Scott Adams, Tech Layoffs, and the State of Solana

The Dilbert guy says "anti-vaxxers" won, thoughts on consumers, and Solana has rallied from $8 at the end of December to $25 now.

There’s a scene in the movie Sum of all Fears when a young Jack Ryan is getting prepped before speaking in front of someone more important than him. Morgan Freeman’s character, a CIA higher-up with access to the President, tells Ryan “don’t be afraid to say you don’t know.” I think this is great advice. Maybe there was a time when admitting you don’t know something was viable but it doesn’t seem to be the case anymore - at least not if the fake world of online engagement is any indicator. Everyone seems to be an expert on everything now.

Almost every single poster on Twitter was an epidemiologist or a virologist (or both!) in 2020. Then in 2021 almost everyone was an expert in vaccine technology. 2022? Twitter’s userbase transitioned away from the health sciences and became geopolitical analysts or wartime strategists. It’s remarkable. How did we get to the point where very few people seem to have the ability to say “I don’t know?” How much self-inflicted damage has been done over the last several years because so many people have been so sure of something that they knew very little about?

Many of you have probably seen this already. But Scott Adams is getting a lot of engagement online for waving the white flag on the jabs. Adams is probably most well-known for being the guy behind the Dilbert cartoons, but after doing 3 minutes of research on his Wikipedia page, I’m now an expert on Scott Adams and it seems he has a history of saying stuff that is intended to provoke. His latest attention-grabber is the proclamation that “anti-vaxxers” have won the COVID vaccine debate:

While many have taken to Twitter and other channels to add their two cents on this, all I’ll say is “anti-vaxxers” haven’t won until people like Scott Adams stop calling the jab a “vaccine.” It’s not a vaccine. It doesn’t stop transmission. It doesn’t stop infection. It doesn’t do the things that we expect from traditional vaccines so why is it still being called a vaccine?

Attempts at changing the expectation goalposts is gaslighting; stopping infection and transmission is exactly how these shots were sold by the drug companies, the media, and the federal government. Period. And it was known in 2021 that the jabs wouldn’t actually stop infection or transmission if you were open to expert viewpoints that weren’t force-fed by big tech or the media conglomerates. So thanks, Scott Adams, and welcome to 2021. “Winning” the argument has never felt so depressing.

I Am Not An Expert

Can I say that clearly enough? I’m not an expert. I have no formal training in anything. I’m not a scientist. I’m not a doctor. I’m not a tech engineer. And I’m not a financial expert. What drives both my personal behavior and my thinking as an investor is that I’m simply willing to ask questions and challenge conventional thinking - possibly to a fault.

I spent about a half hour on Friday talking with Dominic Lombardo - a former Seeking Alpha contributor who is building a crypto-focused YouTube channel called Lam's Cryptoverse:

Dominic has a background in traditional finance working in risk management for foreign banks. We talked quite a bit about inflation, the Fed breaking things, privacy coins like Zcash, and much more. He’s a macro guy. I pay attention to macro, but again, I’m not an expert. At the end of the day I pay attention to pretty simple stuff when I make my bets.

This is a chart of the S&P 500. As I have drawn it, the index is breaking out over a trendline that has served as key resistance for 13 months. The stock market seems to want to take this rally further judging from the chart above and from a similar breakout in the Dow Jones Industrial average that already happened several weeks ago. The question is, beyond arbitrary lines drawn purely from a technical analyst’s viewpoint, is there a fundamental reason for these risk markets to go up?

While consumer sentiment is up off the lows, now at 64.6, it’s still significantly below where we’d expect it to be if the economy is getting better. From an employment perspective, we’ve seen several tech businesses announce significant layoffs in recent weeks:

Google GOOG 0.00%↑: 12,000 jobs cut

Microsoft MSFT 0.00%↑: 10,000 jobs cut

Salesforce CRM 0.00%↑: 8,000 jobs cut

Amazon AMZN 0.00%↑ : 8,000 jobs cut

Just today we learned Spotify SPOT 0.00%↑ is cutting 600 jobs, or roughly 6% of the company's workforce.

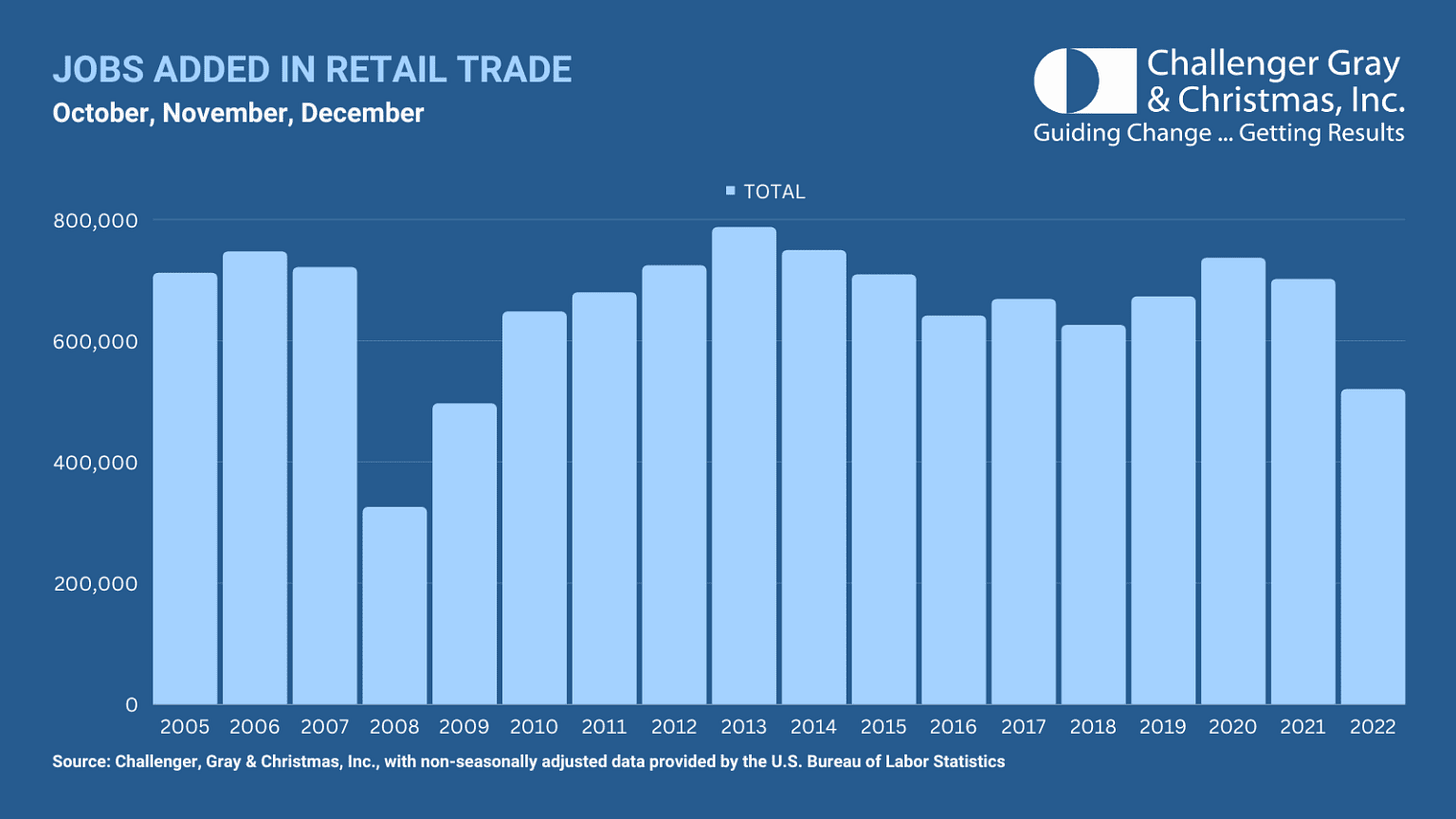

So far, the tech industry has seen more than 56.5k layoffs in January - already 35.6% of the total tech layoffs from all of 2022 and we're just 14 business days into 2023. Looking at the retail sector, we see the lowest amount of Q4 jobs added last year since 2009.

For retail, it’s possible the stores simply couldn’t find the workers. But it’s also possible they workers weren’t needed. For tech, I think it could be argued the industry over-hired in prior years and is now cutting to get closer to reality. Each company is different and it’s likely silly to expect that we can produce one explanation for why all of these companies are now laying off staff. Interestingly, you could make the case the layoffs are actually somewhat bullish if it improves margins in these stocks. We’ll see.

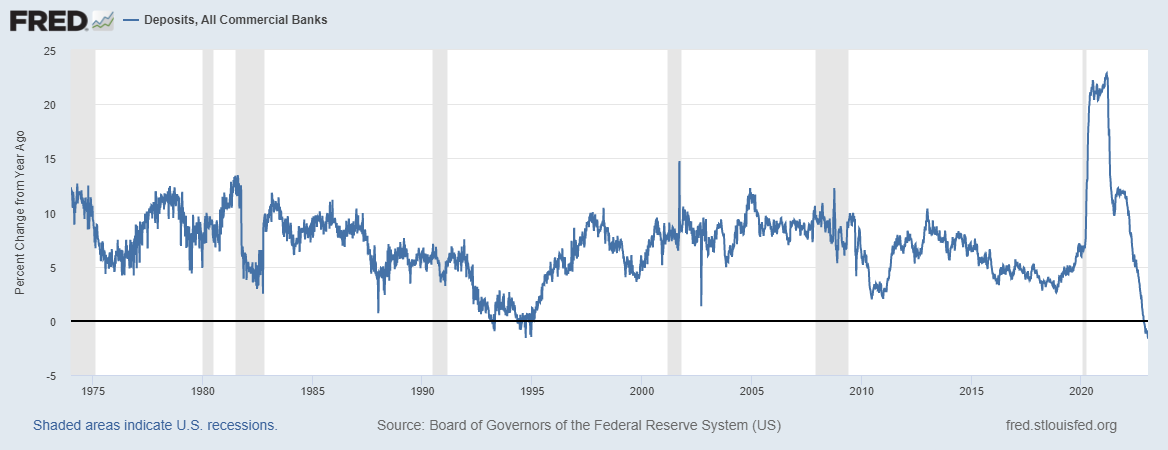

One thing is for sure in my view, the consumer is definitely starting to feel it. The personal saving rate is still under 2.5% - which is mind bogglingly low. Furthermore, at -1.7% year over year, deposits at commercial banks are as negative as they have been in the last 49 years according to this FRED data set:

Elevator up. Elevator down. People are not only failing to save, but they seem to be drawing on stimmy-fueled, lockdown savings to do things like pay for their eggs. What we don’t have is a surge in delinquencies… yet.

“State of Solana” is an excerpt from my Digital Market Overview that was distributed to BlockChain Reaction Subscribers this morning.

State of Solana

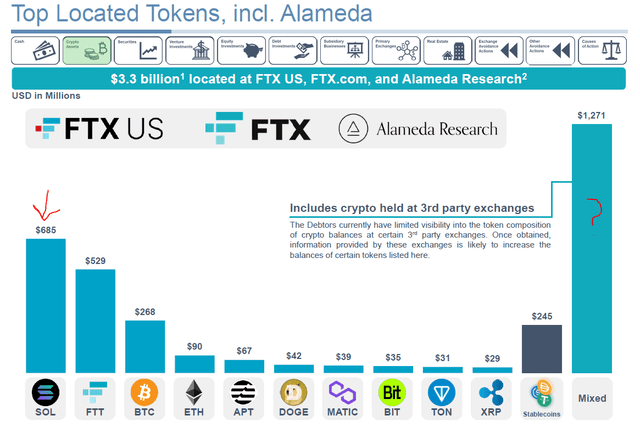

I have to admit I don't know what to make of Solana (SOL-USD) at this point. There is still a large amount of SOL under the control of the FTX liquidation team judging by the January 17th asset disclosure:

There is $685 million in SOL that I think we can reasonably expect will be liquidated. We also don't know what the make up of is of the $1.27 billion in assets that are held on various exchanges - there could certainly be more SOL or BTC in that pool of funds as well. Yet SOL continues to hover around $25 per coin. Why?

Turns out, NFTs on Solana might not be dead after all. According to The Block, Solana experienced a massive 348k NFT mint day on January 20th. This is more than 10x the average daily mints for the weeks leading up to Friday. CryptoSlam already has $108 million in total sales volume on Solana in January which is the highest figure since September of last year and the month still has another week to go.

However, despite the encouraging NFT mint from the weekend, the DeFi footprint on Solana is not growing at all. Measured in SOL tokens, the TVL is just 11.3 million native assets. This is an 83% reduction in the DeFi footprint on SOL.

We're also not seeing the NFT spike create a meaningful spike in DAUs. According to Token Terminal, the Daily Active Users on Solana on 1/20 (the day of the NFT mint spike) were just 161k - lower than the day before. SOL's circulating Price/Sales ratio is also getting a little extended as well. Final point on SOL: most of the top crypto coins are now up over the last 90 days but Solana is still behind the pre-FTX collapse price:

It could mean there is still move to run in SOL, but I obviously already sold out of that trade - too early, per usual. But I think SOL is ahead of itself at $25 and has benefited from a sizeable relief rally like most other coins.

End Excerpt.

Disclaimer: I’m not an investment advisor. I share what I personally do and why I do it. I’ve been managing my own investments since 2014. I have good years and bad years. Fortunately more good than bad so far. I have no position in SOL or any stocks mentioned today. I’m long ZEC.

To justify making a comment one has to act like one has something worth saying.

Hence all the experts.

I don't know enough here to comment on your financial report.

Luckily for me you facilitated a soft comment option.

:)

Everybody “knows” we are/ will be in a recession, but it should be shallow since all the Fed has to do is pivot and our economy will be fine. This explains the sanguine bond and equity markets. And why consumers are ok with no savings and high credit usage. The narrative makes sense if nothing goes wrong. Any shock can make things go sideways real quick except this time with rates at 4% and inflation not near 0 like the last 10 years, we can’t expect the fed to bail us out.