Rock The Kaspa

The top Bitcoin miner in the public equity market is mining Kaspa. Marathon Digital's logic, an assessment of KAS, and a possible secondary motive?

In a public equity market with roughly two dozen Bitcoin (BTC-USD) mining companies, none are bigger than Marathon Digital MARA 0.00%↑. Marathon is the industry leader in market capitalization, monthly hash rate, and BTC treasury.

Market Capitalization: $5.4 billion (1st)

May exahash per second: 29.3 (1st)

BTC Treasury: 17,857 (1st)

Yet despite this obvious leadership in the public equity market, Marathon has a problem; Bitcoin mining profitability is deteriorating.

The chart above shows that even has Marathon Digital has scaled monthly exahash, BTC production has rolled over. The first full month of production data post-halving was Marathon’s lowest single month BTC return since February 2023.

It’d be one thing if Marathon Digital were just battling the supply crunch from a post-halving world. But with the price of BTC showing weakness as well and an all-in breakeven production price that I estimate to be six-figures, Marathon Digital is battling a major profitability problem. Thus, I find the company’s Wednesday announcement about Kaspa (KAS-USD) mining to be so fascinating. Per Marathon:

One of our goals at Marathon is to support and secure the world’s leading blockchain ecosystem, Bitcoin. While we firmly believe in Bitcoin’s long-term viability and expect transaction fees to sustain mining revenues, we are pursuing new avenues for growth. Kaspa mining is just one of the many efforts behind this priority, similar to our initiatives in energy harvesting and technology products. This expansion creates a revenue stream that is diversified from Bitcoin while supporting proof-of-work (PoW) innovation.

I question whether or not crypto mining is diversification from crypto mining, but I won’t spend too many characters on that. Public Bitcoin miners producing more than just Bitcoin isn’t unprecedented by any stretch. Hut 8 HUT 0.00%↑ and Hive Digital Technologies HIVE 0.00%↑ were mining Ethereum (ETH-USD) to a significant degree before Proof-of-Stake migration. Others have mined Dogecoin (DOGE-USD) as a supplement to BTC.

But this is the largest Bitcoin mining company in the public equity markets now committing infrastructure, energy, and labor to mining an additional asset and announcing that commitment very publicly via press release. From where I sit, it’s unusual. I’ll get into some theories momentarily. First, a primer…

What Is Kaspa?

Unlike a more traditional blockchain, Kaspa (KAS-USD) has a directed acyclic graph (or DAG) - this allows the network to process different blocks simultaneously rather than one at a time. This approach allows the network to handle 3 blocks per second and the developers are working an improvements that they hope will get the network to 30 blocks per second. This is incredibly faster than something like Bitcoin which processes 1 block every 10 minutes. Essentially the 400,000 transaction backlog that just skyrocketed Bitcoin's transaction fees last year can't happen on Kaspa.

The best way to visualize how this works is by not thinking about the blocks linearly. Rather, in Kaspa's DAG structure each block doesn't have to point to every single previous block in the chain. This alleviates the scaling problem without sacrificing security because data from the chain is routed through a block string rather than from a single parent block.

I don't generally get this into the weeds when it comes to technical specifications but if you're curious about the history of the chain, deeper understanding of the technical structure, and the background of the early developers, I highly recommend this long but interesting Hackernoon article.

TLDR version; there isn't any other known crypto network outside of Kaspa that is built the way that Kaspa is built. On top of the unique structure, it's an entirely community-driven project with no lead developer, and Github contributions tracing back to 2013. It appears as though they took their time with this in an attempt to get the blockchain trilemma solution right.

KAS Tokenomics

Kaspa operates with a proof of work consensus mechanism. KAS has no pre-mine, no ICO, no vesting schedule, and no insider holdings. It is a completely fair-launched coin that relies on proof of work mining for emissions - which are all points that Marathon touted in its press release Additionally, supply is fixed and nearly 84% of the total coin issuance is already circulating:

Total Token Supply: 28.7 billion

Circulating Supply: 24.0 billion (83.8%)

Token Price: $0.18

Market capitalization: $4.3 billion

Crypto Market Cap Rank: 24th

Like Bitcoin, the mining supply curve of Kaspa produces far less block reward over time.

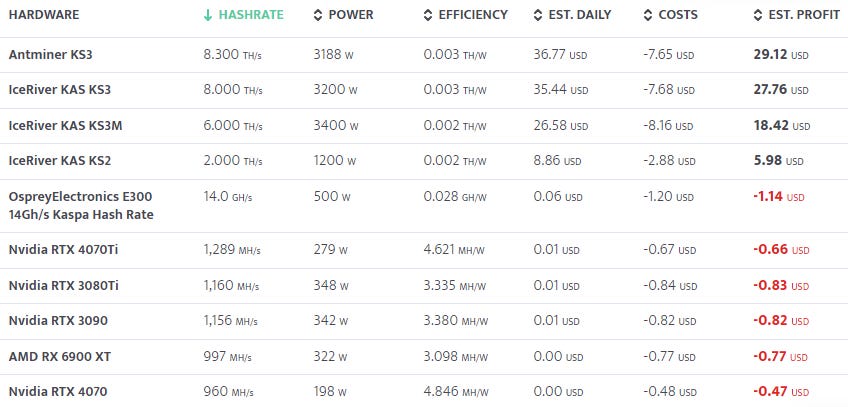

Kaspa estimates that by year 15 post-launch the mining block reward will flip entirely to fees rather than new coins in circulation. The most important thing, and likely the biggest reason why Marathon has gone this route in the first place, is mining Kaspa with the right hardware is like printing currency at the moment:

These are admittedly estimated rates on efficiency and top miners are better optimized for energy costs, but I think its safe to assume there’s some validity to these numbers in aggregate. Consider the growth in Kaspa hashrate:

Hash rate is surging because the coin price is rising and miners want to make money. There is no doubt a clear profit motive driving Marathon’s decision based on these numbers. But is there another motive as well?

Don’t forget, I’m running a summer “flash sale” special that ends July 4th!

Between now and the fireworks, you can lock in 25% off of an annual subscription forever. There will never be a better offer than this. What does a full subscription get you? Beyond the entire content archive, paid members get access to the publication portfolio, and a weekly community chat thread where I share charts and my real time assessment of the markets.

Climb over that paywall, the water is warm.

Keep reading with a 7-day free trial

Subscribe to Heretic Speculator to keep reading this post and get 7 days of free access to the full post archives.