Play Clown Games, Win Clown Prizes

Ben Shalom Bernanke is your newest Nobel prize winner for economic sciences. Naturally, real people are laughing because it is most definitely a joke.

In a clown world with clown leaders and clown institutions, it’s only right that a clown economist wins a clown award. After all, if Paul Krugman has one, I mean…

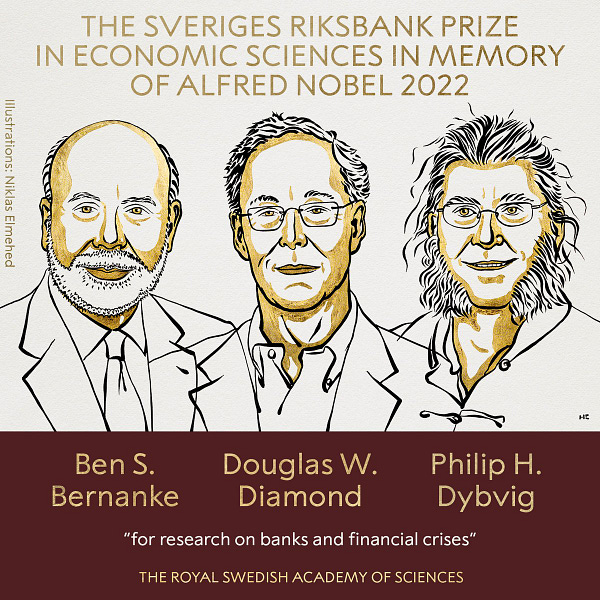

Did you hear the big news yesterday? Helicopter Ben was awarded the 2022 Nobel prize in economic sciences. He’s sharing 2022 with Wolverine and some other normal looking guy with a button up and a jacket:

Bernanke was famously wrong about some fairly critical things as Fed chair; first, he claimed problems in the housing market were contained to just sub-prime:

Given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited

As we all now know, that was not the case. And despite acknowledging back in 2009 that the central bank would need to have an exit strategy from asset purchases, the Fed's balance sheet is now 4 times higher than it was following the immediate financial crisis response:

If there ever actually was an exit strategy, it hasn't worked. While I'm sure I could very easily find other examples of Bernanke's shortcomings as a forecaster, these are the two that come to mind because they are the two that stand out the most. Interestingly, in 2021 the central bank often blamed high inflation on things like supply chain bottlenecks; the sort of catalysts that are beyond the control of any Fed chair. Yet back in 2009, Bernanke seemed very aware of the impact the Fed's policies might have on inflation in the future - bold my emphasis:

My colleagues at the Federal Reserve and I believe that accommodative policies will likely be warranted for an extended period. At some point, however, as economic recovery takes hold, we will need to tighten monetary policy to prevent the emergence of an inflation problem down the road. Looking at the Federal Reserve's balance sheet is useful, once again, in helping to understand key elements of the Federal Reserve's exit strategy from its current policies

It's as if they've always known speaking trillions of dollars into existence by decree was going to lead to pricing problems in real goods. The online response to Bernanke's award has been exactly what you might expect. I see a lot of tomatoes on the stage.

If you don’t get the reference in that last one, it’s from an argument between Tony Soprano and his son at the kitchen table. They’re debating Christopher Columbus. Yesterday was Columbus Day. It is brilliant internet work. Speaking of which, I don’t know how I’ve been unaware this video has existed for 16 years, but it is a Weird Al-level parody done by a bunch of college students. An absolute masterpiece. Enjoy:

The irony is if we have anything to thank Bernanke for, it's probably Bitcoin. The need for a decentralized distributed ledger with coded supply may not have become so evident were it not for Bernanke and the unelected leaders of other central banks throughout the world destroying the value of everyone’s savings.

(Bernanke is) completely useless as a thinker

Roy Sebag, Goldmoney/Mene

That parody song was amazing! Thank you so much for sharing. Of course they award many of their noble prizes to clowns like him. Just like Obama winning the peace prize for drone bombing people.

Upside down clown world is good for a laugh ‘tis true, but the joke is ultimately on us.

The wheels on the financial bus will be all the way off soon. I’m not looking forward to that and wish it were avoidable, but it does not appear to be possible at this stage.