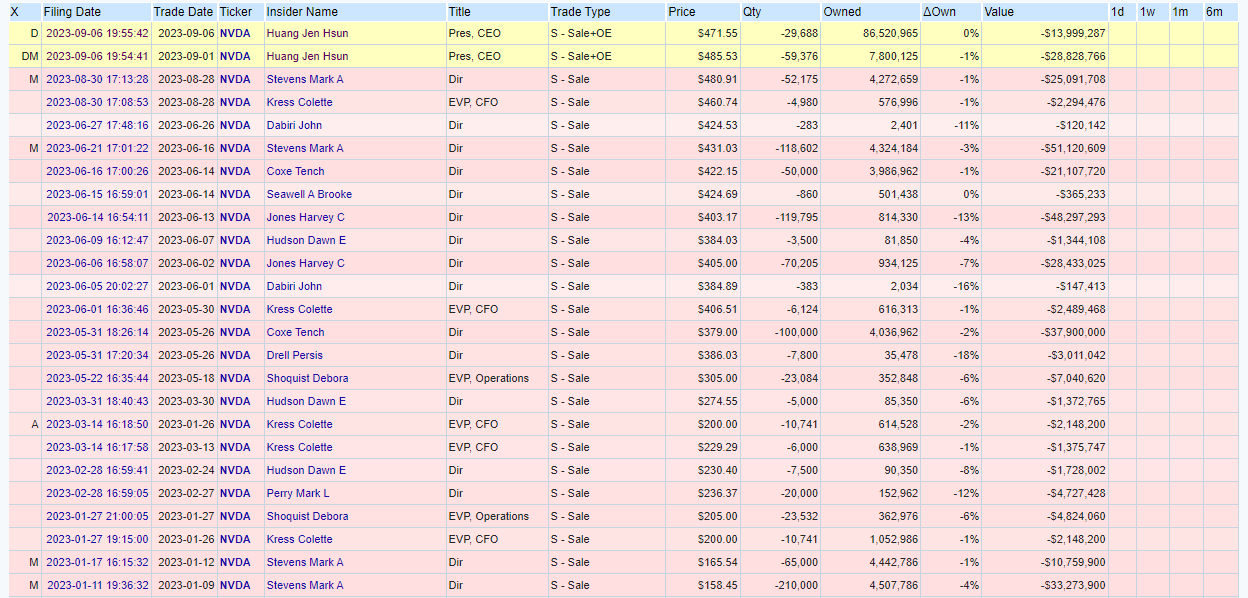

Insider Sales

NVIDIA's CEO Jensen Huang has been actively selling NVDA shares in the early part of September. Over the course of three consecutive sessions between September 1st and September 5th, Huang has disposed of just under $43 million in NVDA shares.

On September 6th, Huang disclosed sales of NVDA shares valued at $28.8 million

Also on September 6th, Huang disclosed sales of NVDA shares valued at $14 million

By itself, Huang's recent sales are not a terribly big deal from where I sit. From 2020-2021 he sold large blocks of shares fairly regularly and he still owns about $43 billion in NVDA shares directly and through trusts. However, before this month he hadn’t sold any NVDA since March 2022 and I do believe we can look at these recent sales as a possible broader signal if history is any indication. Vertical blue lines below indicate dates Huang sold NVDA going back to November 2021:

These recent sales from Huang would mark the second time that NVIDIA's CEO has disposed of equity through multiple transactions in a short amount of time after a sizeable market rip. The large sales in late 2021 and early 2022 came after a 200% rally from low to high. Timed nearly perfectly, I might add. Following those sales, the stock retraced over 65% lower (no doubt aided by broad market declines in 2022).

It should also be noted that at that time, Huang’s sales were far bigger than these recent sales and the late 2021 moves totaled over $276 million. But Huang isn't the only insider who has been selling shares:

In just the last three months, we've seen various directors and executives unload over $180 million in NVDA stock not including the $43 million Huang just sold over the last few days. Year to date, the total amount of insider sales is just below $334 million. And they're probably selling for good reason, the company is overvalued by just about any metric one wants to look at.

I want to be clear about my opinion on NVIDIA; longer term, I actually think it's a solid company and I've previously been long the stock in the past. I'll even entertain getting exposure from the long side again in the future. This article is not a critique of the company's products or fundamental business. It wasn’t Paramount Global’s PARA 0.00%↑ fault that Archegos Capital took the stock for a ride in 2021.

But even conceding that NVIDIA is priced as a growth stock, it is difficult for me to get excited about an equity that gets a "D" or an "F" valuation score from Seeking Alpha in nearly every single metric after what I believe will be a very difficult quarter to replicate and with the obvious bearish divergences all over the chart over the last few months:

I also want to be very clear that I have an interest in seeing the price of NVDA shares decline. I'm currently long the AXS 1.25X NVDA Bear Daily ETF NVDS 0.00%↑ at a $35.80 average cost in my Roth and I’ve now added NVDS shares to the Heretic Speculator Equity Portfolio as well at $37.08. This position is small relative to most of my equity holdings and my exposure to the position is for tactical trading purposes only.

Current State of HSEP

Finally, I have nowhere to run and nowhere to hide. The underperformance in my novelty publication portfolio has been underwhelming. There are a variety of reasons for that including bad timing on my moves, overtrading, and zero exposure to the big names that have pumped the S&P up this year like Apple AAPL 0.00%↑, Tesla TSLA 0.00%↑ , Google GOOG 0.00%↑ , Netflix NFLX 0.00%↑, Microsoft MSFT 0.00%↑ and Meta Platforms META 0.00%↑:

This has not been fun to watch because my personal Roth IRA is positioned similarly to HSEP just in much larger size and with roughly 20 additional equities in similar industries. Even when you’re up, it’s hard to not feel down when the broader market is up by a lot more.

Regarding HSEP, we started with $1k in a cash account and after some fairly wild ups and downs are sitting with a 2% year to date gain. Awful. But I still like where we’re at with many of these names.

Iris Energy IREN 0.00%↑ is reporting “earnings” next week and just dumped $10 million into NVDA chips for HPC services (sigh).

Metal plays like DRDGold DRD 0.00%↑ , B2Gold Corp BTG 0.00%↑ and First Majestic AG 0.00%↑ are completely hated and just waiting on breakouts in the metals.

Allied Gaming & Entertainment AGAE 0.00%↑ is still trading 60% below book and has about $68 million in cash and equivalents versus $10 million in total liabilities. A pop could happen at any time.

We’ll see where next week takes us. Have a great weekend!

Disclaimer: I’m not an investment advisor.