On Twitter, I Have More Thoughts

Musk, Twitter's fragmented competition, Alex Berenson v Twitter, and the possibility that this buyout bid is actually a massive pump and dump scam.

It’s getting to the point where it is almost difficult to keep up with everything happening in the Twitter zeitgeist. While I’ll admit it was incredibly entertaining reading some of the choice Twitter-related meltdowns from the aggrieved courtesy of bad cattitude and Matt Taibbi via a Twitter-prison OG, I think it’s important to keep everything in perspective.

I’d Love For Musk To Pull This Off

Yes, what Musk appears to be attempting is exciting, but it’s an uphill climb and expectation management is probably necessary. Yesterday on Flote I made a prediction for how I think this plays out:

If nothing else, the pure chaos of Musk's buyout offer is seriously fantastic. He already has board members declining to approve his offer. Which is presumably an offer the majority of shareholders should be willing to take since the company already trades at a rich valuation and this offer represents a nice premium over that valuation.

The left has completely exposed itself. The level of hyperbolic calamity forecasted by the outraged is literally laugh out loud funny. These people have lost their damn minds at the mere thought that their monopoly on narrative and safety from debate could be challenged.

In trying to forecast my own expectations for how this plays out, I'll put it like this: I don't think Elon Musk is going to be able to pull this off. I think there is enough financial interest in preserving the tech status quo that Musk will be thwarted. Whether through a larger bid from a collective of left-friendly billionaires or a poison pill strategy from Twitter's executive team.

For selfish reasons, I’d love for Twitter to be a service I’d consider using again. I have no doubt that Musk would change the content moderation policies for the better. For real though, zero doubt. It would be difficult to make that policy much worse than it currently is and that’s why we’ve seen the uptick in Twitter alternatives over the last few years.

But even if Musk buys Twitter and fixes content moderation, there are still plenty of concerns. My main reason for leaving Twitter was the censorship. But I’m also not a fan of the attention monetization model. The dopamine addiction is problematic. I went into that quite a bit in Rediscover Boredom. That addiction issue is also why I continue to use Flote over other alternatives. Low engagement can be a gift in addition to a curse apparently.

While I could make the argument for not having social media at all, there are still short-form nuggets that I think are better in a microblog setting as opposed to a longer-form format like Substack. Things like this picture for instance. I’ll bluntly say it, fixing Twitter’s censorship issue would probably be enough to get me back. But there would still be a lot of things I’d like to see changed. Maybe a topic for another day.

Alternative Moment? Not So Much

As I laid out in a recent Seeking Alpha article, Twitter’s alternatives have failed to really take hold, Flote included. Truth Social looks finished before it even started. Parler could not recover from the double tap to the head it was given by Silicon Valley. There is one that appears to be getting somewhere though and it’s actually one that I haven’t signed up for to this point. Gab seems to be retaining visitors at a pretty good rate.

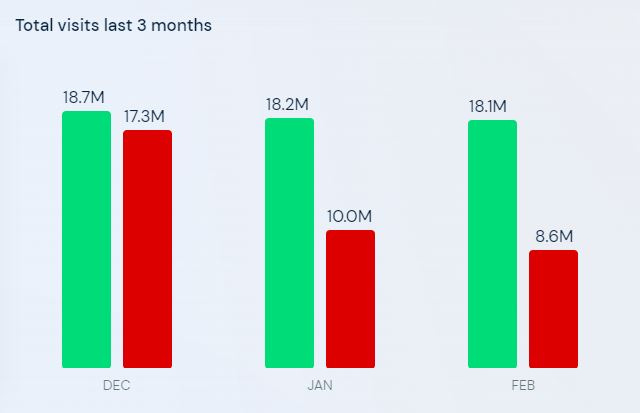

Source: similarweb, Green is Gab. Red is GETTR

Comparing Gab to some of the other alternatives shows an interesting trend in user engagement. When I wrote about Twitter in Seeking Alpha I talked about the fragmentation problem the alternatives have suffered. I wondered if part of Elon Musk’s motivation to fix Twitter stemmed from a realization that the alternatives were failing to prove viable.

Why now? That’s usually a good question to consider when something newsworthy happens. The utter incompetence of the Truth Social rollout might have been the catalyst Musk needed to explore the pathway to fixing Twitter instead. If that is what Musk was thinking, I think it’s pretty sound logic.

As someone who has now used a few of these alternatives, I’ve been pretty unimpressed. I had very high hopes for GETTR. That platform stinks. Flote is good, but it seems very niche at the moment. I actually tried Minds last year after dumping Twitter. It didn’t do it for me. I never messed with Parler or Truth Social and I don’t plan to. Gab is really my last personal holdout. We’ll see. I’d rather Elon fix Twitter because that’s where the people who I enjoyed reading and engaging with are… for now.

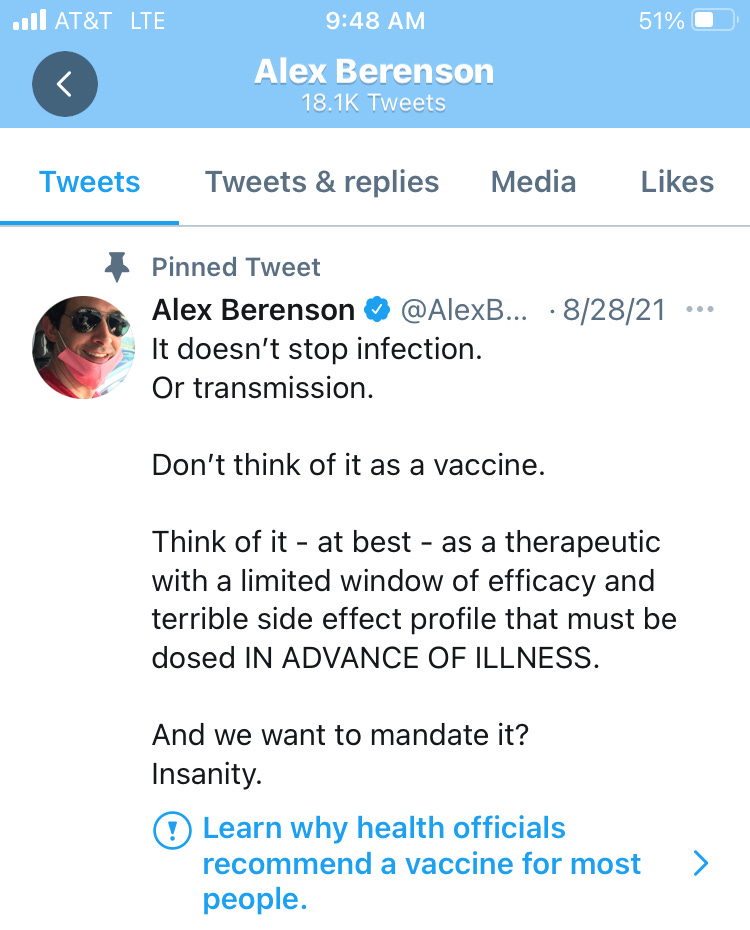

There’s also another interesting angle to this Twitter buyout bid that didn’t cross my mind until last night; Elon’s takeover bid might make Alex Berenson’s lawsuit with Twitter a very important subplot. Berenson was banned from Twitter for tweeting about vaccines. The fact that many of his Twitter-prison comments have turned out to be true shouldn’t be lost on those who cheered on his banishment. This is the one that did him in:

It’s been interesting reading Alex over the last 8 months or so. Needless to say, his lawsuit with Twitter isn’t surprising. He feels wronged and he’s committed to making it known that Twitter’s court defensive of it’s content moderation policies is almost as big of a train-wreck as the content moderation policies themselves.

Twitter can't argue that it is a private business that can do whatever it wants in court and then reject Musk's offer under the assumption that it is too important as a public square platform to be operated by one man. Get your popcorn ready.

The Pump and Dump Theory

What happens if Musk’s deal doesn’t make it? If he honors his word from his offer, he’ll be “reconsidering” his investment in Twitter stock. This is seemingly an indication that Elon Musk would sell his 9.2% stake if he can’t own the entire company. There are some who are claiming selling the stock at a profit is actually the real motivation and Musk is essentially just running a pump and dump scam.

A pump and dump is when a scammer with influence takes a large position in a company and then hypes up the potential that the company has. This hype lures in new buyers that the scammer actually sells their shares to on the way up. When the scammer has sold off the position at a nice premium, they stop hyping it and the price of the equity collapses. Hence, pump and dump. The scammer makes off with everyone else’s money.

I’ve seen a few people pointing out the theory that this could be what Musk is really doing but I think that’s unlikely. We have to consider share volume dynamics in the market. Elon Musk owns over 73.1 million shares. Is it easy or hard for him to get out of a position that large?

This is the daily share volume in Twitter stock going back a full year. Show me on the chart where everyone knew Elon Musk was an owner… kidding. Clearly there has been a much different level of trading the stock since Musk’s disclosure. The average daily volume in Twitter since Musk’s purchase disclosure is roughly 148 million shares per day. That number though is benefiting from three massive trading days:

The day he disclosed his stake (268 million shares traded)

The day after he disclosed his stake (217 million shares traded)

The day he disclosed his buyout bid (257 million shares traded)

If you take out those three days, the average daily volume since his stake announcement is 97.7 million. This next point is critical: the average daily volume from the beginning of the year to the day before his stake was disclosed is just 18.9 million. And reminder, Musk owns over 73 million shares. Do you get why his disclosure was 11 days late now? It’s worth it for Musk to take the SEC penalty for filing late because Twitter’s daily trading volume was so low that Musk had to delicately scale into his position so that he didn’t move the market against himself too much.

The cat is out of the bag now though. And Musk has already insinuated that he’ll sell his shares if his offer isn’t accepted. 73 million shares is a big position to unwind given historical trading volume. Especially when everyone else in the market knows those sells are coming. It is going to be very difficult for Musk to get out of that position profitably unless 1 of 2 things are true:

If he’s already out

A higher buyout offer is coming

There is likely only one way Musk can get out of this at a massive profit. And that’s if there is a bigger bid from somebody else. I’m going to assume it would be very difficult for him to close that out at a profit IF he hasn’t already. And if he’s already closed the position out then this is one of the biggest scams in broad daylight that I can remember. Elon is bold. But I don’t think even he is willing to go that low to make a few bucks. He’s worth almost $300 billion. He doesn’t need to play around like that to make a couple more. It doesn’t make sense.

I’m not buying the pump and dump theory. It’s entirely possible, if not most likely, that the richest man in the world who happens to have a top ten following on Twitter and who uses Twitter all the time simply wants the platform to not suck anymore.

Disclosure: I do not own any TWTR shares.

Well it didn’t take long to get the next chess move in the Musk/Twitter saga. Twitter’s board of directors opted for the “poison pill” approach. This essentially gives shareholders the right to buy new shares of Twitter stock at half market value if Musk tries a hostile takeover in the open market. The new shares would represent shareholder dilution and make it more expensive for a hostile bidder to own the company outright. Bold move, Cotton. We’ll see if it pays off. My quick two cents: this is a really good way to alienate shareholders who actually want Musk’s buyout offer. I am very happy I’m watching this from the sidelines. The BOD doesn't appear to be acting in the interest of shareholders. This also sets up what I described in the article; Berenson's litigation is even more interesting now.

I'd say the most likely outcome of Musk's adventure is that the Deep State takes him out:

https://twitter.com/CGasparino/status/1514560918000185347?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1514560918000185347%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Ftheconservativetreehouse.com%2Fblog%2F2022%2F04%2F14%2Felon-musk-make-a-massive-proposal-offers-to-purchase-twitter-for-41-billion-with-plan-to-take-company-private%2F

https://theconservativetreehouse.com/blog/2022/04/14/elon-musk-make-a-massive-proposal-offers-to-purchase-twitter-for-41-billion-with-plan-to-take-company-private/

"There is no business model, even with paying subscribers, for Twitter to exist. As the business grows, the costs increase, and the costs to subscribers would grow. So, what is going on?

The only way Twitter, with 217 million users, could exist as a viable platform is if they had access to tech systems of incredible scale and performance, and those systems were essentially free or very cheap. The only entity that could possibly provide that level of capacity and scale is the United States Government – combined with a bottomless bank account.

If my hunch is correct, Elon Musk is poised to expose the well-kept secret that most social media platforms are operating on U.S. government tech infrastructure and indirect subsidy. Let that sink in."