Rocket Mortgage keeps calling me. I’ve actually never seen a full court press quite like this one. Since it started, I have received 4 phone calls, 3 voicemails from 3 different reps, and an email. This started at 4:21pm yesterday. 4 phone calls in under 24 hours. Wild stuff.

I feel like if I answer I’m going to get told to buy 50 Apple gift cards and mail them to a PO box or something. Rocket Mortgage isn’t trying to scam me though - well, not in criminal law sense, at least. This is happening because we refinanced through Rocket Mortgage in 2020 when rates were stupid low and now the company checks in annually to test my financial intelligence.

The email I received today was a thing of a beauty. “How much is your home worth? Are you thinking of any home projects or renovations? Can I have the gold from your backyard?” That last one is made up, but it’s not terribly inaccurate philosophically. If you’re not quite following, this is the main point: Rocket Mortgage is in the business of selling mortgages. That business has a problem at the moment…

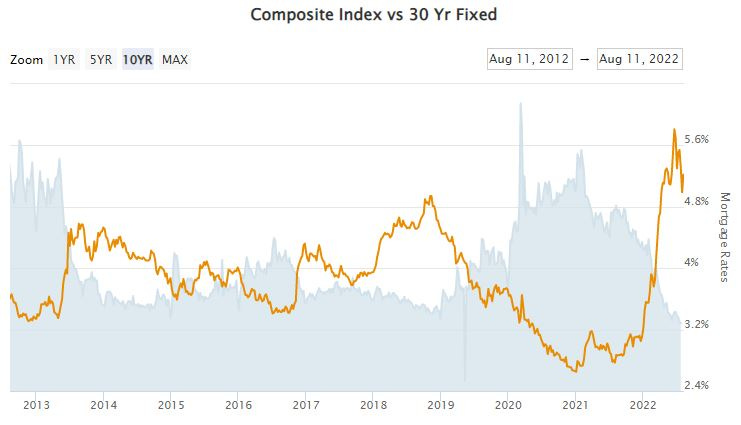

The average 30 year fixed rate mortgage is now 5.2%. Over the last few months, lending rates for home purchases have been higher than they have typically been in over 10 years. This creates a situation where homes are magically far more expensive than they were just a few months ago. Consider the aggregate cost difference of a $440k home at 3.5% vs that same home at 5.2%. I’m assuming 20% down and $3,500 in taxes for this exercise:

This theoretical $440k home purchase is now over $126k more expensive than it was just 8 months ago. And that’s aggregate cost. Most people don’t think about the things they finance in that way; rather, they look to monthly payments. At 3.5% the mortgage is $1,955 per month. At 5.2% it’s $2,307. That $350 per month can potentially be the difference between being able to afford a home and not being able afford a home; and again, the list price is identical. That’s how much the cost of capital matters.

Of course, this spike in rates has led to a massive decline in consumer demand for mortgages. The composite index measures application volume for both purchases and refinances. At 275, that composite index figure is the lowest it has been since 1997. It seems the demand surge from low rates thanks to COVID and lockdowns pulled forward quite a bit of mortgage demand.

Look, I get it. I actually feel for these mortgage bankers. It doesn’t take a rocket mortgage scientist to know what happens to an industry when demand for the product or service disappears. Layoffs are probably coming. But not before the full court press. I’m not 100% certain what the pitch would have been; but I can’t see how refinancing again at a higher rate or taking out a home equity loan the month my zestimate starts going down is a good idea for me.

Setting $47 Billion on Fire = “Lessons Learned”

I didn’t spend my entire day on Twitter yesterday, but in the brief time that I was checking my feed, the biggest story in finance seemed to be venture capital firm a16z plowing $350 million into Flow. What is Flow? Nothing. It’s an idea. That’s not why it was a story though. It was a story because of who is running Flow. It’s this guy…

Yup. That’s Adam Neumann. The same Adam Neumann who started WeWork. The same WeWork that was once valued at $47 billion. The same $47 billion that evaporated in about a month when WeWork tried to go public and had to open the books. That guy. He’s getting a second go courtesy of a16z. From the announcement:

Adam, and the story of WeWork, have been exhaustively chronicled, analyzed, and fictionalized – sometimes accurately. For all the energy put into covering the story, it’s often under appreciated that only one person has fundamentally redesigned the office experience and led a paradigm-changing global company in the process: Adam Neumann. We understand how difficult it is to build something like this and we love seeing repeat-founders build on past successes by growing from lessons learned. For Adam, the successes and lessons are plenty and we are excited to go on this journey with him and his colleagues building the future of living.

Lessons learned. I sure hope so. Because it’d be one thing if Adam Neumann’s second chance was in something completely different. But it’s not. WeWork was a colossal failure of a commercial real estate company. Now with Flow, the man is taking on residential real estate with what appears to be the same basic model:

We think it is natural that for his first venture since WeWork, Adam returns to the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes. Residential real estate — the world’s largest asset class — is ready for exactly this change.

I swear I thought this was a joke at first. But they’re actually serious. One of the big reported reasons why WeWork failed aside from the business model was because of the culture. The work ethic was apparently questionable and the devotion to the brand and the community was cult-like. They were “growing community” by getting smashed and partying. And yet again, the charismatic thinker is going to build a community. This time though with new lessons that have been learned. Well thank God.

Look, I’m not against second chances and the old adage is America loves a comeback story. But what the hell?! We’re doing this again? So much of finance and investment has been corrupted by “narrative.” We can see it everywhere; growth stocks are a narrative, Telsa is a narrative, crypto is a narrative. I don’t think this is a new thing necessarily and there’s a long history of businesses selling dreams rather than products. I get it. I really do. But this just seems irresponsible to me and it actually makes me question a16z more than anything else.

Or maybe the people who left NYC for Florida really do want to live in adult party dorms run by Adam Neumann.

Loved the piece Mike!

Just wanted to reach out in regards to asking you a few more questions about the investment space and crypto / web3. I'm writing for Australia's newest crypto publication and would love to get in touch.

Send me an email at thomas.mitchelhill@thechainsaw.com and we can chat more there.