Rents, Rates, and Real Estate

With less than 24 hours before the latest rate proclamation from the magic money wizards, one wonders when low rate cake will flow from the windows of the ivory tower.

There has been a boom in multi-family units under construction. It takes years to build many of these larger projects. And so there will be pressure on rents, I think, to the downside rather than the upside when all of these units come online. - Jeffrey Gundlach, CEO of Doubleline Capital

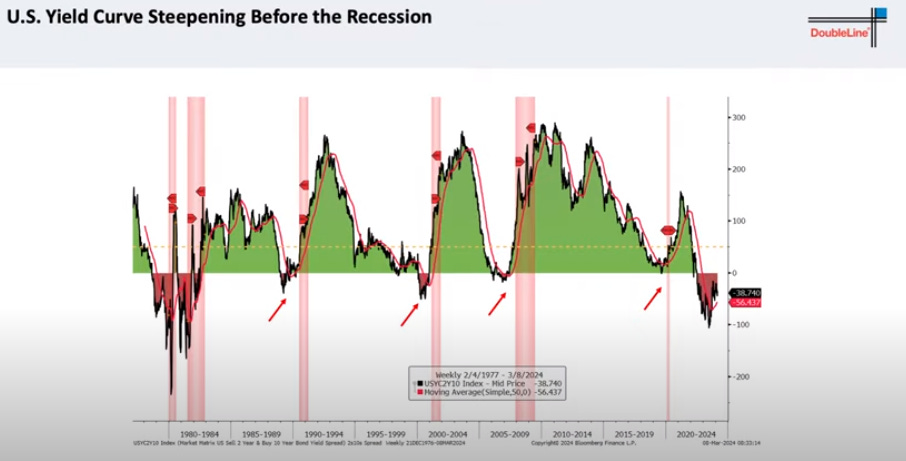

This quote is from Jeffrey Gundlach’s latest Macro and Market update from Thursday. The entire presentation is, frankly, terrific and I think anyone who is in the “looming recession/slowdown” camp (as I obviously am) should watch it as it may serve as perhaps a guide for determining the timing of such things. Take for instance the inverted yield curve:

Yield curve inversion has generally been viewed as one of the most bulletproof signals of a recession. The duration of the current inversion is presently 20 months and counting… according to Jim Grant, this is a record. Per Jeff, you’re not in trouble until the curve un-inverts.

Here’s the full video:

Jeff, apparently a man of the people, gives this research away for free. If you’ve been following my work for any length of time, you’ve likely noticed I reference his commentary occasionally. He’s certainly one of many influences in what forms my macro thinking. His point on lower rents actually spawned a bit of a rabbit hole in my own mind that I’m now happy to share in a fairly raw format.

Lets think a bit deeper on what the ramifications could be from Jeff’s quote in the opening of this post. Lower rents would no doubt be welcomed by renters. And in theory declining rents would free up some cash to put into other things - like buying crap on Amazon AMZN 0.00%↑ or paying down all of the debt that consumers have amassed on credit cards and through “buy now, pay later” (BNPL) deals.

Paying down debt is good in my view. Buying crap? Less so. But a more direct potential consequence of lower rents would be declining values of rental properties. The more a property yields through normal renting or STRs (short term rentals like Airbnb ABNB 0.00%↑ ), the more a speculator buyer may be willing to pay for said property. And we just saw this go bonkers when debt was cheap during COVID lockdowns.

This dynamic works in the opposite direction as well. And since so many recent “homebuyers” have been committing fraud secretly of the investor variety, the declines in rents probably won’t be reflected in the woefully awful owner’s equivalent rent data until well after the AirBnBust bubble has intensified:

If those rent declines don’t actually show up in our clown show official data sets, the occasionally “data-dependent” Federal Reserve may punt on the pivot. Or in plain English, Jerome and Co may feel compelled to keep rates higher for longer even as asset prices fall.

Now consider what is happening in the US debt market, which impacts the return the market expects from other forms of investment:

As of Monday, June was showing a 44.8% chance of “no cut” versus a 50.7% chance of a 25 basis points cut. Essentially, it’s a toss up. First we expected a cut in March. That ain’t happening and we’ll officially find that out tomorrow. The market is already pricing unchanged in May. And now June is no longer a sure thing either. Come to think of it, the 10 year looks like it may actually be going up:

The problem with rising rates on rIsK fREe debt is everything else starts to look less attractive by comparison unless it rerates higher. For example, if we buy the notion that US debt carries no default risk (nominally) due to the powers that be owning a digital printing press, then any debt instrument that theoretically does carry risk of default must offer a higher yield than bonds.

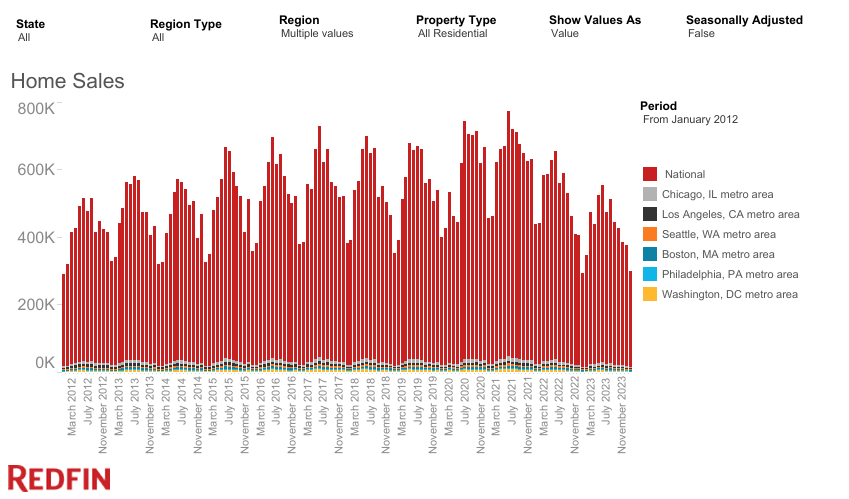

Thus, if the 10 year moves back up, mortgage rates are likely headed up as well. Higher rates on mortgages would further erode the already brutal trend in home sales - which have nerfed since everyone (except Janet Yellen) locked in cheap, fixed at filthy duration:

Now approaching the end of my mental rabbit hole… I swear.

All this is as more boomers are retiring and theoretically motivated to downsize. But who is there to sell to with Case-Shiller still near all time highs and rates seemingly not going down much further? Oh and we can also factor in that we’re possibly at the beginning of beaten up residential property investors looking to get out of bad speculations.

What I’m saying is we may be quickly approaching a dramatic imbalance in the market between sellers who want to lock in high prices and buyers who flat out don’t have the ability to pay the asks… and that’s if we’re not already at that imbalance already. Which, judging from the collapse in home sales, is probably the case.

Other than that, how was the play Mrs. Lincoln?

For me, this can only be satisfied by lower prices in the actual units. Until then, the game of chicken between real home buyers and investors sitting on empty properties should be fascinating to watch unfold. What will the Fed do… we’re all dying to find out.

Alright, rabbit hole over.

Disclaimer: I’m not an investment advisor. I’m wrong all the time. I have a house that I generally view as a home rather than as an investment. However, it is undeniable that the purchase of said house (at a fair price and at great terms) has allowed me to build wealth in other areas. I sincerely hope more people get the opportunity that I’ve had.