The crypto OGs will understand the sub title. It’s one of the most important rules in the ethos of cryptocurrency.

Not your keys, not your coins.

This is a reference to private keys and the idea that owning something like Bitcoin on-chain rather than with a custodian is the most appropriate way to keep crypto as safe as it can be. Understanding this can be difficult for many to grasp because we’re so used to the convenience of custodians in finance.

Dollar deposits with a financial institution? You’re actually loaning them to a bank that lends them to somebody else. STONKS in a brokerage account? You really just have a claim on an asset. The broker might be loaning that asset out to somebody else who would like to bet against your position. Gold in a safety deposit box? If it isn’t business hours, you can’t get it. Not your building, not your bars.

Not your keys, not your coins.

Bitcoin and decentralized blockchains were born out of the Cypherpunk movement. This is a group of software coders who were hyper-focused on protecting privacy and battling the kind of ‘heads I win, tails you lose’ kleptocracy that our governance has become. After the Federal Reserve and the Federal Government worked together to bailout corporations during the financial crisis at the dollar dilution expense of the taxpayers, Bitcoin was born. A supply capped currency that is permission-less to use and controlled by the people rather than by centralized bank or government. Depositing with a custodian? Not necessary for Bitcoin. Doing so would actually destroy the entire point of the currency’s existence. You could just mine it yourself.

Not your keys, not your coins.

We Can’t Help Ourselves

When I first started acquiring Bitcoin, I was obsessed with holding the digital asset in a self-custodial wallet. It took me a couple years to be hypnotized by the allure of yield. Even when I started using Celsius Network, I never deposited more than 20-25% of my crypto with the platform. In my mind giving up control of the coins was a reasonable trade off for generating the yield.

When I first launched faybomb.com, I was a fan of Celsius. I wrote about what it was offering and why I liked the token. I was an account holder. I was getting yield rewards every Monday like clockwork. I proudly shared a personal referral link; thankfully, nobody ever used it. Then in late September, I saw something I didn’t like. And I wrote about it here:

Tell me China is banning crypto assets for the fifth time, I'm not terribly concerned. Tell me the SEC has opinions about crypto, I'm not overly concerned. Tell me the platform that pays me yield for funding arbitrage trading is getting cease and desist letters from several US states, I start to get concerned.

When I wrote that, I was still long the CEL token - I’m not anymore. I followed that quote above with this:

Call it FUD if you like. I can't in good conscience send people to a platform that is getting served cease and desist letters. My opinion, as more states serve Celsius and Blockfi these kinds of orders, the chances of an old school bank run on those platforms increase. I've taken most of my assets out of my Celsius account at this time. I think it's telling that Coinbase scrapped their Lend product after SEC pressure. To me, that's more bearish for platforms like Celsius and Blockfi than it is for Coinbase.

Earlier this year, these yield custodian crypto platforms started changing their business models. BlockFi agreed to a massive fine and stopped onboarding new yield accounts. Nexo stopped allowing yield on new deposits as well in the US. It took a couple more months, but Celsius did the same… for non-accredited investors only. You may remember, I was angry about it and my beef was more with regulators than with Celsius at the time:

There is no consumer protection whatsoever because Celsius can still serve US account holders as a custodian. I can still move my assets into a Celsius account after April 14th. I just can’t earn yield on the deposits. I get all of the risk of depositing with a third party but none of the benefit from doing so. What is the point then?

Want to know what happened next? Essentially exactly what I predicted would happened next. “Old school bank run.”

The Celsius Meltdown

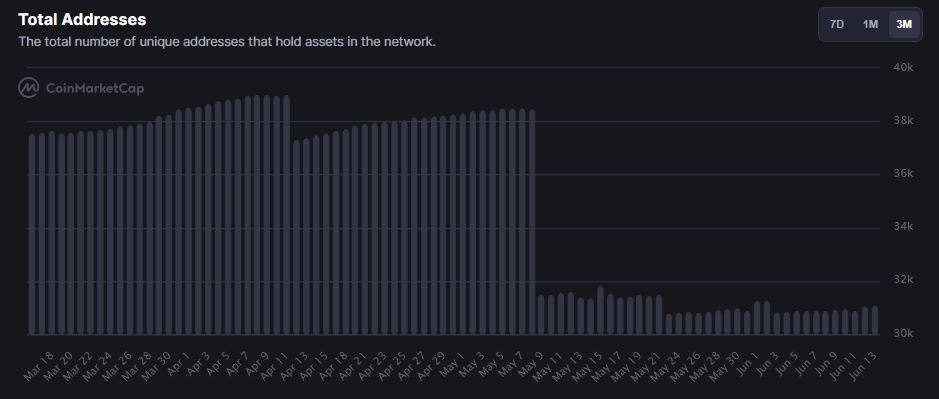

With no yield for new deposits, the baked-in bid on CEL’s utility went away for many account holders. Holders of CEL token fell hard a few weeks after the announcement:

With thousands of accounts no longer needing CEL tokens, the selling helped drive the price down. From late April through early May, CEL token was about $2. On May 7th, CEL was $2 right before the token holders dropped.

By May 12th, CEL had touched just $0.60 intraday; a 70% selloff in less than a week. Following this drawdown, Celsius’ CEO Alex Mashinsky started tweeting weird stuff and I knew something was up. I saw bad metrics in Celsius’ net deposits year over year and wrote about it here. On June 7th, Celsius wrote this in a blog post called Damn The Torpedoes, Full Speed Ahead:

We at Celsius are online 24–7. We’re working around the clock to continue to serve our community. Celsius has one of the best risk management teams in the world. Our security team and infrastructure is second to none. We have made it through crypto downturns before (this is our fourth!). Celsius is prepared.

Just 5 days letter, another Celsius Medium piece titled A Memo To Our Community said this:

Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, Swap, and transfers between accounts. We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.

We’ll never know how much longer Celsius would have had organically. On one hand you could probably argue regulations “saved” those who were early getting their funds out. On the other, you could probably argue regulations helped create the run on assets. I don’t know where on I fall on it, honestly. I’m just glad I got out and I hope I helped others do the same.

If you’re the first out of the door, that’s not called panicking.

Not Your Keys, Not Your Coins

It would be easy to say, “see, this is why if you don’t hold the keys, they’re not your coins.” While I think self-custody is the best way for many, myself included, to hold Bitcoin and other cryptos, it probably isn’t the best way for most to hold Bitcoin and other cryptos right now. Certainly not without learning how and why first. And honestly, learning crypto is difficult. Almost all of the on-ramps now require KYC/AML - I’d wager most people don’t have any interest in opening what is essentially another bank account to buy a few bucks in magic internet money.

The reality is this whole crypto thing is kinda hard for most people and sometimes learning through failure is the best way to learn; after all, that’s how I learned stocks. But balance is probably the correct approach to custody. I can take all of the safety measures I can think of, if I’m relying on myself and only myself for my crypto storage, I have a single point of failure. And even though I’ve been doing the crypto thing for a few years now, I’m still learning and making mistakes! I just lost some coins in a phishing hack a few weeks ago. I still have no idea what the link was but it impacted my Twitter as well. The scammers are getting very sophisticated.

SIDE BAR: If it’s not actually a hoax to promote his new show, Seth Green’s Bored Ape NFT was stolen in a phishing attack. Wamp wamp right? Problem is, he’s literally creating a TV program around that NFT. The crypto ethos would say he either can’t make that show anymore, has to buy a replacement ape, or he has to change the character to a BAYC derivative that grants creative license - which would actually be a hilarious social commentary opportunity, in my opinion. For real… pick the real BAYC out of the lineup…

Which one is a real BAYC picture? Good luck.

The point is, the same strategy isn’t a perfect fit for every person. My desired approach is self-custody. But that might not be right for everyone. Even despite my more self-reliant approach to crypto, it’s not something that I think everyone else must also do unless they want to and they’ve put in the work. It’s is true that custody brings risk and you need to be careful who you trust. But everything has risk.

There are no solutions, only tradeoffs.

Thomas Sowell

It sucks seeing people on Twitter talk about losing everything… again. Between LUNA and Celsius, it has been a very bad few weeks for a lot of people. It’s been a bad few weeks for the whole crypto space. Beyond just the losses, some of which have been individually catastrophic. Businesses are laying people off. It’s not a good scene right now. If you’re in this space, be careful. Don’t risk what you can’t afford to lose. Is the bottom in? I have no idea. Judging from sentiment online, it feels like everything is going to zero. That’s all I’m going to say. I did buy more crypto over the weekend. Dry powder. Always have some.

Disclosure: I’m not an investment advisor. I merely share what I do and why I do it. You shouldn’t take anything I say as investment advice and always do your own research when making investment decisions. Cryptocurrencies, tokens, STONKs, and digital trinkets could all go to zero.

Another exciting day today! Is exciting the word I’m looking for?